Cost Realism Analysis Techniques

advertisement

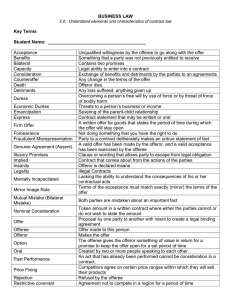

Business Proposal Evaluation FDA Business Management Team Agenda Reasons for Business Analysis Common Definitions Common Business Proposal (SB) Issues Price Analysis – Exercise 1 Cost Analysis – Exercise 2 Technique Determination & Other Considerations – Possible scenarios Business Analysis Report Outline Pivot Table Demonstration Questions Reasons for Business Analysis WARNING! FAR Cites Ahead! FAR 15.402(a) – Pricing Policy states The contracting officer shall purchase supplies and services from responsible sources at fair and reasonable prices. FAR 15.304(c)(1) states Price or cost shall be evaluated in every source selection. Contracting Officers and Contract Specialists are business advisors • Assist customers to make good business decisions. • Be prudent but fair with contractors. |5| Importance of Solicitation Language Brain teaser – Which takes precedence, the FAR or the Solicitation? The FAR States Review Solicitation Language Carefully Separate and Independent • Analysis must be performed in accordance with the solicitation language to avoid protest FAR - 15.305(a). • Shall evaluate competitive proposals and then assess their relative qualities solely on the factors and subfactors specified in the solicitation – FAR 15.305(a). • Price each contract separately and independently - 15.402(b). • Proposal instruction Section L • Evaluation factor Section M • Do not use proposed price reductions under other contracts as an evaluation factor; or consider losses or profits realized or anticipated under other contracts. |6| Common Definitions Underbidding, usually in a competitive environment Fair – Fair market value, reasonable profit for offeror. Realism - whether the estimated proposed cost elements are realistic for the work to be performed, FAR 15.404-1(d)(1). Overbidding, Sole-source & Competitive environments Reasonableness Does not exceed that which would be incurred by a prudent person in the conduct of competitive business, FAR 31.201-3. |7| Common BA Issues - Small Businesses FDA Specific SB Cost Proposal Considerations – Gov’t must verify that SB Offerors have an adequate accounting system for any cost-type proposal (FFP exempt) – Verification must be based on an independent Gov’t accounting system audit Absence of assumptions – Can result in confusion / misunderstanding between Industry and the Government – Small Business vs. Large Business Pricing – At times small businesses do not provide a basis for their proposed pricing – Consequently this makes it difficult for the Gov’t to determine if prices are fair, realistic, and reasonable. Labor Rates (LRs) – Small businesses have a greater tendency to propose LRs not aligned to commercial rates (i.e. GSA Schedules) |8| Common BA Issues - Small Businesses General Mentor-Protégé program not widely understood – Mentor may be treated as subcontractor with a misunderstood 50% performance requirement though SBA has not expressly set a performance requirement. This is supported by allowing the Mentor to create a JV and perform as a Prime. FAR 19.1307 Price evaluation preference for HUBZone – The contracting officer shall give offers from HUBZone small business concerns a price evaluation preference by adding a factor of 10 percent to all non-HUBZone offers. Responsibility Determination – CO may defer to SBA for the “Certificate of Competency”. However, Small Businesses can provide this in response to the RFP => reduces overall processing time. | 10 | Price Analysis Price analysis shall be used when certified cost or pricing data are not required - FAR 15.404-1(b) note the different FAR cite! Key of Price Analysis • Differences of Price vs Cost • Evaluated without reviewing separate cost elements of a proposal. • Price analysis should be used to verify that the overall price offered is fair and reasonable. • FAIR and Reasonable normally established by adequate price competition. • FAR 15.404-1(b)(2)(i) Price Analysis Techniques • Comparison of proposed prices with independent Government cost estimate (IGCE). • Comparison of the proposed prices to historical prices paid. • Use of parametric estimating methods/application of rough yardsticks. • Comparison with competitive published price lists. • Comparison of proposed prices with prices obtained through market research for the same or similar items. • Analysis of data other than certified cost or pricing – can be very useful. | 11 | Price Analysis Exercise (1) A requisition is received for 1,000 first-aid kits for an emergency planning exercise. The kits must be Occupational Safety & Health Administration (OSHA) compliant and received within 21 days. Who would you award the delivery order to? Offeror 1 Offeror 2 Offeror 3 Offeror 4 Offeror 5 Delivery Time 20 days 20 days 20 days 30 days 30 days OSHA Compliance Yes Yes No Yes No Small Business Yes Yes Yes No Yes T/C Exception None None None None None Unit Price $68 $70 $77 $79 $80 Volume Discount 4% 5% 7% 7% 6% Extended Price x 1,000 Units Please Calculate Please Calculate Please Calculate Please Calculate Please Calculate Payment Terms 1%/20 days, Net 30 days 5%/15 days, Net30 days Net 30 days 3%/15 days, Net 30 day 2%/10 days, Net 30 days | 12 | Price Analysis Exercise (2) Offeror 1 Offeror 2 Offeror 3 Offeror 4 Offeror 5 Delivery Time 20 days 20 days 20 days 30 days 30 days OSHA Compliance Yes Yes No Yes No Small Business Yes Yes Yes No Yes T/C Exception None None None None None Unit Price $68 $70 $77 $79 $80 Volume Discount 4% 5% 7% 7% 6% Extended Price x 1,000 Units $65,280 $66,500 $71,610 $73,470 $75,200 Payment Terms 1%/20 days, Net 30 days 5%/15 days, Net30 days Net 30 days 3%/15 days, Net 30 day 2%/10 days, Net 30 days After Payment Discount $64,627 $63,175 $71,610 $71,266 $73,696 1. After payment discount Offeror 2 has the lowest proposed price, but what is the risk for the Government? 2. Why do some vendors offer payment term discounts? | 13 | Cost Realism Analysis The process of independently reviewing and evaluating specific elements of each Offeror’s proposed cost estimate to determine whether the estimated proposed cost elements are realistic for the work to be performed FAR 15.404-1(d)(1) Key of Cost Realism Analysis Cost Realism Analysis Techniques • Must be performed on all cost reimbursement contracts. • Perform a technical analysis of the proposed types and quantities of materials, labor, processes, etc.. • Process of evaluating the methodology used by the offeror (contractor) to estimate proposed costs. • Examine the types and quantities of labor and material proposed. • Use information other than cost or pricing data to evaluate – FAR 15.404-1(a)(4) • Similar to a cost analysis, less extensive and not as exact. • Evaluate pricing related to similar or commercial items requiring minor modifications to determine magnitude of changes. • Compare Government’s “probable” cost of performance with each offeror’s proposed costs to determine best value | 14 | Cost Analysis Review and evaluation of any separate cost elements and profit or fee in an Offeror's proposal, as needed to determine a fair and reasonable price or to determine cost realism, and to determine how well the proposed costs represent the contract - FAR 15.404-1(c)(1) Cost Analysis Techniques Key of Cost Analysis • Must be performed on solesource contracts. • Comparison of costs proposed by the offeror for individual cost elements with: • More laborious than price analysis and cost realism analysis. • Actual costs previously incurred by the same offeror • Similar to a cost realism analysis, but more extensive and more exact. • IGCEs. • Previous cost estimates from the offeror or from other offerors for the same or similar items. • Forecasts of planned expenditures. • Other cost estimates received in response to the Government’s request. • Review to determine whether any additional cost data or pricing data, necessary to make the Offeror's proposal suitable for negotiation. | 15 | Key Cost Elements – Direct Costs Direct Labor Labor hours that are direct support and within scope of the contract. • Proposed labor should be based on the requirement • Hours and rates clearly shown by specific category. • The annual hours that vendor used to define an FTE should be reviewed Travel Travel costs, including airfare, per diem, etc.. may be allowed in direct support of the contract. • Details should be requested if travel cost is expected to be a factor • The contractor may not have to adhere to the JTR if such language is not included in the contract G&A may be assessed on travel costs. ODC/Material Costs used in direct support of the contract and may include: • Subcontractor costs • Consultant costs • Lease of equipment • Computer Hardware • Software licenses Item descriptions, quantities and cost estimates can be obtained using catalogs, price quotes, historical data, etc.. • Emphasis in estimating ODCs is accuracy in type and quantity | 16 | Full-Time Equivalent Example Productive Hours Calculation Example: Starting Point Less: Holiday Annual Leave Sick Leave Training, misc. Productive Hours: 2,080 hours 80 hours 80 hours 40 hours 40 hours 240 hours 1,840 hours *Sample calculation. Productive hours varies depending on individual vendor accounting systems. | 17 | Key Cost Elements – Indirect Costs (1) Fringe Benefits An indirect rate for the purpose of allocating items such as: • Health insurance • Payroll taxes • Holiday and vacation time • Pension & etc.. Fringe rate is applied to total direct labor proposed. The rate may vary significantly from vendor to vendor Material Handling An indirect rate that usually applies to ODC/Material costs. • Typically a rate significantly lower than the G&A • For newer companies and/or small businesses, sometimes the G&A rate is used. Verify through proposal and billing consistency • MH costs may include appropriate indirect costs allocated to direct materials based on contractor accounting procedures and must not include any fee or profit Material Handling rate is typically applied to all ODC and Material costs. Overhead An indirect rate that pertains to a department or cost center that benefits two or more projects/contracts such as: • Depreciation • Indirect labor • Telephone and computers etc.. • Usually structure related OH rate is applied to total direct labor only or total direct labor plus fringe benefits* G&A An indirect rate that pertains to activities such as: • Salary for administrative assistants • Human resource department • Usually activities related and benefits the entire company/cost center G&A rate is applied to total direct labor plus fringe benefits, overhead, material handling (if applicable), and all direct costs. | 18 | Key Cost Elements – Indirect Costs (2) FCCM Facilities Capital Cost of Money • Facilities capital cost of money is an imputed cost related to the cost of contractor capital committed to facilities • Calculated by multiplying the net book value of the business-unit's facilities investment by a cost of money rate based on the interest rates specified semi-annually by the Secretary of the Treasury under Public Law 92-41 • Usually not a significant cost and profit is not allowed Important Note! Note: Each vendor may apply their indirect rate differently based on how their accounting system is set up. | 19 | Fully Burdened Rate Build-Up Example Labor Category Direct Labor Rate IT Specialist 1 Rate $26.83 A $8.05 B $12.21 C G&A $6.59 D Profit $3.76 E $57.44 F Fringe Benefits Overhead Fully Burdened Hourly Rate 30% 35% 14% 7% Calculation B= A x 30% C= (A+B) x 35% D= (A+B+C) x 14% E = (A+B+C+D) x 7% F = Sum of A, B, C, D, E *All indirect rates used herein are fictitious and for demonstrative purposes only For this example, the total burden to direct labor is approximately 114% | 20 | Key Cost Elements - Fee Question – What determines the level of fee rate/%? FAR 15.404-4(c) – Profit states CPFF fee is limited at 10% - FAR 15.404-4(c)(4)(i)(C) CPFF fee is limited at 15% for R&D requirements- FAR 15.404-4(c)(4)(i)(A) FAR does not provide specific guidance on fee for fixed-price and other cost reimbursement contracts, but competition can help the determination. HHSAR 315.404-4 provides detailed guidance on a structured approach for establishing profit objective for negotiation. Typically, the fee rate/% is dependent on the amount of risk, market factors, and any other unique factors that may affect the operation or location of the effort. | 21 | Cost Realism Analysis Exercise (1) OAGS is contracting for 1 year of computer server maintenance services. A CPFF contract is intended. Assuming all Offerors are technically equal and acceptable, 1) Who appears to be underbidding? 2) What adjustments need to be made for cost realism analysis? 3) Who offers the best value? | 22 | Cost Realism Analysis Exercise (2) Offerors’ Proposed Costs Cost Element Offeror 1 Offeror 2 Offeror 3 Direct Labor IT Specialist I $60,000 $55,000 $65,000 Program Analyst II $75,000 $65,000 $70,000 Computer Engineer II $90,000 $80,000 $85,000 Project Manager $100,000 $90,000 $95,000 Subtotal $325,000 $290,000 $315,000 Fringe Benefits $130,000 40% $101,500 35% $129,150 41% Overhead $182,000 40% $137,025 35% $168,777 38% Subtotal $637,000 $528,525 $612,927 Material $60,000 $57,500 $48,000 $4,000 $3,500 $5,000 $701,000 $589,525 $665,927 Travel Total Cost Input G&A Total Cost Profit Total Price Assumptions $77,110 11% $778,110 $54,468 $832,578 1. FTE based on 1880 hours 2. Material includes warranty $58,953 10% $648,478 7% $19,454 $667,932 1. FTE based on 1840 hours 2. Material includes warranty $79,911 12% $745,838 3% $89,501 $835,339 1. FTE based on 1920 hours 2. Material excludes warranty 12% | 23 | Cost Realism Analysis Exercise (3) Labor Costs adjusted based on 1 FTE = 1880 annual hours Cost Element Direct Labor IT Specialist I Program Analyst II Computer Engineer II Project Manager Subtotal Fringe Benefits Overhead Subtotal Material Travel Subtotal Cost Input G&A Total Cost Profit Total Price Assumptions: Offeror 1 Governments’ Probable Costs Offeror 2 $60,000 $56,196 1.022 $75,000 $66,413 1.022 $90,000 $81,739 1.022 $100,000 $91,957 1.022 $325,000 $296,304 $130,000 40% $103,707 35% $182,000 40% $140,004 35% $637,000 $540,015 $60,000 0% $57,500 0% $4,000 $3,500 $701,000 $601,015 $77,110 11% $60,101 10% $778,110 $661,116 $54,468 7% $19,833 3% $832,578 $680,950 1. FTE based on 1880 hours, offeror 1 not adjusted 2. Material warranty is estimated at 20% for Offeror 3 3. Profit adjusted to 10% for Offeror 3 as this is the max fee for CPFF Offeror 3 $63,646 $68,542 $83,229 $93,021 $308,438 $126,459 $165,261 $600,158 $57,600 $5,000 $662,758 $79,531 $742,289 $74,229 $816,517 0.979 0.979 0.979 0.979 Material Warranty estimated at 20% for Offeror 3 41% 38% 20% 12% 10% Fee adjusted to 10% for Offeror 3 | 24 | Key Cost Elements – Direct Costs Most significant element that drives the overall cost in most cases Direct Labor Full-Time Equivalent (FTE) • Proposed labor should be based on the requirement. • Hours and rates clearly shown by specific category. • From vendor to vendor, review the hours for a FTE carefully. • Caution - each vendor may define an FTE differently based on their business practices and accounting system. • A FTE is calculated from total available hours: • 40 hours/week, 52 week in a year = 2,080 hours • Use 2,080 hours as the base and deduction of the following: vacation days, sick leave, holidays and training allowance etc., which defines the actual FTE for the vendor. • Calculated “productive” hours can vary based on how each vendor accounts for their indirect activities. i.e. Some vendors may observe 8 Federal holidays or does not allocate hours for training. | 25 | Technique Determination The analysis technique is generally determined based on contract type and can be confirmed by the necessity of certified cost and pricing data. Note: BMT uses a hybrid technique, which includes Price Analysis and Cost Realism. Fixed-Price Contract Actions • FFP / FPIF - cost realism & price analysis • Sole-source – cost analysis Contract Type Cost Reimbursement Contract Actions • Competitive - realism, (lower LCAT mix, fee rate) vs. cost analysis for sole-source (higher LCAT, fee) Technique Selection Certified Cost or Pricing Data - 15.404-1(a)(2) Price analysis when not required – FAR 15.404-1(a)(2) • Under SAT • Adequate competition - 15.403-1(c), • Price set by law or regulation (i.e. public utility) • Commercial items • HCA Waivers Cost analysis when required – FAR15.4041(a)(3) Technique Determination | 26 | Scenarios and possible technique Type of Contract Action Possible Technique Reason GSA/FSS Schedule Price Analysis Competition, Commercial Item BPA Cost Realism, Price Analysis CR for Base, PA for calls Competitive Solicitation, including Set-Aside Cost Realism, Price Analysis Depending on Contract Type IDIQ/Multiple award Cost Realism, Price Analysis Depending on Contract Type GWAC/NIH NITACC Price Analysis Competition, Commercial Item Sole-Source over SAT (including single source directed 8(a)) Cost Analysis No Competition, Certified CP data required (TINA $700K) | 27 | Other Important Considerations Proposal Assumptions • Review each assumption in a proposal carefully as they may have significant cost impact. i.e. “Assuming software licenses will be provided by the government with annual renewal.” Review Proposals in Detail • Ensure all required documents are submitted (adherence to Section L). • Check for math errors and all other inconsistencies. • Pricing information is included for all contract years. Trust Your Instinct • If you feel something is wrong, peel the onion! • Why is a proposal particularly high or low? • Put yourself in the shoes as the decision-maker. What would help you make a decision? Document! Document! Document! • In reviewing the proposals, including the proposal assumptions, document every finding that may impact the proposed price or cost. • Incomplete submission or missing section • Calculation errors • Assumptions that may have price or cost impact • Prepare a list of findings that can be used for clarification. | 29 | Business Analysis Report – Sample Structure Background (reference RFP) Evaluation Methodology (reference RFP & FAR) Competition Adequacy (reference RFP & FAR) Evaluation Findings (IDIQ / Task Order) – Price Analysis – Cost Realism Analysis (labor rates) Level of Effort (LOE) Analysis – Hours and/or FTEs Issues and Clarifications – Assumptions reviewed (reasonable / realistic) Summary | 30 | PIVOT Table Demonstration | 31 | Questions?! Contact Information: Andrew D. McKenna Email: andrew.mckenna@fda.hhs.gov Phone: 240-402-7541