ADV Economy – oil prices

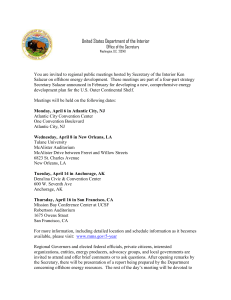

advertisement