WORD 574 KB - Department of State Growth

advertisement

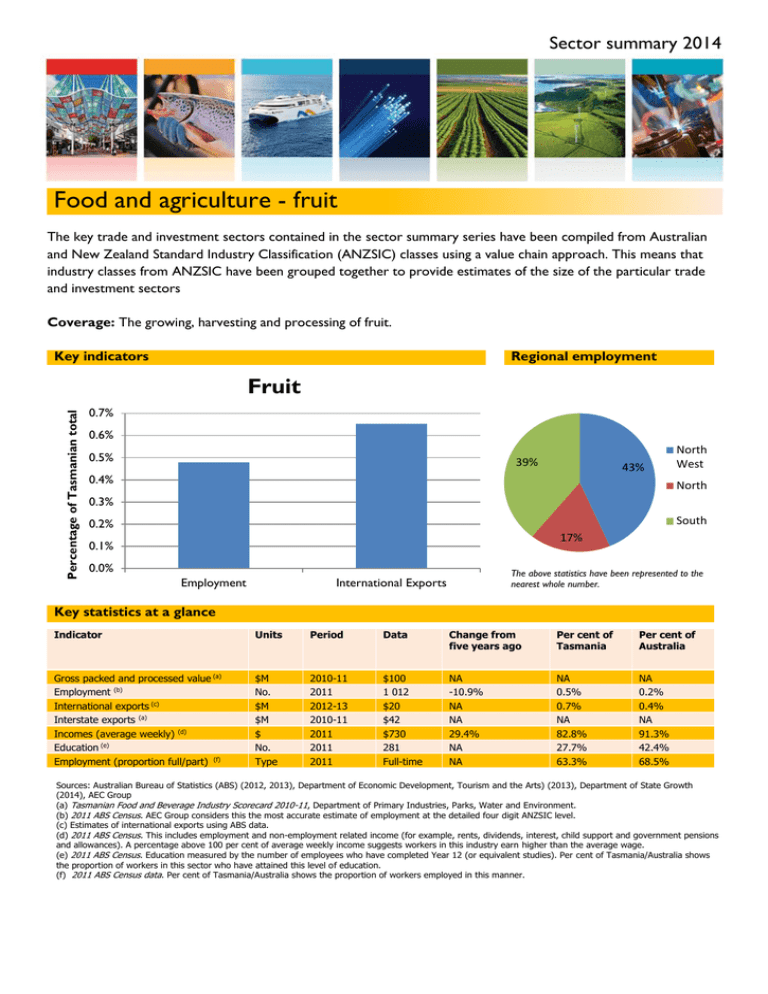

Sector summary 2014 Food and agriculture - fruit The key trade and investment sectors contained in the sector summary series have been compiled from Australian and New Zealand Standard Industry Classification (ANZSIC) classes using a value chain approach. This means that industry classes from ANZSIC have been grouped together to provide estimates of the size of the particular trade and investment sectors Coverage: The growing, harvesting and processing of fruit. Key indicators Regional employment Percentage of Tasmanian total Fruit 0.7% 0.6% 0.5% 39% 43% 0.4% North West North 0.3% South 0.2% 17% 0.1% 0.0% Employment The above statistics have been represented to the nearest whole number. International Exports Key statistics at a glance Indicator Units Period Data Change from five years ago Per cent of Tasmania Per cent of Australia Gross packed and processed value (a) Employment (b) International exports (c) Interstate exports (a) Incomes (average weekly) (d) Education (e) Employment (proportion full/part) (f) $M No. $M $M $ No. Type 2010-11 2011 2012-13 2010-11 2011 2011 2011 $100 1 012 $20 $42 $730 281 Full-time NA -10.9% NA NA 29.4% NA NA NA 0.5% 0.7% NA 82.8% 27.7% 63.3% NA 0.2% 0.4% NA 91.3% 42.4% 68.5% Sources: Australian Bureau of Statistics (ABS) (2012, 2013), Department of Economic Development, Tourism and the Arts) (2013), Department of State Growth (2014), AEC Group (a) Tasmanian Food and Beverage Industry Scorecard 2010-11, Department of Primary Industries, Parks, Water and Environment. (b) 2011 ABS Census. AEC Group considers this the most accurate estimate of employment at the detailed four digit ANZSIC level. (c) Estimates of international exports using ABS data. (d) 2011 ABS Census. This includes employment and non-employment related income (for example, rents, dividends, interest, child support and government pensions and allowances). A percentage above 100 per cent of average weekly income suggests workers in this industry earn higher than the average wage. (e) 2011 ABS Census. Education measured by the number of employees who have completed Year 12 (or equivalent studies). Per cent of Tasmania/Australia shows the proportion of workers in this sector who have attained this level of education. (f) 2011 ABS Census data. Per cent of Tasmania/Australia shows the proportion of workers employed in this manner. Summary of sector The Tasmanian fruit industry comprises three key subsectors: pome fruit (pip fruit) - primarily apples with a smaller amount of pears stone fruit - primarily cherries and apricots with some nectarines and plums berries - raspberries, blueberries, strawberries, blackberries and blackcurrants. Pome fruit The apple industry in Tasmania is experiencing a period of rationalisation and diversification. Increasing production costs have resulted in some fruit growers transitioning away from apples and diversifying into other stone fruit or berry production. The pome fruit sub sector still provides an important contribution to the Tasmanian economy, with a 2010-11 farm-gate value of $32.2 million1. Apple and cherry production is often conducted on the same farm, as it allows for extended use of infrastructure, and producers are able to retain core staff for a greater proportion of the year. Overseas apple exports have declined due to increased production and freight costs, a significant jump in export registration fees, the high Australian dollar and strong demand in the domestic market. Taiwan, Singapore, Malaysia and the Philippines are the main markets for Tasmanian apple exports, with access to China established in 2014. New apple varieties are being introduced to meet changing market demand. Recent rapid growth in the demand and supply of craft and boutique apple and pear ciders is likely to continue and might provide additional diversification options for producers. Opportunities also exist in agri tourism, including cellar doors and cafes, and for diversification into value-added and niche produce. Stone fruit The cherry subsector is rapidly expanding in Tasmania. Strong investment in the cherry industry has been based on the potential of export markets. Tasmania currently exports cherries to around 20 countries. In the 2013 season, approximately 52 per cent of Australia’s total cherry exports were from Tasmania. Access to the Chinese market was achieved in 2013. Industry has estimated that production could increase to 7 000 tonnes by 2015, cementing Tasmania as the largest cherry-producing state in Australia2. Tasmania’s niche for cherries is the top end of premium in overseas markets, where the Tasmanian product is differentiated on the basis of its quality and larger fruit size. Opportunities also exist in the domestic market for premium product. In 2010-11, the cherry subsector’s farm-gate value was $28.4 million3. Aside from cherries, Tasmania still has a relatively small stone-fruit production area. Some growth has occurred in the sector as a result of traditional apple growers diversifying into stone fruit production, which has lower production costs and water requirements. The focus has predominately been on supplying the domestic market, both locally through farm gate and interstate. In 2010-11, the farm-gate value of apricots was $7.7 million and other stone fruit (excluding cherries) was $1.2 million4. 1 Tasmanian Food and Beverage Industry Scorecard 2010-11, Department of Primary Industries, Parks, Water and Environment, Information provided by Fruit Growers Tasmania in consultations with the Department of Economic Development Tourism and the Arts on 10 August 2010. 3 Australian Bureau of Statistics, Value of Agricultural Commodities Produced, Australia 2010-11. 4 Australian Bureau of Statistics, Value of Agricultural Commodities Produced, Australia 2010-11. 2 2 Berries There has been significant production growth in the Tasmanian berry sector over the past few years, due largely to investment in large-scale systems and access to new berry varieties. Globally, the berry category has experienced strong growth and according to market intelligence, fresh berries are the top-selling fresh food category in Europe and in the US. Similarly, demand in the domestic market has rapidly expanded. This sales growth has been driven by consumer recognition of the product’s health benefits, together with improved quality and greater consistency in supply. The berry subsector contributes about five per cent of Australia's total fresh berry production. The farm-gate value of the berry sector was estimated in 2010-11 at $16.1 million5, of which raspberries and strawberries comprised 58 per cent of the value. Blackcurrants are the principal berry fruit grown for processing. Overall Tasmania’s temperate climate provides the essential winter chill followed by a long, mild, growing season to support fruit development and enhanced flavour. Tasmanian stone fruit and berries have a clear, late season production advantage, both within Australia and overseas. The timing of Tasmanian production also provides counter-seasonal supply opportunities to the northern hemisphere. The state’s island status and risk-based quarantine controls mean Tasmania also has the advantage of relative disease and pest-free status. This allows access to a number of international markets, including Asia, where stringent import regulations are in place. The peak industry body is Fruit Growers Tasmania, an organisation which has played a crucial role in the development of the industry and its export culture. The Tasmanian fruit processing sector remains small, with the majority of players being micro or small operations (predominately preserves and jams) servicing niche markets. There are now a number of small processors in the industry producing a range of value-add products, such as juices and ciders, as well as freeze dried products and flavour concentrates. Small agri-tourism ventures, especially those attached to farms, are increasingly moving into other fruit-based value-add products such as ice cream, baked items, fruit wines and chocolates. Constraints and opportunities Constraints/risks Increasing global competition from low-cost production countries for fresh and processed product makes it difficult to compete in some markets. Tasmanian fruit producers generally face higher production costs, in terms of key inputs such as labour, water and energy relative to global competitors. The issue of greatest concern is the cost of labour, which makes up a significant proportion of production costs (50 to 60 per cent in the case of berry production) and is having a major impact on the sector’s profitability and global competiveness. The challenge also exists in accessing appropriately-skilled people to fill scientific and management positions. Reduced investment in research and development is impacting on industry’s capacity to adopt new technologies, production systems, pest and disease control measures and new fruit varieties being sought by the market. Access, cost and surety of water supply for irrigated fruit orchards and production systems is an impediment to production expansion. 5 Tasmanian Food and Beverage Industry Scorecard 2010-11, Department of Primary Industries, Parks, Water and Environment. 3 Issues with ensuring reliable, timely and cost-effective freight services to the mainland and export markets impact on the industry. Freight access over the peak of the season could be an issue, if the capacity to carry the increased production of cherries and berries is not addressed. Maintaining funding and focus on market development (including market access) work is needed to grow and maintain market share in export markets. ‘Red tape’ and regulation at all levels of government presents barriers to business development and profitability. Opportunities Island status offers freedom from many diseases, giving production benefits and market-access advantages, particularly in high-value niche markets. Increased market access into Asian markets, focussing on competitively-priced quality food for Asia’s growing middle class and the marketing of premium products to Asia’s high-income consumers. Technological advancement, ensuring improved cold chain management and freight logistics, presents opportunities for national and export markets. Investment in the state’s irrigation infrastructure opens up opportunities in a broader range of areas, and improves surety of supply to some existing areas. Development and promotion of the Tasmanian brand offers opportunities for premium niche markets in the domestic and international markets. Increased opportunities for value adding of fresh product as well as markets for second-grade fruit. Climate change may open up new markets and investment opportunities for the state, with recognition that the state’s climatic conditions are optimal for the production of stone and berry fruit. Increased production through the incorporation of protected cropping systems and technologies. Better utilisation of tourism infrastructure, including the combination of niche value-adding with tourism product. Strategy summary Industry strategy The long term strategy for the fruit industry in Tasmania is to develop as a producer of premium, high-quality product for national and international markets. Increased global competition from low-cost producers impacts on industry growth. Key strategies for the industry are: 4 Ensure Tasmania maintains and strengthens its level of biosecurity and border protection, in line with the strategies developed by the Primary Industry Biosecurity Action Alliance. Undertake market development and maintenance activities to maintain and grow existing markets, and to access new markets, including leveraging national marketing activities. Maintain and increase competitiveness in key markets. Tasmanian Government strategy The Tasmanian Government, through its Cultivating Prosperity: A 2050 Vision for Agriculture policy, is putting the State's primary industries on the path to achieving a ten-fold increase in the value of the sector by 2050. The Government is committed to working with industry and supporting its continued growth. It has an important role to play in the following: Supporting Fruit Growers Tasmania in the development of a fruit industry workforce survey and associated workforce development plan Maintaining a risk-based approach to biosecurity in line with the Tasmanian Biosecurity Strategy 20132017 Assisting with access to new markets (and developing existing markets) Advancing investment and development opportunities Addressing regulatory and red tape issues Supporting research, development and extension services applicable to industry and the state’s unique environmental conditions. Discussion The Tasmanian fruit industry has comparative advantages in the production of quality pome, stone and berry fruits but its relative distance from market is a constraint. To mitigate this requires further improvement to productivity, efficiency and greater leveraging of the Tasmanian brand. 5