Disclosure to Participants

advertisement

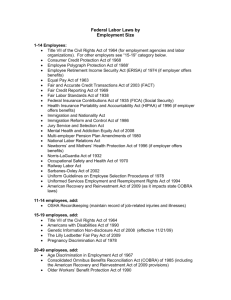

This Employer Webinar Series program is presented by Spencer Fane Britt & Browne LLP in conjunction with United Benefit Advisors Thank You For Your Participation Kansas City = Omaha = Overland Park St. Louis = Jefferson City www.spencerfane.com www.UBAbenefits.com Compliance 101 for Plan Administrators Gregory L. Ash Julia M. Vander Weele November 10, 2009 Copyright 2009 2 Presenters Gregory L. Ash, JD Partner gash@spencerfane.com 913-327-5115 Julia Vander Weele, JD Partner jvanderweele@spencerfane.com 816-292-8182 Copyright 2009 3 Agenda Copyright 2009 Overview of disclosure requirements Document disclosures to participants and beneficiaries General disclosures describing overall plan terms (SPD, SMM, SAR, etc.) Specific disclosures triggered by events or request Method of disclosure (electronic delivery) Governmental reporting obligations Practical issues 4 Disclosure – Which Plans are Covered by ERISA? Copyright 2009 What plans are covered? Employer-employee relationship required Employer must “maintain” the plan Some plans are exempt Governmental plans Church plans Payroll practices exemption “Voluntary” safe harbor 5 Who is Responsible for Disclosures? Generally, the “plan administrator” is responsible for making required disclosures “Plan administrator” is the person or committee specifically designated by the terms of the plan Absent a specific designation, the sponsoring employer is the plan administrator Statutory penalties may be assessed for failure to comply with notice and disclosure requirements Copyright 2009 6 Fiduciary Responsibilities Copyright 2009 Participant communications may be a fiduciary act under ERISA Timely communication of plan changes is a fiduciary duty Violating fiduciary duties can result in personal liability 7 Duty to Disclose More? Fiduciary duty to disclose more, in some circumstances Duty to act for exclusive benefit of participants and beneficiaries May require affirmative disclosure When circumstances could jeopardize eligibility for benefits Information known to fiduciary, not to participant Accurate response to participant requests – duty not to lie Notification of plan changes Serious consideration test Affirmative duty to disclose if promise to “follow up” Copyright 2009 8 Disclosure to Participants – SPD Summary Plan Description Main source of information to participants about the plan Summarizes material plan provisions in language that can be understood by the average plan participant Explains claims procedures, lists ERISA rights Plan administrator must furnish to participants and beneficiaries Permitted to have different SPDs for different groups of participants if benefits differ among groups Copyright 2009 9 Disclosure to Participants – SPD Summary Plan Description – Updates and Delivery Must be updated once every 5 years if plan is amended, once every 10 years regardless Must be provided within following deadlines: 90 days after individual first becomes a participant (120 days if new plan) 90 days after beneficiary begins receiving plan benefits 210 days after close of plan year for which SPD is updated Conflict between plan document and SPD – which one governs? Delivery by measures reasonably calculated to ensure actual receipt (i.e., hand delivery, but not placing a stack in the break room) Copyright 2009 10 Disclosure to Participants – SPD Summary Plan Description – Foreign Language If < 100 employees with > 25% literate only in same non-English language; or > 100 employees with lesser of 500 employees or 10% literate only in same non-English language, then: Copyright 2009 Must include prominent notice, in non-English language, offering assistance Assistance does not need to be in writing 11 SPDs - Content Copyright 2009 Name of the Plan Name and address of the employer EIN and Plan number Type of Plan (e.g., medical, disability, etc.) Type of administration (e.g., TPA) Name, address, and phone number of Plan Administrator Name and address of agent for service of legal process Name, title, and address of each trustee 12 SPDs – Content Copyright 2009 Eligibility requirements Description of QMCSO procedures Disqualification, ineligibility, or denial, loss, forfeiture, suspension, setoff, or recovery of any benefits (including subrogation) Authority to terminate or amend Plan Source of contributions and method of calculating contributions COBRA information 13 SPDs - Content Copyright 2009 Funding medium (e.g., trust or insurer) Plan year Claims procedures (can be furnished as separate document) Statement of ERISA Rights A description of any cost-sharing provisions, including premiums, deductibles, coinsurance, and copayment amounts Any annual or lifetime caps or other limits on benefits under the plan 14 SPDs – Content Copyright 2009 The extent to which preventive services are covered under the plan Whether, and under what circumstances, existing and new drugs are covered under the plan Whether, and under what circumstances, coverage is provided for medical tests, devices and procedures Provisions governing the use of network providers, the composition of the provider network, and whether, and under what circumstances, coverage is provided for out-ofnetwork services Statement regarding hospital length of stay for mother and newborn child 15 SPDs – Content Any conditions or limits on the selection of primary care providers or providers of specialty medical care Any conditions or limits applicable to obtaining emergency medical care; and any provisions requiring preauthorizations or utilization review as a condition to obtaining a benefit or service under the plan Listing of providers may be furnished as a separate document that accompanies the plan's SPD, provided that the summary plan description contains a general description of the provider network and provided further that the SPD contains a statement that provider lists are furnished automatically, without charge, as a separate document Copyright 2009 16 Disclosure to Participants – SMM Summary of Material Modifications Required if “material modification” to plan or information in SPD has changed Explain in manner expected to be understood by average participant Provide within 210 days after end of plan year in which amendment adopted SMM should accompany SPD when provided to new participants Not required for terminated participants, beneficiaries if change does not affect them Copyright 2009 17 Disclosure to Participants - SMR Copyright 2009 Summary of Material Reduction Applicable to group health plans only Sent within 60 days after date of adoption Material reduction = any modification to the plan or change in the information required to be included in SPD that, independently or in conjunction with other contemporaneous modifications or changes, would be considered by the average plan participant to be an important reduction in covered services 18 Disclosure to Participants – SAR Summary Annual Report – Summarizes information on Form 5500 Benefits paid Administrative expenses Total plan assets Right to receive Form 5500 Provide within 9 months after end of plan year (or 2 months after 5500 due date, if extension) Same foreign language requirements as SPDs Copyright 2009 19 Disclosure to Participants upon Request Copyright 2009 Must provide certain documents to participants on request Latest version of SPD Latest Form 5500 Collective bargaining agreements covering plan Trust agreement Insurance contracts Other instruments under which plan is established or operated May impose reasonable charge for copies $110/day penalty if no response within 30 days Disclosure in foreign language may be required 20 Method of Disclosure to Participants Copyright 2009 In-hand delivery Mailing Electronic communication Posting on bulletin board not sufficient 21 Electronic Distribution Copyright 2009 DOL has issued regulations that provide a safe harbor for electronic distribution Format requirement Disclosure requirement Consent and notice requirements 22 Heads-Up Notice Copyright 2009 Indicate the significance of document (if not reasonably evident) Informs the participant of right to request and receive a paper copy, free of charge Notice can be provided electronically (e.g., email) or in writing 23 Electronic Delivery Copyright 2009 On-site Access Participants who can effectively access electronic documents at any location where they are reasonably expected to perform their work duties and for whom access to the employer’s electronic information system is an integral part of those duties Not a kiosk 24 Electronic Delivery Copyright 2009 Distribution beyond the workplace Must obtain affirmative consent Consent must not have been withdrawn Consent must be provided electronically, in a manner that reasonably demonstrates participant’s ability to access documents in the form in which they are being furnished (not applicable to distribution via CD or DVD) Participant must have provided an address for electronic receipt 25 Electronic Delivery – Website Copyright 2009 Homepage must contain prominent link Website must include instructions on how to obtain replacement for lost or forgotten password Documents must remain on website for reasonable period of time after participants are notified of their availability 26 Governmental Reporting – Form 5500 Copyright 2009 If plan is exempt from Title I, it generally does not file Form 5500 Welfare plans exempt from filing if cover fewer than 100 participants (as of beginning of plan year) and either fully insured or unfunded (i.e., no trust) File with DOL, they transmit to IRS Use form for calendar year in which plan year begins Electronic filing (“EFAST2”) required effective for 2009 plan years 27 Form 5500 – Procedures Copyright 2009 Audit requirement for large plans (100+ participants) Due by last day of seventh month after end of the plan year (2½ month extension automatically available) Penalties for failure to file IRS - $25 per day up to $15,000 DOL - $1,100 per day with no max (typically $300/day with $30,000 max per year) Separate penalties for certain missing items, even if Form 5500 timely filed Delinquent Filer Voluntary Compliance Program 28 COBRA – General Notice Timing: 90 days from the coverage effective date or the deadline for providing election notice, if earlier Can use SPD for this notice, but: Must be sent to covered employee and spouse, and Must be sent within time frame for providing general notice Copyright 2009 29 COBRA - General Notice Copyright 2009 Single notice addressed to employee and spouse is OK if They reside at same location, and Spouse’s coverage commences before deadline for providing general notice Model notice contained in regulations 30 COBRA – Election Notice Timing: 14 days after notice of qualifying event received, or If employer is COBRA administrator, 44 days after occurrence of qualifying event Must be furnished to each qualified beneficiary May use single notice, addressed to covered employee and spouse, if all reside at same location Model notice contained in regulations Copyright 2009 31 Other COBRA Notices Notice of Unavailability If administrator receives notice of divorce, legal separation or child’s loss of dependent status – but individual is not entitled to COBRA coverage – administrator must provide notice explaining why not Timing – same period as would be required for providing election notice Notice of Early Termination Timing: As soon as practicable Contents: Reason for early termination Effective date of coverage termination Alternative coverage options (e.g., conversion) May be combined with certificate of creditable coverage Copyright 2009 32 Delivery of COBRA Notices Mailing by certified mail or 1st class regular mail to last known address is generally sufficient Example – Mailing notice to couple’s post office box sufficient Example – Mailing notice to employee’s home, even though employee was in hospital and no one was checking his mail, was sufficient Copyright 2009 33 Delivery of COBRA Notices Good faith effort to provide notice is sufficient, even if notice is not actually received Example – Good faith effort demonstrated where employer sent notice via certified mail, even though employer knew it had been returned unclaimed Example – Good faith effort not demonstrated where employer did not send another notice after employee called to inquire Copyright 2009 34 Some Specific Participant Notices Copyright 2009 Women’s Health and Cancer Rights Act HIPAA Special Enrollment Medicare Part D Notice of Creditable or Non-Creditable Coverage Notice of Pre-existing Condition Limitations HIPAA Notice of Privacy Practices Michelle’s Law 35 Women’s Health and Cancer Rights Act Notice Copyright 2009 Must be provided at initial enrollment and each year thereafter Notice regarding availability of mastectomy-related benefits Practice tip: provide with annual open enrollment materials 36 Notice of Special Enrollment Rights Copyright 2009 Must be provided at or before the time that individual is offered opportunity to enroll Might need to amend to comply with CHIPRA (60 days vs. 30 days) SPD insufficient 37 Medicare Part D Notice Copyright 2009 Must be provided to “Part D-eligible” individuals Timing: Prior to each Medicare Part D annual election period (beginning November 15 of each year) Prior to the effective date of coverage for any Medicare-eligible individual who joins the plan (may be included in new hire package) Whenever there is a change in creditable coverage status Upon request (personalized notice may be used) 38 General Notice of Pre-existing Condition Limitations Copyright 2009 Cannot impose pre-existing condition limitation until notice has been provided Must be provided as part of any written application materials or by the earliest date following a request for enrollment that the plan or issuer, acting in a reasonable and prompt fashion, can provide it Stand-alone notice recommended 39 HIPAA Notice of Privacy Practices Copyright 2009 Initial notice upon enrollment Reminder regarding availability of the notice and how to obtain it at least once every three years Reminder can be included with other plan communications (e.g., SMM) 40 Michelle’s Law Copyright 2009 Notice of availability of continued coverage for students who would otherwise lose coverage due to medically necessary leave of absence Must be included in any materials relating to certification of student status Timing will depend upon when plan typically requests certification 41 Practical Issues – Record Retention Copyright 2009 ERISA requires certain records to be maintained for at least 6 years May need to keep past versions of SPDs and SMMs for longer period of time in order to accurately determine benefits 42 Contact Information Gregory L. Ash, JD Partner gash@spencerfane.com 913-327-5115 Julia Vander Weele, JD Partner jvanderweele@spencerfane.com 816-292-8182 www.benefitsinbrief.com Copyright 2009 43 Thank you for your participation in the Employer Webinar Series. To obtain a recorded version of this or any other webinar presentations and to qualify for HRCI credits, contact your local UBA Member Firm. This Employer Webinar Series program is presented by Spencer Fane Britt & Browne LLP in conjunction with United Benefit Advisors Kansas City = Omaha = Overland Park St. Louis = Jefferson City www.spencerfane.com www.UBAbenefits.com