Finance Vocabulary

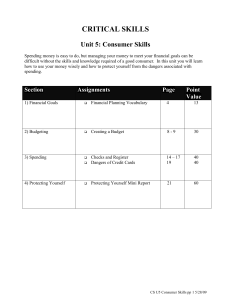

advertisement

Consumer Services Chapter 10-3: Managing Your Money Careers related to this topic: Credit counselor Account manager Financial planner Family economics specialist When selecting a financial institution, you will want to consider its services. Saving Accounts Checking Accounts Debit Cards Automated Teller Machines (ATMs) Loans Certified and Cashier’s Checks Traveler’s Checks Safe-Deposit Boxes Other Services-Credit Cards, Drive-up windows, Online Banking Savings Accounts Savings accounts can protect extra money and make it earn money for you by collecting interest. Savings accounts can be used to save for a major goal, such as college education or a car, or to save for emergencies. Interest Interest is the money a financial institution pays at regular intervals for the use of your money. Checking Accounts A check is a written order to a financial institution to pay a specific amount of money. Checking accounts are sometimes called demand deposits. That is, money in them is available on demand. Debit Cards A debit card shows that you have an established checking account with the financial institution identified on the card. Swiping the card immediately transfers payment from your checking account. ATMs An automated teller machine (ATM) is a machine for withdrawing and depositing money. An ATM offers people the flexibility of banking at any time. Electronic banking lets you use a phone or computer to check on your account, pay bills, and transfer funds to other accounts. Loans and Charge Accounts There are two types of credit: loans and charge accounts. Loans are when you borrow money from financial institutions and then pay it back. Charge accounts are when you receive your purchase now and pay a store or credit card company later for what you owe. Other Services Certified and Cashier’s Checks A certified check is simply a personal check for which the financial institution guarantees payment. A cashier’s check is a check drawn on the financial institution’s own funds. You present the money and the institution issues the check. Traveler’s Checks Safe-Deposit Boxes Depositing Money You open a checking account by making a deposit, or putting money into an account. Depositing Money Deposit slip:A slip of paper you fill out in order to deposit a check or cash into a bank account. Endorse: To sign over your rights to a check by writing your name on the back. Reconciling When you receive your statement you need to reconcile your account. Reconcile means that you need to make sure that your own records and your bank statement are the same. This may also be called balancing your checkbook. Credit Credit is an arrangement that lets you buy things now and pay for them later. Credit Rating Credit rating: A record that shows your ability and willingness to pay your debts. Companies called credit bureaus keep track of your record of paying debts. A poor credit rating can stop you from getting more credit in the future and may cause you to pay higher interest rates. Creditors Creditors are people or companies to whom you owe money. Who is a Consumer? A consumer is someone who buys and uses goods and services produced by others. Being a wise consumer means being able to determine the right products and services and being able to find a good price. Comparison Shopping Comparison shopping involves taking time to compare products, prices, and services. Impulse Buying You want to avoid impulse buying which is making unplanned purchases on the spur of the moment. Stores promote impulse buying with eyecatching displays. Impulse items are often placed close to the front of the store so you notice them as you enter. They’re also placed near checkout counters, tempting customers as they wait in line. Look Before You Buy Name brand or store brand? Sometimes name brands only cost more because they spend more on advertising, not because they are better products. Read product labels. Ask about warranty and return policy. A warranty is a written guarantee that a product will work properly for a specified length of time unless misused or mishandled by the consumer. Creating a Budget A budget is a plan to help manage your money wisely. When you make a budget, you set up guidelines for spending money on things that are worth the time and effort you put into earning the money. Budgets are designed to reflect income and expenses for a given period of time. A few basic steps for setting up a budget are: Set goals for your spending Determine sources of income Estimate your expenses Compare Income and Expenses Write the Budget and Keep Records Evaluate the Budget Income & Expenses Income is the amount of money you have coming in. Expenses are the goods and services that you spend money on. Types of Expenses Fixed expenses – expenses that cost a set amount that you are committed pay. Mortgages Rent Insurance Savings Flexible expenses – costs that occur repeatedly, but vary in amount from one time to the next. Food Clothing Recreation Transportation Have a plan Financial planning – the process of defining goals, developing a plan to achieve them, and putting the plan into action. Financial Planning Steps 5. Monitor and Modify the Plan 4. Implement the Plan 1. Set Goals 2. Analyze Information 3. Create a Plan What is cash flow? A measure of the money you receive and the money you spend.