Title I Compliance Training - the School District of Palm Beach County

advertisement

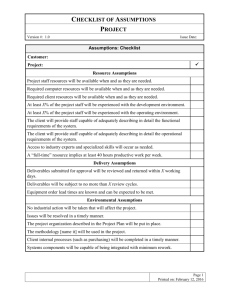

Title I Technical Assistance Training Federal and State Programs Welcome Introductions Overview of training Title I Charter School Handbook Two sets of handouts 2 Handouts • • • • • • • • • • • • • • • • Contact List SINI Chart Functions and Accounts Allowable Expenses Title I Food Purchase Audit Compliance Checklist Title I Travel Audit Compliance Checklist Title I Field Trip Audit Compliance Checklist Title I Checklist for Quarterly Reimbursement Sample Grant Reimbursement Request Letter Job Codes Tutorial Guidelines Components Checklist Elements Checklist FY12 Audit Checklist by Folder FY12 Title I Grant Compliance by Month FY12 September Electronic Checklist 3 4 Goal of Title I To help ensure that all children have the opportunity to obtain a high-quality education and reach proficiency on challenging state academic standards and assessments 5 Benefits of Title I • Additional funding to supplement the existing curriculum • Parent involvement • Highly qualified staff • Staff development • Adequate Yearly Progress (AYP) 6 Title I Eligibility • Based on number of students who qualify for free or reduced priced meals, ages 5-17 • Percentages posted on School Food Services website http://www.palmbeachschools.org/sfs/reports/Title1.pdf • “Date Certain” (FY13 - December 22, 2011) • Schools ranked by percentage • Academic Leadership Team sets Title I cutoff • FY12 eligibility set at 49.5% 7 Schoolwide Programs • All Palm Beach County Title I schools are schoolwide programs • Serve all students in the school, but require special focus for lowest achieving students • All staff, resources, and classes are part of the overall schoolwide program 8 Adequate Yearly Progress AYP Targets for FY12 Reading - 86% of students need to score at level 3 and above Math - 86% of students need to score at level 3 and above 9 SINI Schools If a school does not make AYP for two consecutive years, in the same subject area, the school will be classified as a School In Need of Improvement (SINI). 10 Responsibilities of Title I Schools • Adhere to Federal Requirements • Document compliances • Manage budget in accordance with SIP/SWP • Close the Achievement Gap Recommendation Create a Title I school team consisting of key personnel 11 Changes to Support Services • Provide budget information and updates • Offer technical assistance and training for Area Offices • Participate in monthly Area Staff Meetings to impart information to Title I Principals • Collaborate with Area Directors • Meet with Title I Contacts in small groups with similar needs • Monitor SIP and align budgets • Hold budget conferences with schools • Approve budgets and requisitions • Monitor scanned and submitted documentation • Visiting school activities for compliance (e.g. Annual Meeting, AYP Meetings, etc.) 12 FY12 Budgets Step 1 – School submits Title I Planning Tool in May for approval 13 FY12 Budgets Step 2 – Budget is uploaded into PeopleSoft in June 14 FY12 Budgets Step 3 – School documents budget in SIP by September 15 FY12 Budgets Step 4 – Once the plan is approved by Title I, any changes to the budget must be approved by SAC and revised in the SIP template Recommendation Print approved SIP Final Budget to review when submitting budget transfers and requisitions 16 Title I Funds • Title I (Part A Basic) – Fund 4201 closes June 30, 2012 • Stimulus Grant (ARRA) – Fund 4920, closes Sept. 30, 2011 • School Improvement Grant (SIG) – Fund 4215 or Fund 4216 • Sanction (Corrective Action) – Fund 4214 17 Functions How will the money be used? What is the function? Title I supports seven types of functions: • Function 5150 – Instructional • Function 6152 – Family Involvement • Function 6402 – Staff Development • • • • Function Function Function Function 6202 6501 7802 7803 – Media Center – Technology Instruction – Student Transportation for Tutorial – Student Transportation for Field Trips 18 Minimum Requirements a.k.a Set Asides • All Title I schools must expend their Parent Involvement allocation in function 6152 • All schools must utilize their Title I allocation on professional development (function 6402) activities that address the subgroup(s) that did not make AYP Functions and Accounts Using incorrect functions and accounts will slow processing down and may result in denial of request. 19 20 FY12 Title I Allowable Expenditures Supplemental salary positions Supplemental supplies Classroom/resource teachers HQ paraprofessionals Community Language Facilitator Tutorial programs - beyond regular day Extra periods for secondary teachers Subs for release time to attend PD Part-time for collaborative work Classroom libraries Learning centers Readers/Writers Workshop materials Calculators/math manipulatives Headphones/microphones Lab consumable materials Laminating film Paper for classroom use Ink for classroom use Parent resource center Food for parent trainings Postage for parent mailings Book study Coach supplies Training supplies PD Webinars Technology Computers/mimeo pads Printers Document cameras SMART boards Projectors Software (i.e. Reading Plus) Online instructional websites Zip drives 21 FY12 Title I Unacceptable Expenditures • • • • • • • • • • • • • Secretary, office assistant, attendance clerk School police officer, security guard, school police aide Clinic aide, school nurse, clinic supplies Custodian, custodial supplies Cafeteria worker, cafeteria supplies Administrative personnel and costs (i.e. grade books, office computers, and toner) ESE and ELL coordinators, ESE forms and tests Behavioral Intervention Assistant (BIA) Incentives and rewards Marketing items such as brochures, banners, and flags Memberships for professional organizations Field trips for entertainment Food items (unless purchased for parent trainings) 22 Reminders • Title I allocations not used by the end of the fiscal year are returned to the District • Title I allocations generated during a specific fiscal year must be utilized during that fiscal year • Recommended that purchases be made by December 22, 2011 23 Criteria for Food Purchases for Title I Family Involvement Trainings • Training must be tied to curriculum such as enhancing literacy or math and teach parents ways they can assist their children at home • Not part of the School Advisory Council, PTA, or other committee meetings • Reasonable in cost and type of food 24 Criteria for Food Purchases for Title I Family Involvement Trainings • Be identified in the school’s Family Involvement Policy/Plan as a means of encouraging or expanding family involvement • Absolutely no food expenditures will be allowed for faculty or student events • Contact your Title I Specialist to get clarification before incurring expenses 25 Title I Food Purchase Audit Compliance Checklist 26 Travel • Conferences/workshops must be documented in your SIP/SWP • Out-of-County travel must be approved by Area Superintendent (account 533600) • Out-of-State travel must be approved by CAO (account 533620) • No charges should be incurred prior to approval 27 Title I Travel Audit Compliance Checklist 28 Field Trips • All field trips must relate to the needs outlined in the SIP • All field trips must have a direct tie to the core content areas of reading, writing, mathematics, or science in efforts to improve AYP results in those areas • Title I field trips may not be used as incentives or rewards • Field trip costs should be reasonable • Resort or vacation areas (water parks, amusement parks, etc.) are not allowable as the issue of being “academic” in nature comes into play • Title I funds cannot cover expenses for parents or chaperones 29 Title I Field Trip Audit Compliance Checklist 30 Property and Equipment • All unit items costing $250.00 through $999.99 must be labeled as Title I • A running list of these items must be maintained throughout the year (Template on NCLB website) • All items costing $1,000.00 or more must be labeled with a white Property Records Tag • An accurate inventory of your equipment is essential 31 Procedures for Reimbursements Title I funds may be used only for student achievement, staff development, and to build parental capacity. These funds must supplement the regular school program. • How does this expenditure affect student achievement? • How does this expenditure affect staff development? • How does this expenditure increase parental capacity or involvement? • Is this something that would be purchased if the school was not Title I? 32 Timeline for Financial Requests A quarterly submission of receipts is required. Any expenses, including salary, submitted outside of the quarter timeline may not be reimbursed. • October 14, 2011 (Expenses from July – September) • January 13, 2012 (Expenses from October – December) • April 13, 2012 (Expenses from January – March) • June 14, 2012 (Expenses from April – June) The last day to submit salary for June expenses for reimbursements is July 6, 2012. 33 Procedures for Reimbursements • An approved School Improvement Plan/Schoolwide Plan must be on file that documents expenses • Submit a completed Title I Checklist for Quarterly Reimbursements signed by principal 34 Checklist for Quarterly Reimbursement 35 Procedures for Reimbursements • Submit Original Grant Reimbursement Request Letter • Charter school’s letterhead • Address on the letter must match the address on file with the District • Separate letters and packets are needed for multiple funding sources • Signed in blue ink by a board member • Copies are not acceptable 36 Grant Reimbursement Request Letter 37 Procedures for Reimbursements • Submit completed Charter School Summary Reimbursement Spreadsheet • Submit documentation of expenditures by non-salary/salary and by function 38 39 Documentation of Expenditures Non-salary expenses • Copies of cancelled check(s) or bank statement(s) • Copies of credit card statement(s), if applicable • Itemized receipts/paid invoices 5150 Classroom expenses (classroom libraries, software, etc.) 6152 Family Involvement expenses (training materials, postage, etc.) 6402 Professional Development expenses (PD books, training materials, etc.) Title I does not reimburse taxes except for out-of-state travel. 40 Documentation of Expenditures Salary expenses • Detailed payroll reports • Federal Grants Charter School Staff Directory • Tutorial documentation, if applicable 5150 Classroom expenses (tutoring, teacher salary, etc.) 6152 Family Involvement expenses (parent liaison salary, PRT, etc.) 6402 Professional Development expenses (stipends, trainers, subs, etc.) Charter School Staff Directory must be included with each packet. 41 42 43 Documentation of Expenditures Consultant expenses • Board approved consultant contract • Copies of invoices • Copies of cancelled check(s) or bank statement(s) • Documentation of services – agenda, sign-in sheets, etc. 6402 Professional Development expenses (PD trainer, etc.) It is recommended that consultant contracts be all inclusive. If not, follow travel reimbursement procedures outlined below. 44 Documentation of Expenditures Travel expenses • Per diem per day is allowed for meals based upon school Charter and not exceed federal guidelines • No meal receipts are required • Mileage is reimbursed based upon school Charter and may not exceed federal guidelines • Copy of the registration form and receipt • Receipt for air travel • Receipt for hotel showing a zero balance • Parking or toll receipts, if applicable • Agenda/program of the activities • PBSD 0096 summarizing all expenditures for travel • Completed Title I Travel Audit Compliance Checklist Title I does not reimburse taxes except for out-of-state travel. 45 Documentation of Expenditures Food expenses • Allowed for parent trainings only • Agenda • Sign-in sheets • Itemized receipts • Parent evaluation of training • Cancelled check(s) or bank statement(s) • Title I Food Purchase Audit Compliance Checklist Title I does not reimburse for gratuity. 46 Procedures for Reimbursements Order packet as follows: 1. 2. 3. 4. 5. 6. Quarterly Checklist Request Letter Spreadsheet Non-salary documentation for 5150, 6152, 6402 Staff Directory Salary documentation for 5150, 6152, 6402 47 District Reimbursement Procedures • Grant Reimbursement Request Packet is date stamped when received • Documentation reviewed and verified by Title I Specialist • Title I budget manager reviews packet and forwards to Director for final approval/signature • If corrections are required, the Title I specialist contacts school • If no corrections are needed, the reimbursement will be processed for payment Expect payment within 10 business days upon final approval of reimbursement packet. 48 Stipends vs. Part-time In-system (PRT) • Stipends are used to pay teachers to attend a workshop or training. The only function for stipends is 6402. The rate is $20.44 for teachers. • PRT is used to pay tutors (5150), trainers (6402), temp parent liaisons (6152), etc. • Miscellaneous Employee Payment (OmniForm 1767) is only used for non-instructional payroll and staff not assigned to your school 49 Highly Qualified Personnel • All teachers of core content areas are to be highly qualified before they are hired • All paraprofessionals providing instructional support must be highly qualified, such as those who assist with classroom management, provide instructional assistance in a computer lab or media center, or provide instructional support services • Non-instructional staff who are not highly qualified cannot work in a tutoring program (i.e. Media Clerk) 50 Tutoring Guidelines • The District teacher rate is $20.44 an hour. • Non-instructional staff earn their regular hourly rate. • ONLY HQ teachers may be placed in tutoring positions • Teachers may be paid for 15 minutes of planning time for every hour of tutoring. • One-on-one tutoring is not allowed. A minimum of 5 students should be in a tutoring session. • Different instructional strategies and/or programs should be used for tutorial instruction than those used during the regular day 51 Tutoring Guidelines • Tutorial documentation should be ordered by teacher sign-in/out, student attendance, and lesson plans and submitted weekly for approval. • Payroll should not be entered until appropriate documentation is signed off by the tutorial administrator or lead teacher. • If no students are in attendance, tutors may be paid up to 15 minutes wait time. Tutors may not be paid for the entire scheduled tutorial session without students present. • It is recommended that students not be assigned to their regular classroom teacher. 52 Tutoring Tools • Individual Time Sheet • Individual Time Sheet with Make-up Hours • Student Attendance Sign-in • School Sign-In Time Sheet • Title I Tutorial Budget Planner • Track Hours for Tutorial Program • Title I Tutorial Monitoring Checklist 53 Conclusion • Questions • Evaluation • Thank you for your attention