C38BA_C4

advertisement

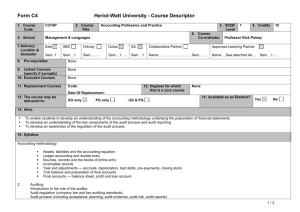

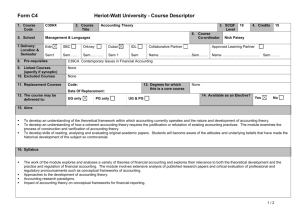

Form C4 Heriot-Watt University - Course Descriptor 1. Course Code C38BA 2. Course Title 5. School Management & Languages 7. Delivery: Location & Semester Edin SBC HWUM Dubai IDL Collaborative Partner Approved Learning Partner Sem 1 Sem…. Sem……1.. Sem…….. Sem… Name…………………….....Sem..…... Name … … 8. Pre-requisites None 9. Linked Courses (specify if synoptic) 10. Excluded Courses None 11. Replacement Courses Code: Business Accounting and Assurance 6. Course Co-ordinator 8 4. Credits 15 TBA Sem…….. None 12. Degrees for which this is a core course Date Of Replacement: 13. The course may be delivered to: 3. SCQF Level UG only PG only UG & PG MA (Hons) Accounting and Business Finance 14. Available as an Elective? Yes No 15. Aims To understand the nature and purpose of financial and management accounting in the business context To enable students to develop an understanding of the accounting methodology underlying the preparation of financial statements To develop an understanding of the key components of the audit process and audit reporting To develop an awareness of the regulation of the audit process 16. Syllabus 1. The accountant in business and the nature & purpose of financial and management accounting 2. The sole trader, partnership and limited liability company 3. Accounting methodology: Assets, liabilities and the accounting equation Ledger accounting and double entry Sources, records and the books of prime entry for recording tarnsactions and events Incomplete records Year end adjustments, the trial balance and preparation of basic financial statements Company annual reports and financial ratios 4. Islamic accounting concepts 5. Assurance: Introduction to the role of the auditor 1/2 Form C4 Heriot-Watt University - Course Descriptor Audit regulation (company law and key auditing standards) and the audit process (including acceptance, planning, audit evidence, audit risk, audit reports) 17. Learning Outcomes (HWU Core Skills: Employability and Professional Career Readiness) Subject Mastery Understanding, Knowledge and Cognitive Skills Personal Abilities Scholarship, Enquiry and Research (Research-Informed Learning) understand and explain the disctinction between financial and management accounting set up financial accounting systems to record the transactions of a trading company complete year end adjustments normally required in accounting system prepare final accounts from the figures produced by an accounting system understand the basic features of the audit process, audit reporting and audit regulation Industrial, Commercial & Professional Practice develop a professional awareness of the importance of maintaining accurate records for a business and the role of the accounting and/or audit professional formulate opinions and conclusions supported by evidence demonstrate an interest in current developments in auditing Autonomy, Accountability & Working with Others plan and organise own learning through selfmanagement and independent study work both independently and as part of a group 18. Assessment Methods Method 19. Re-assessment Methods Duration of Exam Weighting (%) Synoptic courses? Method (if applicable) Coursework Examination Communication, Numeracy & ICT use core skills in a variety of situations apply numerical and analytical skills 2 Hours Duration of Exam 30% 70% None None Examination 2 hours Resit 20. Date and Version Date of Proposal 02 October 2014 Diet(s) (if applicable) Date of Approval by School Committee Date of Implementation Version Number 2/2