CHAPTER 10 – WILLS, TRUSTS, AND ESTATES A. Chapter

advertisement

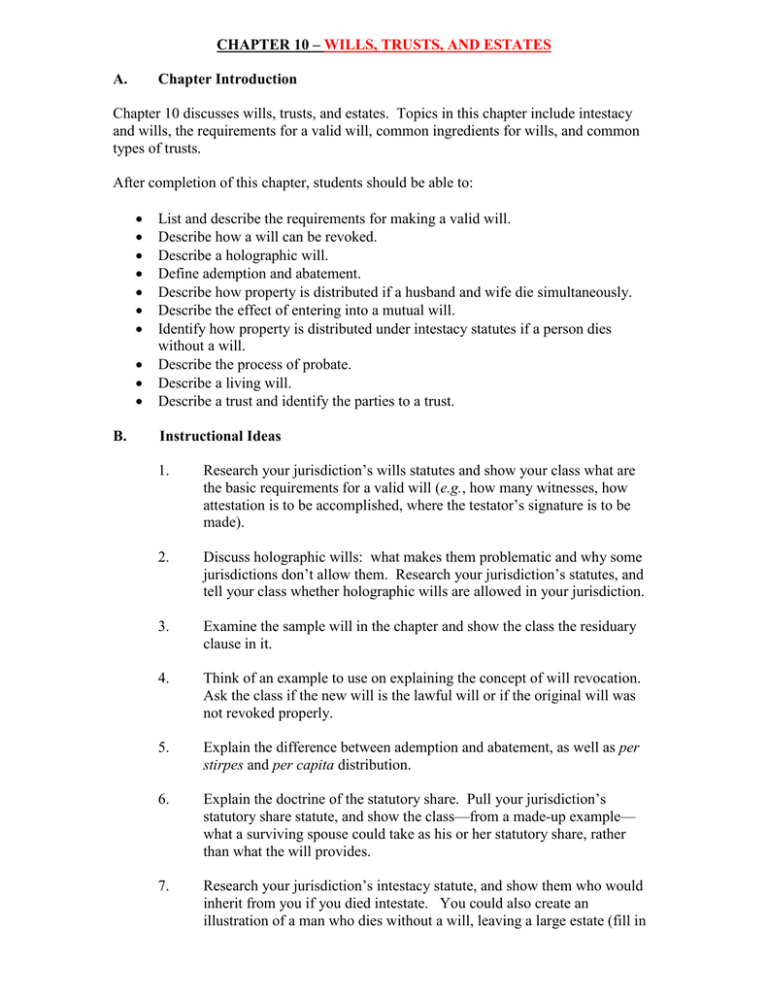

CHAPTER 10 – WILLS, TRUSTS, AND ESTATES A. Chapter Introduction Chapter 10 discusses wills, trusts, and estates. Topics in this chapter include intestacy and wills, the requirements for a valid will, common ingredients for wills, and common types of trusts. After completion of this chapter, students should be able to: B. List and describe the requirements for making a valid will. Describe how a will can be revoked. Describe a holographic will. Define ademption and abatement. Describe how property is distributed if a husband and wife die simultaneously. Describe the effect of entering into a mutual will. Identify how property is distributed under intestacy statutes if a person dies without a will. Describe the process of probate. Describe a living will. Describe a trust and identify the parties to a trust. Instructional Ideas 1. Research your jurisdiction’s wills statutes and show your class what are the basic requirements for a valid will (e.g., how many witnesses, how attestation is to be accomplished, where the testator’s signature is to be made). 2. Discuss holographic wills: what makes them problematic and why some jurisdictions don’t allow them. Research your jurisdiction’s statutes, and tell your class whether holographic wills are allowed in your jurisdiction. 3. Examine the sample will in the chapter and show the class the residuary clause in it. 4. Think of an example to use on explaining the concept of will revocation. Ask the class if the new will is the lawful will or if the original will was not revoked properly. 5. Explain the difference between ademption and abatement, as well as per stirpes and per capita distribution. 6. Explain the doctrine of the statutory share. Pull your jurisdiction’s statutory share statute, and show the class—from a made-up example— what a surviving spouse could take as his or her statutory share, rather than what the will provides. 7. Research your jurisdiction’s intestacy statute, and show them who would inherit from you if you died intestate. You could also create an illustration of a man who dies without a will, leaving a large estate (fill in the blanks), survived by three children from a previous marriage and a subsequent spouse who had no children with the decedent. Have the class help determine who inherits what. C. 8. Describe the process of probate. 9. Explain what trusts are and why they are advantageous forms of owning property. Explain the different types of trust, including express, implied and constructive. Video Recommendation(s) I highly recommend Changing Lanes, starring Ben Affleck and Samuel L. Jackson. There are many themes in this provocative movie, primarily the ratcheted-up-revenge story line between a lawyer and a man who get in a car accident on a New York City freeway. Part of the story includes Ben Affleck’s character taking part in a fraud to control a trust in a manner that benefits the Affleck’s law firm. In re Michael Martin: To Live or Die? is a Court TV documentary about the trial of a Michigan woman who wants the court to discontinue the medical procedures used to keep her husband alive after he suffered brain damage from a car accident. This might be a powerful documentary to relate to the chapter’s discussion on living wills and health care proxies. D. Chapter Outline I. Wills A. Definition: A declaration of how a person wants his or her property to be distributed upon his or her death. B. Parties to a Will: 1. Testator or testatrix: person who makes a will. 2. Beneficiary: person designated in the will to receive the testator’s property. There may be multiple beneficiaries. C. Requirements for Making a Will: 1. Statute of Wills: a state statute that establishes the requirements for making a valid will. 2. The normal requirements for making a will are: a. Testamentary capacity (legal age and “sound mind”). b. In writing. c. Testator’s signature. d. Attestation by witnesses (mentally competent and uninterested). D. Changing a Will: 1. Codicil: a legal way to change an existing will. 2. Must be executed with the same formalities as a will. II. Special Types of Wills A. Holographic Will: A will that is entirely handwritten and signed by the testator. Most states recognize the validity of these wills even though they are not witnessed. B. Nuncupative Will: Oral will made by dying persons before witnesses. Many states recognize these oral wills. Also called a deathbed will or a dying declaration. III. Types of Testamentary Gifts A. Special Gift: Gift of a specifically mentioned piece of property. (e.g., a ring) B. General Gift: Gift that does not identify the specific property from which the gift is to be made (e.g., gift of cash). C. Residuary Gift: Gift of the remainder of the testator’s estate after the debts, taxes, and specific and general gifts have been paid. D. Ademption: If a testator leaves a specific gift but the property is no longer in the estate when the testator dies, the beneficiary of that gift receives nothing. E. Abatement: If the testator’s estate is insufficient to pay the stated gifts, the gifts are abated (reduced) in the following order: (1) residuary gifts, then (2) general gifts proportionately. F. Per stirpes Distribution: Lineal descendants inherit by representation of their parent; they split what their deceased parent would have received. G. Per capita Distribution: Lineal descendants equally share the property of the estate without regard to degree. IV. Special Issues Concerning Wills A. Simultaneous Deaths: Uniform Simultaneous Death Act provides that if people who would inherit property from each other die simultaneously, each deceased person’s property is distributed as if he or she had survived. B. Joint Will: Two or more testators execute the same instrument as their will. C. Mutual or Reciprocal Will: Two or more testators execute separate wills that leave property in favor of the other on condition that the survivor leave the remaining property upon his or her death as agreed by the testators. D. Undue Influence: A will may be found to be invalid if it was made under undue influence, in which one person takes advantage of another person’s mental, emotional, or physical weakness and unduly persuades that person to make a will. E. Murder Disqualification: A person who murders another person cannot inherit the victim’s property. F. Intestate Succession: 1. Intestacy statute: state statute that stipulates how a deceased’s property will be distributed if he or she dies without leaving a will or if the will fails for some legal reason. 2. Heirs: relatives who receive property under an intestacy statute. 3. Escheat: if no heirs, deceased’s property goes to the state, under intestacy statute. V. Probate A. Definition: Legal process of settling a deceased person’s estate. B. Administrator or Adminstratrix: Person named to administer the estate of a deceased person who dies intestate. An administrator also is named if an executor is not named in a will or the executor cannot or does not serve. VI. Trusts A. Definition: A legal arrangement whereby one person delivers and transfers legal title to property to another person to be held and used for the benefit of a third person. B. Trust Corpus: The property that is held in trust; also called trust res. C. Parties: 1. Settlor: person who establishes a trust; also called a trustor or transferor. 2. Trustee: person to whom legal title of the trust assets is transferred; responsible for managing the trust assets as established by the trust and law. 3. Beneficiary: person for whose benefit a trust is created; holds equitable title to the trust assets. There can be multiple beneficiaries, including: a. Income beneficiary: person to whom trust income is to be paid. b. Remainderman: person who is entitled to receive the trust corpus upon termination of the trust. D. Express Trusts: Voluntarily created by the settlor. Two types: 1. Inter vivos trust: created while the settlor is alive; also called a living trust. 2. Testamentary trust: created by will and comes into existence when the settlor dies. E. Implied Trusts: Imposed by law or from the conduct of the parties. Two types: 1. Constructive trust: equitable trust imposed by law to avoid fraud, unjust enrichment, and injustice. 2. Resulting trust: trust created from the conduct of the parties. F. Special Types of Trusts: 1. Charitable trust: created for the benefit of a segment of society or society in general. 2. Spendthrift trust: a trust whereby the creditors of the beneficiary cannot recover the trust’s assets to satisfy debts owed to them by the beneficiary. 3. Totten trust: created when a person deposits money in a bank account in his or her own name and holds it as a trust for the benefit of another person. E. Critical Legal Thinking Questions 1. Define a will. What purpose does a will serve? A will is a declaration of how a person wants his or her property to be distributed upon his or her death. It serves the purpose of carrying out a testator’s wishes. 2. Describe the requirements for making a valid will. Why are the requirements so stringent? The common requirements for making a will include testamentary capacity (being of legal age and of “sound mind”), that the will be in writing (except for dying declarations), and that the testator’s signature be on the will. The requirements are stringent because it is a serious thing to dispose of one’s assets by giving them away at death, and strict requirements help to minimize mistake or fraud. 3. Describe the following types of special wills: (1) holographic will and (2) nuncupative will. A holographic will is one entirely written by the testator and signed by the testator, without any witnesses attesting to its authenticity. A nuncupative will is an oral will made before witnesses and is generally only valid if made during the testator’s last illness. 4. Describe the following types of testamentary gifts: (1) specific gifts, (2) general gifts, and (3) residuary gifts. A specific gift is a specifically named piece of property, such as a ring, a boat, or a piece of real estate. A general gift is one that does not identify the specific property from which the gift is to be made, such as a cash amount that can come from any source in the estate. A residuary gift is established by a residuary clause in a will, and it is a gift that goes to a contingent beneficiary if the intended beneficiary is unable (due to dying before the testator) to receive the gift. 5. Describe the difference between the doctrine of ademption and abatement. Both involve the testator’s stated wishes not being able to be carried out as stated in the will. Ademption occurs when a specific gift named in the will is not able to be passed to the beneficiary because the gift left the estate before the testator’s death. Abatement occurs when monetary gifts are proportionately reduced because there are insufficient funds in the estate to make the monetary gifts to the named beneficiaries. 6. Describe how a testator’s property is left pursuant to per stirpes distribution and pursuant to per capita distribution. The difference between per stirpes and per capita distribution is that in per stirpes, the lineal descendants inherit by representation of their parent (which means they split what their deceased parent would have received), and in per capita, the lineal descendants equally share the property of the estate without regard to degree of relationship to the testator (which means grandchildren would share equally with the children of the testator). 7. Describe the doctrine of undue influence? Is it difficult to prove? Because a will must be made voluntarily by the testator, wills that are the product of undue influence. Undue influence involves a beneficiary being in a relationship of confidence and trust and using that trust to unfairly convince the testator to change the will in favor of that beneficiary. Undue influence is difficult to prove by direct evidence, but it may be proven by circumstantial evidence. 8. Describe intestate succession. What is an intestate statute? Intestate succession is the process of distributing one’s assets after death when that person has died without a valid will. The decedent’s assets are distributed according to the jurisdiction’s intestate statute, which prioritizes the heirs of the decedent (the relatives as opposed to the “loved ones”). If there are no heirs to take the intestate estate, it escheats to the state. 9. Define a trust. Who are the parties to a trust? A trust is a legal arrangement under which one person delivers and transfers legal title to property to another person, to be held and used for the benefit of a third person. The person who delivers or transfers the property into the trust is known as the settlor or trustor. The person who manages the trust is known as the trustee. And, the person or persons who benefit from the use of the trust (by receiving income or principal from the trust corpus) is known as the trust’s beneficiary or beneficiaries. 10. F. What is a living will and health care proxy? Is it a good idea for people to have these? A living will is a document that stipulates the wishes of the one creating the living will in the event that person suffers a catastrophic illness or tragedy that doesn’t kill them. Those with a living will could state which lifesaving measures they do and do not want. A heath care proxy is the part of the living will where that person appoints someone to make their health care decisions when the occasion would necessitate. Many people believe that it is a good idea to have living wills and health care proxies because it allows those persons to retain some control over which types of medical care they want to refuse, so they can avoid living in varying levels of a vegetative state. Cases for Discussion In the Matter of the Estate of Reed¸672 P.2d 829 (1983), concerned the alleged taperecorded will of Robert Reed, who died without a will. As his intestate estate was being administrated, Margaret F. Buckley came forward alleging that a tape recording found by the police in Reed’s home was Reed’s valid will, and she attempted to have it probated. The tape recording was in a sealed envelope that said, “To be played in the event of my death.” The trial court refused to admit it. The Wyoming Supreme Court also refused to acknowledge the tape recording, finding that it didn’t meet the requirements of a holographic will, which, according to the probate code, had to be written and signed in the handwriting of the testator. Handwriting does not include voice print. QUESTIONS 1. Should tape recordings be admitted into probate? Why or why not? This is an opinion question, since the court clearly stated that tape recordings should not be admitted under the present holographic will statute. Perhaps that tape recording accurately reflected Reed’s wishes, but it didn’t meet the statute’s requirements. 2. Did Buckley act ethically in trying to probate the tape recording as a will? Who can say? Presumably, Buckley’s financial picture would have been improved by the admission of the tape recording. 3. What were the economic consequences of this decision? Reed’s estate passed according to the intestacy statute. There was no evidence that the state of Wyoming received Reed’s possessions. Opperman v. Anderson, 782 S.W.2d 8 (1989), concerned the application of the doctrine of ademption. Ms. Ramchissel’s will left, inter alia, certain shares of one stock to one beneficiary and certain shares of another stock to another beneficiary. Her will also had a residuary clause leaving the residue of her estate to a third beneficiary. By the time she died, the shares of both stocks were reduced to cash after Ms. Ramchissel sold the shares, placing the proceeds in two bank accounts. The probate court awarded the money to the beneficiaries who were to have received the stock shares, and the residuary beneficiary appealed. The Texas Court of Appeals reversed, holding that the specific bequests of stock were adeemed when they were sold. The cash in the two bank accounts became part of the residuary estate. QUESTIONS 1. Should the doctrine of ademption be recognized by law? What other solution would there be? This is an opinion question. Ademption is recognized by law, and will continue to be. There is no other viable solution than ademption, or else the law would force testators to be held hostage by the future (which is uncertain), rather than bound by their actual gift-intent (which is certain). 2. Do you think the result reached in this case was fair or what Ramchissel intended? This is another opinion question. One could make a strong claim that the result was absolutely fair—the law was followed—and absolutely what Ramchissel intended: that the residuary beneficiaries get the residuary estate. 3. Explain the difference between ademption and abatement. Ademption is what happened here: specific bequests fail when they no longer are in the estate at the time of the testator’s death. Abatement is the reduction—often proportionate—of general gifts, such as amounts of money, when there are insufficient funds to cover all general gifts. Robison v. Graham, 799 P.2d 610 (1990), concerned the consequences of one spouse violating the terms of a mutual will. The Grahams (Mary and Clyde) made a mutual will in which they promised to leave all of each other’s property to the survivor, with the survivor agreeing to leave half of the remaining property to Kathryn Robison and the other half in trust to William Robison. The Grahams agreed not to revoke, alter, or amend the will except by mutual written consent. Mrs. Graham died first, and the will was probated. Two years later, Mr. Graham remarried, placing his property in joint tenancy with his new wife and revoked his will by executing another one that designated his new wife as the beneficiary of his estate. After he died, his second wife attempted to probate the will and the Robisons sued, alleging breach of the mutual will. The Oklahoma Supreme Court ruled that Mr. Graham breached the terms of the mutual will, which only allowed that will to be changed by the written consent of Mr. and Mrs. Graham (the first one). The court considered that will to be a contract binding both parties after the death of either spouse, and that Mr. Graham accepted the benefits of that contract by probating the mutual will when his first wife died because his share was greater under the will than not under the will. Since Mr. Graham breached the terms of that irrevocable agreement, and since the property covered by the mutual will was still in existence—but in the second wife’s name—the court created a constructive trust on Mr. Graham’s estate for the benefit of the Robisons. QUESTIONS 1. Should mutual wills be enforced? Why or why not? This is an opinion question, but it seems easy to argue that if the parties agree to be bound by the terms of a mutual will, the last one to die shouldn’t be able to undo the original agreement of both. 2. Did Clyde act ethically in what he did? Clyde violated the agreement with his first love after she died, making a new disposition of their property with his second love. This seems unethical. 3. Why are mutual wills made? As evidenced by this case, mutual wills are made to bind both spouses irrevocably to their original wishes, unless both spouses agree to change the original terms. 10.1 In the Matter of the Estate of Jansa, 670 S.W.2d 767 (Tex.App. 1984), concerned which of three possible wills was the operative will of Martha Jansa. The first will left all her property to her two sons, but, after her death, two more documents were discovered in her safe deposit box. One was a handwritten document, dated after her will and unsigned, which left her home to her grandson, and the remainder to her sons. The other document was a typed version of the handwritten one, and it was signed but not attested by witnesses. ISSUE: Which of the three documents should be admitted to probate? The first document should be admitted to probate. Although the grandson argued that the two documents in the safe deposit box should be construed as a two page codicil, the court thought otherwise. Each document was insufficient as a codicil (or will), and that can’t be cured by tying them together. The statutes on wills and codicils are clear, and those later documents fell short. 10.2 Woods v. Woods, 397 S.E.2d 291 (GA 1990), concerned the validity of an agreement between Mr. and Mrs. Woods, who had previously been married and widowed. Both of the Woods had individually acquired significant estates. Before leaving on a trip to Kansas in 1987, they executed an instrument entitled “Agreement,” which stated that in the event of accident or disaster resulting in the death of one of them, the other would retain ownership in both spouses’ real and personal property. About 14 moths after returning from their trip—and without executing a subsequent will—Mr. Woods died. ISSUE: Should the March 27, 1987, agreement be admitted into probate? No. The court concluded that as a result of the non-occurrence of the conditions precedent (the death of one or both of them by accident or disaster on their Kansas trip), the agreement never became operative as a will. 10.3 In re Estate of Potter, 469 So.2d 957 (Fla.App. 1985), concerned the will of Mrs. Potter, whose will gave her house to her daughter and an equal amount of cash to her son, evidently to treat her children equally in the distribution of her estate. At her death she still owned the home but lacked sufficient assets to give her son the equivalent cash bequest. ISSUE: Can the son share in the value of the house so that his inheritance is equal to his sister’s? No. The court concluded that the gift of money was a general legacy, while the gift of the house was a specific legacy. The principle of abatement applies first to general legacies before specific legacies, so the cash gift abated. 10.4 Jones v. Jones, 718 S.W.2d 416 (Tex.App. 1986) concerned the estate of Mrs. Edna Jones, who, with her husband Homer in 1967, created a joint will that left each other’s property to the surviving spouse. Homer died in 1975. In 1977 Edna executed a new will that left a substantially larger portion of her estate to her daughter Sylvia, rather than dividing it equally among the three children, as the 1967 will stated. Edna Jones died in 1982 and her daughter introduced the 1977 will for probate, while the other two children introduced the 1967 will. ISSUE: Who wins? Did Edna act ethically in this case? The two children who brought the 1967 will to court win. The court found that the joint will was a contractual agreement that bound the survivor to the terms of that will. As to whether Edna acted ethically, who is to say? She might have forgotten the significance of the 1967 will? or might have never known its significance G. Case for Briefing 1. Case Name In re Estate of Vallerius, 629 N.E.2d 1185 (1994) 2. Key Facts A. On December 22, 1987, Douglas White murdered his grandmother, Adella Vallerius, in her home, while his brother Craig murdered Ms. Vallerius’s friend in the same home. B. Ms. Vallerius’s will left her entire estate to her murderous grandsons. C. A few months after the murder, Ms. Vallerius’s daughter, Renie White, the mother of the Douglas and Craig, died intestate, leaving her two sons as her only heirs. D. Other relatives of Ms. Vallerius came forward to oppose the Craig brothers inheriting either from their grandmother or through their mother, since their inheritances are fruit of their murderous actions. E. The trial court concluded that objecting relatives had met their burden of proof that Douglas and Craig had intentionally caused the death of their grandmother and that Illinois law has long prevented wrongdoers from profiting from intentionally committed wrongful acts. F. The brothers appealed, arguing that Craig—who killed his grandmother’s friend—can’t be accountable for Douglas’s murder of their grandmother, and can’t be denied his right to inherit from his mother’s intestate estate. 3. Issue Although the law would deny a murderer from inheriting from his victim, can that person still inherit the estate of someone else who inherited the estate of the murder victim? 4. Holding The Appellate Court of Illinois refused to allow Craig to inherit from his mother, who inherited from her mother. 5. Court’s Reasoning A. The court held that Craig could not receive any benefit by reason of the death of Mrs. Vallerius, whether through her estate directly or indirectly through the estate of Renie White. B. If Craig were allowed to run an end-around his grandmother’s murder and inherit the same property through his mother’s estate, that would directly contravene the state’s unambiguous mandate that Craig not receive any property by reason of his grandmother’s murder. C. Although Craig didn’t physically use the axe that killed his grandmother, he shouldn’t benefit by that technicality, since he was legally just as involved in the murderous conspiracy.