neely-net-pricing - University of Southern California

advertisement

Optimal Pricing in a Free Market

INFOCOM 2007

Wireless Network

S1

S3

?

S1

S3

S4

current $:

q3(t)

current $:

q2(t)

S2

5

6

7

S2

Michael J. Neely

University of Southern California

http://www-rcf.usc.edu/~mjneely

*Sponsored in part by DARPA IT-MANET Program and NSF Grant OCE 0520324

S1

S3

?

S1

S3

S4

current $:

q3(t)

current $:

q2(t)

S2

5

6

7

S2

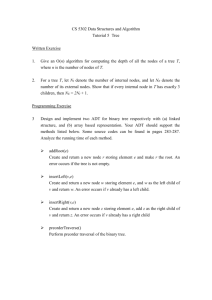

Time-slotted System: t

{0, 1, 2, …}

Time-Varying Channels: (fading, mobility, etc.)

Sn(t) = (Sn1(t), Sn2(t), …, Snk(t))

(channel states on outgoing links of node n)

Transmission Rate Options (nodes use orthogonal channels):

mn(t) = (mn1(t), mn2(t), …, mnk(t))

Wn(Sn(t))

S1

S3

?

S1

S3

S4

current $:

q3(t)

current $:

q2(t)

7

5

S2

Transmission Costs:

Example:

S2

6

Cntran(mn(t), Sn(t))

Cntran(m)

m

Reception Costs: Cnbrec(mnb(t))

*Example:

Cnbrec(mnb(t))

= { sb if mnb(t) > 0

{ 0 if mnb(t) = 0

*this example is

used in slides

for simplicity

S1

S3

?

S1

S3

S4

current $:

q3(t)

current $:

q2(t)

S2

5

6

7

S2

For simplicity of these slides: Assume single commodity (multisource, single sink) (multi-commodity case treated in the paper)

Un(t) = Queue Backlog in node n at time t

Rn(t) = *New data admitted to network at source n at time t

New source data R2(t)

Endogenous arrivals

U3(t)

Transmit out

Node 3 (a source)

*Not all nodes are sources: Some simply act as profit-seeking relays

S1

S3

?

S1

S3

S4

current $:

q3(t)

current $:

q2(t)

S2

6

5

7

S2

For simplicity of these slides: Assume single commodity (multisource, single sink) (multi-commodity case treated in the paper)

Un(t) = Queue Backlog in node n at time t

Rn(t) = *New data admitted to network at source n at time t

Endogenous arrivals

U5(t)

Transmit out

Node 5 (pure relay: not a source)

*Not all nodes are sources: Some simply act as profit-seeking relays

Free Market Network Pricing:

revenue

Data that node n already

needs to deliver

Advertisement

current $: qn(t)

expenses

rec. cost: sn

Node n

-Each node n sets its own per-unit price qn(t)

for accepting endogenous data from others.

(Seller Node Challenge: How to set the price?)

-Node n advertises qn(t) and the reception cost.

(fixed reception cost sb used in slides for simplicity)

Free Market Network Pricing:

Seller Node n Perspective

Node n

Advertisement

$ = qn(t)

rec = sn

Buyer Node a Perspective

Node a

Advertisement

?

?

$ = qn(t)

rec = sn

n

Advertisement

?

?

$ = qn(t)

rec = sn

b

“Buyer Nodes” pay handling charge + reception fee:

-Handling Charge: ban(t) = man(t)qn(t)

-Reception Fee: sn

Free Market Network Pricing:

Seller Node n Perspective

Node n

Advertisement

$ = qn(t)

rec = sn

Buyer Node a Perspective

Node a

Advertisement

?

?

$ = qn(t)

rec = sn

n

Advertisement

?

?

$ = qn(t)

rec = sn

b

Buyer Node Challenge: Where to send? How much

to send? Is advertised price acceptable?

(current transmission costs Cntran(mn(t), Sn(t)) play a role,

as does the previous revenue earned for accepting data)

Free Market Network Pricing:

The sources’ desire for communication is the

driving economic force!

Modeling the Source Demand Functions:

-Elastic Sources

-Utility gn(r) = Source n “satisfaction” (in dollars)

for sending at rate r bits/slot.

gn(r)

h

r

Assumed to be:

1. Convex

2. Non-Decreasing

3. Max slope h

Node n profit (on slot t):

fn(t) = total income(t) - total cost(t) - payments(t)

Income

Payments

Costs

Node n

Source (at node n) profit (on slot t):

yn(t) = gn(Rn(t)) - qn(t)Rn(t)

Rn(t)

Source at n

$ = qn(t)

Node n

Social Welfare Definition:

Social Welfare =

n

where:

rn

[gn( rn ) - costn ]

= time avg admit rate from source n

costn = time avg external costs expended

by node n (not payment oriented)

Simple Lemma: Maximizing Social Welfare…

(i) …is equivalent to maximizing sum profit

(sum profit = “network GDP”)

(ii)…can (in principle) be achieved by a stationary

randomized routing and scheduling policy

We will design 2 different pricing strategies:

1) Stochastic Greedy Pricing (SGP):

- Greedy Interpretation

- Guarantees Non-Negative Profit

- If everyone uses SGP, Social Welfare Maxed

over all alternatives (and so Sum Profit Maxed)

2) Bang-Bang Pricing (BB):

- No Greedy Interpretation

- Yields a “optimally balanced” profits

(profit fairness…minimizes exploitation)

Prior Work:

Utility Maximization for Static Networks:

[Kelly: Eur. Trans. Tel. 97]

[Kelly, Maulloo, Tan: J. Oper. Res. 98]

[Low, Lapsley: TON 1999]

[Lee, Mazumdar, Shroff: INFOCOM 2002]

Utility Maximization for Stochastic Networks:

[Neely, Modiano, Li: INFOCOM 2005]

[Andrews: INFOCOM 2005]

[Georgiadis, Neely, Tassiulas: NOW F&T 2006]

[Chen, Low, Chiang, Doyle: INFOCOM 2006]

Pricing plays

only an

indirect role

in yielding

max utility

solution

For the stochastic algorithms, dynamic “prices”

do not necessarily yield the non-negative profit goal!

Prior Work:

Revenue Maximization for Downlinks (non-convex):

[Acemoglu, Ozdaglar: CDC 2004]

[Marbach, Berry: INFOCOM 2002]

[Basar, Srikant: INFOCOM 2002]

Profit is

central to

problem

Markov Decision Problems for single-network owner:

[Paschalidis, Tsitsiklis TON 2000]

[Lin, Shroff TON 2005]

Market Mechanisms:

[Buttyan, Hubaux: MONET 2003]

[Crowcroft, Gibbens, Kelly, Ostring WiOpt 2003]

[Shang, Dick, Jha: Trans. Mob. Comput. 2004]

[Marbach, Qui: TON 2005]

Need a stochastic theory for market-based network economics!

Stochastic Greedy Pricing Algorithm (SGP):

(Similar to Cross-Layer-Control (CLC) Algorithm from

[Neely 2003] [Neely, Modiano, Li INFOCOM 2005])

For a given Control Parameter V>0…

Pricing (SGP):

Rn(t)

qn(t) = Un(t)/V

Admission Control (SGP):

“instant utility”

Node n

payment

Max:

gn(Rn(t)) - qn(t) Rn(t)

Subj. to: 0 < Rn(t) < Rmax

Queue Backlog Un(t)

Stochastic Greedy Pricing Algorithm (SGP):

(Similar to Cross-Layer-Control (CLC) Algorithm from

[Neely 2003] [Neely, Modiano, Li INFOCOM 2005])

For a given Control Parameter V>0…

Resource Allocation & Routing (SGP):

Define the modified differential price Wnb(t):

qn(t)

qb(t)

Wnb(t) = qn(t) - qb(t) - d/V

where d = max[mmax out, mmax in + Rmax]

Maximize:

b

Wnb(t)mnb(t) -

Subj. to :

b

Cnbrec(mn(t)) - Cntran(mn(t), Sn(t))

mn(t) Wn(Sn(t))

Theorem (SGP Performance): For arbitrary S(t)

processes and for any fixed parameter V>0:

(a) Un(t) < Vh + d for all n, for all time t

(b) All nodes and sources receive non-negative

profit at every instant of time t:

t-1

1

Nodes:

fn(t) > 0

t t=0

Sources:

(

gn

t-1

t-1

1 R (t)

1 q (t) R (t) > 0

- t

n

n

t t=0 n

t=0

)

(a)(b) hold for any node n using SGP, even if others don’t use SGP!

Theorem (SGP Performance): For arbitrary S(t)

processes and for any fixed parameter V>0:

(a) Un(t) < Vh + d for all n, for all time t

(b) All nodes and sources receive non-negative

profit at every instant of time t:

(c) If Channel States S(t) are i.i.d. over slots and

if everyone uses SGP:

Social Welfare > g* - O(1/V)

g* = maximum social welfare (sum profit) possible,

optimized over all alternative algorithms for

joint pricing, routing, resource allocation.

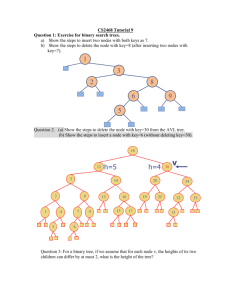

Simulation of SGP:

S1

6

S3

S2

S4

5

7

Parameters:

V= 50

Dotted Links:

ON/OFF Channels (Pr[ON] = 1/2)

Transmission costs = 1 cent/packet, reception costs = .5 cent/packet

Solid Links:

Transmission costs = 1 cent/packet

Utilities: g(r) = 10 log(1 + r)

Simulation of SGP:

S1

S3

S2

S4

5

6

7

SGP: V=50

C2 = C5 = C7 = 1

g(r) = 10 log(1+r)

Simulation of SGP (increase cost of C2, C5):

S1

S3

S2

S4

5

6

7

SGP: V=50

C7=1

C2 = C5 = 3

g(r) = 10 log(1+r)

Bang-Bang Pricing (BB) Algorithm:

Objective is to Maximize:

n

[ Fn( fn ) + Yn( yn ) ]

Where Fn(f) and Yn(y) are concave profit metrics.

Yields a more balanced (and “fair”)

profit distribution.

Quick (incomplete) description of Bang-Bang

Pricing (see paper for details):Uses General Utility

Optimization technique from our previous work in

[Georgiadis, Neely, Tassiulas NOW F & T 2006]

BB Algorithm: Define Virtual Queues Xn(t), Yn(t)

And Auxiliary Variables gn(t), nn(t).

Nodes n:

Sources n:

expenses(t) + gn(t)

payment(t) + nn(t)

Xn(t)

Yn(t)

income(t)

gn(Rn(t))

Pricing (BB):

qan(t) = { Qmax if Xa(t) < Xn(t)

{0

else

(Price depends on the incoming link)

Distributed Auxiliary Variable Update:

Each node n solves:

Maximize: VFn(g) - Xn(t)g

Subject to: 0 < g < Qmax d

Resource Allocation Based on Mod. Diff. Backlog:

Wnb(t) = Un(t) - Ub(t) -qnb(t)[Xn(t) - Xb(t)]

Theorem (BB Performance): If all nodes

Use BB with parameter V>0, then:

1) Avg. Queue Congesetion < O(V)

2)

n

[ Fn( fn ) + Yn( yn ) ]

> Optimal - O(1/V)

Simulation of BB:

S1

S3

S2

S4

5

6

7

SGP: V=50

C2 = C5 = C7 = 1

g(r) = 10 log(1+r)

Simulation of BB (increase cost of C2, C5):

S1

S3

S2

S4

5

6

7

SGP: V=50

C7=1

C2 = C5 = 3

g(r) = 10 log(1+r)

Conclusions:

1) SGP: Guarantees

Non-negative profit and

Bounded queues,

Regardless of actions of

Other nodes. If all nodes

Use SGP => Max sum

Profit!

2) BB: Optimally

Balanced, but has no

greedy interpretation.

S1

S3

S2

S4

5

6

7

SGP: V=50

C7=1

C2 = C5 = 3

g(r) = 10 log(1+r)