Budget Presentation, March 23, 2015

advertisement

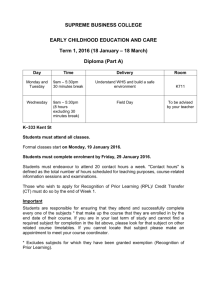

“FY 2016 County Administrator’s Budget Recommendation March 23, 2015” Summary of Factors Affecting 2016 Budget Development Revenue 1. Slowly Improving Economy 2. State and Federal Revenues Flat or Declining 3. Significant Reductions in Property Tax Base Due to New Assessments 4. Decline in Number of Utility Connections Expenses 1. School Requested Increase $572,500 2. Volunteer Fire/EMS Requested Increase $125,000 3. Increasing County Debt Service $196,000 4. Correction to 2015 Budgeted Jail Cost $286,000 5. Correction to 2015 Budgeted CSA (Comprehensive Services Act) $113,000 6. Employee Compensation (each 1% increase in pay) 7. Capital Needs $80,000 $275,000 Equalization of the Real Estate Tax Due to Change in Assessed Value in CY2015 (Real Estate Rate Only) Real Estate FY2015 Budgeted (100% Collection Rate & No Elderly Tax Relief) FY2016 (100% Collection Rate & No Elderly Tax Relief) % Change From Prior Year Countywide Assessed Value $1,696,444,145 $1,498,654,494 -11.7% Special School Taxing District Assessed Value $1,385,987,815 $1,188,107,562 -14.3% $0.38 $0.43 13.2% $6,446,488 $6,444,214 0% $0.44 $0.51 15.9% $6,098,346 $6,059,349 -0.6% General Gov’t Rate 100% Tax Collections School Fund Rate 100% Tax Collections Constitutional Officer Funding $4,000,000 $3,500,000 $3,000,000 $2,500,000 $2,000,000 Revenue Expenditures $1,500,000 $1,000,000 $500,000 $0 School Division Revenue FY2010 FY2011 FY2012 FY2013 FY2014 State Revenue $10,261,607 $9,187,164 $9,027,694 $9,093,614 $9,394,101 State Sales Tax $1,940,419 $2,015,956 $2,088,711 $2,062,260 $2,037,845 Federal Revenue $1,520,217 $2,256,112 $1,298,026 $999,752 $985,686 $10,154,596 $10,154,343 $11,053,956 $10,324,145 $10,664,640 $143,967 $238,670 $221,921 $562,992 $186,531 $24,020,806 $23,852,245 $23,690,308 $23,042,763 $23,268,803 Local Appropriation (including debt) Miscellaneous Total Comparison of Revenue Sources 25,000,000 20,000,000 2015 2016 $ 15,000,000 10,000,000 5,000,000 2015 2016 2015 2016 Local State Other FY2015 Projection % FY2016 Budget % Difference % Local 19,892,939 86.5% 20,440,276 87.1% 547,338 2.8% State 2,971,012 12.9% 3,019,005 12.9% 47,993 1.6% Other 142,625 0.6% 165 0.0% (128,321) -90.0% 23,006,576 23,459,446 467,010 2.0% General Fund Expenditures by Function PUBLIC WORKS, $1,772,447 , 8% DEBT SERVICE/CAPTIAL PROJECTS, $1,043,786 , 4% PUBLIC SAFETY, $4,903,971 21% HEALTH & WELFARE, $905,999 , 4% FINANCIAL SERVICES, $879,775 , 4% NON-DEPARTMENTAL, $803,242 , 3% PARKS, RECREATION & CULTURAL, $730,382 , 3% ADMINISTRATION, $633,957 , 3% COURT SERVICES, $574,278 , 2% COMMUNITY DEVELOPMENT, $548,969 , 2% TRANSFER TO SCHOOLS $10,662,640 , 46% FY 2015 to FY 2016 Cost Increases – No Recourse Prisoner Housing Costs $286,000 Debt Service $196,000 Comprehensive Services Act $113,000 Transfers to Utility Debt $125,000 Social Services – Local Share $34,000 Health Insurance Premiums $66,000 Total $820,000 Break Out of Rate Increase Districts 2 - 5 Town of West Point General Government Equalization .05 .05 Special School Tax District Equalization .07 _ General Government Additional Rate Proposed .04 .04 .16 .09 .82 .38 Total FY 2015 Real Estate Rate (.44 School Division) FY 2016 Proposed Real Estate Rate .98 (.51 School Division) .47 Impact of Tax Rate Increase on Selected Properties Remaining Budget Work Sessions (adopted by the Board of Supervisors on January 26, 2015) Monday, April 6, 2015 7:00 p.m. Regular Board Work Session Detailed Review of County Administrator’s Recommendations (Q&A) Monday, April 13, 2015 7:00 p.m. Public Hearing – Budget and Tax Levies Friday, April 17, 2015 and Monday, April 20, 2015 (time TBD) Budget Work Sessions as needed Monday, April 27, 2015 7:00 p.m. Regular Board Meeting – Adopt Budget and Tax Rates