Expense Tracker and Account Register Instructions

advertisement

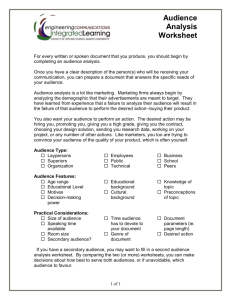

Instructions for Expense Tracker and Account Register Updated as of January 9, 2014 By Melissa Gould 1 Table of Contents Introduction 3 Basic Guidelines for Using Microsoft Excel Cell Formulas Workbook Worksheet Basic Use 5 5 5 6 6 6 Expense Tracker Monthly Balance Worksheet Income Deductions Expenses Retirement Investments and Savings Columns N and O, Subtotals and Total Column N Column O Subtotals Total 7 7 7 8 8 9 10 10 10 10 10 Account Register Worksheets Checking, Credit Card, and Savings 12 12 Liquid Worksheet 12 Loans Worksheet 13 Retire Worksheet 14 Balance Worksheet 15 Figure 1: Depiction of a Cell Figure 2: Depiction of a Formula Figure 3: Depiction of Worksheets Figure 4: Income Figure 5: Deductions Figure 6: Expenses Figure 7: Retirement Investment and Savings Figure 8: Columns N and O Figure 9: Account Registers Figure 10: Liquid Figure 11: Loans Figure 12: Retirement Investments and Savings Figure 13: Balance Worksheet 5 5 6 7 8 8 9 10 12 13 14 15 15 2 Introduction My husband and I began closely tracking all of our accounts in June of 2013. This was due in large part to his canned statement, “I wanna see it in writing,” every time we had a discussion about our finances. The below Microsoft Excel workbook is a recent result of my response. The initial attempt was less detailed than this one, but the same intent was captured. We have stopped asking ourselves where our money goes each month and my husband has learned to use his phrase a little more selectively since then. To be clear, I'm just a hobby saver/penny pincher/money manager; I'm not a professional. I *DO NOT* do this for a living. However, I didn't find a comprehensive worksheet to track spending and I didn't want to buy a program so I made my own way using what I already had: a bit of elbow grease, and Microsoft Excel. This is just how my mind works and it all makes sense to me. It's imperfect; I know this. So, if you see something that should really be added, please comment below. This is only as good as the information you input. It's also very basic; I don't deal with interest rates and such on loans and savings accounts. Your and my money philosophies most assuredly differ. We consider the total balances of our liquid accounts to fulfill our six months of expenses that are recommended by most financial advisers. That may not be true for you or you may not want to track it that way. Either way, after one month, you can estimate your six month expenses so you can start a savings goal if you don’t already have one. The longer you track your expenses, the more accurate that estimate will be. Step one is getting started, though. One saving and investing method we employ is to take our annual savings goal (e.g.: 401k annual limits) and divide it by 12. We automatically schedule the payments and then the money basically doesn’t exist in our accounts. We do this for our employers’ retirement programs and private investments. This isn't going to tell you where you are overspending or under saving. It's just going to show you where your funds are going. From there, it's up to you to make the determination whether you can or want to spend less, save and invest more, etc. I tell my husband all the time what is a need versus a want and he does the same for me. We also recently started a monthly allowance so we can purchase our wants without guilt. Our allowances are listed under entertainment expenses. We’ve agreed we can go backward, but not forward. Meaning, if we don’t spend all of our allowance one month, the remainder can be added to the following. We cannot take money from the following month to fill a gap in the current month, though. I balance our accounts several times a week and do a full account review within the same timeframe each month. This makes it easier for me to keep track of everything. It’s also a motivator to not spend money. 3 If you don't know what a balanced account means, it simply means that you and the bank are tracking the same transactions with the same account balance. Uncleared transactions will make your account balance to differ by that amount. We don't use the envelope method and we use our credit card like a checking account. These are contrary methods to most recommendations. I'm sure we would benefit from modifying our behavior, but I'm proud of having gotten this far. Baby steps. The first worksheet is not in order of precedence. The top two sections are because of the way my husband's paystub is organized. The remainder of the sheet is in alphabetical order by category. This is why Retirement Investments and Savings are at the bottom. It is certainly not because they are the least important. I'm including two workbooks. The one labeled EXAMPLE includes mock numbers to show you where the formulas are and how they work. The one labeled TO USE is blank but with the formulas intact so you can get started. The instructions are really long but I think it's worth it. You do not have to read the instructions for the worksheet to make sense if you are familiar with Excel. The instructions and workbook are linked below. The instructions are also included in the workbook in named worksheets. Good luck with your new money management method. 4 BASIC GUIDELINES FOR USING MICROSOFT EXCEL Excel Definitions (as I use them): Cell: An intersection of a column and a row. An individual rectangle in which data can be entered. They are the little rectangles in the worksheet. They are named by the column heading and then row heading in which they occur. Cell C3 can be found under column "C" in row "3". When selected, the contents of the cell will display in the function "fx" box above. Cell C3 Figure 1: Depiction of a cell Formulas: Equations that can be entered into the cells to automatically generate a result. [e.g.: "=5000+2500” or "+5000+2500" generating a result of $7,500.00, or "-1.19-1.191.19-1.19-1.19-1.19-1.19-1.19-1.19-1.19" generating a result of -$11.90]. Note that if the first number is positive, the equals sign "=" or plus sign "+" is required to obtain a result. When the first number is negative, the equals sign "=" is not required. It's never necessary to enter hanging zeroes (.1 versus .10), dollar signs, or commas into formulas used in this file. Formula Bar Formula Location Figure 2: Depiction of a formula 5 Workbook: The entire file is a Microsoft Excel workbook. A workbook is comprised of more than one worksheet. Worksheet: An individual page in a Microsoft Excel file. Worksheets can be navigated to across the bottom of the open file. Each one has a different name. Worksheets Figure 3: Depiction of Worksheets Basic use ALWAYS double-click a cell with the mouse and make sure the cursor is at the end before typing or you will lose or change all the information that was originally in the cell. NEVER click on another cell or worksheet when you are entering a formula into a cell. The program will think you are selecting that cell to include in your formula and it can be a pain to fix. When you are entering information into a cell, the LAST CHARACTER in a cell should always be a NUMBER. If you insert a new row into a section with a formula in one of the columns, it will be necessary to apply the formula to the new cells. Column N and O have formulas in the Monthly Balance worksheet. Simply click in the cell above the new row. Move your mouse over the tiny square in the bottom right corner of the cell, press and hold the mouse and drag to the new cell below then release the mouse. You could also click in the cell above, copy (Ctrl+C), and paste (Ctrl+V) into the new cell. Viola! 6 EXPENSE TRACKER Monthly Balance Worksheet All the formulas are in the cells with bold numbers. This worksheet is designed to show an end of month balance based on your income and spending strictly from the first to the end of month. This is exclusive of any money you have in your accounts already. You can use this to track cash, account withdrawals, credit card charges or all of the above. If you use this worksheet throughout the month (instead of inputting everything once a month), make sure to double click in the cell to which you are making changes and place the cursor at the end of the values. Income Take this straight from your paystub(s). Change the categories to match what your paystub displays and add or delete rows as necessary. Income Figure 4: Income All numbers in this section must be positive. If you are entering a single income, simply enter that number into the cell. If you are entering two incomes at the same time, click in the applicable cell. Enter an equals "=" or plus "+" sign and the first value. Enter a plus "+" and the next value for each succeeding value until you have entered each value. Click enter. If you are adding an additional income later in the month, double click in the applicable cell. Add either a plus "+" or equals "=" to the beginning of the value. Add a plus "+" to the end of the value and then the additional income. Click enter and the value will automatically calculate. 7 Also input any gifts, rental or disability income, child support, bonuses, tax refunds or other sources of income. Merchandise returns should be entered as a positive number under expenses. Deductions Deductions Figure 5: Deductions Again, take this straight from your paystub(s) and change the categories and add or delete rows as necessary. All the numbers in this section must be negative. Use the minus "-" with each number. If you have a single deduction for a category for a month, simply enter that number with the minus "-". When entering multiple entries into these cells, use the same methods as "Income" above, except use the minus "-" sign before each value. Expenses Expenses Figure 6: Expenses 8 As in "Income" and "Deductions," add, delete, condense, and expound as necessary. Expenses are broken down into categories. Those categories are broken down further into more specific expenses. Each category has its own subtotal (Rows 36, 47, 80, 90, and 102). The entirety of all expenses is subtotaled as well (Row 104). As before, if you have a single expense for a category for a month, simply enter that number with the minus "-" sign. When entering multiple entries into these cells, use the same methods as "Deductions" above. It's possible to have items on the same receipt that belong to separate categories, too. When that happens, I subtract the total value of the receipt from the overarching category and then add back the specific single items into the same cell. I then deduct the single items from the appropriate category (e.g.: groceries and snacks). Make sure if you are going to track cash to not double tap. So if you withdraw $200 cash and end up with a receipt for $25.90 for groceries purchased with cash, make sure to deduct only $200 from cash. If you want to keep things balance, add $25.90 to the cash cell and then subtract it from the groceries cell. Retirement Investments and Savings Retirement Investments and Savings Figure 7: Retirement Investment and Savings Because this is money being taken from your income, these numbers are also going to be negative. They will be positive in the respective accounts into which they are deposited. But it's important to deduct them from your income first. 9 Columns N and O, Subtotals and Total Column O Column N Columns N and O are already programmed with formulas. Figure 8: Columns N and O Column N will subtotal each row's calculations for the entire year. If you have only reached June, it will show you results through June. So, cell N3 will show you what you have entered for your base pay. Cell N12 will show you your entire income for the year. Cell N16 will show you what you have paid in federal taxes for the year. Cell N23 will show you your total deductions for the year. So on and so forth. This is true for each category. Column O will constantly divide the result in column N by 12 showing you what the average monthly calculation is at the end of the year. This is mostly relevant in December, unless you have a category you only pay once a year. If you want to know what your average monthly calculation is before December, simply divide Column N with the number of months you have completed using a separate calculator. Come December, cell O12 will display your average monthly income for the entire year. Cell O23 will show your average monthly deductions for the year. So on and so forth. This is true for each category. Subtotals display the total for each month as you go along. These are in each section (Income, Deductions, Retirement....) as well as categories under Expenses. So, Row 12 will show you your total income for each month as you enter it. Total is calculated in Row 116, the very last row. This cell, under each month, will show you your monthly balance after you input your income, deductions, expenses, and 10 retirement savings. This could be negative or positive. If it's positive, it means you have spent less than you earned this month. If it's negative, that means you dipped into what you had to pay bills or that you increased your credit card debt. It also means you are overspending or living beyond your means. Cell N116 will show you your total balance for the year. Cell O116 will show you your average monthly balance. 11 Account Register Worksheets Checking 1, Checking 2, Credit Card, Savings 1, Savings 2, Savings 3 Additional Worksheets Figure 9: Account Registers These worksheets are basically check registers that you can use to balance your accounts. They are self-calculating so all you have to do is enter the amounts with positives and negatives the new balance will show in Column A . I applied the formula to several cells so it will do it for you for a bit. After you run out of room, you'll have to apply the formula to the new cells. Column B is simply to mark if the item has cleared the bank. I use an asterisk "*", Shift+8. Liquid Worksheet This is a location to track all of your liquid assets or accounts. Each month, on or about the same day, enter the balance of each relevant account into this worksheet. Enter the date of the most recently cleared transaction and balanced account balance. Do this for each account you consider liquid (meaning cash money). Most of these will be positive. If you are tracking a credit card as liquid, this entry would be negative. 12 Column M, TOTAL, will display the total amount of cash you carry in your accounts on that date. This number should be positive. Column N, CHANGE, will show you what amount of change this is from the previous month, positive or negative. Cell O14 shows the annual change. If this is positive, your liquid assets have increased over the year. If it's negative, your assets have decreased by that value over the year. This will only fully calculate at the end of the year. Figure 10: Liquid Loans Worksheet Each month, on or about the same date, check the balances of your loans. Input that number into the necessary column and the date the last transaction cleared. These numbers will be negative. Column I, TOTAL DEBT, will show you the total amount you carry in loans. Column J, CHANGE, will show you how much this has changed from the previous month. If it's positive, you are decreasing the amount of money you owe. If it's negative, your loan burden is increasing. Cell K14 shows the annual change. If this is positive, you have reduced your loans by that value. If it is negative you have increased your loans by that value. This will only fully calculate at the end of the year. 13 Figure 11: Loans Retire Worksheet As above, on or about the same date each month, check any retirement and investment accounts that you have. Input the most recently cleared transaction date and the balance here. These numbers will be positive. Column G, TOTAL, will show you the total amount you carry in retirement and investment accounts. Column H, CHANGE, will show you how much this has changed from the previous month. If it's positive, this means your investments increased overall. If it's negative, your investments decreased in value. If you so desire, you will have to manually enter the amount that you deposited into these accounts into Column I, DEPOSIT. Column J, RETURN, will show the return if you enter a value in Column I. If it's a positive number, then this value is what you earned on your investments without including the amount you deposited. If it's negative then this is what you lost on your investments, exclusive of your deposited amount. Make sure that if you enter the amount deposited that it corresponds correctly to the date you are checking the balance. If you are checking your accounts on the 15th, but your deposit goes in on the last day of the month, the deposit should be added to the next months' calculation. 14 Cell K19 shows the annual change. If this is positive, your retirement accounts have increased in value by this amount. If the number is negative, your retirement accounts have decreased in value by that much. This will only fully calculate at the end of the year. Figure 12: Retirement Investments and Savings Balance Worksheet Figure 13: Balance Worksheet 15 Again, once a month when you have checked the balances in each worksheet (Liquid, Loans, Retire), enter that information into this worksheet. You can enter the date you are doing it or the last balanced date from one of the sheets. The idea is to do it about the same time each month. Column E will display a rough estimate of your total financial worth or debt liability. If the number is positive you have more financial assets than liabilities. If the number is negative, you have more debt than financial assets. Note that this does not take into account any equity. Equity would change this value but unless you are going to use it, it has no bearing on this workbook. Cell F13 shows the annual change. If this is positive, your financial assets have improved by that value. If it is negative, your debt liability has increased by that value. This will only fully calculate at the end of the year. 16