Act on assistance for persons entitled to maintenance

advertisement

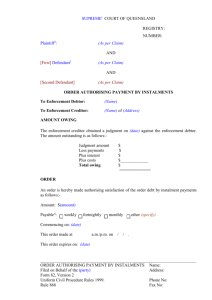

Dz.U.2012.1228 2014.05.15 amended Dz.U.2014.567 Article 22 ACT of 7 September 2007 on assistance for persons entitled to maintenance (consolidated text) Considering that providing means of support for individuals who are unable to independently satisfy their needs, especially children, is in the first place the obligation of members of their family set forth in the Family and Guardianship Code, the constitutional principle of subsidiarity imposes on the state the obligation to support only those poor people, who are not able to independently satisfy their needs and do not receive due support from people belonging to the group of those obliged to support them, supporting people being in a difficult financial situation due to inability to enforce child support should be combined with measures aimed at increasing the accountability of people liable for alimony, the following provides that: Chapter 1 General Provisions Article 1. 1. The Act shall define: 1) the principles of the state aid to persons entitled to maintenance under a writ of execution, in the event of ineffectiveness of enforcement; 2) the conditions for entitlement to cash benefits paid in the case of ineffectiveness of enforcement of maintenance, hereinafter referred to as "benefits from the alimony fund"; 3) the principles and procedures for granting and payment of benefits from the alimony fund; 4) the principles of financing benefits from the alimony fund; 5) actions undertaken against alimony debtors. 2. The alimony fund is a system for supporting persons entitled to maintenance funds from the state budget. 3. The alimony fund is not a fund, within the meaning of the public finance. Article 1a. 1. Benefits from the alimony fund shall be granted to: 1) Polish citizens; 2) foreigners: a) (repealed), b) if it results from bilateral agreements on social security binding for the Republic of Poland, c) residing on Polish territory on the basis of a permanent residence permit, residence permit for a long-term resident of the European Union, and temporary residence permits granted in connection with the circumstance referred to in Article 1 186(paragraph 1) point 3 of the Act of 12 December 2013 on foreigners (Dz. U. item 1650), d) residing within the Polish territory in connection with obtaining a refugee status or subsidiary protection. 2. Benefits from the alimony fund shall be granted to persons referred to in paragraph 1 if they reside on the Polish territory for a benefit period in which they receive benefits from the alimony fund, unless the bilateral international agreements on social security provide otherwise. Article 2. Whenever in the Act any reference is made to: 1) administrative enforcement body- shall mean a proper enforcement authority responsible for enforcement proceedings agreed established under the provisions of the Act of 17 June 1966 on enforcement proceedings in administration (Dz.U. of 2012 items 1015 and 1166); 2) ineffectiveness of enforcement - shall mean execution, as a result of which within the last two months no full amount of the arrears and ongoing maintenance obligations was enforced; ineffective enforcement is also considered the inability to instigate or conduct maintenance execution against the alimony debtor being outside the Republic of Poland, in particular due to: a) lack of the legal grounds to undertake actions to comply with a writ of execution in the place of residence of the debtor, b) for the inability to identify the place of residence of the alimony debtor abroad by the entitled person; 3) alimony debtor - shall mean a person obligated to support under a writ of execution, against whom enforcement was ineffective; 4) income - shall mean income referred to in the legislation on family benefits; 5) family income - shall mean family income referred to in the legislation on family benefits; 5a) income of a family member- shall mean the average monthly income of a family member reached in the calendar year preceding the benefit period, subject to Article 9 paragraphs 3-4a; 6) institution providing round-the-clock maintenance - shall mean a social assistance house, care and education centre, youth education centre, hostel for minors, reform centre, remand centre, prison, care and treatment centre, care centres, cadet school or other school, if these institutions provide free full maintenance; 7) unduly collected benefit - shall mean benefits from the alimony fund that is: a) paid despite circumstances causing the cessation or withholding of benefit payment, either in full or in part, b) granted or paid in the case of fraudulent misrepresentation of a person collecting these benefits, c) paid without legal basis or with in serious infringement in the case of ineffectiveness of the decision granting the benefit or if due to the resumption of the proceedings, the decision granting the benefit was rescinded and the right to benefit was denied, d) paid, if the entitled person, during their collection, received, outstanding or ongoing maintenance to the amount of maintenance received in that period, not in line with the sequence set out in Article 28, e) (revoked); 8) benefit period - shall mean the period for which the right to benefit from the alimony fund is established, i.e. from 1 October to 30 September of the following calendar year; 9) authority competent for the debtor - shall mean the voit, a mayor or a president of the city competent for the place of the alimony debtor's residence; 10) competent authority of the creditor - shall mean the voit, a mayor or a president of the city competent for the place of residence of an entitled person; 2 11) entitled person - shall mean a person entitled to maintenance from the parent under a writ of execution originated in or approved by the court if the execution proved ineffective; 12) family - shall mean the following members of the family respectively: parents of an entitled person, spouse of a parent of an entitled person, a person with whom the parent of an entitled person brings up a child, dependent children below 25 years of age, as well as a child older than 25 years of age with a certificate of high level of disability if, due to the disability, they are entitled to care benefit or special attendance allowance referred to in the Act of 28 November 2003 on family benefits (Dz.U. of 2013 item 1456 as amended ) or caretaker's benefit referred to in the Act of 4 April 2014 on determining and payment of benefits for caretakers (Dz. U. item 567) as well as the entitled person; family members do not include: a) a child under the custody of a legal custodian, b) a child who is married, c) (repealed), d) a parent of an entitled person obliged under a writ of execution originating in or approved by the court for maintenance for them; 13) school - shall mean a primary school, secondary school, post-secondary school and art school, where the compulsory education is implemented and an obligation to study, as well as a special training-educational centre, a special educational centre for children and youth requiring special organisation of study, methods of work and education and a centre enabling children and young people who are profoundly mentally handicapped to perform the compulsory education obligation and the obligation to study; 14) university – shall mean a higher school within the meaning of Law on Higher Education, as well as teacher training college, teacher training college of foreign languages, and social services’ employees college; 15) (repealed); 15a) employment or other gainful activity – shall mean performing work under employment contract, service relationship, home based work contract, and performing work or providing services under agency contract, contract of mandate, contract for a specific work or in the period of membership in agricultural cooperative, agricultural circles cooperative or agricultural services cooperative, as well as conducting nonagricultural business activity 16) high level of disability – shall mean: a) high level of disability within the meaning of the provisions on vocational and social rehabilitation and employment of disabled persons, b) total incapacity to work and independent life ordered in accordance with the provisions on retirement and disability pensions from the Social Insurance Fund, c) permanent and long-term incapacity to work in an agricultural holding and to independent life ordered in accordance with the provisions on farmer’s social insurance in order to receive benefits specified in the above-mentioned provisions, d) having a certificate of 1st disability class, e) incapacity to independent life ordered in accordance with the provisions on retirement and disability pensions from the Social Insurance Fund or the provisions on farmer’s social insurance, 17) loss of income – shall mean the loss of income caused by: a) entitlement to parental leave, b) loss of entitlement to unemployment benefit or scholarship, c) loss of employment or other gainful activity, with the exception of work performed under the contract for a specific work, d) loss of pre-retirement allowance or benefit, teachers' compensation benefits, as well as retirement and disability pension, survivor’s pension or social pension, with the exception of pensions granted to farmers due to transfer or lease of an agricultural 3 holding, e) unregistering non-agricultural business activity, f) loss of sickness benefit, rehabilitation benefit or maternity benefit, granted after the loss of employment or other gainful activity; 18) obtaining income – shall mean obtaining income as a result of: a) end of parental leave, b) entitlement to unemployment benefit or scholarship, c) employment or other gainful activity d) obtaining pre-retirement allowance or benefit, teachers' compensation benefits, as well as retirement and disability pension, survivor’s pension or social pension, with the exception of pensions granted to farmers due to transfer or lease of an agricultural holding, e) registration of non-agricultural business activity, f) obtaining sickness benefit, rehabilitation benefit or maternity benefit, granted after the loss of employment or other gainful activity. Chapter 2 The principles of the state aid for the persons entitled to maintenance under a writ of execution in the case of ineffectiveness of enforcement and actions taken against alimony debtors Article 3. 1. In the case of ineffectiveness of enforcement, the entitled person may submit to the competent authority of the creditor an application for action against the alimony debtor. 2. The application should be accompanied by a certificate of an authority conducting the enforcement proceedings confirming ineffectiveness of enforcement and containing information about the execution, the reasons of its ineffectiveness and any actions taken in order to enforce the awarded maintenance. 3. In the case of an application without the certificate of an authority conducting enforcement proceedings, a competent authority of the creditor calls on the authority conducting the enforcement proceedings to send a certificate proving ineffectiveness of enforcement, containing information on the status of enforcement, the reasons for its ineffectiveness and any actions taken in order to enforce the awarded maintenance. 4. The authority conducting the enforcement proceedings is obliged to send the certificate within 14 days from the date of receipt of the request. 5. The competent authority of the creditor makes an application to the competent authority of the debtor to undertake action against the alimony debtor in case of: 1) receiving the application referred to in paragraph 1; 2) granting benefits from the alimony fund to the entitled person; 3) placing the entitled person in foster care. 6. The authority conducting the enforcement proceedings shall be obliged to notify the competent authority of the debtor and the competent authority of the creditor about the state of enforcement and the reasons for its ineffectiveness each time at the request of these authorities, within 14 days from the date of receipt of the call as well as each time in the event circumstances affecting the right to benefit or actions taken against the alimony debtors, within 14 days of the date of being informed about the existence of those circumstances. 7. The competent authority of the debtor and the competent authority of the creditor shall communicate any information relevant to the enforcement to the authority conducting the enforcement proceedings. 8. The competent authority of the debtor and the competent authority of the creditor shall inform the court about omission or any signs of tardiness of the court executive officer 4 conducting the enforcement proceedings against the alimony debtor. Article 4. 1. Upon receipt of the application referred to in Article 3(paragraph5), the competent authority of the debtor shall carry out a maintenance interview in order to determine the family situation, income and professional situation of the alimony debtor as well as his state of health and the reasons for failure to pay the maintenance to the entitled person, it shall receive his financial standing declaration and shall inform the debtor about forwarding to the credit information bureau of any business information about the obligation or obligations of the alimony debtor under the titles referred to in Article 28(paragraph 1) points 1 and 2, in the event of arrears for a period longer than 6 months. 2. The alimony debtor shall file a declaration referred to in paragraph 1 under penalty of prosecution for perjury, of which he should be informed prior to filing of a declaration. 3. (Repealed). 4. The competent authority of the debtor may apply to the head of a social assistance centre for information referred to in paragraph 1 concerning the alimony debtor if the head of the centre is in possession of a family history survey concerning that debtor, conducted on the basis of the social welfare, not earlier than three months from the date of application for information. 5. The minister responsible for social security shall determine, by regulation, the model of the questionnaire for a maintenance interview conducted at alimony debtor and an example of financial standing declaration of the alimony debtor, in consideration of the need to undertake actions by the competent authority of the debtor specified in the Act aimed at improving maintenance enforcement. Article 5. 1. The competent authority of the debtor shall forward to the court executive officer any information having impact on the effectiveness of the conducted executions, in particular those included in a child maintenance interview and the financial standing declaration of the alimony debtor. 2. If the alimony debtor cannot fulfil his obligations due to lack of employment, the competent authority of the debtor: 1) requires the alimony debtor to register as unemployed or as a person looking for a job if it is not possible to register as unemployed; 2) informs the competent district employment office about the need of professional activation of the alimony debtor. 3. In the case when the alimony debtor makes it impossible to carry out a maintenance interview or refused to: 1) submit a financial standing declaration, 2) register in the district employment office as unemployed or looking for a job, 3) accept a proposal of a suitable employment or another gainful activity, performance of socially useful works, intervention works, public works, works on terms of public works or participation in a training, internship or professional training for adults, without any reasonable cause as defined by the regulations on employment promotion and labour market institutions, - the competent authority of the debtor shall initiate proceedings concerning recognition of the alimony debtor as avoiding maintenance obligations. 3a. The decision recognising the alimony debtor as avoiding maintenance obligations shall not be issued towards the alimony debtor, who for the last 6 months fulfilled the maintenance obligations in every month in the amount not lower than 50% of the currently determined maintenance. 3b. If the decision recognising the alimony debtor as avoiding maintenance obligations becomes final, the competent authority of the debtor sends an application to the district starost on suspending the driving licence of the alimony debtor, enclosing a copy of this decision, as well as submits an application for prosecution for an offence referred to in 5 Article 209(1) of the Act of 6 June 1997 - the Criminal Code (Dz.U. no.88, item 553, as amended). 4. In the cases referred to in paragraph 3 points 2 and 3, the starost is obliged to notify the competent authority of the debtor about this fact. 4a. The competent authority of the alimony debtor forwards to a district employment office information about the loss of the status of an alimony debtor or cessation of the need to professionally activate the alimony debtor. 5. On the basis of the application referred to in paragraph 3b, the starost shall issue a decision on suspending a driving licence. 6. Cancellation of the decision on suspending a driving licence shall take place at the request of the competent authority of the debtor addressed to the starost when: 1) the cause for suspending a driving licence referred to in paragraph 3 ceases, and the alimony debtor fulfilled the maintenance obligations for the period of the last 6 months in every month in the amount not lower than 50% of the currently determined maintenance or 2) the status of an alimony debtor is lost. Article 6. The competent authority of the debtor informs the competent authority of the creditor and the executive officer about the actions undertaken against the alimony debtor and their effects. Article 7. 1. In any cases regarding maintenance claims, the competent authority of the creditor or the competent authority of the debtor can file an action for the benefit of the citizens. 2. In the proceedings before the court instituted with the lawsuit of the competent authority of the creditor or the competent authority of the debtor respectively, the regulations concerning the participation of a prosecutor in civil proceedings shall be applied to these authorities. Article 8. The court sends to the competent authority of the creditor and the competent authority of the debtor rulings issued under Article 132 and 138 of the Act of 25 February 1964 - the Family and Guardianship Code (Dz.U. of 2012 item 788) in cases where an entitled person receives a benefit from the alimony fund, within 14 days from the date of the ruling becoming final and binding. Article 8a. The competent authority of the creditor forwards to the credit information bureau any business information about an obligation or obligations of the alimony debtor under the titles referred to in Article 28(1) points 1 and 2, in the event of arrears for a period longer than 6 months. Article 8b. The competent authority may authorise in writing their deputy, an office employee or a director of a social assistance centre or of another gmina’s organisational unit and another person upon request of a director of a social assistance centre or of another gmina’s organisational unit to undertake actions in relation to the alimony debtors, conduct proceedings and issue decisions in such cases. Article 8c. The provision of Article 8b shall apply accordingly to the competent authority of the creditor with regard to implementation of the obligation specified in Article 8a. Article 8d. Upon receipt of the application of the Polish central authority, acting on the basis of Article 51(2)(c) and Article 53 of the Council Regulation (EC) no. 4/2009 of 18 December 2008 on jurisdiction, applicable law, recognition and enforcement of rulings and 6 cooperation in the scope of maintenance obligations (EU Journal of Laws L 7 of 10 January 2009, page 1 as amended), the competent authority of the debtor shall carry out a maintenance interview in order to determine the family situation, income and professional situation of the alimony debtor as well as his state of health and the reasons for failure to pay for maintenance of the entitled person, and receives the financial standing declaration. Chapter 3 The terms of the acquisition of the right to benefit from the alimony fund Article 9. 1. Benefits from the alimony fund shall be granted to the entitled person until he reaches the age of 18, or if he study at school or university until he reaches the age of 25, or if he has the certificate of high level of disability - for indefinite time. 2. Benefits from the alimony fund shall be awarded if the family income per person in a family does not exceed the amount of PLN 725. 3. In the case of the loss of income by a family member in the calendar year preceding the benefit period or following the year, the lost income shall not be considered while calculating income. 4. In the case of obtaining income by a family member in the calendar year preceding the benefit period, while calculating the income of the family member, this year's income shall be divided by the number of months when this income was generated if this income is earned on the date of granting benefits from the alimony fund. 4a In the case of obtaining income by a family member after the calendar year preceding the benefit period, the income shall be calculated on the basis of income of the family member increased by the amount of earned income from the month following the month the income was obtained if this income is earned on the date of granting benefits from the alimony fund. 5. (repealed). 6. If a family member stays in the institution providing round-the-clock maintenance, a person staying in the institution shall not be considered in the calculation of the family income per person. 7. In the case of calculating income from agricultural holding, it is assumed that income in the amount of 1/12 of income announced on a yearly basis by way of an official announcement of the President of the Central Statistical Office in accordance with Article 18 of the Act of 15 November 1984 on agricultural tax (Dz.U. of 2006 No. 136, item 969, as amended) 8. While calculating family income from agricultural holding, leased agricultural areas shall be included in the area of an agricultural holding being the agricultural tax basis, with the exception of: 1) part or the whole agricultural holding possessed by the family leased, under the lease contract concluded in accordance with the provisions on farmer’s social insurance; 2) an agricultural holding brought to be used by agricultural cooperative; 3) an agricultural holding leased due to receiving disability pension specified in the provisions on the rural development support with funds from the Guarantee Section of the European Agricultural Guidance and Guarantee Fund. 9. While calculating the family income obtained by a lessee of an agricultural holding leased in accordance with the rules referred to in paragraph 8a, income obtained from an agricultural holding shall be decreased by rent. 10. While calculating the family income obtained from an agricultural holding leased from the Agricultural Property Agency, income obtained from the agricultural holding shall be decreased by rent. 11. If a family obtains income from an agricultural holding and non-agricultural income, the above-mentioned incomes shall be aggregated. 7 12. In the case of a person under legal custody entitlement to family benefits shall be granted only on the basis of the person’s income. Article 10. 1. Benefits from the alimony fund shall be granted in the amount of the currently set maintenance, however, not higher than PLN 500. 2. Benefits from the alimony fund shall not be granted if the entitled person: 1) is placed in an institution providing round-the-clock maintenance or in foster care; 2) (no longer valid); 3) is married. 3. When determining the right to benefits from the alimony fund, the family income shall not include the amounts received from benefits from this fund. 4. If the social assistance centre had informed the competent authority that the entitled person or their representative squandered the awarded benefits from the alimony fund, the competent authority of the creditor may award the due benefits , in full or in part to the person as in kind assistance. Article 11. When determining the right to benefits from the alimony fund and their amount: 1) in the event of determining the total amount of maintenance for several entitled people, the amount of maintenance granted to one person shall be considered a part of the aggregate amount proportional to the number of persons for whom the maintenance has been determined; 2) in the event of determining child support with more than one writ of execution from the child's parents, the amount of child support granted to one person is considered to be the amount of child support granted on the basis of all the writs of execution. Article 12. 1. Proceedings concerning the benefits from the alimony fund are conducted by a competent authority of the creditor. 2. The competent authority of the creditor may authorise, in a written form, their deputy, an office employee or the director of the social assistance centre or another gmina’s organisational unit as well as another person upon request of the director of the social assistance centre or another gmina’s organisational unit to conduct proceedings in cases referred to in paragraph 1 as well as to issue decisions in such cases. 3. (repealed). 3a (repealed). 4. (repealed). Article 13. (repealed). Article 14. The Council of Ministers, by way of a regulation, may increase the amounts referred to in Article 9(2) and Article 10(1), bearing in mind the amount of paid maintenance benefits. Chapter 4 The principles and procedures for the granting and payment of benefits from the alimony fund Article 15. 1. Awarding entitlement to benefits from the alimony fund and their payment shall be made respectively upon the application of the entitled person or his statutory representative. 8 2. The application shall be submitted in the gmina office or the city office competent for the place of residence of the entitled person. 3. The application should include: 1) data concerning family members, including: first and last name, date of birth, PESEL number, and in the event of no PESEL number assigned - the series and number of an ID card or a passport; 2) the applicant's statement on providing the enforcement authority with any information known to him necessary to conduct the enforcement proceedings against the alimony debtor; 3) the applicant's statement about the place of residence, age, employment and economic situation of persons liable to a person entitled to maintenance. 4. The application should be accordingly supplemented by: 1) taxable income statement in accordance with the principles specified in Article 27, 30b, 30c and 30e of the Act of 26 July 1991 on personal income tax), of every family member (Dz.U. of 2012 item 361, as amended), issued by the head of the competent tax office, providing information about the amounts of income, b) social insurance contributions deducted from income, c) due tax; 2) certificates or statements documenting the amount of other income; 3) other certificates or statements and the evidence necessary to determine the right for benefits, including: a) a document certifying the age of the entitled person, b) certificate of an authority conducting the enforcement proceedings or a statement of ineffectiveness of enforcement, c) certificate of high level of disability, d) a copy of a final judgment of the court that orders maintenance, a copy of a judgment of the court on the security for maintenance claim, a copy of a protocol with the content of a court settlement, or a settlement concluded before the mediator, e) family court's decision on determining a legal guardian for the entitled person, f) certificate or a statement of the entitled person's attendance at school or university, g) information of a competent court or a competent institution about the entitled person undertaking actions related to the writ of execution enforced abroad or on failure to perform these actions in particular in connection with: – lack of legal basis to perform them – impossibility of the entitled person to indicate the place of residence of the alimony debtor abroad, h) certificate or statement concerning health insurance contributions. 4a. In the case of loss of income or obtaining income, documents proving its loss or generation and its height shall be supplemented to the application for benefit from the alimony fund. 5. In the case of submitting an application without the certificate referred to in paragraph 4 point 3 letter b, the competent authority of the creditor shall apply to the authority conducting the enforcement proceedings with a request to send a certificate proving ineffectiveness of enforcement. 6. The authority conducting the enforcement proceedings is obliged to send a certificate proving ineffectiveness of enforcement within 14 days from the date of receipt of the request. 7. The person submitting the application for awarding benefits from the alimony fund shall submit a statement referred to in paragraph 3 points 2 and 3 and paragraph 4 points 1, 2 and point 3 letter b and f, under penalty of prosecution for perjury. A person submitting the statement is obliged to include the in it following clause: "I am aware of criminal liability for perjury." This clause supersedes the instruction of the authority on criminal liability for perjury. 9 8. For performing tasks in the area of benefits, public administration offices use software compliant with the requirements specified by the minister competent for social security in the provisions issued in accordance with paragraph 10, and prepare reports that they submit to the voivode. 8a. The minister competent for family affairs shall be obliged to create a central register covering the following information collected in accordance with the provisions of the act by the competent authorities and self-governments of the voivodeships while performing tasks in the area of family benefits: 1) data concerning persons receiving family benefits: a) name and surname, b) date of birth, c) residence or stay address, d) place of residence or stay, e) PESEL (Personal Identification No.), f) number of the personal identification document in the case of persons who do not have PESEL no., g) marital status, h) citizenship, i) degree of kinship with the family members, j) the type of school attended by the child receiving a family benefit or a person in education, k) health condition, l) number, type and amounts of the benefits paid, m) gender, n) income; o) the amount of awarded maintenance, p) the level of enforcement of awarded maintenance; 2) data concerning alimony debtors and undertaken actions: a) name and surname, b) date of birth, c) residence or stay address, d) place of residence or stay, e) PESEL (Personal Identification No.), f) number of the personal identification document in the case of persons who do not have PESEL no., g) marital status, h) citizenship, i) degree of kinship with the family members, j) health condition, k) education, l) profession, m) employment, n) a person or persons, for whom the maintenance is awarded (name and surname, PESEL number) and the amount of adjudged maintenance, o) the level and type of liabilities of the debtor due to unenforced maintenance, p) financial standing of the debtor, r) a driving licence of the debtor, s) the type of actions taken against alimony debtors. 8b Information referred to in paragraph 8a may be processed by the minister competent for family affairs on the terms of the Act of 29 August 1997 on personal data protection (Dz.U. of 2002, No. 101 item 926, as amended). The competent authorities of the creditor and the competent authorities of the debtor shall forward data for the central registry, using the software referred to in paragraph 8. 10 9. The minister competent for social security shall determine, by way of ordinance: 1) the manner and the procedure in cases for granting benefits from the alimony fund and withholding its payment; 2) the manner of calculating income that entitles to benefits from the alimony fund; 3) templates: a) the application for determination of entitlement to benefits, b) certificates from the tax revenue office referred to in paragraph 4 point 1, c) family income declaration, including declarations of persons subject to the provisions on flat-rate income tax from some revenues of natural persons, and other declarations and proofs necessary to determine the right to benefits, d) certificate of an authority conducting enforcement proceedings concerning ineffectiveness of enforcement containing information on the state of enforcement, the reasons for its ineffectiveness and any actions taken in order to enforce the adjudged maintenance - following the need of efficiently award of benefits from the alimony fund and ensuring proper documentation. 10. The minister competent for social security in consultation with the minister competent for computerisation shall specify by way of ordinance: 1) description of ICT systems used public administration offices performing tasks in the area of benefits, containing the system structure, required minimal functionality of the system and the scope of communication between system structure elements, including records of e-document structures, data formats and communication and encryption protocols, referred to in Article 13(2) point 2(a) of the Act of 17 February 2005 on the computerisation of operations of entities performing public tasks (Dz.U. No.64, item 565 as amended), 2) standardising safety, efficiency and system development requirements, 3) the procedures pertaining to determining compliance of software with the description of the system taking into account the need to ensure compliance of the teleinformation systems applied by public administration offices for the implementation of tasks in the area of benefits, in particular, within the scope of uniformity of the scope and type of data, which would make possible their aggregation into a central set, as well as maintaining compliance with the minimum standards and the manner of determining software compliance, defined on the basis of the Act of 17 February 2005 on the computerisation of operations of entities performing public tasks.. Teleinformation systems do not apply to operations of the Head of Tax Revenue Office following from the provisions of the Act of 14 June 1960 – the Code of Administrative Proceedings (Dz.U. of 2000 no. 98, item 1071, as amended). Article 16. (repealed). Article 17. (repealed). Article 18. 1. The right to benefits from the alimony fund shall be determined for the benefit period starting from the month when an application was submitted to the competent authority of the creditor, not earlier than from the beginning of the benefit period to the end of this period. 2. If the entitled person upon completing education at school was in the same calendar year admitted to university, benefits under the alimony fund shall also be granted for September. 3. In the case expiry of certificate of high level of disability and re-obtaining another, which is a continuation of the previous one, the right to benefit from the alimony fund shall be awarded from the first day of the month following the month in which the expiration date 11 of the previous certificate has elapsed, if the person submitted the application for determination of the right to benefits from the alimony fund within 3 months from the date of re-issuing a certificate of high level of disability 4. In the event of loss of income, the right to benefits from the alimony fund shall be determined from the first full month following the month when income was lost, however not earlier than from the month of filing application. 5. In the case when family income increased by the obtained income results in a loss of the right to benefits from the alimony fund, benefits shall not be granted from the month following the first month of the month when income was earned. Article 19. 1. In the case of the change in the number of family members, obtaining income or its loss, or other changes influencing the right to benefits from the alimony fund, the entitled person or his statutory representative, who have submitted the application for granting benefits from the alimony fund, are obliged to immediately notify the authority paying the benefits. 2. Persons receiving benefits from the alimony fund, public institutions and nongovernmental organisations shall be obliged to provide, at the demand of the competent authority of the creditor, explanations and information with regard to the circumstances having impact on the entitlement to benefits from the alimony fund. Article 20. 1. Benefits from the alimony fund shall be paid monthly. 2. Decisions on benefits from the alimony fund shall be immediately enforceable, except for decisions in cases concerning unduly collected benefits. 3. Applications for determination of the entitlement to benefits from the alimony fund for a new benefit period shall be accepted from 1st August. 4. If the person applying for benefits from the alimony fund for a new benefit period submits the application along with the documents by 31st August, the determination of the entitlement to benefits from the alimony fund and payment of the benefits payable for October shall take place by 31st October. 5. If the person applying for benefits for a new benefit period submits the application along with the documents from 1st September to 31st October, the determination of the right to benefits from the alimony fund and payment of benefits due for October shall take place by 30th November. Article 21. 1. Payment of benefits from the alimony fund shall be suspended if the entitled person or his statutory representative who have submitted the application for awarding benefits from the alimony fund: 1) refused to provide or failed to provide explanations concerning circumstances having impact on the entitlement to benefits before the set deadline; 2) refused to provide the authority conducting enforcement proceedings with information having impact on the effectiveness of enforcement or provided untrue information; 3) did not collect benefits for three consecutive calendar months. 2. In the event of providing explanations, benefits from the alimony fund shall be paid from the month, when the explanations were received by the end of the benefit period, provided that the entitled person still meets the requirements to receive them. 3. If the entitled person reports after three months, benefits from the alimony fund shall be paid for the entire period of suspension, provided that the entitled person still meets the requirements to receive them. 4. If the resumption of the payment of suspended benefits from the alimony fund does not take place by the end of the benefit period, the right to benefits expires. Article 22. 1. The competent authority of the debtor and the competent authority of the creditor may collect and process, within the scope specified in the Act, personal data of 12 persons referred to in Article 15(1), members of their families, and alimony debtors and members of their families. 2. Employers, competent organisational units of the Minister of National Defence, competent units that are subordinate to the minister competent for internal affairs, Head of Internal Security Office, Head of Intelligence Agency, Head of the Central Anti-Corruption Bureau, the Minister of Justice, entities paying pensions to retired persons or family pensions, entities that entered into agency contracts or contracts of mandate or service contract, agricultural co-operatives, competent financial bodies, retirement and disability pension bodies, the Social Insurance Institution, the Agricultural Social Insurance Fund and government and self-government administration offices shall be obliged to issue certificates necessary to determine the right to benefits from the alimony fund. Certificates shall be issued free of charge. Article 23. 1. A person who unduly received benefits shall be obliged to return them with statutory interest. 2. The outstanding liabilities arising from unduly received benefits shall become overdue after 3 years from the day when a decision determining the amount thereof has become final. 3. The time limitation shall be stopped from running by: postponement of the outstanding liabilities payment deadline, dividing by spreading the repayment of outstanding liabilities into instalments and by any action aimed at recovery of outstanding liabilities, provided that the person obliged to return unduly received benefits was notified of such an action. 4. Decision on the recovery of unduly received benefits shall not be issued if more than 10 years had passed from the date of their collection. 5. The amounts of unduly received benefits along with interest, determined by a final decision, shall be set off from the systematic payments of benefits from the fund. 6. Outstanding liabilities arising from unduly received benefits shall be subject to recovery pursuant to the provisions on enforcement proceedings in administration. 7. Interest shall be charged from the first day of the month following the day of benefits payment from the alimony fund, until the day of repayment. 8. The competent authority of the creditor and the Marshal of the Voivodeship may remit the amount of unduly received benefits with interest, in whole or in part, defer the payment deadline or divide them into instalments, particularly if justified circumstances related to the situation of the family occur. 9. In the case of death of a person who unduly received benefits, the liabilities referred to in paragraph 1 shall expire. Article 24. 1. The competent authority of the creditor and the Marshal of the Voivodeship may, without the consent of the entitled person or his statutory representative, change or repeal the final administrative decision determining the right of the party to benefits from the alimony fund if the family or family income situation affecting the right to benefits had changed, enforcement became effective, a family member had became entitled to benefits in another country due to the application of the provisions on the coordination of social security systems, or the person had unduly received a family benefit. 2. Change of the decision to the entitled party’s advantage shall not require their consent. Article 25. Any matters not provided for herein shall be governed by the provisions of the Act of 14 June 1960 – the Code of Administrative Proceedings. 13 Article 26. The authority conducting the enforcement proceedings shall be obliged to provide the competent authority of the creditor with information having impact on payment of benefits from the alimony fund. Article 27. 1. An alimony debtor is obliged to return to the competent authority of the creditor any amount of benefits paid from the alimony fund to the entitled person with statutory interest. 1a. The interest shall be charged as of the first day of the month following the day of disbursement of the benefits until the day of repayment. 2. The competent authority of the creditor shall issue, after the end of the benefit period or after revoking of the decision on granting benefits from the alimony fund, an administrative decision on the return of the amount arising from the benefits received by the entitled person from the alimony fund by the debtor. 3. The outstanding liabilities shall be subject to recovery following the procedure as provided in the Act of 17 June 1966 on enforcement proceedings in administration, taking into account the provisions of this Act. 4. 20% of outstanding liabilities shall constitute own income of the creditor's gmina, 20% shall constitute own income of the debtor's gmina, and the remaining 60% of this amount and the interest shall constitute the state budget income. 5. If the competent authority of the creditor is not at the same time the competent authority of the debtor, it shall transfer to the competent authority of the debtor 20% of the amount referred to in paragraph 1. 6. Income obtained by the competent authority of the debtor and the competent authority of the creditor referred to in paragraph 4, shall be allocated in particular to cover the costs of taking actions against alimony debtors. 7. The competent authority of the creditor shall transfer to the alimony debtor and to the competent authority of the debtor: 1) information on awarding benefits from the alimony fund to the entitled person; 2) the decision concerning the return the outstanding liabilities arising from the benefits received by the entitled person from the alimony fund by the alimony debtor; 3) information about the amount of liabilities of the alimony debtor towards the State Treasury under: a) benefits paid to the entitled person from the alimony fund under the Act, b) maintenance advance payments made to the entitled person under the Act of 22 April 2005 on the proceedings against alimony debtors and maintenance advance payment (Dz.U. No.86, item 732 and No.164, item 1366), c) benefits from the alimony fund paid under the Act of 18 July 1974 on the alimony fund (Dz.U. of 1991 No. 45, item 200 as amended). 7a. The competent authority of the creditor shall provide the competent authority of the debtor with information about obligations resulting from titles referred to in Article 28, (1), points 1 and 2. 8. The competent authority of the creditor shall provide the executive officer conducting enforcement proceedings with a decision on granting benefits to the entitled person from the alimony fund. 9. In the period when the entitled person receives benefits from the alimony fund, the executive officer shall transfer the amounts recovered from the alimony debtor that are set off against the maintenance to the competent authority of the creditor to the amount of benefits paid from the alimony fund with interest. 10. The transfer referred to in paragraph 9 shall take place on the basis of a decision awarding benefits from the alimony fund. Article 28. 1. In the period when the entitled person receives benefits from the alimony fund, the amounts recovered in the enforcement proceedings from the alimony debtor, shall 14 be allocated by the authority conducting the enforcement proceedings in the following order: 1) outstanding liabilities arising from benefits from the alimony fund paid to the entitled person under the Act - until completely satisfied, 2) outstanding liabilities arising from maintenance advance payments paid to the entitled person under the Act of 22 April 2005 on the proceedings against alimony debtors and maintenance advance payment - until completely satisfied, 3) receivables of the alimony creditor - until completely satisfied, 4) receivables of the liquidator of the alimony fund arising from maintenance benefits paid under the Act of 18 July 1974 on the alimony fund - until completely satisfied after arrears specified in Article 115(1) (1) of the Act of 17 June 1966 on enforcement proceedings in administration or in Article 10251(1) of the Act of 17 November 1964 – the Code of Civil Procedure (Dz.U. No. 43, item 296, as amended) respectively, and before liabilities specified in Article 115(1) points 2-6 of the Act of 17 June 1966 on enforcement proceedings in administration or in Article 1025(1), points 2-10 of the Act of 17 November 1964 – the Code of Civil Procedure, respectively. 2. If, in the period of payment of benefit from the alimony fund, the outstanding liabilities arising from benefits paid from the alimony fund to the entitled person will not be satisfied, after suspension of benefit payment, the authority conducting the enforcement proceedings shall satisfy them in the following order: 1) receivables of the alimony creditor - up to the amount of adjudged monthly benefits, 2) outstanding liabilities arising from benefits from the alimony fund paid to the entitled person under the Act - until completely satisfied, 3) liabilities arising from maintenance advance payments made to the entitled under the Act of 22 April 2005 on the proceedings against alimony debtors and maintenance advance payment - until completely satisfied, 4) receivables of the alimony creditor - until completely satisfied, 5) receivables of the liquidator of the alimony fund arising from maintenance benefits paid under the Act of 18 July 1974 on the alimony fund - until completely satisfied - after arrears specified in Article 115(1)(1) of the Act of 17 June 1966 on enforcement proceedings in administration or in Article 1025(1)(1) of the Act of 17 November 1964 – the Code of Civil Procedure, and before outstanding liabilities specified respectively in Article 115(1) points 2-6 of the Act of 17 June 1966 on enforcement proceedings in administration or in Article 1025(1) points 2-10 of the Act of 17 November 1964 – the Code of Civil Procedure. 3. In the case of death of the alimony debtor the outstanding liabilities referred to in paragraph 1 points 1, 2 and 4 shall expire. Article 29. 1. Changes in the amount of benefits from the alimony fund as a result of change in the amount of adjudged maintenance shall be made after the receipt of the writ of execution by the executive officer conducting enforcement proceedings from the month in which the change took place and in the amount of the adjudged maintenance. 2. If the entitled person, in the period from the date of changes in the adjudged maintenance until the date of the receipt of a writ of execution from the court executive officer, received benefits from the alimony fund in the amount higher than the adjudged maintenance for this period, he shall be obliged to return them without statutory interest. The provisions of Article 23 shall apply accordingly. 3. If the court exempted the person from the maintenance obligation, and the entitled person, in the period referred to in paragraph 2, collected benefits from the alimony fund for this period, he is obliged to return them without statutory interest. The provisions of Article 23 shall apply accordingly. 4. In the case of increasing the amount of adjudged maintenance, compensation shall be made for the period referred to in paragraph 2. 15 Article 30. 1. The competent authority of the debtor may remit the receivables referred to in Article 28, paragraph 1, points 1, 2 and 4 of the Act, in the total amount of: 1) 30% if the enforcement against the alimony debtor is effective for the period of 3 years in the monthly amount not lower than the amount of the adjudged maintenance; 2) 50% if the enforcement against the alimony debtor is effective for the period of 5 years in the monthly amount not lower than the amount of the adjudged maintenance; 3) 100% if the enforcement against the alimony debtor is effective for the period of 7 years in the monthly amount not lower than the amount of the adjudged maintenance. 2. The competent authority of the creditor may at the demand of the alimony debtor remit receivables arising from benefits paid from the alimony fund together with interest, either in whole or in part, defer the payment term or divide them into instalments, taking into consideration income and family situation. 3. Remission of receivables shall take place by way of an administrative decision. Chapter 5 Financing of implementation of tasks provided in the Act Article 31. 1. Awarding and payment of benefits from the alimony fund and taking actions against alimony debtors is to the responsibility of the gmina within government administration, financed in the form of designated subsidies from the state budget. 2. Actions taken against alimony debtors and the costs of servicing benefits from the alimony fund are financed in the form of designated subsidies from the state budget for family benefits and from own incomes of the gmina referred to in Article 27 (4). 3. The costs of actions taken against alimony debtors and the costs of servicing benefits from the alimony fund amount to 3% of the received subsidy for benefits from the alimony fund, subject to Article 27(6). 4. The competent authorities of the debtor, the competent authority of the creditor and the Marshal of the Voivodeship shall be obliged to present, through the Voivode, any reports on tasks implementation provided in the Act to the minister competent for social security. 5. The report should include information on: 1) the expenditure on benefits sustained from the funds of the state budget; 2) the amount of benefits paid from the alimony fund; 3) people receiving the benefits; 4) alimony debtors; 5) conducted proceedings with regard to granting benefits from the alimony fund; 6) actions taken against alimony debtors; 7) costs of servicing; 8) conducted enforcement proceedings. 6. (repealed). 7. The minister competent for social security shall determine, by way of ordinance, templates and ways of drawing up reports and the terms and method of presentation, taking account of the need to consolidate the information forwarded by entities implementing the Act. Chapter 6 Amendments to applicable provisions Article 32. In the Act of 25 February 1964 - the Family and Guardianship Code (Dz. U. No.9, item 59, as amended) Article 52 shall be amended as follows: 1) after § 1, § 1a shall be added, as follows: „§ 1a. The creditor of one spouse may demand that the court establish the distribution 16 of property, if it proves that satisfying the claims from a writ of execution is likely to require the division of the joint property of the spouses.."; 2) after § 2, § 3 shall be added, as follows: „§ 3. The distribution of property by the court at the demand of either spouse does not prevent the spouses from concluding a marital property agreement. If the distribution of assets is established at the demand of the creditor, the spouses may enter into a marital property agreement after the distribution of joint property, or after the creditor receives security or satisfaction for his/her claims, or three years after the distribution of property..". Article 33. In the Act of 17 November 1964 – the Code of Civil Procedure (Dz.U. No. 43, item 296, as amended) the following changes shall be introduced: (changes ignored). Article 34. In the Act of 17 June 1966 on enforcement proceedings in administration (Dz.U. of 2005 No. 229, item 1954, as amended) in Article 10 § 4 shall have the following wording: „§ 4. Maintenance benefit, cash benefits paid in the case of ineffectiveness of maintenance enforcement, family benefits, family allowances, care, childbirth benefits and benefits for orphans shall not be subject to enforcement.” Article 35. In the Act of 26 July 1991 on personal income tax (Dz.U. of 2000 No.14, item 176, as amended) in Article 21 (1)(8) shall have the following wording: "8) family benefits paid pursuant to the provisions on family benefits, family and care allowances, and cash benefits paid in the case of ineffectiveness of maintenance enforcement and childbirth benefits paid under separate regulations'. Article 36. In the Act of 6 June 1997- the Polish Criminal Code (Dz. U. No.88, item 553, with later as amended) Article 209 shall have the following wording: "Article 209. § 1. Anyone who persistently evades the duty imposed on him by law or by court judgement to pay for the support of a next of kin or another person, and thereby exposes such a person to a situation where they cannot satisfy their essential needs is liable to a fine, the restriction of liberty or imprisonment for up to two years. § 2. The prosecution takes place at the motion of the aggrieved party, a social welfare authority or an institution conducting activity towards the child support debtor. § 3. When the aggrieved party has been assigned appropriate family benefits or cash benefits in the event of the ineffective enforcement of child support, the prosecution is carried out ex officio. Article 37. In the Act of 29 August 1997- Tax Ordinance Act (Dz.U. of 2005 No. 8, item 60, as amended) in Article 299 the following changes shall be introduced: 1) in § 3 point 9 shall have the following wording: "9) voits, mayors, presidents of cities or marshals of voivodeships with regard to proceedings conducted for awarding family benefits or cash benefits paid in the case of ineffectiveness of maintenance enforcement;" ; 2) § 4 shall have the following wording: „§ 4. Information about bank account numbers held by the taxpayers may be made available to: 1) Social Insurance Institution and the Agricultural Social Insurance Fund; 2) enforcement authorities in connection with pending enforcement proceedings; 3) voits, mayors, presidents of cities or marshals of voivodeships with regard to proceedings for awarding family benefits or cash benefits paid in the case of 17 ineffectiveness of maintenance enforcement.” Article 38. In the Act of 14 February 2003 on disclosure of economic information a (Dz.U. No.50, item 424, of 2004 No.68, item 623 and No.116, item 1203 and of 2006 No. 157, item 1119) the following changes shall be introduced: (changes ignored). Article 39. In the Act of 28 November 2003 on family benefits (Dz.U. of 2006 No. 139, item 992 and No.222, item 1630 and of 2007 No. 64, item 427 and No.109, item 747) in Article 3,(1),(letter) in indent 26 the semicolon shall be replaced with a comma and indent 27 shall be added, as follows: "- cash benefits paid if the execution of maintenance allowance is not possible;” Article 40. In the Act of 20 April 2004 on employment promotion and labour market institutions (Dz.U. No.99, item 1001, as amended as amended) the following changes shall be introduced: (changes ignored). Chapter 7 Transitional and repealing provisions, provisions on entry into force Article 41. Cases concerning maintenance advance payment, the right to which was established on the date of entry into force of the Act, shall be subject to examination on the principles and according to the procedures set forth in the current provisions. Article 42. 1. A person who unduly received maintenance advance payment is obliged to return it. 2. Cases concerning unduly received maintenance advance payment shall be subject to examination and investigation on the principles and according to the procedures set forth in the current regulations. 3. The amounts of unduly received maintenance advance payments with interest determined by the final decision shall be set off from the systematically paid benefits from the alimony fund. Article 43. 1. Recovery of receivables arising from maintenance advance payments shall be carried out continuously until they are satisfied under current regulations. 2. The application for cancellation or suspension of execution requires the consent of the competent authority of the creditor. Article 44. When determining the right to benefits from the alimony fund for the benefit period from 1 October 2008 until 30 September 2009 and from 1 October 2009 to 30 September 2010 the family income shall not include the maintenance advance payments received in 2007 and 2008 Article 45. 1. The benefit period which starts on 1 September 2007, for which the right to maintenance advance payment shall be determined, shall be extended until 30 September 2008. 2. Change in the decision takes place ex officio and shall not require the consent of the party. Article 46. 1. The competent authority of the creditor, on the date of entry into force of this Act, shall make settlement between the made advance payments and the maintenance allowance collected by the executive officer for this period. 18 2. After the settlement referred to in paragraph 1, in the case of underpayment or overpayment of benefits, the competent authority of the creditor shall pay advance payment or demand its return. Regulations on unduly received benefits shall apply accordingly. Article 46a. Certificate of ineffective enforcement shall be issued by the authority conducting the enforcement proceedings, starting from 1 August 2008. Article 47. The Act of 22 April 2005 on the proceedings against alimony debtors and maintenance advance payment shall lose legal force (Dz.U. No.86, item 732 and No.164, item 1366), except for Article 17 paragraphs 5 that shall lose legal force on 1 December 2008. Article 48. The Act comes into force on 1 October 2008, except for: 1) Article 12, paragraphs 2 and 3a, Article 15 (9), Article 20 paragraphs 3-5 and Article 46a that come into force on 1 August 2008; 2) Article 32 that come into force after 3 months from announcement; 3) Article 45 that come into force 14 days after the date of announcement. 19