Calculating Taxable Income

advertisement

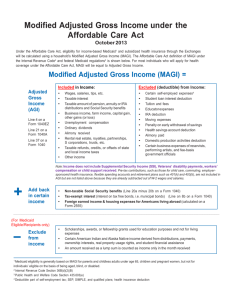

Taxes_Overview_Beg-Numeracy Taxes: Beginning Numeracy Section 2: Gross, Adjusted, and Taxable Income EL Civics 2011-13 Unit Description: This unit is divided into three sections with each section having 3 to 5 activities. This document contains teaching materials for Section 2. Section 1: Standard Deductions and Exemptions Section 2: Gross, Adjusted, and Taxable Income Section 3: Calculating Taxes Ronald Hubbs Center 2011-2013 1 Taxes_Overview_Beg-Numeracy Total Gross Income (S2-A1) Total Gross Income is all the money you make before taxes. Sometimes people have more income than from their job. Here are some other kinds of income: Interest: money you earn from your savings account Dividends: money you make from investments in stocks or bonds (Some people buy very small pieces of a company. These pieces are called stocks. Every year, people can earn money from that company for each stock they have. The money they earn is called dividends.) Alimony: money you get from your ex-spouse; not for child support Unemployment: money you get when you get laid off from a job Social security benefits: money you get from social security if you are elderly (older) or disabled When you do taxes, you must add ALL your income together. For Example, the Thao family made $27,600 last year. They also got $677 interest from their savings account. What is their total gross income? $27,600 + 677 $28, 277 = total gross income Find the total gross income for each family: 1. The Mohamud family made $43,958 last year. They also got $450 taxable social security benefits. What is their total gross income? _____________________ 2. The Phoung Nyguen made $32,548 last year. She also got $2400 in alimony. What is her total gross income? ____________________ 3. Sofia Gonsalez made $18,456 last year. She also got $9,789 in unemployment compensation. What is her total gross income? _______________________ 4. Jorge Hernandez made $37,942 last year. He also got $546 in dividends from his stock. What is his total gross income? ______________________________ Ronald Hubbs Center 2011-2013 2 Taxes_Overview_Beg-Numeracy Adjusted Gross Income (S2-A2) You can also subtract some expenses from your total gross income. After you subtract expenses from your gross income, it is called Adjusted Gross Income. Here are a few expenses you can subtract from your income. Educator expenses: money teachers spend to buy things for their students and classes. Alimony paid: money you pay to an ex-spouse; not child support Tuition: money you pay for someone in your family to go to school Student loan interest: money you pay for interest on a loan for college or training Find the adjusted gross income for each family below. 1. The Mohamud family’s total gross income is $44,408. But Ismael is a teacher and last year he spent $200 on things for his class. What is their adjusted gross income? ______________________ 2. Phuong Nyguen’s total gross income is $34,948. She paid $3500 for tuition for her child’s preschool. What is her adjusted gross income? ______________________ 3. Sofia Gonsalez’ total gross income is $28,245. She paid $267 interest on her student loan. What is her adjusted gross income? ________________________ 4. Jorge Hernandez’ total gross income is $38,488. He paid $1200 in alimony to his ex-wife. What is his adjusted gross income? ___________________________ Ronald Hubbs Center 2011-2013 3 Taxes_Overview_Beg-Numeracy Taxable Income? (S2-A3) Part1: What is Taxable Income? Taxable income is the income you must pay taxes on. Earlier, we learned that we can subtract both the standard deduction and total exemptions from our adjusted gross income before we calculate taxes. (Remember, adjusted gross income is all the money you make minus a few possible expenses.) After we subtract these, we have what is called taxable income. This is the income the government uses to calculate your taxes. Filing Status Single Standard Deduction $5,950 Head of Household $8,700 Married Filing Separately $5,950 Married Filing Jointly $11,900 Qualifying Widow(er) $11,900 Exemption = $3800 For example: A husband and wife have an adjusted gross income of $28,000. They are filing jointly. They have 1 child. What is their taxable income? Step 1: $28,000 - $11,900 $16,100 Step 2: $3800 x 3 $11,400 Step 3: Standard Deduction Total Exemptions $16,100 -$11,400 $4,700 Taxable Income Their Taxable Income is $4,700. This is the amount the government will use to calculate taxes. What about you? What was your Adjusted Gross Income for 2012? _______________________________ What is your filing status? _____________________________ What is your standard deduction? ___________________________________ What is your total exemptions? ___________________________________ Ronald Hubbs Center 2011-2013 4 Taxes_Overview_Beg-Numeracy Part 2: Practice 1. Jamila and her husband have two children. Together they make $36,000 a year. They are married filing jointly. How much is their taxable income? Step 1: Gross income – standard deduction $36,000 - Step 2: Exemption amount x number of people $3800 x Step 3: Step 1 answer – exemptions $ - How much is their taxable income? ________________________________ 2. Manuel and his wife have three children. Together they make $32,600 a year. They are married filing jointly. How much is their taxable income? Step 1 $ Step 2 $ x - Step 3 $ - How much is their taxable income? ________________________________ 3. Moua is a single mother of three children. She is filing as head of household. She makes $24,000 a year. How much is their taxable income? Step 1 $ - Step 2 $ x Step 3 $ - How much is her taxable income? ________________________________ Ronald Hubbs Center 2011-2013 5 Taxes_Overview_Beg-Numeracy Calculating Taxable Income (S2) In a small group, complete each step to calculate the taxable income for each person. 1. Cut out all the cards: a. Yearly income b. Filing status c. Additional income d. Expenses. 2. Put each type of card in a pile upside down. Pick one card from each pile. 3. Fill in the chart with the information from each card for each person in your group. 4. Help each other calculate: a. Total gross income: salary + additional income b. Adjusted gross income: total gross income - expenses c. Taxable income: Step 1: Gross income – standard deduction Step 2: Exemption x number of people Use the information in the charts below: Filing Status Single Standard Deduction $5,950 Head of Household $8,700 Married Filing Separately $5,950 Married Filing Jointly $11,900 Qualifying Widow(er) $11,900 Exemption = $3800 Ronald Hubbs Center 2011-2013 6 Step 3: Step 1 answer - total exemptions Taxes_Overview_Beg-Numeracy Group Cards Filing Status Married filing jointly Head of household Single Married filing separately Exemptions 3 children 5 children 2 children 4 children Salary $28,958 $46,789 $18,379 $31,965 Additional Income $625 interest on savings account $6400 unemployment $790 social security benefits $2400 alimony received Expenses $3480 tuition $178 student loan interest $2000 alimony paid $200 teacher educational expenses Ronald Hubbs Center 2011-2013 7 Taxes_Overview_Beg-Numeracy Group Chart & Calculation Worksheet Name Filing Status Exemptions Salary Additional Income Your Total Gross Income: _____________________________ Salary: Additional Income: _____________ + ___________ Your Adjusted Gross Income: ___________________________ Total Gross Income: Expenses: _____________ - ____________ Your Taxable Income: ___________________________________ Adjusted Gross Income: _____________ Standard Deduction: - ____________ Exemption: Number of People: _____________ x ____________ Step 1 Answer: Total Exemptions: _____________ -____________ Ronald Hubbs Center 2011-2013 8 Expenses