Click to open Sample Work #1

Limited Liability Companies: An In-Depth Term Paper

William Greenbaum

ACCT 4611 – Taxes for Business Decision Making

Dr. Joseph M. Hagan

1

Table of Contents

Introduction………………………………………………………….Page 3

History……………………………………………………………….Page 3

Classification and Details of LLCs………………………………….Pages 3-5

LLCs-Partnerships…………………………………………………..Pages 5-6

LLCs-Disregarded Entities………………………………………….Pages 6-7

LLCs-Corporations………………………………………………….Pages 7-8

Conclusion…………………………………………………………..Pages 8-9

Bibliography……………………………………………………….Page 10

2

Introduction

A limited liability company (LLC) can be defined out of Sally M. Jones and Shelley C. Rhoades-

Catanach textbook, Principles of Taxation For Business and Investment Planning, as “a form of unincorporated business organization in which the members have limited liability for business debt. LLCs are generally treated as partnerships for federal tax purposes (textbook).” This paper will address the above definition and expand on it by diving into tax laws, advantages and disadvantages, classifications, examples, cases, and everything LLC.

History of the Limited Liability Company

The first state to allow such a unique way of forming a company was Wyoming in 1977. The idea of creating a business entity permitting less tax burden than a C corporation while on the other hand allowed more liability security than a limited partnership seemed like a risk worth taking for them

(congressional.proquest). Regardless of only 26 companies jumping on the opportunity to form an LLC in

Wyoming, Florida followed their footsteps being the second state in 1982 to adopt the LLC practice

(congressional.proquest). They were hoping to help out their economic position and increase foreign investment but with only 2 companies entering their new business practice after the first year, it didn’t seem like it would work. It wasn’t until 1988 when LLCs took off in America. In 1988 the IRS issued a favorable tax status on the Wyoming LLCs which triggered 22 new states to follow in Wyoming and

Florida’s footsteps by the end of 1993 (congressional.proquest). As of 2013, every state in the United

States implemented LLCs as a common business practice.

Classifications and Details of LLCs

With the wide variety of ways to form a business like sole proprietorship, partnerships, subchapter S corporations, and corporations, why choose to create a Limited Liability Company? First off, LLC’s are allowed by each individual state. Furthermore, these states have the power to use different regulations so familiarizing yourself with the LLC regulations in the state and the companies interested in

3

is a must before proceeding any further. As an owner in an LLC you are classified as a “member” instead of “owner” and majority of states do not restrict ownership (irs.gov/businesses). By not restricting ownership it allows members to include people, companies, foreign entities, and other LLC’s and there is no restriction on the number of members (irs.gov/businesses). This means you could only have one

(yourself aka single member LLCs) or hundreds if desired.

Based on the above definition, an LLC sounds a lot like a partnership. In some ways this is correct, but there are some major differences that separate the two. Under an LLC, the owners are considered members. These members have partial individual liability for the company’s debts

(irs.gov/pub). This is different from a partnership where the owners take on full responsibility for their company’s debts. As stated above, LLC’s tend to be treated as partnerships for federal tax purposes but could also be treated as a corporation or an entity but only if it is treated as separate from its owners

(irs.gov/pub). In order for an LLC to be treated as an entity separate from its owner it must apply the rules in “Regulations section 301.7701-3” (irs.gov/pub). Regulation section 301.7701-3 is a treasury regulation which states that:

“A business entity that is not classified as a corporation under section 301.7701-2(b)(1), (3), (4),

(5), (6), (7), or (8) (an eligible entity) can elect its classification for federal tax purposes as provided in this section. An eligible entity with at least two members can elect to be classified as either an association (and thus a corporation under section 301.7701-2(b)(2)) or a partnership, and an eligible entity with a single owner can elect to be classified as an association or to be disregarded as an entity separate from its owner (iulaw.indy.indiana.edu).”

To summarize what we know so far, LLCs need to be classified regarding a number of situations to clarify how they will be treated for tax purposes. An LLC with only one member is characterized as an entity separate from its owners for income tax reasoning while at the same time treated as a separate entity for employment tax and specific excise taxes (irs.gov/pub). They get classified as a disregarded

4

entity for federal tax purposes. If the member is an individual it gets treated as a sole proprietorship, if the member is an entity it gets treated as a division/branch of the entity (textbook). On the other hand, an

LLC that includes at least two members will be characterized as a partnership for federal income tax purposes (irs.gov/pub). These are known as default clarifications rules and are what most LLCs will choose. LLCs who do not wish to classify themselves under the above two ways are included in another option, the ejected classification rule (irs.gov/pub). This is when an LLC chooses to classify themselves as an association which is than taxable as a corporation or as an S corporation (irs.gov/pub).

Before going more into detail, business owners need to understand exactly where they can benefit from LLC’s and where they can be hurt by them. As described in the book, “LLCs offer business owners a terrific combination: one owner-level tax on income and limited liability for business debt (textbook).”

LLCs definitely offer the best of both worlds combining advantages of both partnerships and sole proprietorships but what differentiates them from S-corporations/corporations and why not just start one of those instead? It all comes down to restrictions and regulations. They offer major relief from restrictions that S-corporations and corporations are involved in and allow you to keep control of your company (textbook). On the other hand, LLCs are somewhat of a new business format which leaves many unanswered questions as to how certain areas of them should be taxed. This causes a great deal of uncertainty and the chance of change that could hurt your company in the long run (textbook).

LLC’s- Partnerships

As was talked about above, LLCs with two or more members are classified as partnerships. Under this, income produced from

5

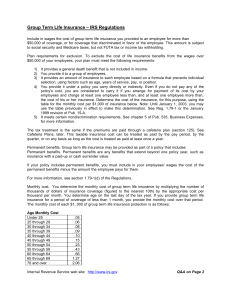

the company gets passed through its members and employees and are not taxed at the entity level

(textbook). These LLCs generally will file Form 1065 U.S. Return of Partnership Income as demonstrated in the picture above (irs.gov/pub). Only the member manager has the authority to sign this partnership tax return (irs.gov/pub). A member manager is defined in the article Taxation of Limited Liability Companies produced by the IRS as, “any owner of an interest in the LLC who, alone or together with others, has the continuing authority to make the management decisions necessary to conduct the business for which the

LLC was formed (irs.gov/pub).” Also, if there is no member manager to represent the LLC yet, the owners become responsible.

If throughout the company’s life, the members (owners) get reduced to one, regulation section

301.7701-3 comes into effect (defined above). This creates the entity to be separate from its owner except for one exception (irs.gov/pub). If the entity is being changed to a corporation at the same time the change in membership is going into effect, Regulation 301.7701-3, creating the entity separate from its owner as a disregarded entity does not apply (irs.gov/pub).

Like most other situations that involve changing of ownership, tax consequences are involved.

The publication by the IRS, Taxation of Limited Liability Companies, uses the recognition of gain/loss as an example of how tax consequences are handled (irs.gov/pub). According to this publication, they are

“determined by the transactions through which an interest in the LLC is acquired or disposed of

(irs.gov/pub).”

LLCs- Disregarded Entities

When an LLC is treated as a sole proprietorship only one member is involved and the entity is disregarded as separate from its member (textbook).

Under this clarification, the LLCs

6

income, gains, deductions, losses, and credits get stated on the owner’s income tax return (irs.gov/pub).

Every individual, regardless if an owner of an LLC, is required by tax law to fill out form 1040 which is the U.S. Individual Income Return demonstrated above. If you are the single owner of an LLC you must provide your LLC’s income and expenses on three separate schedules to be filed with form 1040

(irs.gov/pub). These schedules are Schedule C, Profit or Loss from Business (sole proprietorship);

Schedule C-EZ, Net Profit From Business (sole proprietorship); Schedule E, Supplemental Income and

Loss or Schedule F, Profit or Loss from Farming (Irs.gov/pub).

There are a number of tax rules regarding this classification of an LLC. The single owner of the disregarded entity does not get characterized as an employee, therefore does not receive a salary and does not get subjected to those types of taxes (irs.gov/Businesses). How does the owner make money than and how does he get taxed? The owner receives income from the net earnings the LLC produces. These net earnings are what get taxed; they are the owner’s income (irs.gov/pub). If the owner has employees working under him, the LLC gets subjected to employment and excise taxes (irs.gov/pub). As of

1/1/2009, according to Taxation of Limited Liability Companies, “the single-member LLC is required to use its name and employer identification number for reporting and payment of employment taxes. A single-member LLC is also required to use its name and EIN to register for excise tax activities on form

637; pay and report excise taxes reported on forms 720,730,2290, and 11-C; and claim any refunds, credits, and payments on form 8849 (irs.gov/pub).”

LLCs- Corporations

Under this classification, if an LLC contains only one member or more than one member it can choose to be characterized as a corporation instead of a partnership or disregarded entity (sole proprietorship)

(irs.gov/Businesses). In order to file to become an

LLC classified as a C-corporation it must fill out form 8832 shown to the left. Along with the

7

completion of this form, a copy must be sent along with the LLC’s federal income tax return every year for each owner both direct and indirect indicating the date on which the filing took effect (irs.gov/pub).

For taxation purposes, any corporation is required to fill out a corporate tax return. C-corporations are taxed based off their taxable income (irs.gov/pub). Also, distributions to the corporations’ members

(owners) get imbedded in the owner’s gross income to the amount of the corporation’s earnings/profits, according to Taxation of Limited Liability Companies, and this is called double taxation (irs.gov/pub). If the LLC wanted to file as an S-corporation instead, it must file form

2553 shown to the left. As for taxation, S-Corporations, for the most part, are not subject to any income tax

(irs.gov/pub). On the other hand income, deductions, gains, losses, and credits of the corporation “pass through” to the members and file form 1120 and for 1120S (irs.gov/pub).

Conclusion

In conclusion, Limited Liability Companies are complex, intriguing, and both advantageous and disadvantageous. They are like the middle man between sole proprietorship/partnership and Scorporation/C-corporation. They offer some incredible opportunities to business owners by limiting debt and the anxiety filled circumstance of personal liability while at the same time offering business owners the flexibility that partnerships produce. LLCs have been growing in popularity since their introduction to the business world in 1977 and are now offered in all 50 states. Given the right situation, creating an LLC blows any other option out away. On the other hand, this is still a young and growing business process and still creates a lot of uncertainty, especially related to how it should be taxed because of all the different ways to go about classifying your LLC. One of the most important things an individual can do

8

before jumping into a new business venture is familiarize themselves with the states rules and regulations.

Each state has different regulations set on LLC’s. All-in-all, limited liability companies are innovative and could grow to be the future for business owners.

9

Bibliography

Dayman, Mark A. "Limited Liability Companies Offer Economic and Tax Advantages."

Limited

Liability Companies Offer Economic and Tax Advantages

(n.d.): n. pag.

Proquest

. Web.

3 Apr. 2013. <http://search.proquest.com.jproxy.lib.ecu.edu/?accountid=10639>.

USA. IRS.

Limited Liability Company (LLC)

. IRS, 12 Dec. 2012. Web. 3 Apr. 2013.

<http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Limited-Liability-

Company-(LLC)>.

USA. IRS.

Taxation of Limited Liability Companies

. Washington, DC: Internal Revenue Service,

2010.

Taxation of Limited Liability Companies

. IRS, Mar. 2010. Web. 3 Apr. 2013.

<http://www.irs.gov/pub/irs-pdf/p3402.pdf>.

USA. Treasury.

Treas. Reg. §§ 301.7701-1 to -3

. Treasury Regulations, n.d. Web. 03 Apr. 2013.

<http://www.iulaw.indy.indiana.edu/instructors/allington/pt/Reg7701.htm>. http://congressional.proquest.com/congressional/result/pqpresultpage.gispdfhitspanel.pdflink/http%3A$2f

$2fprod.cosmos.dc4.bowker-dmz.com$2fapp-bin$2fgis-congresearch$2f1$2f8$2f1$2f8$2fcrs-1993-oss-

0036_from_1_to_17.pdf/entitlementkeys=1234

10