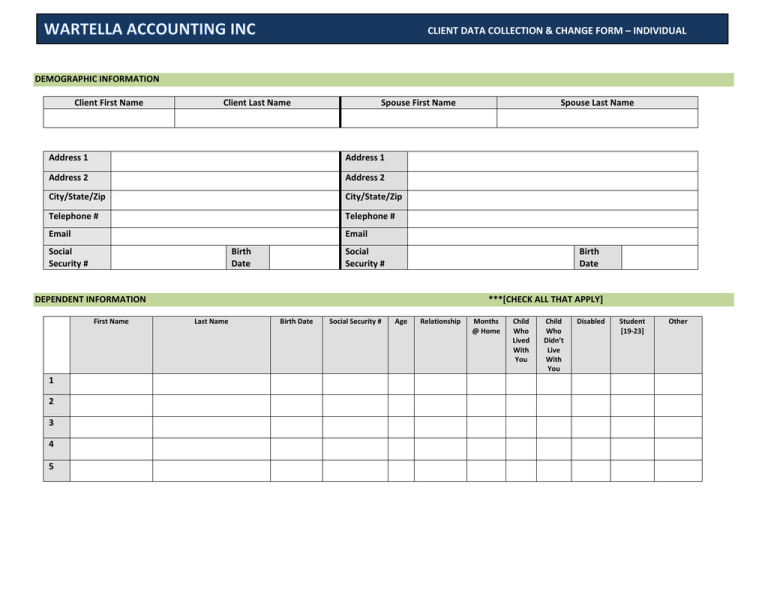

the Data Collection and Change Form

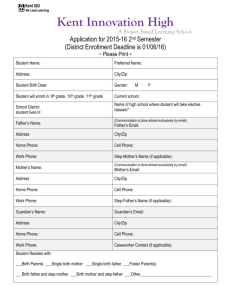

advertisement

CLIENT DATA COLLECTION & CHANGE FORM – INDIVIDUAL DEMOGRAPHIC INFORMATION Client First Name Client Last Name Spouse First Name Address 1 Address 1 Address 2 Address 2 City/State/Zip City/State/Zip Telephone # Telephone # Email Email Social Security # Birth Date Social Security # Birth Date DEPENDENT INFORMATION First Name 1 2 3 4 5 Spouse Last Name ***[CHECK ALL THAT APPLY] Last Name Birth Date Social Security # Age Relationship Months @ Home Child Who Lived With You Child Who Didn’t Live With You Disabled Student [19-23] Other DOMICILE/RESIDENCY INFORMATION Yes ☐ Have you lived in the state indicated in your address during ALL of the current tax year? IF “NO”: No ☐ List dates & states you lived in during the current tax year_____________________________________________________ EARNED WAGES INFORMATION **If you are self-employed skip this section** Yes ☐ Did you earn all of your wages for the current tax year in PA? IF “NO”: No ☐ List each state you earned wages from or in ___________________________________________________________________________________ **This would be each state listed on your W-2 Form, OTHER than wages earned in your state of residence SELF-EMPLOYMENT INFORMATION Indicate your business structure: **Skip this section if your self-employment is from a corporation** ☐ Sole Proprietor ☐ Partnership ☐ Sole Member LLC Business Name or D/B/A Name:_______________________________________________________ Address:_____________________________________________________ _____________________________________________________ City/State/Zip:________________________________________________ Phone #:______________________________ Federal Tax ID # or Social Security #:___________________________________ If Partnership or Multi-Member LLC list all business partners and their share of ownership: First Name Last Name Share of Ownership Partner 1 __________________________________________________________ Partner 2 __________________________________________________________ Partner 3 __________________________________________________________ Partner 4 __________________________________________________________ ☐ Multi-Member LLC ANNUAL TAX RELATED INFORMATION OR DOCUMENTION 1. 2. 3. 4. Please provide us with all W2’s Please provide us with all K-1, 1065/1120S schedules Please provide us with a copy of your previous years; Federal, State & Local tax returns Did you receive any interest payments during the current tax year? 5. 6. 7. 8. Did you purchase, sell or realize and gains, losses or dividends from investments during the current tax year? Do you receive any pension and/or annuity payments? Do you receive any Social Security or Railroad retirement benefits? Do you receive any “other” income such as unemployment comp, independent contractor fees? No ☐ No ☐ 12. 13. 14. 15. No ☐ Yes ☐ No ☐ Yes ☐ [Form 1099-R] No ☐ Yes ☐ [Form SSA-1099] Yes ☐ [Form UC-1099G, 1099-MISC, 1099-C No ☐ 9. Do you have any gambling winnings or losses for the current tax year? 10. Do you maintain a home office? 11. Do you have any UNREIMBURSED employee business expenses for the current tax year? No ☐ No ☐ Yes ☐ [Form 1099-INT, DIV, B] Yes ☐ [Form W-2G] Yes ☐ Yes ☐ Do you have any UNREIMBURSED employee vehicle expenses for the current tax year? No ☐ Yes ☐ Do you have any Student loan, tuition fee or education costs for the current tax year? No ☐ Yes ☐ [Form 1098-T, 1098-E, 1099-Q] Do you have any Traditional or Roth IRA accounts? No ☐ Yes ☐ Did you make any conversions or cash out any retirement account; IRA, 401K etc… during the current tax year? No ☐ Yes ☐ No ☐ 16. Did you buy or sell a home or land during the current tax year? 17. Did you make any estimated Federal, State or Local tax payment during the current tax year? No ☐ Yes ☐ Yes ☐ ****For any question you answered “YES” to, please provide us with all notices, statements or IRS forms you may have received. We will also review this information prior to your scheduled appointment E-FILE INFORMATION Would you like your FEDERAL AND/OR STATE TAX RETURNS filed electronically? ☐ Yes ☐ No If you would like your Federal Tax Returns filed electronically, please provide the following information and provide a copy of a VOIDED CHECK: Bank Name:___________________________ Checking Account Routing #:_______________________ Checking Account #__________________________ ****Not all states accept electronic filing