2014-11-06 - ACA Update - Arizona Total Rewards Association

advertisement

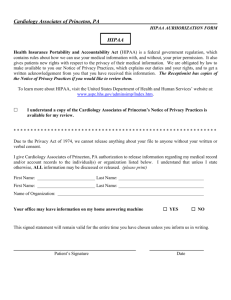

November 6, 2014 2014 Compliance Expectations Arizona Group Updates Jason N. Sheffield, J.D. NATIONAL LEGAL & RESEARCH GROUP Program Overview Affordable Care Act • Employer Mandate • Transition Rules • Worker Exceptions Agency Audits • Agencies & Targets • Worker Misclassification • Audit Procedure Privacy & Security • HIPAA Review • 2014 Rules • HPID/Security Certifications section one AFFORDABLE CARE ACT UPDATE EMPLOYER MANDATE “PAY OR PLAY” THRESHOLD PHASE IN BASED ON EMPLOYER SIZE Employer Size 2015 Plan Year 2016 Plan Year + 1–49 full-time employees or full-time equivalents Does not apply Does not apply 50-99 full-time employees or full-time equivalents* Does not apply Employer must offer coverage to 95% of full-time employees and dependents to age 26 Employer must offer coverage to 70% of full-time employees and dependents to age 26 Employer must offer coverage to 95% of full-time employees and dependents to age 26 100 or more full-time employees or full-time equivalents 3 EMPLOYER MANDATE “PAY OR PLAY” WORKBOOK Do you offer coverage to all full-time employees? NO $2,000 / Full Time Employee (less first 30)* YES Does the plan provide “minimum value”? (60%+ of total allowed costs) NO $3,000 full-time employee receiving tax credit* YES Is the coverage affordable? (< = to 9.5% of income) NO YES No penalty *80 for plan years beginning in 2015; 30 for PYB in 2016 and after 4 EMPLOYER MANDATE “FULLTIME” employee performs an average of 30+ hours of service per week or 130+ hours of service in any calendar month “FULLTIME EQUIVALENTS” equals the sum of all hours of service performed by all employees: = 16 FTEs = 16.11 2,080 33,500 Total Hours (max = 2,080 / worker) Divided by 2,080 Rounded to next lowest whole number Equals the FTE Total Count 5 EMPLOYER MANDATE EMPLOYEE CLASSIFICATIONS POST-ACA Fulltime • Eligibility following satisfaction of waiting/orientation period Part-time • Eligibility following close of initial measurement period (if 30+) Variable Hour • Eligibility following close of initial measurement period (if 30+) Seasonal • Eligibility following 180 days of service (if 30+ during first 180 days) 6 EMPLOYER MANDATE PART-TIME, VARIABLE HOUR & SEASONAL EMPLOYEES LOOK BACK ADMINISTRATIVE PERIOD STABILITY PERIOD Measurement period in which the employer measures an employee’s hours of service Implementation of the lookback period observations, e.g., identification of fulltime workers and enrollment in the plan The coverage period for fulltime employees & the ineligibility period for parttime workers 7 EMPLOYER MANDATE VARIABLE HOUR PROCESS 2014 Hired 10/5/14 Measurement Period 10/5/14 - 10/4/15 2015 First Administrative Period 10/5/15 - 11/30/15 First Stability Period 12/1/15 – 11/30/16 First Ongoing Measurement Period 1/15/15 - 1/14/15 First Ongoing Administrative Period 1/15/16-3/31/16 2016 First Ongoing Stability Period 4/1/16-3/31/17 2017 8 EMPLOYER MANDATE FINAL REGULATIONS ON WAITING PERIODS Health coverage eligibility conditions based solely on the lapse of a time period are permissible for no more than 90 days Period before late or special enrollment is not waiting period If Plan conditions eligibility on FT/specific hours of service and employer reasonably believes the EE will not be FT, Plan can use a measurement period that: • does not exceed 12 months • begins on any date between start date and first day of first calendar month following start date and • coverage is effective no later than 13 months from start date, plus time remaining until first day of next calendar month 9 EMPLOYER MANDATE PROPOSED RULEMAKING ON THE FEDERAL ORIENTATION PERIOD New “reasonable and bona fide employmentbased orientation period" in addition to 90day waiting period May delay waiting period until orientation period is complete • First calendar month following hire, minus one calendar day • Orientation period must end on/before end of next calendar month 10 section two AGENCY AUDITS ON THE RISE AGENCY AUDITS WHO DOES WHAT? Medicare ERISA Medicaid Welfare Plans CMS HHS ACA Health Insurance Exchanges OCR/Title VII IRS CHIP Retirement Plans Misclassification (1099) Health Insurance Marketplace Fringe Benefits HIPAA Privacy ACA/Tax 12 AGENCY AUDITS FLSA – Wages ERISA – Fiduciary FMLA Correction programs Child Labor Government Contracts Immigration DOL / EBSA DOL / WHD WHO DOES WHAT? COBRA HIPAA GINA MHPAEA Agricultural Employment CHIP Employee Polygraphs 13 AUDIT TRIGGERS WHAT TRIGGERS AN AGENCY AUDIT? Random Technical Inquiry Targeted Inquiry (Occupation, Industry) Compliantbased Investigation Regulatory Compliance (Filings, Disclosures) Agency Information Sharing CURRENT STANDARDS OF WORKER CLASSIFICATION Behavioral Control Financial Control Relationship of Worker & Firm IDENTIFYING MISCLASSIFICATION WITHIN THE ORGANIZATION Part A – Employee Relations Termination On-boarding Process Supervision/ Management Discipline Promotion IDENTIFYING MISCLASSIFICATION WITHIN THE ORGANIZATION Part B – Organizational Alignment Business Units Subsidiaries & Affiliates FIRM Geographic Boundaries Skilled Trades & Professional Designations MANAGING AGENCY AUDITS Audit Process Negotiation & Settlement Findings of Fact & Determination of Liability Investigation Agency Notification Closing Agreement MANAGING AGENCY AUDITS Negotiation & Settlement of Audit Penalties & Civil Liabilities Civil Liability Workers’ Compensation Unemployment Taxes Benefits Wages – e.g., O.T. Interest Responsible person liability Federal Tax Liability Employment tax Penalty for failure to withhold Penalty for failure to file W-2s State Tax Liability Penalty for failure to withhold Interest SUTA (state unemployment tax) Responsible person liability section three PRIVACY & SECURITY UPDATE NEW HIPAA Regulations DESIGNED TO BUILD ON EXISTING RULES Implementation of statutory amendments under HITECH Modifications to increase privacy protection for genetic information (GINA) HIPAA administrative simplification to improve workability & effectiveness Increase flexibility for regulated entities Decrease burden on regulated entities 21 2013 RULE NO. 1 – PART I Final Modifications to HIPAA’s Privacy, Security & Enforcement Rules Business Associates are responsible for their own compliance Increased restrictions on uses and disclosures of PHI related to marketing and fundraising Prohibition against sales of PHI absent individual authorization Expansion of individual rights to include receipt of electronic form health records (e-PHI) 22 2013 RULE NO. 1 – PART II Final Modifications to HIPAA’s Privacy, Security & Enforcement Rules Restrictions on the disclosure of self-pay treatment information Modification and redistribution of NPPs (notices of privacy practices) Modification of individual authorizations to: •Facilitate research •Enable disclosure of immunization records •Enable access of decedent information by family members and others Adoption of HITECH enhancements to the Enforcement Rule •Enforcement of noncompliance due to “willful neglect” 23 2013 RULE NO. 2 HITECH – Final Rule Modifying the Enforcement Rule Final rule adopting HITECH modifications to the Enforcement Rule • Increased penalties for noncompliance • Incorporation of tiered penalty scheme • Outline of civil monetary penalty (CMP) structure 24 2013 RULE NO. 3 HITECH – Final Rule on Breach Notification Final Rule on Breach Notification Rule •Outlines BNR for unsecured PHI •Discards traditional “harm” standard •Implements an agency objective standard 25 2013 RULE NO. 4 GINA – Final Rule Prohibiting Genetic Information Disclosure for Underwriting GINA modifications to the Privacy Rule •Prohibition against using or disclosing genetic information •Specifically relates new prohibitions to all underwriting applications 26 THE NEW TIERED BREACH SCHEME LEVEL D: Uncorrected Willful Neglect LEVEL C: Corrected Willful Neglect LEVEL B: Reasonable Cause LEVEL A: Unknowing Breach 27 THE NEW TIERED ENFORCEMENT SCHEME 28 FACTORS AFFECTING CIVIL MONETARY PENALTY Nature & extent of the violation Nature & extent of harms resulting from the violation History of prior compliance Financial condition of the CE or BA 2014 Irvine Fall Boot Camp | 29 HISTORY OF OCR ENFORCEMENT OCR – Resolutions by Year & Type April 14, 2003 – December 31, 2013 30 ADMINISTRATIVE SIMPLIFICATION UTILIZATION OF UNIQUE HEALTH PLAN IDENTIFICATION NUMBERS & OTHER ENTITY IDENTIFIERS Rule proposes an “other entity identifier” (OEID) for entities that are not health plans, health care providers, or individuals, but that need to be identified in standard transactions. Rule establishes a unique “health plan identifier” (HPID) for use with electronic health care transactions. • Health plans (except small health plans) are required to obtain HPIDs by Nov. 5, 2014. • Small health plans are required to obtain HPIDs by Nov. 5, 2015. • All covered entities are required to use HPIDs in the standard transaction by Nov. 7, 2016. 31 ADMINISTRATIVE SIMPLIFICATION HIPAA-REQUIRED CERTIFICATIONS Health plans must certify compliance with HIPAA-standardized transactions by December 31, 2015 • Health care claims or equivalent encounter information • Enrollment and disenrollment in a health plan • Health plan premium payments • Health claims attachments • Referral certification • Authorizations 32 ADMINISTRATIVE SIMPLIFICATION HIPAA-REQUIRED CERTIFICATIONS Penalties for Noncompliance with Information Technology Certification Requirements • Penalty = $1 [x] total of covered lives [x] number of days of noncompliance • Begins at certification deadline and continues until certification is complete • Penalties are subject to annual caps of $20 per covered life or, in the event of misrepresentation when certifying compliance, $40 per covered life. 33 QUESTIONS? PARTICIPANT RESOURCES PARTICIPANT RESOURCES IRS DOL States EMPLOYEE MISCLASSIFICATION ASSISTANCE Distinguishing Employees & Independent Contractors http://www.irs.gov/Businesses/Small-Businesses-&Self-Employed/Independent-Contractor-SelfEmployed-or-Employee Voluntary Classification Settlement Program (VCSP) http://www.irs.gov/Businesses/Small-Businesses-&Self-Employed/Voluntary-Classification-SettlementProgram Advance Determinations & Form SS-8 http://www.irs.gov/uac/Form-SS-8,-Determination-ofWorker-Status-for-Purposes-of-Federal-EmploymentTaxes-and-Income-Tax-Withholding Independent Contractor Standards http://www.dol.gov/elaws/esa/flsa/docs/contractors.as p Misclassification Initiative of the Wage & Hour Division (WHD) http://www.dol.gov/whd/workers/misclassification/ Identifying Contractors under the Fair Labor Standards Act (FLSA) http://www.dol.gov/whd/workers/misclassification/ DOL Guide to State Labor Offices http://www.dol.gov/whd/contacts/state_of.htm#AZ American Institute of CPAs – Guide to Departments of Revenue (link to state revenue departments) http://www.aicpa.org/Research/ExternalLinks/Pages/Taxe sStatesDepartmentsofRevenue.aspx PARTICIPANT RESOURCES HIPAA GENERAL HIPAA COMPLIANCE Full-text version of the 2013 Rulemaking: www.gpo.gov/fdsys/pkg/FR-2013-01-25/pdf/2013-01073.pdf Sample revised contract language for business associate agreements: www.hhs.gov/ocr/privacy/hipaa/understanding/coveredentities/contractprov.html HITECH Full-text version of HITECH: www.hhs.gov/ocr/privacy/hipaa/understanding/coveredentities/hitechact.pdf GINA Full-text version of GINA: www.govtrack.us/congress/bills/110/hr493/text HHS HHS fact sheets and compliance Q&As: www.hhs.gov/ocr/privacy/hipaa/understanding/coveredentities/index.html PARTICIPANT RESOURCES HHS/CMS HEALTH AND HUMAN SERVICES CENTERS FOR MEDICARE & MEDICAID Health Plan Identifier http://www.cms.gov/Regulations-and-Guidance/HIPAA-Administrative-Simplification/AffordableCare-Act/Health-Plan-Identifier.html Affordable Care Act http://www.cms.gov/Regulations-and-Guidance/HIPAA-Administrative-Simplification/AffordableCare-Act/index.html Medicare http://www.cms.gov/Medicare/Medicare.html Medicaid/CHIP http://www.cms.gov/Medicare/Medicare.html Health Insurance Marketplaces (exchange regulations) http://www.cms.gov/CCIIO/Programs-and-Initiatives/Health-Insurance-Marketplaces/index.html PARTICIPANT RESOURCES HHS/OCR HEALTH AND HUMAN SERVICES OFFICE FOR CIVIL RIGHTS Health Information Privacy Homepage http://www.hhs.gov/ocr/privacy/ Understanding HIPAA http://www.hhs.gov/ocr/privacy/hipaa/understanding/index.html HIPAA’s privacy Rule http://www.hhs.gov/ocr/privacy/hipaa/administrative/privacyrule/index.html HIPAA’s Security Rule http://www.hhs.gov/ocr/privacy/hipaa/administrative/securityrule/index.html HIPAA’s Enforcement Rule http://www.hhs.gov/ocr/privacy/hipaa/enforcement/index.html HIPAA’s Breach Notification http://www.hhs.gov/ocr/privacy/hipaa/administrative/breachnotificationrule/index.html DEPARTMENT OF THE TREASURY PARTICIPANT RESOURCES INTERNAL REVENUE SERVICE EMPLOYER PLANS UNIT Affordable Care Act Tax Provisions IRS http://www.irs.gov/uac/Affordable-Care-Act-Tax-Provisions-Home ACA Q&As http://www.irs.gov/uac/Newsroom/Affordable-Care-Act-Tax-Provisions-Questions-and-Answers ACA for Employers http://www.irs.gov/uac/Affordable-Care-Act-Tax-Provisions-for-Employers Employer Plans Division http://www.irs.gov/Retirement-Plans/Plan-Sponsor Wages & Withholdings http://www.irs.gov/Individuals/Withholding-Compliance-Questions-&-Answers Assessing Independent Contractor Classifications http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Independent-Contractor-Self-Employed-or-Employee Fringe Benefits http://www.irs.gov/uac/Publication-15-B,-Employer%27s-Tax-Guide-to-Fringe-Benefits Account-based Plans (HSAs, MSAs, FSAs, HRAs) http://www.irs.gov/publications/p969/index.html PARTICIPANT RESOURCES DOL/EBSA UNITED STATES DEPARTMENT OF LABOR EMPLOYEE BENEFITS SECURITY ADMIN. EBSA Home http://www.dol.gov/ebsa/compliance_assistance.html Employer Health Benefits Advisor http://www.dol.gov/elaws/ebsa/health/employer/index.asp ERISA http://www.law.cornell.edu/uscode/text/29/chapter-18 Affordable Care Act http://www.dol.gov/ebsa/healthreform/ COBRA http://www.dol.gov/ebsa/COBRA.html HIPAA Compliance Assistance Guide for Employers http://www.dol.gov/ebsa/publications/CAG.html GINA Fact Sheet http://www.dol.gov/ebsa/newsroom/fsGINA.html MHPAEA Fact Sheet http://www.dol.gov/ebsa/newsroom/fsmhpaea.html CHIP Fact Sheet http://www.dol.gov/ebsa/newsroom/fschip.html MEWA – Guide to State and Federal Regulations http://www.dol.gov/ebsa/publications/mewas.html ERISA Fiduciary Responsibilities http://www.dol.gov/ebsa/publications/fiduciaryresponsibility.html PARTICIPANT RESOURCES DOL/WHD UNITED STATES DEPARTMENT OF LABOR WAGE & HOUR DIVISION Wages/FLSA http://www.dol.gov/whd/flsa/index.htm FMLA/Newborns & Mothers http://www.dol.gov/whd/fmla/index.htm Child Labor http://www.dol.gov/whd/childlabor.htm Government Contracts http://www.dol.gov/whd/govcontracts/index.htm Immigration http://www.dol.gov/whd/immigration/index.htm Agricultural Employment http://www.dol.gov/whd/ag/index.htm Special Employment http://www.dol.gov/whd/specialemployment/index.htm Polygraph Protection Act http://www.dol.gov/whd/polygraph/index.htm