Phased retirement

advertisement

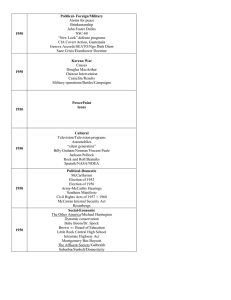

Employee Benefit Plans Joseph Applebaum, FSA October 4, 2002 Views expressed are those of the speaker and do not represent the views of the U.S. General Accounting Office. applebaumj@gao.gov Employee Benefit Plans •What is the Big Picture Issue? •Ageing of the U.S. Population •U.S. is not alone – G-7 countries have similar, if not worse trends. •Key Drivers •Increased Life Expectancy •Decreased Fertility Fertility Rates 4 3.5 3 2.5 2 1.5 1 0.5 0 1940 1950 1955 1960 1970 1975 1980 1990 2000 2025 2050 2075 Fertility Rates 1940 2.23 1950 3.03 1955 3.5 1960 3.61 1970 2.43 1975 1.77 1980 1.85 1990 2.07 2000 2.13 2025 1.96 2050 1.95 2075 1.95 Life Expectancy at Birth 90 85 Females 80 75 70 Males 65 60 1940 1950 1955 1960 1970 1975 1980 1990 2000 2025 2050 2075 Life Expectancy at Age 65 24 22 20 Females 18 16 14 Males 12 10 1940 1950 1955 1960 1970 1975 1980 1990 2000 2025 2050 2075 Life Expectancy Year 1940 1950 1955 1960 1970 1975 1980 1990 2000 2025 2050 2075 At Birth Males Females 61.4 65.7 65.6 71.1 66.7 72.8 66.7 73.2 67.2 74.9 68.7 76.6 69.9 77.5 71.8 78.9 73.7 79.4 76.5 81.5 79 83.5 81.1 85.3 At Age 65 Males Female 11.9 13.4 12.8 15.1 13.1 15.6 12.9 15.9 13.1 17.1 13.7 18 14 18.4 15 19 15.7 19 17.3 20.3 18.8 21.8 20.2 23.1 Employee Benefit Plans Demographic trends have implications for •Size and composition of work force, •Pension costs, •Healthcare costs Structure of U.S. pension programs •Mixed system – part voluntary, part governmental program •Three ( four ?) legged stool – Social Security, employment based pensions, personal savings ( post-retirement earnings) Social Security •Financed on a modified pay-as-you-go basis •Combined employer/employee tax rate for 2002 of 12.4% on earnings up to $84,900 •Maximum amount subject to tax is updated each year for change in average wage in covered employment •Benefits are paid to retired and disabled workers, their eligible spouses, children, and their survivors (esp. aged widows) Social Security •Big Issue for Social Security is cost rising relative to payroll. •Because current system is pay-as-you-go (more or less) cost of system is related to number of workers supporting each beneficiary. Let’s look at costs over next 75 years or so. •The costs go sharply upward, a few years from now, when Baby Boomers start retiring. •Under current program benefit rules, costs keep growing well after the Boomers retire. • Principal drivers are demographic – life expectancy, particularly life expectancy at retirement age, and fertility which determines, with a lag, number of workers. Social Security Costs and Income Rates 25% Cost as % of taxable payroll 20% 15% 10% Income as % of taxable payroll 5% 0% 1990 2000 2010 2020 2030 2040 2050 2060 2070 2080 Social Security Costs and Income Rates Year 1990 2000 2010 2020 2030 2040 2050 2060 2070 2080 OASDI Cost as a Percentage of Taxable Payroll 10.7% 10.4% 11.0% 14.2% 17.2% 17.8% 17.9% 18.6% 19.4% 20.1% OASDI Tax Income as a Percentage of Taxable Payroll 12.7% 12.7% 12.8% 13.0% 13.2% 13.3% 13.3% 13.3% 13.4% 13.4% Social Security Two sets of measures of demographic trends: dependency ratios – the ratio of those over 65 ( or those under 20 plus those over 65) to those between ages 20 and 64, and; ratio of beneficiaries to workers. Some observations •Around 1950, only a portion of the elderly were eligible for social security benefits •The percentage of workers covered by social security has grown •The labor force participation rates of women have increased •Labor force participation rates of older (greater than 55) men declined. •Disability benefits were introduced in 1950’s, but didn’t expanded rules later. Aged and Total Dependency Ratios 100% 90% Total Dependency 80% 70% 60% 50% 40% 30% Aged Dependency 20% 10% 1950 1960 1970 1975 1980 1990 2000 2025 2050 2075 Aged and Total Dependency Ratios Year 1950 1960 1970 1975 1980 1990 2000 2025 2050 2075 Aged 13.8% 17.3% 18.2% 18.5% 18.9% 20.9% 21.1% 31.9% 37.1% 42.3% Total 71.9% 90.4% 94.7% 89.8% 74.9% 70.1% 69.9% 77.1% 81.2% 85.1% OASDI Covered Workers and Beneficiaries (in millions) 200 Covered Workers 175 150 125 100 75 Beneficiaries 50 25 0 1950 1960 1970 1975 1980 1990 2000 2025 2050 2075 OASDI Covered Workers & Beneficiaries (in millions) Year 1950 1960 1970 1975 1980 1990 2000 2025 2050 2075 Covered Workers 48.3 72.5 93.1 100.2 113.6 133.7 153.7 175.4 187.3 200.5 OASDI Beneficiaries 2.9 14.3 25.2 31.1 35.1 39.5 45.2 77.4 94.1 109.9 OASDI Covered Workers (in millions) 200 175 150 125 100 75 50 25 0 1950 1960 1970 1975 1980 1990 2000 2025 2050 2075 OASDI Covered Workers (in millions) 1950 48.3 1960 72.5 1970 93.1 1975 100.2 1980 113.6 1990 133.7 2000 153.7 2025 175.4 2050 187.3 2075 200.5 OASDI Beneficiaries (in millions) 110 100 90 80 70 60 50 40 30 20 10 0 1950 1960 1970 1975 1980 1990 2000 2025 2050 2075 OASDI Beneficiaries (in millions) 1950 2.9 1960 14.3 1970 25.2 1975 31.1 1980 35.1 1990 39.5 2000 45.2 2025 77.4 2050 94.1 2075 109.9 Worker to OASDI Beneficiary Ratio 20 18 16 14 12 10 8 6 4 2 0 1950 1960 1970 1975 1980 1990 2000 2025 2050 2075 Worker to Beneficiary Ratio 1950 16.7 1960 5.1 1970 3.7 1975 3.2 1980 3.2 1990 3.4 2000 3.4 2025 2.3 2050 2.0 2075 1.8 Social Security Problems are well understood Last major reform culminated in 1983 Amendments •Incremental changes in benefits and taxes •Put program in balance for 75 years – Program is now out of actuarial balance •Valuation period change •Experience & assumption changes What are criteria for solution? •Continue to provide layer of protection against insured events •Program should be sustainable •Cost levels should be near current levels Demographic Impacts on Private Plans Demographic forces also impact private sector employee benefit plans. Phased retirement •Most defined benefit pension plans allow early retirement ( i.e. before 65) •Some plans require a reduction in monthly payments to make up for longer payout period – others don’t; virtually none do not subsidize early retirement – that is, the value of the early retirement benefit is greater than the value of deferring starting receipt of those benefits until 65. Phased Retirement Let’s consider a hypothetical employee who is now, say age 60 and is entitled, based on her service with the company, to a monthly pension benefit of 50% of final pay. If she retires, she can go to work elsewhere and get her pension benefit and increase her current compensation. (She might even go on to collect a pension from the second employer!). Under current law before she attains NRA, there are significant impediments for the employee to collect her pension benefits while continuing to work for her current employer. This economic conundrum has existed since the wide spread introduction of pension plans – however, the relatively slow growth in the labor force supply has increased the importance of addressing this problem. OASDI Covered Workers (in millions) 1950 48.3 1960 72.5 1970 93.1 1975 100.2 1980 113.6 1990 133.7 2000 153.7 2025 175.4 2050 187.3 2075 200.5 Changes in Pension Plan Design Around 1975, the dominant pension benefit design was the final average pay defined benefit plan – a typical formula is the product of •Years of service •Final pay •A number around 1.5% The trend over the last 25 years or so has been towards other designs – defined contribution plans, and hybrid defined benefit plans like cash balance plans. Changes in Pension Plan Design Regulatory Environment •Introduction of Section 401(k) of the Internal Revenue Code. •Greater rigidity of defined benefit funding Current designs are more attractive to mobile,typically younger, workers. Changes in employment patterns •Service economy •Greater job mobility •Less attachment to firm •Employer Views •Risk aversion •Changing demographics – the relative scarcity of younger workers Trends in Pension Plan Coverage (millions) Year 1979 1980 1985 1990 1995 1996 1997 1998 Source: U.S. Dept. of Labor DB DC Participants Participants 29.4 17.5 30.1 18.9 29.0 33.2 26.3 35.5 23.5 42.7 23.3 44.6 22.7 48.0 23.0 50.3