Click here to - Florida Association of Court Clerks and

advertisement

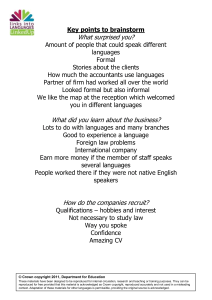

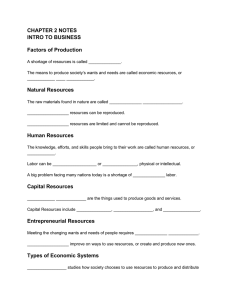

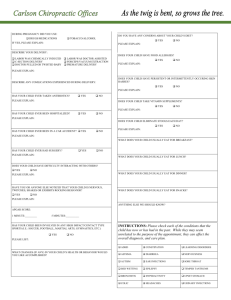

Risk Management for Health Care Benefits Including Health Care Reform By the Numbers Presented by: Kate Grangard, CPA, CFO June 25, 2013 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Overview of Health Care Reform • PPACA Passed on 3/23/10 • Goal: make coverage affordable, accessible, and comprehensive – Estimated 32 million additional people covered by 2019 – Florida one of six states that represents 50% of uninsured 2 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. 3 Ind. Mandate MEC Subsidy-Exchange Age 26 Medicaid Expansion SBC $$$ Health Care Costs Medicaid Expansion High Risk Pool Exchange Rate Review EHB 1. 2. 3. 4. 5. 1. Risk based payment models 2. PCORI 3. EHR 4. ACO/PCMH 5. Medicare Payment This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. 1. 2. 3. 4. 5. 6. 7. 8. 9. Employers State Governments 1. Medicaid Expansion 2. Medicare Reform (Donut Hole, PCMH, MSSP) 3. ERRP 4. High Risk Pool Funding 5. Exchange Funding 6. Credit/Subsidy Elig. – The Hub 7. Legislative Interpretation 8. FFE Providers 1. 2. 3. 4. 5. 6. Federal Government 1. No Pre-ex 2. Wellness 3. Appeals Process/Patients’ Bill 4. MLR 5. Rate Review 6. SBC 7. Max Ded/OOP 8. PCORI 9. Preventative 10.EHB/QHP 11.No Lifetime Max 12. Health Ins. Ind. Fee Taxpayers Insurance Companies Corralling Health Care Costs Through PPACA Pay or Play ERRP Tax Credit (Sm. Grp.) Wellness Rewards Age 26/100 % Preventive/Max. Ded. & Max OOP PCORI & TRF Fees SBC Cadillac Tax Reporting Compliance • W-2, Exchange, Mandatory discl., Avail Exchange, SBC, Monthly Coverage Exploring the Risks of Health Care Reform • • • • Financial Risk Audit Risk Culture Risk Legal Risk 4 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Healthcare Reform PPACA Highlights Timeline • Dependent coverage to age 26 • Eliminate lifetime benefit maximums on essential health benefits • Restricted annual benefit maximums • Non-grandfathered plans must cover preventive services at 100% • Eliminate pre-existing condition exclusions for children under 19 2010 • Plans must provide SBC with OE materials • Plans must cover additional women’s preventive care at 100% • Plans charged PCORI fee 2011 • Employers must report health coverage costs on W-2 • OTC drugs are “qualified medical expenses” for HSA/FSA/HRA You are here 2012 • Individual Mandate • Employers must offer coverage to FT employees or pay a penalty • Health Insurance Exchanges established • Insurers cannot discriminate based on health status • Plans charged Transitional Reinsurance Fee • Plan waiting periods cannot exceed 90 days • Eliminate annual benefit maximums • Eliminate pre-existing condition exclusions for all adults 2013 • HCFSA contributions limited to $2,500 • Employers must provide notice to employees regarding Exchanges by Oct. 1, 2013 5 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. 2014 2018 • Employers begin to pay excise tax on “Cadillac Plans” Exploring the Risks of Health Care Reform • • • • Financial Risk Audit Risk Culture Risk Legal Risk 6 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk • Employer Shared Responsibility Provision (ESRP) a.k.a. Pay or Play The ESRP states that “large” employers must offer coverage that is “affordable” and of “minimum value” to “full-time employees” and their “dependents”. 7 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Employer Shared Responsibility Provision • ESRP is effective on the first day of the plan year beginning on or after January 1, 2014 – Fiscal Year Plan Transition Relief available 1. Eligible employees in plan under currently eligibility terms as of 12/27/12 – no potential penalty payment until 1st day of fiscal plan year 2. No penalty payment for full time employees until month of fiscal plan start in 2014 if: a) Employer offered plan to 1/3 of FT and PT employees at most recent open enrollment b) Fiscal plan covered > ¼ of employees within specified period (point in time test on any day between 10/31/12 – 12/27/12) 8 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Employer Shared Responsibility Provision • Penalties – Monthly Test 1. No Coverage Penalty - $2,000 / Full-time employee 2. Inadequate Coverage Penalty - $3,000 / Full-time employee 3. Margin of Error Rule: Offer coverage to substantially all full-time employees and deps., a.k.a., the 95% Rule (or 5 employees.) Note: If Employer offers coverage under the 95% Safe Harbor, Employer will still be subject to $3,000 penalty for those full-time employees who receive tax credits/subsidies from the Exchange. Also applied if coverage not offered to dependents. Coverage is unaffordable and employee obtains federally subsidized coverage through an Exchange, OR Coverage does not meet “minimum value” requirements and employee obtains federally subsidized coverage through an Exchange. Pay and Play penalty exposure 9 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Penalty is calculated monthly, not annually. Financial Risk Employer Shared Responsibility Provision Sample Employer PAY AND PLAY PENALTY EXPOSURE CALCULATION Employee Count and Plan Enrollment Summary Total Full-time Employees Enrolled Retirees Enrolled 1,000 Total Eligible Full-time Employees 50 PT, Seasonal and Variable EE's Not Offered Coverage but now benefit eligible Total Plan Participants 1,050 Total EE’s Not Offered Coverage Additional Enrolled Members 1,550 Total Enrolled Lives (Belly Buttons) 2,600 1,000 70 70 Pay and Play Penalty Calculation Total Eligible Full-time Employees (1,000 + 70) (assuming all PT deemed eligible) Margin of Error Breakeven Point (5% of eligible employees) Multiple employer plans may have to perform Total Eligible Under ESRP Pay or Play calculation for multiple entities. Less ESRP Allowance Total Subject to Penalty Annual Penalty Amount per Employee Total Annual Pay AND Play Penalty 10 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. 1,070 54 1,070 -30 1,040 $2,000 $2,080,000 Financial Risk Employer Shared Responsibility Provision Determining “Affordability” • Employers may be assessed a penalty for offering coverage to full-time employees that is not “affordable”. • Three Affordability Safe Harbors: 1. Form W-2 Safe Harbor – Employee contribution for lowest cost employee only coverage does not exceed 9.5% of employee’s Box 1 W-2 wages for the applicable calendar year. 11 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Employer Shared Responsibility Provision Determining “Affordability” 2. Rate of Pay Safe Harbor – Test using monthly salary at the beginning of the plan year as base. Employee only cost cannot exceed 9.5% of earnings as of the first day of the plan year 3. “Federal Poverty Line” (FPL) Safe Harbor – Coverage will be “affordable” if self-only coverage does not exceed 9.5% of Federal Poverty Level for single individual. Current individual FPL is $11,170 12 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Employer Shared Responsibility Provision Determining “Minimum Value” • 60% Actuarial Value • Out of pocket max - $6,350 single/$12,700 family • Essential Benefits – Large employers – – – – Physician and mid-level practitioner care Hospital and emergency room services Pharmacy benefits Laboratory and imaging services • Exchange (Marketplace) Bronze equivalent 13 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Employer Shared Responsibility Provision Defining a “Dependent” • PPACA indicates coverage must be made available to employees and their dependents. Dependents defined through this further guidance as: Child of an employee who has not attained age 26 Spouse coverage not necessary to be offered – if offered, not necessary to be “affordable” Maximum Waiting Period • Waiting period for coverage can be no greater than 90 days (not three months) 14 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Employer Shared Responsibility Provision Defining a “Full-Time Employee” • An employee who is employed on average at least 30 “hours of service” per week or 130 hours per month – Include compensable hours – those worked, also hours paid when no work is performed – Special periods of unpaid leave may not be counted against to reduce average hours of service including: FMLA, Military Service, Leave of absence, Jury duty, Vacation, Sick, Personal, Holiday, Incapacity including disability – Re-hired employees Breaks in service greater than 26 weeks Parity rule for breaks in services less than 26 weeks • Qualifying part-time, seasonal and variable employees 15 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Employer Shared Responsibility Provision Determining Eligibility of Part-Time Seasonal, & Variable Hour Employees Safe Harbor Rule • Seasonal, Variable and Part-time employees – Measurement, Administrative and Stability Periods to determine average hours of service – All employees of all entities consistently assessed 16 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Employer Shared Responsibility Provision • Definitions Measurement Period A “standard” look-back period f 3-12 consecutive months used to determine employees’ full time status for purposes of determining benefits eligibility and employer penalty responsibility during subsequent Stability Period for variable/seasonal employees. For new hires, this “initial” period must start no later than the first day of the calendar month following employee start date. Administration Period A period of up to 90 days between the Standard Measurement Period and the associated Stability Period to determine eligibility, notification and enrollment. 17 Stability Period A period of time following a Measurement Period in which a variable or seasonal employee is/is not considered a full time employee for purposes of determining benefits eligibility and accordingly, pay or play penalty, regardless of hours worked during this period as long as still employed. This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Employer Shared Responsibility Provision • Rules ONGOING EMPLOYEE NEW EMPLOYEE Standard Measurement Period Must be 3 – 12 consecutive months Administration Period Up to 90 days (not 3 months) Must overlap prior stability period (no lapse for FT EE’s both years) Stability Period Must be 6 – 12 consecutive months, but Not shorter than Measurement Period If not full-time employee, Stability Period cannot be longer than Measurement Period Initial Measurement Period Must be 3 – 12 consecutive months Must start no later than the first day of the calendar month following employee start date. Administration Period A period of up to 90 days Administration Period plus Initial Measurement Period cannot exceed last day of first calendar month beginning on/after one year anniversary of employee start date. (13 + fraction month) Stability Period Must be 6-12 consecutive months Period must be as long as Stability Period for ongoing employees. 18 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Testing a Variable Employee Ongoing Employee Ongoing variable, part-time and seasonal employee assessment cycle: EMPLOYER: Plan Year 10/1/14 Cycle 1 8/1/13 7/31/14 Standard Measurement Period 12 months Cycle 2 Measure Must be 3 – 12 consecutive months Period Uniform and consistent basis for all employees in same category Admin. Period Up to 90 days (not 3 months) Must overlap prior stability period (no lapse for FT EE’s both years) 8/1 - 9/30/14 Admin Period 10/1/14 9/30/15 Stability Period (Plan Year) 61 days 12 months 7/31/15 8/1 – 9/30/15 Standard Measurement Period Admin Period 8/1/14 12 months Stability Must be 6 – 12 consecutive months, but Period Not shorter than Measurement Period If not full-time employee, Stability 19 Period cannot be longer than Measurement This document is subject to copyright and Period may not be transmitted or reproduced without express written permission from Gehring Group. 61 days 10/1/15 thru 9/30/16 Stability Period (Plan Year) 12 months Defining a Variable Employee New Employee New variable, part-time and seasonal employee assessment cycle: Employee Start Date: 11/18/14 New Employee: Hillary Clinton – Year of Hire 12/1/14 11/30/15 Initial Measurement Period 12 months 12/1-12/31/15 1/1/16 12/31/16 Admin Period Stability Period (Plan Year) 1mo+13days 12 months (44 days) 13 + fraction months 20 Initial Measurement Period Must be 3 – 12 consecutive months Uniform and consistent basis for all employees in same category Administration Period Up to 90 days (not 3 months) Combined with Initial Measurement Period, cannot exceed 13 + fraction month (last day of 1st calendar month beginning on or after one year anniversary of EE start date.) Stability Period Must be same length as ongoing employees’ > 6 consecutive calendar months > measurement period FT during Measurement Per. Benefits thru end of Stability Period If not a FT employee, Stability Period cannot be greater than initial measurement period + 1 month AND cannot exceed remainder of standard measurement period in which initial measurement period ends This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. EXAMPLE: Transition from New to Ongoing Employee Employee Start Date: 11/18/14 (Employer A – 10/1 Fiscal Plan) New Employee: 12/1/14 11/30/15 Initial Measurement Period 12 months 12/1-12/31/15 1/1/16 12/31/16 Admin Period Stability Period (Plan Year) 1mo+13days 12 months (44 days) Scenario 1 – FT during Initial & Standard Measurement Periods: Full time employee from 1/1/16-9/30/17 13 + fraction months Transition to Ongoing Employee: 8/1/14 7/31/15 8/1-9/30/15 10/1/15 Standard Measurement Period 12 months 9/30/16 Admin Period Stability Period (Plan Year) 61 days 12 months 8/1/15 7/31/16 8/1-9/30/16 10/1/16 Standard Measurement Period 21 Scenario 2 – FT during Initial but NOT FT during Standard Measurement Period: Full time employee from 1/1/16-12/31/16 12 months This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Admin Period 61 days 9/30/17 Stability Period (Plan Year) 12 months Financial Risk Employer Shared Responsibility Provision Penalty Assessment Process • IRS will notify employer of potential liability and provide opportunity to respond • Notification will be given after: – Employees’ individual tax returns are due – Employer has filed an informational report (more info to come) identifying full-time employees and describing coverage offered • If penalty deemed assessable, IRS to bill and expect immediate payment • Penalty to employers will not be paid on any tax return 22 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Cadillac Tax • 40% excise tax on “Cadillac Plans” $10,200 for single coverage (High Risk Employees: $11,850) $27,500 for family coverage (High Risk Employees: $30,950) Excludes dental and vision Includes health plan, FSA, HSA, HRA and supplemental Employers must calculate and report excess value and tax PENDING GUIDANCE 23 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Non-Compliance Penalties • Reporting – Form W-2 – Form 720 • Notifications – – – – – Plan amendments Grandfather Plan Exchange Availability Updated COBRA notice SBC 24 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Non-Compliance Penalties 25 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Non-Compliance Penalties 26 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Non-Compliance Penalties Summary of Benefits & Coverage (SBC) • 2012 Culturally and Linguistically Appropriate Services (CLAS) Florida County Data http://www.cms.gov/CCIIO/Resources/Fact-Sheets-and-FAQs/clas-data.html 27 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Non-Compliance Penalties Summary of Benefits & Coverage Compliance/Logistics: Triggers, Timing and to Whom 28 *If policy not issued by renewal date, SBC must be issued within 7 business days after the either of: a) the date the policy is issued, or b) receipt of written confirmation of intent to renew. This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Non-Compliance Penalties W-2 Reporting of Employer Sponsored Health Coverage General Rules 1. Reportable cost is ER contribution + EE contribution of group health coverage for entire family – including adult dependents and domestic partners. If group health plan includes dental & vision – report entire premium. 2. Do not report clinics, Wellness or EAP plans unless separate COBRA premium is charged. 3. Do not include HRA, Employee contributions to FSA, HSA or Archer MSA’s. 4. Calendar year calculation 5. Three methods to calculate value: a) b) c) 29 Premium charged method – Fully insured COBRA applicable premium method – Self-insured, HDHP, Minimum Premium Modified COBRA premium method – where employer subsidizes cost of COBRA 6. CONSISTENCY 7. Keep documentation 8. Further guidance with Q&A Notices 2012-9 and 2011-28. This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. http://www.irs.gov/uac/Form-W-2-Informational-Reporting-of-the-Cost-of-Employer-Sponsored-Group-Health-Plan-Coverage Coverage Type Major medical Dental or vision plan not integrated into another medical or health plan Dental or vision plan which gives the choice of declining or electing and paying an additional premium Health Flexible Spending Arrangement (FSA) funded solely by salary-reduction amounts Health FSA value for the plan year in excess of employee’s cafeteria plan salary reductions for all qualified benefits Health Reimbursement Arrangement (HRA) contributions Health Savings Arrangement (HSA) contributions (employer or employee) Archer Medical Savings Account (Archer MSA) contributions (employer or employee) Hospital indemnity or specified illness (insured or self-funded), paid on after-tax basis Hospital indemnity or specified illness (insured or self-funded), paid through salary reduction (pre-tax) or by employer Employee Assistance Plan (EAP) providing applicable employer-sponsored healthcare coverage On-site medical clinics providing applicable employer-sponsored healthcare coverage Wellness programs providing applicable employer-sponsored healthcare coverage Multi-employer plans Domestic partner coverage included in gross income Military plan provided by a governmental entity Federally recognized Indian tribal government plans and plans of tribally charted corporations wholly owned by a federally recognized Indian tribal government Self-funded plans not subject to Federal COBRA Accident or disability income Long-term care Liability insurance Supplemental liability insurance Workers' compensation Automobile medical payment insurance Credit-only insurance Excess reimbursement to highly compensated individual, included in gross income Payment/reimbursement of health insurance premiums for 2% shareholder-employee, included in gross income Other Situations Employers required to file fewer than 250 Forms W-2 for the preceding calendar year Forms W-2 furnished to employees who terminate before the end of a calendar year and request, in writing, a Form W-2 before the end of that year Forms W-2 provided by third-party sick-pay provider to employees of other employers This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Report on form W-2 Do Not Report on Form W-2 Optional Reporting X X X X X X X X X X Required if employer charges a COBRA premium Required if employer charges a COBRA premium Required if employer charges a COBRA premium Optional if employer does not charge a COBRA premium Optional if employer does not charge a COBRA premium Optional if employer does not charge a COBRA premium X X X X X X X X X X X X X X Report Do Not Report Optional X X 30X Financial Risk Non-Compliance Penalties • Benefit Plan Design – – – – – – – No annual max No lifetime max Max waiting period Wellness HIPAA violation Medical FSA HRA Discrimination 31 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure Industry Related Fees • PCORI Fee • Health Insurance Industry Fee • Transitional Reinsurance Program 32 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure PCORI Fee • $1 PMPY in year 1; $2 PMPY in years 2-7 (indexed for medical inflation) • Fee applies to policy or plan years ending on or after 10/1/12 and before 10/1/2019. • Fee is due in July of the calendar year that follows the end of applicable plan or policy year for self-funded plans on Form 720. (Expect fee built into rates of fully insured plan.) • First payment due by 07/31/2013 for calendar year plans or those with plan years ending in October, November or December of 2012. • Plans with policy years ending after 12/31/2012, will make first payment in July, 2014. • Plan sponsor is responsible to file report on behalf of all participating employer groups in plan. • Recommend payment not made from plan assets 33 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure PCORI Fee • Form 720 34 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure PCORI Fee • What plans are subject to the PCORI Fee? FEE APPLIES TO: Employer Sponsored FEE DOES NOT APPLY TO: • • • • • • • • • • • • • • • • • Fully insured medical plans, including minimum premium plans Self-insured group medical plans Individual/family plans Stand-alone behavioral health plans Individuals on a temporary U.S. Visa who live in the U.S. Medicare Surround and Medicare Expand policies Retiree-only plans Health Reimbursement Accounts (HRAs) Flexible Spending Accounts (FSAs) if the employer contribution is > $500 and it is more than the employee contribution • Health Savings Accounts (HSAs) Stand-alone dental plans Stand-alone vision plans Employee Assistance Plans (EAPs) Exempt FSA plans Medicare Parts A-D coverage Medicaid coverage Expatriate coverage provided primarily for employees who work and reside outside the U.S. U.S.-based “trailing dependents” of expatriate employees who live overseas 35 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure PCORI Fee • Special rules for multiple plans: – For multiple plans running on same plan year: All Plans Self Insured: (i.e. Medical & Rx, or Medical & HRA) If two or more self-insured plans cover the same individuals and have the same plan year, do not pay the fee twice. Mixed Fully Insured and Self Insured: (i.e. Medical & HRA) If major medical is fully insured and fee is paid by insurance carrier, the plan sponsor (employer) is responsible for payment of fee for all covered lives in the HRA, thus double counting the participants 36 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure PCORI Fee • Three methods for determining the average number of covered lives based on entire plan year: Actual Count Method The plan sponsor counts the number of individuals covered by the plan each day of the plan year and divides by the number of days in the plan year. Snapshot Method The plan sponsor counts the number of individuals covered by the plan on one or more dates during each quarter of the plan year and divides by the number of dates on which the count was made. (Dates must be within three days of the date used in the first quarter.) Snapshot Factor Method Allows employer to count all “self only” participants, and use a factor of 2.35 for any employee with other than “self only” coverage. Form 5500 Method The plan sponsor uses the plan’s annual Form 5500 filed for the plan year – adding the count of participants at the beginning of the year and at year end to arrive at the average number of covered lives. 37 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure Health Insurance Industry Fee • Fee to assist the government in subsidizing coverage for lower income individuals and families • Paid by the carrier providing fully insured plans • Fee is ongoing (no planned end) Year 2014 2015 & 2016 2017 2018 Years after 2018 Fee $8 billion $11.3 billion $13.9 billion $14.3 billion Prior year amount indexed by rate of annual premium growth • Result = premium increase of 2.3 – 3.5% for 2014 38 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure Transitional Reinsurance Program • Temporary program intended to stabilize premiums in the individual market from 2014 – 2016. • Protects insurers from uncertainty in rate setting. (PCIP and other high risk pools to flow into Exchange(s)) • Applies to: – Fully insured grandfathered and non-grandfathered plans Insurance carrier pays fee – Self insured grandfathered and non-grandfathered plans TPA’s may make payment on behalf of plan sponsor or plans may pay directly, although plan liable for the fee. 39 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure Transitional Reinsurance Program • How much is the fee? Year Total Fee to be Collected* Fully Insured Self Insured 2014 $12 billion 2015 $8 billion 2016 $5 billion Built in premium or direct pass-through at rate of $63 PMPY or $5.25 PMPM for 2014. **Estimates expected to decrease to $42.00 and $26.25 in years 2015 and 2016 respectively. TPA to bill/collect/remit or plan sponsor direct pay at rate of $63 PMPY or $5.25 PMPM for 2014. **Estimates expected to decrease to $42.00 and $26.25 in years 2015 and 2016 respectively. *State has option to add an additional a state-level fee. **To be confirmed through HHS Notice of Benefit and Payment Parameters 2014-2015 40 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure Transitional Reinsurance Program • Budget Calculation Example – 10/1 Fiscal plan year / 2600 Total Members 2013 / 2014 Impact (Applies for 9 months) Transitional Reinsurance Fee (Per Member per Month) January 1, 2014 – September 30, 2014 Expense $5.25 $122,850 2014 / 2015 Impact (Applies for 12 months) Transitional Reinsurance Fee (PMPM) – 3 Months $5.25 Transitional Reinsurance Fee (PMPM) – 9 Months $3.50 Annual Expense 41 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. $122,850 Financial Risk Budget Exposure Transitional Reinsurance Program • When is it due and how is it paid? – Fee is a calendar year fee – Fully insured: pay in/with monthly premiums starting plan years that extend into 2014 – Self insured: likely remit to TPA monthly or annually – Enrollment count submitted to HHS by November 15th of years 2014, 2015, and 2016 – HHS issued invoice expected by December 15th – Payment due within 30 days of invoice NOTE: Fee is tax deductible expense. 42 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure Transitional Reinsurance Program • What plans are subject to the fee? FEE APPLIES TO: FEE DOES NOT APPLY TO: • • • • • • • All insured individual and group medical plans (HMO, Network, PPO and OAP) regardless of funding type (i.e., Guaranteed Cost or Shared Returns including Minimum Premium) TPAs/plan sponsor on behalf of self-insured group medical plans Taft-Hartley Plans to the extent the plans meet the other criteria for inclusion Stand-alone pharmacy and behavioral health • • • • • • • Stand-alone dental and vision plans Hospital indemnity and specified disease plans Private Medicare, Medicaid, CHIP, state and federal high-risk pools and basic health plans Health Reimbursement Accounts (HRAs) integrated with a group health plan Health Savings Accounts (HSAs) Flexible Spending Accounts (FSAs) Employee assistance programs, disease management programs and wellness programs Stop-loss and indemnity reinsurance policies Military health benefits Indian Health Service coverage 43 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure Transitional Reinsurance Program • Special rules for multiple plans: – For multiple plans running on same plan year: All Plans Self Insured: (i.e. Medical & Rx, or Medical & HRA) Mixed Fully Insured and Self Insured: (i.e. Medical & HRA) If two or more self-insured plans cover the same individuals and have the same plan year, do not pay the fee twice. If integrated major medical is fully insured and HRA or Rx plan self-insured – treat as a single group health plan to calculate fee. 44 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure Transitional Reinsurance Program • Three methods for determining the average number of covered lives based on entire plan year: Actual Count Method The plan sponsor counts the number of individuals covered by the plan each day of the first 9 months of the applicable year and divides by the number of days in the first 9 months of the year. Snapshot Method The plan sponsor counts the number of individuals covered by the plan on one or more dates during the first three quarters of the plan year and divides by the number of dates on which the count was made. Snapshot Factor Method (Dates must be within three days of the date used in the first quarter.) Allows employer to count all “self only” participants, and use a factor of 2.35 for any employee with other than “self only” coverage during first three quarters of the year. (Not available for groups with both fully insured and self insured options) Form 5500 Method Add the total count of participants at the beginning of the year and at year end, as reported on 5500, and divide by two. (May not be used if plan sponsor has multiple self insured plans or both fully insured and self insured plans.) 45 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure Trend and Plan Design Impact • “Too good to be true” renewals • Under 100 market manual rate increases – Guaranteed issue, guaranteed renewability, but no credible experience • • • • • • • • Small group composite rate elimination Specialty drug rising costs / Clinical trials Medical trend Max out of pocket limits Elimination of lifetime/annual maximums Smoker surcharge/Wellness rewards Adverse risk entering small group market Special change in election/marketplace enrollment 46 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure Trend and Plan Design Impact • Special Change in Election Amendment – Section 1.125-4 – Availability of Exchange is NOT a change in status – Transition Relief Large Employers Fiscal Plan Years Starting in 2013 – Section 125 Plan doc amendment Accident & Health plans only Allows 1 change prospectively to o o Revoke, change current election (go to exchange) Make salary reduction election for fiscal plan that began in 2013 (go in ER plan) – Must incorporate rules into Section 125 plan doc by 12/31/14 and must be retro to first day of fiscal plan year started in 2013. 47 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Financial Risk Budget Exposure 48 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Audit Risk Regulatory Agencies • Internal Revenue Service – Pay or Play Penalty / ESRP – FSA; $2,500 max – Form W-2 reporting of employer sponsored health coverage – Form 720 – Elimination of stand alone HRA – Imputed Income 49 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Audit Risk Regulatory Agencies • Department of Labor - Compliance – – – – Mandatory disclosures MLR rebate distribution Max waiting period Summary of Benefits and Coverage (SBC) Content and distribution – Amended plan documents FSA, $2,500 max Special change in election amendment 50 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Audit Risk Regulatory Agencies • Department of Labor - Compliance – Non-discrimination Eligibility & benefits Wellness rewards – Pay or play transitional guidance requirements met – Anti-abuse rules – Notice of Exchange availability 51 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Audit Risk • Model Exchange Notice Due to employees by October 1, 2013 52 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Culture Risk Align Expectations • Management – Staffing – Ownership of timekeeping • Employee – – – – – – Marketplace media blitz Medicaid expansion Access to care Wellness programs Special change election / 2 deductibles & 2 OOP Private exchanges / Defined contribution 53 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Culture Risk Align Expectations • Managing authority – Position recommendation – Comparative entity survey • Collective bargaining units – Representation among leadership – Clear communication and education for buy-in – Balancing benefits expectations & potential wage suppression 54 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Legal Risk • Wellness plan discrimination • Benefits classification and eligibility • ERISA / Reduction in hours / Anti-abuse 55 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Legal Risk Other Looming Legislation & Guidance • • • • • • DOMA legislation Lawsuit - Exchange subsidy from FFE Non-discrimination rules Final ESRP guidance Medicaid expansion The Hub 56 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Emerging Trends • ACO’s • Local hospital/physician group issuers • Innovative product offerings & plan design strategies – – – – – – – – – – – 57 Smaller “designated” networks Telemedicine Specialty procedures at “centers of excellence” Outcome-based Wellness programs – 30%/50% Planning around “substantially all” eligible employees 60% actuarial value with buy-up Stratified plans w/in discrimination – Culture/reporting/economics Non/limited offering of spousal coverage Early renewals HDHP with Gap plan Skinny plans (MEC but not Minimum Value) This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Emerging Trends • Clinics – – – – Employee health and wellness center Urgent Care Primary Care Prescription dispensing • Access to care – – – – Telemedicine Interlocal agreements Concierge Minute clinics and similar 58 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Emerging Trends • Private Exchanges – Florida Health Choices 4-50 employees Single Carrier Minimum employer contribution – 50% – Single Carrier exchange – Multiple Carrier exchange • Public Exchange – – – – – – Notification requirement Subsidy qualification Florida FFE Essential Health Benefits – QHP Metal Levels: Bronze – Platinum The Hub 59 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Emerging Trends • Exchange Applications Individual Short Form Family Application 60 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Individual Without Financial Assistance Balancing Risks, Costs & Rewards I don’t know if you know this, but I’m kind of a big freaking deal. 61 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Balancing Risks, Costs & Rewards • Budget for fees and, mitigate exposure through safe harbors, assess and update processes and systems, and be forward thinking in planning. • Stay abreast of emerging compliance and reporting mandates and legislation and document, document, and maintain those documents. • Collaborate and communicate to organizational decision makers, leaders, and employees. 62 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Balancing Risks, Costs & Rewards • Beware of HIPAA and ERISA that does apply including forthcoming discrimination rules – as well as in house practices and pending legislation that may impact your plan • Stay updated on emerging products and trends and consider them in relation to your dynamics, industry, and culture. • Ask questions. 63 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Questions 64 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group. Contact Information: Copy of presentation: cindy.thompsom@gehringgroup.com Questions: Kate Grangard, CPA, CFO kate.grangard@gehringgroup.com (561) 626-6797 This document is subject to copyright and may not be transmitted or reproduced without express written permission from Gehring Group.