How to Start a Nonprofit Step by Step

advertisement

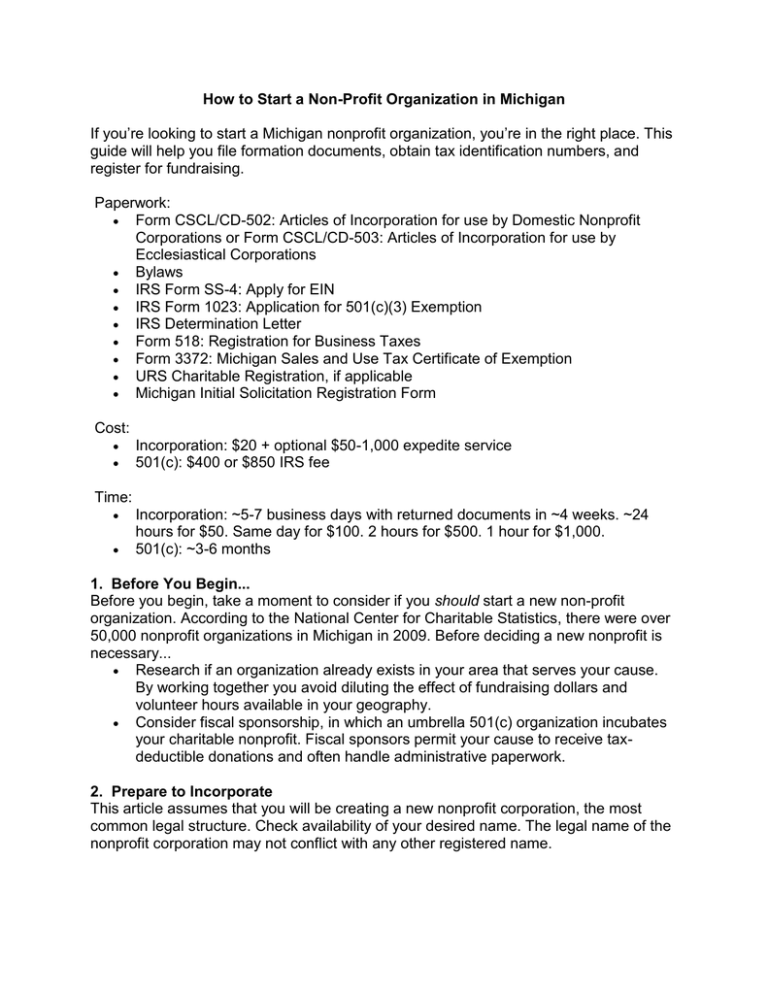

How to Start a Non-Profit Organization in Michigan If you’re looking to start a Michigan nonprofit organization, you’re in the right place. This guide will help you file formation documents, obtain tax identification numbers, and register for fundraising. Paperwork: Form CSCL/CD-502: Articles of Incorporation for use by Domestic Nonprofit Corporations or Form CSCL/CD-503: Articles of Incorporation for use by Ecclesiastical Corporations Bylaws IRS Form SS-4: Apply for EIN IRS Form 1023: Application for 501(c)(3) Exemption IRS Determination Letter Form 518: Registration for Business Taxes Form 3372: Michigan Sales and Use Tax Certificate of Exemption URS Charitable Registration, if applicable Michigan Initial Solicitation Registration Form Cost: Incorporation: $20 + optional $50-1,000 expedite service 501(c): $400 or $850 IRS fee Time: Incorporation: ~5-7 business days with returned documents in ~4 weeks. ~24 hours for $50. Same day for $100. 2 hours for $500. 1 hour for $1,000. 501(c): ~3-6 months 1. Before You Begin... Before you begin, take a moment to consider if you should start a new non-profit organization. According to the National Center for Charitable Statistics, there were over 50,000 nonprofit organizations in Michigan in 2009. Before deciding a new nonprofit is necessary... Research if an organization already exists in your area that serves your cause. By working together you avoid diluting the effect of fundraising dollars and volunteer hours available in your geography. Consider fiscal sponsorship, in which an umbrella 501(c) organization incubates your charitable nonprofit. Fiscal sponsors permit your cause to receive taxdeductible donations and often handle administrative paperwork. 2. Prepare to Incorporate This article assumes that you will be creating a new nonprofit corporation, the most common legal structure. Check availability of your desired name. The legal name of the nonprofit corporation may not conflict with any other registered name. Name Search: LARA - Corporation Division Business Entity Search database Name Reservation: Optional Recruit initial directors for your nonprofit board of directors. Michigan law requires at least three board members for nonprofit corporations. Identify the nonprofit’s registered agent. This individual or company receives notice of lawsuit and other legal service for the corporation. 3. File Michigan Nonprofit Articles of Incorporation File articles of incorporation to create your non-profit corporation. Submit to: State of Michigan Department of Licensing and Regulatory Affairs (LARA) Corporations, Securities, & Commercial Licensing Bureau Corporations Division http://www.michigan.gov/lara Form: Form CSCL/CD-502: Articles of Incorporation for use by Domestic Nonprofit Corporations or Form CSCL/CD-503: Articles of Incorporation for use by Ecclesiastical Corporations Instructions: Michigan Nonprofit Corporation Filing Information Filing Method: Mail or in person. MICH-ELF filers may file by fax or e-mail. Fee: $20 + optional $50-1,000 expedite service Turnaround: ~5-7 business days with returned documents in ~4 weeks. ~24 hours for $50. Same day for $100. 2 hours for $500. 1 hour for $1,000. See Expedited Service Request Law: Michigan Compiled Laws (MCL) - Chapter 450: Corporations - Act 162 of 1982: Nonprofit Corporations Act Notes: Submit one original of this document. Upon filing, the document will be added to the records of the Corporations Bureau. The original will be returned to your registered office address, unless you specify otherwise. Warning : The IRS requires specific language in the articles of incorporation to qualify for 501(c)(3) federal tax exemption. Refer to IRS Pub 557 for guidance and sample language. 4. Establish Company Records, Bylaws, and Hold First Meeting Your filed articles of incorporation are the first document for your nonprofit corporate records. Office supplies intended for nonprofit corporations help you stay organized and save time: optionally, get a company record book, seal, and templates. Create bylaws (potentially using a template), which is the governing document for the nonprofit. This document defines how the corporation will run itself. You do not have to file them with the state; keep them in your company records. Hold the first meeting of the board of directors. At this meeting, the nonprofit should approve the bylaws, elect additional directors, appoint officers, and approve initial resolutions such as opening a company bank account. Keep minutes of this meeting. 5. Get a Federal Employer Identification Number (EIN) Your nonprofit must obtain an EIN regardless of whether it will hire employees. Submit to: Internal Revenue Service http://www.irs.gov/ Form: IRS Form SS-4 Guidance: IRS Pub 1635: Understanding Your EIN Filing Method: Mail, phone, fax, or apply online with the IRS Fee: $0 Turnaround: Immediately online Notes: The IRS website is only available during certain hours. Print your EIN before closing your session. 6. Get Michigan State Tax Identification Numbers/Accounts Register with the Department of Treasury for Sales Tax, Use Tax, Income Tax Withholding, Corporate Income Tax, Flow Through Withholding, Unemployment Insurance Tax. Submit to: Michigan Department of Treasury http://www.michigan.gov/treasury Form: Form 518: Registration for Business Taxes Filing Method: Mail, fax, or online Fee: $0 Turnaround: 6+ weeks Notes: Mail your application at least six weeks but not more than six months, before you intend to start your business to allow your registration to be processed. The treasury will forward your application to Unemployment Insurance Agency (UIA). 7. Apply for 501(c) Save money by obtaining federal income tax exemption. This is most difficult and costly step of setting up a nonprofit. Submit to: Internal Revenue Service http://www.irs.gov/ Form: IRS Form 1023 Instructions: IRS Instructions for Form 1023 Guidance: IRS Pub 557: Tax-Exempt Status for Your Organization Filing Method: Mail Fee: $400 or $850 Turnaround: ~3-6 months. The IRS will return a Determination Letter which officially recognized your exemption. 8. Apply for Michigan Tax Exemption(s) Nonprofits are exempt from Michigan's 6% Michigan Corporate Income Tax (CIT). No filing is needed. 501(c)(3) organizations are automatically exempt from sales and use tax on purchases. No application is needed, simply start presenting Form 3372 and your IRS Determination Letter to sellers. Form: Form 3372: Michigan Sales and Use Tax Certificate of Exemption Fee: $0 Notes: Attach IRS Determination Letter More information: Michigan Department of Treasury http://michigan.gov/taxes 9. Register for Charitable Solicitation / Fundraising Before soliciting any funds or hiring solicitors, you must complete your charitable organization registration in each state where you will raise funds. To file only in Michigan: Submit to: State of Michigan Attorney General http://www.michigan.gov/ag Form: Initial Solicitation Registration Form Filing Method: Mail or online Fee: $0 Law: Michigan Charitable Organizations and Solicitations Act Exemption: Some organizations are exempt. For example, the Solicitations Act exempts organizations that raise funds exclusively using volunteers and receive less than $25,000 a year. These organizations must submit a request for exemption form. Notes: Verify that the attorney general's office received the registration form by searching for the organization at www.michigan.gov/AGCharitySearch. Following review if your initial registration or exemption, the Attorney General may instruct your organization to complete additional forms. 10. Obtain Business Licenses & Permits To run your business legally, you must obtain applicable licenses and permits. The easiest way to navigate the wide range of federal, state, and local requirements is to search by your business type and locality using the Small Business Administration Business License & Permit look-up tool. Nonprofits who wish to conduct bingo, raffles, and other charitable games must obtain a license. Submit to: Michigan Lottery Charitable Gaming http://www.michigan.gov/cg/ Form: Qualification Information Form Filing Method: Mail Fee: varies Turnaround: ~8 weeks Law: Michigan Charitable Gaming *** Ongoing filings*** You must file federal and state tax returns. You must also file: Michigan nonprofit corporations must file an annual report. Submit to: State of Michigan - Department of Licensing and Regulatory Affairs (LARA) Corporations, Securities, & Commercial Licensing Bureau - Corporations Division http://www.michigan.gov/lara Form: A pre-printed Form CBCS/CD-2000: Information Update is mailed to the registered agent. Filing Method: Mail, in person, or online Fee: $20 Due: October 1st, beginning in the year after incorporation Reminder: Form is mailed to the registered agent 3 months prior to due date. Law: Required by section 911 of the Act, MCL 450.2911. Michigan charitable organizations renew annually with the Attorney General. The expiration occurs 7 months after the close of the nonprofit's fiscal year.