Core Elements of the OECD Principles The rights of shareholders

advertisement

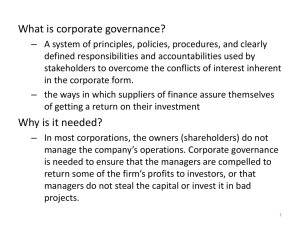

THE OECD CORPORATE GOVERNANCE PRINCIPLES AND THE ONGOING REVIEW Grant Kirkpatrick – OECD Policy Dialogue on Corporate Governance in China Shanghai February 25, 2004 1 Core Elements of the OECD Principles 1. 2. 3. 4. 5. The rights of shareholders The equitable treatment of shareholders The role of stakeholders Disclosure and transparency The responsibility of the boards 2 Why “core principles”? Enormous variation in ownership and control structures in the world No single model of good corporate governance: but need for a global language Detailed codes, best practices should be established at national and regional levels Objective: to identify common elements or core principles underlying good corporate governance across the different systems: a multilateral policy framework 3 The call for an assessment/review of the Principles 4 OECD Ministers at their 2002 Annual Meeting Observed that the integrity of corporations, financial institutions and markets is essential to maintain confidence and economic activity and to protect the interests of stockholders. Agreed to implement best practices in corporate and financial governance which entails an appropriate mix of incentives, balanced between government regulations and self regulation, backed by effective enforcement. Agreed to survey recent experience and assess the Principles of Corporate Governance. 5 THE FINANCIAL STABILITY FORUM’S GUIDANCE FOR THE REVIEW Recent improvements in national standards should be reflected in the revised Principles. While the Principles themselves should remain general, they should be strengthened. Provide more substantial guidance on applicability, implementation and enforcement in different economic and legal contexts. 6 Policy concerns and driving forces Corporate scandals and large failures,problems of compensation and legitimacy…. New awareness of links between Corporate governance arrangements and growth Reveal need for improving: »Transparency and disclosure »Alignment of incentives »Monitoring by boards »Shareholder rights »Implementation and enforcement 7 The Review Process and Timetable OECD’s Steering Group on Corporate Governance has carried out the Review (30 OECD Governments, World Bank, IMF, IOSCO, BIS, Basel Banking Committee, BIAC, and TUAC) Consultations were held with a wider group of interested parties, with non-OECD countries, and with several highlevel roundtables chaired by the Secretary-General A survey of corporate governance developments in OECD countries since 1999, and a summary of experiences in nonOECD countries were prepared are available on our web site - www.oecd.org/daf/corporate-affairs Draft revised Principles were placed on the web for comment in January 2004 and resulted in some 100 replies which are posted on our web site. Final version will go to Ministers in May 8 The current state of the discussions, chapter-by-chapter: - Major issues - Possible solutions 9 Chapters I and II, The rights of shareholders (plus their key ownership functions) and their equitable treatment 10 The corporate governance framework should protect shareholders rights Right to have shares registered and secure Should be able to take part in shareholder meetings and in major decisions concerning the firm Equitable treatment of all shareholders, foreign and minority especially Should not be abused by insiders 11 But in practice the rights are often weak and redress is difficult Need for greater voice through strengthened voting rights and information More active institutional investors and disclosure of their conflicts of interest In presence of major shareholders improve protection of minority shareholders Takeovers often blocked 12 Improving Shareholder voice… The ability of shareholders to elect board members o their choice, to table proposals and ask questions of directors is, in reality, very limited in a number of countries. Should shareholders be given more decision rights with respect to board and executive compensation? Need to avoid shareholders second guessing management 13 Ownership and shareholding structures The transparency of ownership and shareholding structures, including pyramids that result in control rights being greater than cash flow rights is limited in many cases. The Regional Roundtables have called for improvements in the disclosure of beneficial ownership to assist in efforts to curb abusive related party transactions. Beneficial ownership information also is important for the battle against international financial crime 14 Regional Roundtables on shareholder rights and equitable treatment… Typically high degree of concentrated ownership, with control through pyramids and cross-holdings, combined with weak shareholder protection and insufficient disclosure: equitable treatment of shareholders is a pivotal issue. Need to facilitate the exercise of shareholder rights. Minority shareholder rights in relation to changes in capital structure, in corporate control and delisting a concern (lack of pre-emptive or tag-along rights, etc.) Voting of depository receipts. Frequent abuse of related party transactions; improved disclosure needed. 15 Improving and facilitating the exercise of voting rights… Exercise of voting rights varies widely VOTES CAST BY INVESTORS AS A % OF TOTAL U.S. Japan U.K. 83% 71-80% 50% Greater use of electronic communications? Institutional investors that act as fiduciaries being pressed to be more active. Legal and practical problems to cross-border voting widespread among the OECD countries. 16 The rights and responsibilities of institutional investors. While institutional ownership is growing in size and importance, institutional investors typically play a limited role in corporate governance. The issue is not always to add to their already established rights as shareholders. The problem is that they do not make use of them. This is partly due to a lack of proper incentives and sometimes due to restrictions on their ability to set aside sufficient resources to carry out key ownership functions in an informed way. Should those who act as fiduciaries disclose their voting policies. If they do, it would also be natural to ask that they disclose how they, in practice, will implement these policies; for example what resources will they set aside to carry out their ownership functions. 17 III. The role of stakeholders in corporate governance Stakeholders include creditors, depositors and employees Encourage active co-operation between between company and stakeholders Performance enhancing mechanisms should be available Redress for violation of legal rights Access to relevant information 18 Stakeholders Issues are complex and difficult. Best to consider two major groups- creditors and employees – separately Creditor rights are important for the terms and conditions of finance… These rights arise from bankruptcy and other laws, but in some countries these rights are deficient and/or the courts are poorly structured to enforce them. Recent reforms in Germany, Japan and Italy. Reorganization procedures and the rights of creditors to remove management vary widely. World Bank and UNCITRAL developing principles. 19 Regional Roundtables have stressed their concerns about corporate practices that impede the opportunity for stakeholders to seek redress for violation of their rights. To communicate their concerns about illegal or unethical transactions they have observed or asked to undertake. Such complaints can provide important information to shareholders. In response to such concerns, in a number of countries, boards are encouraged to Protect “whistle blowers” Give them confidential access to someone on the board Establish an ombudsman to deal with complaints 20 IV Disclosure and transparency Objective is to ensure meaningful and reliable disclosure, which allows markets to judge the fair value of a company. 21 Key elements of disclosure and transparency Major share ownership and voting rights Material foreseeable risk factors Full financial disclosure Governance structure and policies Information should be prepared audited and disclosed in accordance with high standards of accounting, audit and nonfinancial disclosure Regular disclosure 22 The integrity of the disclosure process and of transparency have been called into question Rules based accounting lead to “show me I cant do it mentality”. Holes such as derivative, pension and options accounting too wide. Audit independence called into question. They think they are employed by management. Standards of the big 4 not what they were expected. Peer review failed. 23 Reactions Auditor independence strengthened both structurally and by rules. Move effective responsibility to another organ than management Convergence of accounting standards -but implementation an issue. Greater consideration of disclosure of material information and conficts of interest More calls for non-financial disclosure 24 IOSCO released (Oct. 2002) principles for national standards covering auditor independence and auditor oversight…. Reflect a growing international consensus. Many in OECD consider these principles to be minimum requirements. Importance of audit firms establishing internal monitoring and control systems. Auditors should be subject to an independent auditor oversight body, or if a professional body plays that role, it should be overseen by an independent body. 25 The Financial Stability Forum has “…underscored the importance of progress towards a single set of high quality principles-based accounting standards, with due regard to financial stability concerns.” US moving closer to a principles-based system. Process in place to work towards convergence of IAS and US GAP. EU (including its candidate states), Australia, NZ, Hong Kong, Russia, Singapore to adopt IAS. Indeed, GAAP Convergence 2002 survey of 59 countries indicated that all but three ( Japan, Saudi Arabia and Iceland) intend to converge with IAS. 26 Ensuring that corporate service providers work in the interests of shareholders… In exercising ownership rights, shareholders have to rely on agents (brokers, investment advisors, analysts, rating agencies) for information. Recently a number of cases of serious conflicts of interest and inappropriate incentives have come to light. Responses include changes in stock exchange rules and professional codes of conduct, structural changes such as firewalls, and increased disclosure, e.g., of material conflicts of interest. 27 V. Towards independent and more effective boards… Moves towards increasing not only the number of nonexecutive directors but also ensuring they are “independent”: 1. UK - Higgs Report 2. Japan – new company law 3. US – Commission on Public Trust and Private Enterprise NYSE Sarbanes-Oxley Independence of judgement and independence from management. 28 Board Integrity Issues Responsibility to Whom? Is it Clear? Duty of Loyalty / Duty of Care Status of Independent Directors Legal Status of Committees Alternate / Supplementary Directors 29 Typology of Directors Executive Directors Knowledge of DayTo Day Operations; Communicate Implement Decisions Management NexusFocused Non-Executive (“Outside”) Directors Strategy; Continuity; Long-Term Planning; Expertise Oversight of Key Risk Areas “Independent” Directors Perspective; Objectivity Conflict-Sensitive Functions 30 Separation of Chairman and Chief Executive Officer? UK view: Separation (with the Chairman also independent) would help ensure an appropriate balance of power, increase accountability and enhance capacity of the board for independent decision making. Many in US and France disagree. In US, while Commission on Public Trust proposed a separation, other US codes and principles do not. NYSE reforms may set precedent. But there is recognition that the board should be given more structure. For example, independent or non-executive directors should be able to meet separately under some lead director who can the channel opinions to the Chairman/CEO. 31 A number of countries have moved to require better disclosure of board and executive compensation… Nomination and appointment of the board is a key corporate governance decision; transparent and evenhanded nomination and recruitment process is needed. Remuneration including information on the structure of compensation schemes and termination conditions relevant not only for financial implications but also for assessing incentives and performance. Some countries call for disclosure of individual remuneration; others ask for only aggregate board compensation. NYSE and NASDAQ have proposed independent compensation committees; codes and principles in 32 other countries go in same direction. The use of special purpose committees The use of board committees for such tasks as audit, remuneration, nomination, etc. has spread rapidly around the globe in the last five years. However, it has become quite evident that the underlying concepts are not always well understood and that such committees serve quite different roles in different countries. In the worst case they have become nothing but windowdressing. In order to avoid confusion and inform investors about the added value of board committees, it has, therefore, been suggested that the composition, mandate and remit of committees must be well defined and disclosed, even if they are established on a voluntary basis. 33 Implementation and enforcement of laws, regulations and codes Enacting laws, regulations and codes that meet international standards is the easy step; effective implementation and enforcement is much more difficult. Scope and content of self regulation is under scrutiny; incentives facing the professions may conflict with their integrity and credibility to uphold and enforce expected standards. Capacity and independence of regulatory and enforcement authorities are a serious concern, especially in emerging market and transition countries. Legal and regulatory framework should provide shareholders opportunity for effective legal redress. 34 Steps toward implementing a more robust corporate governance regime Review regulatory costs of any proposed measure and whether there are any more effective instruments at hand. Strengthen market disciplines as they are the most effective continuing discipline on management. Give emphasis to getting incentives aligned properly. Strengthen the ownership function of shareholders. Monitor the governance system – particularly the effects of new measures. 35