Business Strategy

McGraw-Hill/Irwin Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

Business Strategy

Chapter 8

Learning Objectives

1.

Determine why a business would choose a low-cost, differentiation, or speed-based strategy

2.

Explain the nature and value of a market focus strategy

3.

Illustrate how a firm can pursue both low-cost and differentiation strategies

4.

Identify requirements for business success at different stages of industry evolution

5.

Determine good business strategies in fragmented and global industries

6.

Decide when a business should diversify

8-3

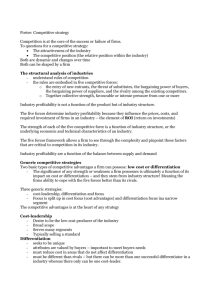

Evaluating and Choosing Business Strategies: Seeking

Sustained Competitive Advantage

The two most prominent sources of competitive advantage can be found in the business’s cost

structure and its ability to differentiate the business from competitors

Businesses that have one or more sources/capabilities that let them operate at a lower cost will consistently outperform their rivals that don’t.

8-4

Evaluating Cost Leadership Opportunities

Business success built on cost leadership requires the business to be able to provide its product or service at a cost below what its competitors can achieve

8-5

Ex. 8.2 Evaluating a Business’s Cost Leadership Opportunities

8-6

Sustainable Low-Cost Activities

1.

Some low-cost advantages reduce the likelihood of buyers’ pricing pressure

2.

Truly sustained low-cost advantages may push rivals into other areas

3.

New entrants competing on price must face an entrenched cost leader

4.

Low-cost advantages should lessen the attractiveness of substitute products

5.

Higher margins allow low-cost producers to withstand supplier cost increases

8-7

Risks of a Cost Leadership Strategy

1.

Many cost-saving activities are easily duplicated

2.

Exclusive cost leadership can be a trap

3.

Obsessive cost cutting can shrink other competitive advantages

4.

Cost differences often decline over time

8-8

Evaluating Differentiation

Differentiation requires that the business have sustainable advantages that allow it to provide buyers with something uniquely valuable to them

Differentiation usually arises from one or more activities in the value chain that create a unique value important to buyers

Strategists use benchmarking and consider the 5 forces in considering differentiation

8-9

Ex. 8.3 Evaluating a Business’s Differentiation Opportunities

8-10

Evaluating Speed as a Competitive Advantage

Speed-based strategies, or rapid

response to customer requests or market and technological changes, have become a major source of competitive advantage for numerous firms in today’s intensely competitive global economy

8-11

Ex. 8.5 Evaluating a Business’s Rapid Response (Speed)

Opportunities

8-12

Speed can be created by:

Customer responsiveness

Product development cycles

Product or service improvements

Speed in delivery or distribution

Information Sharing and Technology

8-13

Risks of Speed-based Strategy

Speeding up activities that haven’t been conducted in a fashion that prioritizes rapid response should only be done after considerable attention to training, reorganization, and/or reengineering

Some industries may not offer much advantage to the firm that introduces some forms of rapid response

Customers in such settings may prefer the slower pace or the lower costs currently available, or they may have long time frames in purchasing

8-14

Evaluating Market Focus as a Way to Competitive Advantage

Market focus: the extent to which a business concentrates on a narrowly defined market

Small companies, at least the better ones, usually thrive because they serve narrow market niches

Market focus allows some businesses to compete on the basis of low cost, differentiation, and rapid response against much larger businesses with greater resources

8-15

Risks of Market Focus

The risk of focus is that you attract major competitors who have waited for your business to “prove” the market

Publicly traded companies built around focus strategies become takeover targets for large firms seeking to fill out a product portfolio

Slipping into the illusion that it is focus itself, and not low cost, etc. that is creating the business’s success.

8-16

Stages of Industry Evolution and Business Strategy Choices

The requirements for success in industry segments change over time

Strategists can use these changing requirements, which are associated with different stages of industry evolution, as a way to isolate key competitive advantages and shape strategic choices around them

8-17

Emerging Industries

Emerging industries are newly

formed or re-formed industries that typically are created by technological innovation, newly emerging customer needs, or other economic or sociological changes

There are no “rules of the game”

8-18

Business Strategies in Emerging Industries

Technologies that are most proprietary to the pioneering firms and technological uncertainty will unfold

Competitor uncertainty because of inadequate information about competitors, buyers, and the timing of demand

High initial costs but steep cost declines

Few entry barriers

First-time buyers requiring initial inducement to purchase

Inability to obtain raw materials and components until suppliers gear up to meet the industry’s needs

Need for high-risk capital because of the industry’s uncertain prospects

8-19

Emerging Industries

For success in this industry setting, business strategies require one or more of these features:

The ability to shape the industry’s structure

The ability to rapidly improve product quality and performance features

Advantageous relationships with key suppliers and promising distribution channels

The ability to establish the firm’s technology as the dominant one

The early acquisition of a core group of loyal customers and then the expansion of that customer base

The ability to forecast future competitors

8-20

Competitive Advantages and Strategic Choices in Growing

Industries

Rapid growth brings new competitors into the industry

At this stage, growth industry strategies that emphasize brand recognition, product differentiation, and the financial resources to support both heavy marketing expenses and the effect of price competition on cash flow can be key strengths

8-21

Growth Industries

For success in this industry setting, business strategies require one or more of the following features:

The ability to establish strong brand recognition

The ability and resources to scale up to meet increasing demand

Strong product design skills to be able to adapt products and services

The ability to differentiate the firm’s product[s] from competitors entering the market

R&D resources and skills to create product variations

The ability to build repeat buying from established customers

Strong capabilities in sales and marketing

8-22

Competitive Advantages and Strategic Choices in

Mature Industries

As an industry evolves, its rate of growth eventually declines

Firms working with the mature industry strategies sell increasingly to experienced, repeat buyers who are now making choices among known alternatives

Competition becomes more oriented to cost and service as knowledgeable buyers expect similar price and features

8-23

Mature Industries

Strategy elements of successful firms in maturing industries often include the following:

Product line pricing

Emphasis on process innovation that permits low-cost product design, manufacturing methods, and distribution synergy

Emphasis on cost reduction

Careful buyer selection to focus on buyers who are less aggressive, more closely tied to the firm, and able to buy more from the firm

Horizontal integration to acquire rival firms whose weaknesses can be used to gain a bargain price

International expansion to markets where attractive growth and limited competition still exist

8-24

Competitive Advantages and Strategic Choices in Declining

Industries

Declining industries are those that make products or services for which demand is growing slower than demand in the economy as a whole or is actually declining

Focus on higher growth or a higher return

Emphasize product innovation and quality improvement

Emphasize production and distribution efficiency

Gradually harvest the business

8-25

Competitive Advantage in Fragmented Industries

A fragmented industry is one in which no firm has a significant market share and can strongly influence industry outcomes

Tightly managed decentralization

“Formula” facilities

Increased value added

Specialization

Bare bones/no frills

8-26

Competitive Advantage in Global Industries

A global industry is one that comprises firms whose competitive positions in major geographic or national markets are fundamentally affected by their overall global competitive positions

License foreign firms to produce and distribute the firm’s products

Maintain a domestic production base and export products to foreign countries

Establish foreign-based plants and distribution to compete directly in the markets of one or more foreign countries

8-27

Four Generic Global Competitive Strategies

Broad-line global competition

Global focus strategy

National focus strategy

Protected niche strategy

8-28

Ex. 8.10

Grand Strategy Selection Matrix

8-29

Ex. 8.11

Model of Grand Strategy Clusters

8-30

Building Value as a Basis for Choosing Diversification or Integration

The grand strategy selection matrix and model of grand strategy clusters are useful tools to help dominant product company managers evaluate and narrow their choices among alternative grand strategies

Dominant product company managers who choose diversification or integration eventually create another management challenge

8-31

Key Terms

Concentrated growth

Concentric diversification

Conglomerate diversification

Declining industry

Differentiation

Divestiture

Emerging industry

Fragmented industry

Global industry

Grand strategy clusters

Grand strategy selection matrix

Growth industry strategies

Horizontal acquisition

8-32

Key Terms (contd.)

Innovation

Joint ventures

Liquidation

Low-cost strategies

Market development

Market focus

Mature industry strategies

Product development

Retrenchment

Speed-based strategies

Strategic alliances

Vertical acquisition

8-33