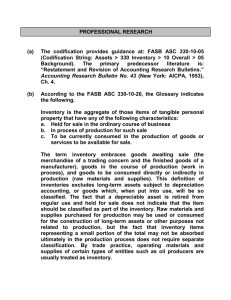

File

advertisement

IAS 2 INVENTORIES Orhan Balıkçı Introduction • The Standard prescribes the accounting treatment for inventories. • The main issue with respect to accounting for inventory is the amount of cost to be recognized as an asset. • In addition, the Standard provides guidance on the determination of the cost and subsequent recognition of expense (including write-down of inventory to its net realizable value). • In April 2001 the International Accounting Standards Board (IASB) adopted IAS 2 Inventories Objective and scope This Standard applies to all inventories other than; • Work in progress under construction contracts and directly related service contracts • Financial instruments • Biological assets related to agricultural activity and agricultural produce at the point of harvest Definitions • Inventories are assets: held for sale in the ordinary course of business; in the process of production for such sale; or in the form of materials or supplies to be consumed in the production process or in the rendering of services. • Net realisable value (NRV) is the estimated selling price in the ordinary course of business minus any cost to complete and to sell the goods. • Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date Cost of Inventories The cost of inventories comprises all; • Costs of purchase • Costs of conversion • Other costs Cost of Inventories The costs of purchase constitute all of • • • • The purchase price Import duties Transportation costs Handling costs directly pertaining to the acquisition of the goods Cost of Inventories • Cost of conversion of inventory includes costs directly attributable to the units of production, for example, direct labor. The conversion costs could also include variable and fixed manufacturing overhead incurred in converting raw material into finished goods. • Other costs in valuing inventories include those costs that are incurred in bringing the inventories to their present location and condition. An example of such “other costs” is costs of designing products for specific customer needs. Inventories of Service Providers • Inventories of service providers are measured at costs of their production. These costs consist primarily of labor and other costs of personnel directly used in providing the service, including cost of supervisory personnel, and attributable overheads. Techniques of Measurement of Costs • The standard cost method takes into account normal levels of material, labor, efficiency, and capacity utilization. • The retail method is often used by entities in the retail industry for which large numbers of inventory items have similar gross profit margins. Cost Formulas The cost of inventories should be measured using either • The FIFO (first-in, first-out) method; or • The LIFO (last in, first out) • The weighted-average cost method. Example of The FIFO • XYZ Inc. is a newly established international trading company. It commenced its operation in 2005. XYZ imports goods from China and sells in the local market. It uses the FIFO method to value its inventory. • • • • • • • • Listed next are the purchases and sales made by the entity during the year 2005: Purchases: January 1 10 units @ $ 25 each January 3 15 units @ $ 30 each January 25 20 units @ $ 35 each Sales: January 10 15 units January 30 20 units Example of The FIFO Date Purchases January 1 10 @ $ 25 250$ January 3 15 @ $ 30 250+450= 700$ January 10 January 25 January 30 Sales Balance 10*25$+5*30$ 300$ =400$ 20 @ $ 35 700+300= 1000$ 10*30$+10*35 350$ $=$650 Example of The LIFO • Use The LIFO method on valuing inventory of XYZ Inc. Date Purchases January 1 10 @ $ 25 250$ January 3 15 @ $ 30 250+450= 700$ January 10 January 25 January 30 Sales Balance 10*30$+5*25$ $275 =$425 20 @ $ 35 700+275= $975 20*$35=$700 $275 Example of The Weighted-Average Cost Method Date Purchases January 1 10 @ $ 25 250$ January 3 15 @ $ 30 250+450= $700 January 10 January 25 January 30 Sales 15 @ $28=$420 20 @ $ 35 Balance $280 700+280= $980 20*$32=$640 $340 Net Realizable Value • Inventories are written down to net realizable value (NRV) on the basis that assets should not be carried in excess of amounts likely to be realized from their sale or use. • Write-down of inventories becomes necessary for several reasons; for example, inventories may be damaged or become obsolete or their selling prices may have declined after year-end or period-end Disclosure • The financial statements should disclose; Accounting policies adopted for measuring inventories and the cost flow assumption (i.e., cost formula) used Total carrying amount as well as amounts classified as appropriate to the entity Carrying amount of any inventories carried at fair value less costs to sell Amount of inventory recognized as expense during the period Amount of any write-down of inventories recognized as an expense in the period Amount of any reversal of a write-down to net realizable value and the circumstances that led to such reversal Circumstances requiring a reversal of the write-down Carrying amount of inventories pledged as security for liabilities IAS 7 Statement of Cash Flows Introduction • IAS 1 makes it incumbent upon entities preparing financial statements under International Financial Reporting Standards (IFRS). • IAS 7, Cash Flow Statements, lays down rules regarding cash flow statement preparation and reporting. Scope • All entities, regardless of the nature of their activities, should prepare a cash flow statement in accordance with the requirements of IAS 7. The cash flow statement should be presented as an integral part of the financial statements for each period for which the financial statements are presented. Definitions • Cash Comprises: cash on hand and demand deposits with banks. • Cash equivalents: Short-term, highly liquid investments that are readily convertible into known amounts of cash and that are subject to an insignificant amount of risk of changes in value. • Operating activities: Principal revenue-producing activities of the entity and other activities that are not investing or financing activities. • Investing activities: Activities of the entity that relate to acquisition and disposal of long lived assets and other noncurrent assets (including investments) other than those included in cash equivalents. • Financing activities: Activities that result in changes in the size and composition of the equity capital and borrowings of an entity Benefits of Presenting a Cash Flow Statement A cash flow statement provides this additional information to users of financial statements: • A better insight into the financial structure of an entity, including its liquidity and solvency, and its ability to affect the amounts and timing of cash flows in order to adapt to changing circumstances and opportunities; and • Enhanced information for the purposes of evaluation of changes in assets, liabilities, and equity of an entity. Cash and cash equivalents • Cash equivalents are held by the entity for meeting short-term commitments. According to the definition, cash equivalents are required to possess these two attributes: • They should be “short term” in nature; • They should be “highly liquid investments” Presentation of a Statement of Cash Flow • The statement of cash flow shall report cash flows during the period classified by operating, investing and financing activities. • Classification by activity provides information that allows users to assess the impact of those activities on the financial position of the entity and the amount of its cash and cash equivalents. This information may also be used to evaluate the relationships among those activities 1. Operating Activities • Cash flows from operating activities are primarily derived from the principal revenue-producing activities of the entity. This is a critical indicator of the financial strength of an entity because it is an important source of internal finance. 2. Investing activities • Investing activities include the purchase and disposal of property, plant, and equipment and other long-term assets, such as investment property. • Examples of cash flows arising from investing activities are cash payments to acquire property, plant and equipment, intangibles and other long-term assets. • When a contract is accounted for as a hedge of an identifiable position, the cash flows of the contract are classified in the same manner as the cash flows of the position being hedged. 3. Financing activities • The separate disclosure of cash flows arising from financing activities is important because it is useful in predicting claims on future cash flows by providers of capital to the entity. Examples of cash flows arising from financing activities are: • cash proceeds from issuing shares or other equity instruments; • cash payments to owners to acquire or redeem the entity’s shares; • cash proceeds from issuing debentures, loans, notes, bonds, mortgages Reporting cash flows from operating activities • An entity shall report cash flows from operating activities using either: • the direct method, whereby major classes of gross cash receipts and gross cash payments are disclosed; or • the indirect method, whereby profit or loss is adjusted for the effects of transactions of a non-cash nature, any deferrals or accruals of past or future operating cash receipts or payments, and items of income or expense associated with investing or financing cash flows. Example of Direct Method Example of Indirect Method Reporting Cash Flows on a Gross Basis versus a Net Basis • IAS 7 permits financial institutions to report cash flows arising from certain activities on a net basis. These activities, and the related conditions under which net reporting would be acceptable, are set out below: • Cash receipts and payments on behalf of customers when the cash flows reflect the activities of the customers rather than those of the bank; for example, the acceptance and repayment of demand deposits • Cash flows relating to deposits with fixed maturity dates • Placements and withdrawals of deposits from other financial institutions • Cash advances and loans to bank customers and repayments thereon Foreign Currency Cash Flows • Cash flows arising from transactions in a foreign currency shall be recorded in an entity’s functional currency by using the rate of exchange between the functional currency and the foreign currency on the date of the cash flow. • Foreign subsidiaries must prepare separate cash flow statements and translate the statements to the functional currency at the exchange rate prevailing on the date of cash flow Acquisitions and Disposals of Subsidiaries and Other Business Units • IAS 7 recognizes that an entity may acquire or dispose subsidiaries or other business units during the year and thus requires that the aggregate cash flows from acquisitions and from disposals of subsidiaries or other business units should be presented separately as part of the investing activities section of the statement of cash flows. QUESTIONS? THANK YOU