Entry 3b: Artifact

advertisement

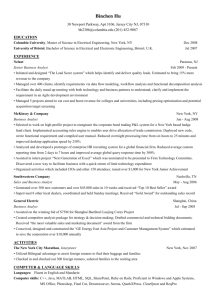

Running head: RECRUITMENT OF A STAR Assignment 4: Recruitment of a Star Case Analysis April Tuggle McDaniel College 1 RECRUITMENT OF A STAR 2 Assignment 4: Recruitment of a Star Case Analysis The sudden resignation of a productive and essential employee is a shock to most organizations, it can cause anxiety and panic in some instances, but if proper succession planning and recruitment and selection process are already in place, the aforementioned stress can be avoided. In the case study, “Recruitment of a Star,” by Stephan Balog, Boris Groysberg, and Jennifer Haimson: Stephen Connor, the director of research at the investment banking firm, Rubin, Stern, and Hertz (RSH) was tasked with recruiting and selecting a replacement after the sudden resignation of Peter Thompson, a star analyst, and the only senior semi-conductor analyst at RSH (2006, p. 1). This case study examines the process of recruitment and selection of an integral upper level position in the fast paced investment banking industry. To fully understand and analyze the “Recruitment of a Star” it is necessary to first understand the culture and situation at RSH. An organization’s culture should be considered one of its strongest attributes, at RSH this was certainly the case. In fact: “Many considered RSH’s culture one of its prime competitive advantages. Teamwork led to superior company coverage. As an additional incentive to teamwork, the director of research tied analysts’ bonuses not only to individual success but also to the success of the group” (Groysberg et al., 2006, p. 1) Clearly, investment banking can be a highly competitive business especially with bonuses tied directly with an employee’s productivity. RSH was able to bridge the competitive gap by fostering a team environment instead of what could be a highly autonomous workplace. RSH also fostered mentorships between senior and junior level analysts so their employees were able to develop their careers and grow within the organization (Balog et al., 2006, p. 1). Ultimately this led to very low turnover at RSH and incredible organizational loyalty, however “the turnover RECRUITMENT OF A STAR 3 rate was so low that it stung when anyone resigned” (Balog et al., 2006, p. 2). Low turnover can indicate general employee job satisfaction, but with low turnover also comes lack of experience with recruitment and selection. In this case, the extremely low turnover led to a lack of replacement and succession planning at RSH and general panic whenever anyone resigned unexpectedly. According to Staffing Organizations, “Replacement and succession planning focuses on identifying individual employees who will be considered for promotion, along with thorough assessment of their current capabilities and deficiencies, coupled with training and development plans to erase any deficiencies” (Henaman, Judge & Kammeyer-Mueller, 2012, p. 107). Although replacement and succession planning did not seem to be a top priority for RSH, Stephen Connor was able to temporarily replace Peter Thompson with Rina Shea (Peter Thompson’s junior analyst) while he conducted the search (Balog et al., 2006, p. 1). This allowed Stephen Connor to conduct his search without having to panic about the upcoming deal with the PowerChip Company (Balog et al., 2006, p. 1). Officially, Stephen Connor promoted Rina Shea to senior analyst but was unsure whether he would allow her to continue as the senior semi-conductor analyst, he decided he would investigate other candidates before offering her the position as the sole senior semi-conductor analyst. If Stephen Connor decided to offer the position to someone else he would simply “give her some smaller technology industry” (Balog et al., 2006, p. 3). After Stephen Connor stabilized conditions by appointing Rina Shea he immediately contacted an external recruiter or “head hunter” to see if there were any “star analysts” looking to move. A senior semiconductor analyst is a highly technical position that is very competitive, rankings of these analysts are published in the Institutional Investor (II) magazine – if an analyst RECRUITMENT OF A STAR 4 is not ranked in this magazine they are not considered “star analysts” (Balog et al., 2006, p. 20). The rankings are based upon institutional client’s rankings on an analyst’s, “earnings forecasts, industry knowledge, overall service, accessibility and responsiveness, stock selection, and written reports” (Balog et al., 2006, p. 21). Peter Thompson ranked third on a list of fifty analysts in Institutional Investor (II) magazine (Balog et al. 2006, p. 21). Although this magazine provides a short list of fifty potential candidates Stephen Connor felt he did not have the time to conduct a search himself, and he did not want to start making calls. Stephen Connor felt the calls would spread all over Wall Street that RSH was searching for a new senior semi-conductor analyst months before the PowerChip Company deadline. Using a recruiter in this case was a way to save Stephen Connor time, and prevent any rumors about RSH. Apparently, Stephen Connor had used this recruiter before because Craig Robertson’s number (who worked for Triple S recruiting) was on his speed dial (Balog et al., 2006, p. 2). This indicates that RSH was completely dependent on outsourced recruitment offices to fill at least their senior level positions. According to Heneman et al. “Outsourcing decisions require consideration of organizational strategy, size, and the skills required” (2012, p. 652). Therefore outsourcing should not be considered in all situations. Due to the large size of RSH it was interesting that there was no mention of human resources during this case, as it would be an accurate assumption that there would be a human resources department for a firm the size of RSH. Clearly, an inhouse recruitment could have been considered if human resources were notified due to the core organization competencies that Peter Thompson served, and the specific attributes Stephen Connor outlined. However, since Stephen Connor was on a constricted timeline due to lack of replacement and succession planning, an outsourced recruitment office became in his eyes the only option. RECRUITMENT OF A STAR 5 After checking in with the recruiter and scheduling a meeting to discuss the qualities Stephen Connor was looking for in a “star analyst,” he contacted a trusted work colleague and “star telecommunications analyst” Tom Walters to seek advice and test the reaction to Peter Thompson’s resignation. During this conversation the point is made that “a couple of months ago Peter Thompson was thinking of resigning and you must know by now that he has given notice. I considered countering for a while, but simply didn’t think it was a good idea” (Balog et al., 2006, p. 3). Stephen Connor had no contingency plan in place a few months ago even though it was relatively well known that Peter Thompson was considering resigning from RSH. Yet another indication that replacement and succession planning is not a part of RSH. After the initial phone conversation with Craig Robertson, Stephen Connor met with Craig Robertson to outline the necessary skills and qualifications for the senior semi-conductor analyst position. Craig Robertson asked Stephen Connor to outline Peter Thompson’s best and worst qualities in order to seek out the best fit (Balog et al., 2006, p. 4). Peter Thompson’s faults included being over competitive, doing anything to get ahead, and money being his sole motivator (Balog et al., 2006, p. 4). However, Peter Thompson’s attributes included, incredibly intelligent, superior analytical skills, go-getter, taking on additional projects, industry knowledge, good writer, client oriented, and access to upper management at companies (Balog et al., 2006, p. 4). Overall, Peter Thompson possessed the hard skills to be successful but was lacking in soft skills especially with his co-workers to be successful. RSH above all wanted a team oriented employee, and Peter Thompson was not team oriented. Stephen Connor’s final remarks to Craig Robertson were: “I’m going to give you fairly free range on this one, Craig. If you can scrounge up two or three highly ranked stars, I’ll be extremely pleased. But search your pool of regional RECRUITMENT OF A STAR 6 firms and local boutiques as well. And if there’s an up-and-comer out there, I’d like to see his or her résumé. A rising analyst could improve a lot on our platform, but he or she would have to have the right ingredients already” (Balog et al., 2006, p. 5). After this final conversation Craig Robertson was able to successfully identify three viable candidates for the position. While Seth Horkum approached RSH with his own recruiter, Rina Shea must also be considered a candidate as Stephen Connor offered Rina Shea an unofficial promise of the semiconductor position if no one else was more qualified than she. Please see Exhibit 1: Required vs. Preferred Qualifications below for the required and preferred qualifications outlined by Stephen Connor. After examining Exhibit 1: Required vs. Preferred Qualifications please see Exhibit 2: Candidates vs. the Required & Preferred Qualifications to examine how David Hughes, Gerald Baum, Sonia Meetha, Seth Horkum, and Rina Shea compare to the required and preferred qualifications. All of the candidates have experience as analysts in the semiconductor industry and advanced degrees all from Ivy League institutions. Clearly, they could all perform the job, but the question becomes who is the best match for the position and organization. After reviewing the interviews and background information about each candidate, it is clear that Gerald Buam should not be considered for the senior analyst semiconductor position. Although, Gerald Baum has only been in the semiconductor industry for 18 months and risen to eleventh place in Institutional Investor (II) magazine he does not exhibit the soft skills necessary to become a productive member of RSH. Gerald Baum is clearly an autonomous analyst, he does not value team work and is mainly drive by competition and monetary compensation. He even had the gall to arrive late to the interview offering no apology, ask about compensation upfront, and shows absolutely no loyalty towards RSH, whenever the next best RECRUITMENT OF A STAR 7 offer came along, Gerald Baum would leave RSH. He may be wonderful with clients and produce viable results, but he is a liability due to his cavalier attitude and documented lack of cooperation with other staff members (firing one of his junior analysts during a client presentation). Gerald Baum would be a terrible fit at RSH due to its team oriented culture, Gerald Baum’s should remain at his own competitive firm Gotz & Loeb. Almost the exact opposite of Gerald Baum is Seth Horkum. Seth Horkum has been with the same Wall Street Firm, Jefferson Brothers for over 15 years and is an extremely loyal analyst. He pursued Stephen Connor because he felt he had reached a point in his career where he could no longer grow at Jefferson Brothers. Since he had been with the organization since the beginning of his career, he felt they would never recognize him as a star no matter how many extra projects he acquired, catered to clients by agreeing to last minute travel or how high his ranking was in Institutional Investor (II) magazine. Seth Horkum was ranked 5th and had been ranked as a runner up but had received no recognition at Jefferson Brothers. However, Craig Robertson did not identify him during his recruiting process as a viable candidate for RSH, even though he was ranked higher than Sonia Meetha in Institutional Investor (II) magazine. Seth Horkum seemed to be habitually overlooked even though he had true star analyst potential. Although Seth Horkum comes from a firm that is known for autonomy, he was responsive to working in a team oriented environment. Seth Horkum would take some time to adjust after being with the same firm for over 15 years to the team oriented culture at RSH, but he has the work ethic, commitment and is noted as brilliant stock picker (one of the preferred qualifications) which could make him successful. Sonia Meetha is from a small firm or a boutique, but is trying to make the transition to a larger firm. Originally from a larger California firm, she transitioned to the East Coast and RECRUITMENT OF A STAR 8 accepted a position at WHS. She has over 15 years of experience as a technology analyst, and has been with WHS for 5 years but is ready to transition to Wall Street. Even though she is from a small firm in Connecticut, she is ranked 8th in Institutional Investor (II) magazine. She has the potential to make big changes at RSH by implementing a global initiative that she successfully did at WHS a great feat for such a small firm. Sonia Meetha was by far the best prepared for the interview by bringing pointed questions and inquiring about projects she was familiar with at RSH. She was especially interested in working with other upper level female analyst, and was excited to hear about the team oriented environment at RSH. Sonia Meetha also discussed telecommuting options, but Stephen Connor emphasized that being onsite at RSH was important for this position, but that RSH may be able to accommodate. Stephen Connor seemed to be overly worried that Sonia Meetha had a family and would not be able to balance the workload, this should not have even been thought of because she has made her way at WHS and this was not suggested of any of the men who have children. Sonia Meetha would be at a disadvantage at first due to her lack of contacts on Wall Street, and inquired about assistance from other senior analysts during her first few months. Although Sonia Meetha has the potential to make great changes at RSH through global initiatives, she does not meet the preferred qualification of being able to “hit the ground running.” Rina Shea has already been doing the senior semiconductor analyst position in Peter Thompsons absence for a few months. As Stephen Connor notes that while the semiconductor department has stabilized he has received mixed reviews about Rina Shea’s work at RSH. Some note that she needs to be more assertive, while others believe she is knowledgeable and capable of doing the job. Unfortunately, not being assertive enough or being too assertive is often attributed to women in the workforce therefore I would not buy into this colleagues analysis. RECRUITMENT OF A STAR 9 Although Rina Shea is doing the job, she is still relying on other senior analysts for assistance. This is the main reason why Stephen Connor should consider other candidates for the position. However, Stephen Connor should have given Rina Shea the opportunity to interview as well so he could accurately compare her to other candidates instead of just assessing her from afar and receiving feedback from colleagues (who may have their own motives as well). In comparison to the other candidates Rina Shea does fall short, mainly because of her lack of years as an analyst. Rina Shea is an up and comer, but she should be reassigned to a smaller industry as Stephen Connor suggested. David Hughes is already a star analyst. He has over 30 years of experience as a semiconductor analyst. He is ranked 2nd in the Institutional Investor (II) magazine this year and has been ranked 1st four times in his career along with other consecutive rankings. David Hughes could definitely fulfill the preferred qualification of “hitting the ground running.” However, the chatter on Wall Street is that he is winding down, but Stephen Connor expressed interest in hiring a well established star with well established contacts on Wall Street all which David Hughes exemplifies. David Hughes also expressed that he would be willing to train junior analyst and pass on his wealth of knowledge, particularly meeting the needs of the development program Stephen Connor is establishing at RSH. David Hughes meets all the required and preferred qualifications, although some question his age that should not be a consideration during the hiring process. David Hughes is by far the most qualified candidate with the potential to train other staff members at RSH to have the same capabilities. There were many issues with the recruitment and selection process for the senior semiconductor analyst position at RSH, however in the end viable candidates were interviewed and could be selected for the position. First, the recruitment process could have been on a better RECRUITMENT OF A STAR 10 timeline if proper succession and replacement planning were implemented at RSH. An exit interview should have been conducted with human resources, and it might have shed some light on the reasons why Peter Thompson decided to resign. Also, Stephen Connor needs to learn to “slow it down” according to “Finding the Right 1,” Nicholas Dunlap suggests that “smart employers are slowing down the hiring process and incorporating additional members of the management team to help interview and uncover whether or not a particular candidate best fits the company’s culture” (2014, p. 24). Stephen Connor did not have meetings with any upper management, other than his work colleague via phone, he only consulted the recruiter for the most part. Even if turnover was extremely low, panic should not be the first response when someone resigns or retires. Second, the recruitment process could have remained in house if Stephen Connor would have thought to contact human resources. Outsourcing recruitment is costly and it could be extremely beneficial for RSH to have their own recruiting department as a part of human resources on staff. Outsourcing recruiting is usually the most beneficial for smaller organizations that do not have robust human resources department (Heneman et al., 2012, p. 652). Maybe a job description would have been created for the position rather than simply telling Craig Robertson your thoughts on what Stephen Connor did and did not like about Peter Thompson (Balog et al., 2006, p. 4). Also, if you are recruiting using an in-house team you have more access to the recruiters and are able to provide more feedback. It is possible that Stephen Connor did not want to use in-house recruiters because he did not want news to spread that RSH was without a semiconductor analyst months before the PowerChip company project, but as Tom Walter’s said “News travels fast here, Stephen” (Balog et al., 2006, p. 3). Also, Craig Robertson did not even RECRUITMENT OF A STAR 11 identify Seth Horkum as a candidate even though he was ranked 5th in Institutional Investor (II) higher than both Gerald Baum and Sonia Meetha. Third, the selection process should have been more standardized and less casual. Although this is an upper level position and certain qualifications are assumed, Stephen Connor’s interviewing capabilities were abysmal. He never gave Rina Shea the opportunity to interview at all, denying her the right to fair consideration. The questions he asked were vague and catered towards each of the candidates, none of the candidates were asked the same questions. Meaning the interviews were unfair and completely reliant on the candidate to do the majority of the talking. Stephen Connor was so ill prepared for David Hughes’ interview he noted to himself that he felt like he was being interviewed by David (Balog et al., 2006, p. 12). Also, the selection process could have greatly benefitted from panel interviews, so it was not just on one person’s shoulders to make the decision, and then there would be a variety of perspectives on the candidates instead of just Stephen Connors perspective. Bringing the candidates in for a day at RSH was a great idea, but unfortunately he only sought feedback from word of mouth, he did not have his staff fill out evaluation forms, or have them ask standard questions of the candidates. Basically, he just set the candidates lose at RSH, other than Sonia Meetha who requested to have a meeting with other female senior analysts. Stephen Connor himself did not have a ranking system in place for himself either, he simply reflected to himself after the interviews. At the end of the case study, Stephen Connor still had yet to make a decision because he did not have the above practices in place. However, after gathering the information from the recruiters and the interviews on each candidate I would suggest the hiring of David Hughes. David Hughes is already a noted “star analyst” and brings over 30 years of knowledge to RSH which he could pass on to other RSH analysts as well making RSH more secure in the future. RECRUITMENT OF A STAR 12 David Hughes exceeds both the required and preferred qualifications therefore, he should be selected. Although, the other candidates had great potential and could make changes at RSH like global initiatives, David Hughes is the best fit for the position at this point with a large upcoming project with PowerChip. RECRUITMENT OF A STAR 13 Exhibit 1: Required vs. Preferred Qualifications Required Qualifications Experienced Sell-Side SemiConductor Analyst Preferred Qualifications Highly Ranked "Star Analyst" in Institutional Investor (II) Magazine Industry Knowledge Good Writer Client Oriented Access to upper management at companies Team Work Oriented Analytical Skills Self-Motivated Ability to travel Global Outlook Established contacts on Wall Street Good stock-picker "Hit the ground running" RECRUITMENT OF A STAR 14 Exhibit 2: Candidates vs. the Required & Preferred Qualifications David Hughes “The Seasoned Professional” Required Qualifications Experienced Sell-Side SemiConductor Analyst Industry Knowledge Good Writer Client Oriented Access to upper management at companies Team Work Oriented Analytical Skills Self-Motivated Preferred Qualifications Highly Ranked "Star Analyst" in Institutional Investor (II) Magazine Ability to travel Global Outlook Established contacts on Wall Street Good stock-picker "Hit the ground running" Comments Has been in the semiconductor industry since 1976, 30+ years of experience Joined the Wall Street firm Buck and Associates in 1976 as a junior analyst, after 4 years he was promoted to a senior analyst. In 1988 he moved to Spensers in a hopes to move up the rankings in Institutional Investor (II) Magazine. known to have "superior work" Rare interpersonal skills that generated a large client base Well established on Wall Street - Stephen Connor refers to him as a celebrity Commented in the interview that he would be happy to pass on his knowledge to juniors - saying "I still have a few tricks up my sleeve" Known to have a razor sharp mind Noted that he wanted to leave Spensers because he wanted to be challenged Comments Ranked #2 in the Semiconductor industry rankings, has received 1st place 4 times, 2nd 5 times, and in other years received a 3rd place or runner-up ranking His travel schedule was noted as being less intense Some felt David Hughes was winding down, but others felt he was just growing bored at Spensers With 30+ years as a semi-conductor analyst David Hughes has exponential contacts Work seen as superior Definitely an experienced semi-conductor analyst, he would have no problem adjusting at RSH - he even plans on bring his juniors and assistants along which indicates loyalty RECRUITMENT OF A STAR 15 Gerald Baum “The Competitor” Required Qualifications Experienced Sell-Side SemiConductor Analyst Industry Knowledge Good Writer Client Oriented Access to upper management at companies Team Work Oriented Analytical Skills Self-Motivated Preferred Qualifications Highly Ranked "Star Analyst" in Institutional Investor (II) Magazine Ability to travel Global Outlook Established contacts on Wall Street Good stock-picker "Hit the ground running" Comments Has been a technology analyst since 1991, became a ranked analyst after 2 years with a firm, jumped Wall Street Firms until he settled at Gotz & Loeb where he remains today, but has only been in the semi-conductor industry for 18 months and is already in the 11th spot in II rankings 15+ years experience as Wall Street technology analyst To achieve II rankings he has to be a good writer Clients confirmed he treated his staff terribly, but his client work was superior and that they would move with Gerald. Not completely client oriented, he fired a junior analyst in the middle of client presentation completely unprofessional, he was also tardy to the interview and was unapologetic about it Due to his years with various Wall Street firms Gerald Baum has connections, however those connection could be unreliable due to his arrogant attitude Gotz & Loeb is a highly competitive firm with bonuses based on individual successes, therefore it is a highly autonomous environment, Gerald Baum is not team oriented Attended MIT and Yale School of Management, and has achieve II rankings Motivated to get ahead, and find the best possible offer to benefit himself motivated by monetary compensation, even asked about compensation and benefits in the interview, which is why he is welcoming offers from other firms Comments Ranked in II magazine has been spotty at times, currently ranked 11th (the lowest out of all the candidates) Active travel schedule, and said in the interview that he answered client emails and voicemails promptly Covered cutting edge companies at Gotz & Loeb, competitive therefore he values the global outlook Has contacts on Wall Street but is known for his terrible attitude towards other staff members "Noted as a rare candidate who excelled at all skills clients considered most important, industry knowledge, service, stock picking, and report writing" Has been in the technology industry for years, he could do the job, but he would have difficulty fitting into the culture at RSH, too autonomous would not value team bonuses or the team approach at RSH RECRUITMENT OF A STAR 16 Sonia Meetha “The Innovator” Required Qualifications Experienced Sell-Side SemiConductor Analyst Comments Has been a technology analyst since 1991, she moved to the East Coast in 1997 at a small firm, WHS she has been with the firm ever since Industry Knowledge Good Writer Client Oriented 15+ years as a technology analyst Praised by her Director for her accurate research reports Well received by clients for her work on two non-US semiconductor firms, "financial models are elegant, clients appreciated her insights" Since she is from a small firm she would have to move fast to create contacts on Wall Street Values a coordinated and team approach, values the larger team and working with other female analysts BS in Engineering, MBA from Stanford Business School Extremely self motivated, ranked in II as an "up and comer" even though she belongs to a small firm Comments Ranked 8th overall in II, noted as an "up and comer" Access to upper management at companies Team Work Oriented Analytical Skills Self-Motivated Preferred Qualifications Highly Ranked "Star Analyst" in Institutional Investor (II) Magazine Ability to travel Global Outlook Established contacts on Wall Street Good stock-picker "Hit the ground running" Needs some flexibility and offered telecommuting Global initiatives are her passion, she expanded her small firms reach by pushing global initiatives, asked a lot of questions pertaining to global outreach during her interview Will have to quickly establish contacts, asked if she would be offered assistance in doing this during the interview Noted as a good stock picker by clients with elegant models It would take an adjustment, but she seems eager to make the transition to Wall Street, came prepared and did her research on RSH, extremely passionate about her job RECRUITMENT OF A STAR 17 Seth Horkum “The Strategist” Required Qualifications Experienced Sell-Side SemiConductor Analyst Comments Has been an analyst since 1989 working 12-16 hour days to work on assignments Industry Knowledge Good Writer 15+ years of experience as a Wall Street Analyst Clients praise the quality of his research reports, Graduate Cum Laude from Harvard, and attended Columbia Business school to earn his MBA Clients appreciate his responsiveness, answering phone calls and emails promptly, as well as traveling at short notice Although he has been on Wall Street for 15+ years he is rarely recognized as a star at his own organization Interested in working as a team, positive response to teams in the interview even though he comes from a more autonomous firm Research director regards him as a top analyst, brought along one of his reports to the interview Clearly motivated to please clients and upper management Client Oriented Access to upper management at companies Team Work Oriented Analytical Skills Self-Motivated Preferred Qualifications Highly Ranked "Star Analyst" in Institutional Investor (II) Magazine Comments Recognized as a runner up, Ranked 5th overall as a semi-conductor analyst in II Ability to travel Willing to travel at short notice Global Outlook Established contacts on Wall Street Good stock-picker "Hit the ground running" No mention of global contacts/outlook Since he is not recognized as a star analyst at his own organization he may struggle to have established contacts elsewhere Noted as a brilliant stock picker Coverage of only medium sized companies may be problematic, he might have some adjusting RECRUITMENT OF A STAR 18 Rina Shea “The RSHer” Required Qualifications Experienced Sell-Side SemiConductor Analyst Industry Knowledge Good Writer Client Oriented Access to upper management at companies Team Work Oriented Analytical Skills Self-Motivated Preferred Qualifications Highly Ranked "Star Analyst" in Institutional Investor (II) Magazine Ability to travel Global Outlook Established contacts on Wall Street Good stock-picker "Hit the ground running" Comments Serving as the "temporary semiconductor", recently promoted to a senior analyst, worked as Peter Thompson's Junior analyst at RSH Working at RSH for over 3 years, began in California a top technology firm in CA MBA at Columbia Business School Some think she needs to be more assertive, others categorize her as being very knowledgeable Recently promoted to a senior analyst she may struggle making these contacts Already a part of the RSH culture, she is clearly motivated to stay in the team environment Received a promotion from a junior analyst to a senior analyst Accepted the offer to stay on after Peter Thompson left to senior analyst, not guranteed the semiconductor job but willing to do it to prove her capabilities Comments Not ranked in II Magazine Not addressed because she did not receive an official interview Not addressed because she did not receive an official interview Previous junior analyst may not have extensive contacts on Wall Street Not addressed because she did not receive an official interview Stabilized the semiconductor unit, preparing for the PowerChip company project RECRUITMENT OF A STAR 19 References Balog, S., Groysberg, G., & Haimson, J. (2006). Recruitment of a star. Harvard Business School, Case Number 407036-PDF-ENG. Boston, MA: Harvard Business School Publishing. Dunlap, N. (2014). Finding the right 1. Journal Of Property Management, 79(3), 24. Heneman, H., Judge, T. & Kammeyer-Mueller, J. (2012). Staffing Organizations (7th ed.). Middleton, WI: McGraw-Hill Irwin.