Chapter 10 - The Citadel

advertisement

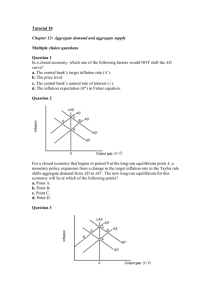

Chapter 10 Real GDP and the Price Level in the Long Run Introduction Though the prospect of deflation is unlikely in the U.S., it has been a real phenomenon in some Asian countries in recent years. How do you expect your economic decisions would be affected if you anticipated a decline in the overall price level? Slide 10-2 Learning Objectives Understand the concept of long-run aggregate supply Describe the effect of economic growth on the long-run aggregate supply curve Explain why the aggregate demand curve slopes downward and list the factors that cause the curve to shift Slide 10-3 Learning Objectives Discuss the meaning of long-run equilibrium for the economy as a whole Evaluate why economic growth can cause deflation Evaluate likely reasons for persistent inflation in recent decades Slide 10-4 Chapter Outline Output Growth and the Long-Run Aggregate Supply Curve Spending and Total Expenditures The Aggregate Demand Curve Shifts in the Aggregate Demand Curve Slide 10-5 Chapter Outline Long-Run Equilibrium and the Price Level The Effects of Economic Growth on the Price Level Causes of Inflation Slide 10-6 Did You Know That... The Wonderful Wizard of Oz was an allegory about how to achieve longrun price stability? The story looks at how the money supply affects the price level? The characters and events in the story represent political issues that arose in the populist movement? Slide 10-7 Output Growth and the Long-Run Aggregate Supply Curve Long-Run Aggregate Supply Curve – – – – – An amount of real GDP People have full information and have adjusted The price level is fixed Technology does not change All resources are fully employed The economy is on its production possibilities curve Slide 10-8 Output Growth and the Long-Run Aggregate Supply Curve Figure 10-1 Slide 10-9 The Long-Run Aggregate Supply Curve LRAS is vertical – Input prices fully adjust to changes in output prices – Suppliers have no incentive to increase output – Unemployment is at the natural rate Slide 10-10 Economic Growth and Long-Run Aggregate Supply Growth is shown by outward shifts of either the production possibilities curve or the LRAS curve caused by: – Growth of population and the labor-force participation rate – Capital accumulation – Improvements in technology Slide 10-11 Economic Growth and the Long-Run Aggregate Supply Curve Figure 10-2, Panels (a) and (b) Slide 10-12 Economic Growth and Long-Run Aggregate Supply Figure 10-3 Slide 10-13 Spending and Total Expenditures Aggregate Demand – The total of all planned expenditures in the economy Aggregate Supply – The total of all planned production in the economy Slide 10-14 Spending and Total Expenditures Questions – What determines the total amount that individuals, governments, firms, and foreigners want to spend? – What determines the equilibrium price level? Slide 10-15 The Aggregate Demand Curve Aggregate Demand Curve – A curve showing planned purchase rates for all goods and services in the economy at various price levels, all other things held constant Slide 10-16 The Aggregate Demand Curve As the price level rises, real GDP declines Price Level 160 140 A 120 AD 0 Figure 10-4 8 9 10 11 12 Real GDP per Year ($ trillions) 13 14 Slide 10-17 The Aggregate Demand Curve Price Level 160 B 140 A 120 AD 0 Figure 10-4 8 9 10 11 12 Real GDP per Year ($ trillions) 13 14 Slide 10-18 The Aggregate Demand Curve C Price Level 160 B 140 A 120 AD 0 Figure 10-4 8 9 10 11 12 Real GDP per Year ($ trillions) 13 14 Slide 10-19 The Aggregate Demand Curve What happens when the price level rises? – The Real-Balance Effect (wealth effect) – The Interest Rate Effect – The Open Economy Effect Slide 10-20 The Aggregate Demand Curve The Real-Balance Effect – The change in the real value of money balances when the price level changes Slide 10-21 The Aggregate Demand Curve The Interest Rate Effect – Higher price levels indirectly increase the interest rate, which in turn cause a reduction in borrowing and spending. Slide 10-22 The Aggregate Demand Curve The Open Economy Effect – Higher price levels result in foreigners’ desiring to buy fewer American-made goods while Americans desire more foreign-made goods (i.e., net exports fall). Slide 10-23 Aggregate Demand versus Demand for a Single Good When the aggregate demand curve is derived, we are looking at the entire circular flow of income and product. When a demand curve is derived, we are looking at a single product in one market only. Slide 10-24 Shifts in the Aggregate Demand Curve Any non-price-level change that increases aggregate spending (on domestic goods) shifts AD to the right. Any non-price-level change that decreases aggregate spending (on domestic goods) shifts AD to the left. Slide 10-25 Factors Increasing Aggregate Demand A drop in the foreign exchange value of the dollar Increased security about jobs and future income Improving economic conditions in other countries A reduction in real interest rates (nominal interest rates corrected for inflation) not due to price level changes Tax decreases An increase in the amount of money in circulation Slide 10-26 GDP Deflator Shifts in the Aggregate Demand Curve 120 90 AD 0 1 2 3 4 5 Real GDP per Year ($ trillions) 6 7 Slide 10-27 GDP Deflator Shifts in the Aggregate Demand Curve 120 90 AD 0 1 2 3 4 5 Real GDP per Year ($ trillions) 6 7 Slide 10-28 Shifts in the Aggregate Demand Curve GDP Deflator Increase in aggregate demand 120 90 AD 0 1 2 3 4 5 Real GDP per Year ($ trillions) 6 AD1 7 Slide 10-29 Factors Decreasing Aggregate Demand A rise in foreign exchange value of the dollar Added fears about jobs and future income Declining economic conditions in other countries A rise in real interest rates not due to price level changes Tax increases A decrease in the amount of money in circulation Slide 10-30 Shifts in the Aggregate Demand Curve GDP Deflator Decrease in aggregate demand 120 100 0 9 10 11 12 AD1 AD 13 14 Real GDP per Year ($ trillions) 15 Slide 10-31 The Aggregate Supply Curve The Long-Run Aggregate Supply Curve – Real output at full employment – A vertical line representing real output based on full information and after full adjustment has occurred Slide 10-32 Long-Run Equilibrium and the Price Level Figure 10-5 Slide 10-33 Long-Run Equilibrium and the Price Level Long-run equilibrium occurs at the intersection of the LRAS curve and the AD curve – Equilibrium price level is determined – Planned real expenditures for the economy are equal to total planned production along the economy’s trends growth path Slide 10-34 The Effects of Economic Growth on the Price Level Figure 10-6, Panel (a) Slide 10-35 The Effects of Economic Growth on the Price Level Figure 10-6, Panel (b) Slide 10-36 The Effects of Economic Growth on the Price Level Secular Deflation – An increase in LRAS will, ceteris paribus, result in a decrease in the price level. Avoiding Secular Deflation – If the AD curve shifts outward by the same amount as the LRAS curve, the price level remains constant. – The AD curve can be shifted outward by increasing the money supply. Slide 10-37 E-Commerce Example: Information Technology and LRAS The communication capabilities of computer networks have enhanced economic growth by – Adding to the capital stock – Allowing for the further development of entrepreneurial talent Slide 10-38 E-Commerce Example: Information Technology and LRAS In countries where information technologies have been most widely adopted, they account for about onethird of the growth in real GDP. Slide 10-39 Inflation Rates in the United States Figure 10-7 Source: Economic Report of the President; Economic Indicators, various issues Slide 10-40 Causes of Inflation: Supply-Side Inflation • When LRAS1 shifts to LRAS2, the price level rises from 120 to 140 • Inflation is caused by a decrease in LRAS. Figure 10-8, Panel (a) Slide 10-41 Causes of Inflation: Demand-Side Inflation An increase in AD from AD1 to AD2 causes the price level to rise from 120 to 140. An increase in AD causes inflation. Figure 10-8, Panel (b) Slide 10-42 International Example: High Marginal Tax Rates and Inflation High marginal tax rates on income in European nations have slowed the growth rate of LRAS. One effect of this is a higher rate of inflation than would prevail otherwise. Slide 10-43 Causes of Inflation: Economic Growth and Inflation Figure 10-9 Source: Economic Report of the President; Economic Indicators, various issues Slide 10-44 Issues and Applications: Different Sources of Deflation The deflation observed in the U.S. in the 1930’s was the result of a leftward shift of LRAS. The recent deflation in Japan and China occurred with increases in real output, suggesting that it resulted from an increase in LRAS along with a stable aggregate demand. Slide 10-45 Summary Discussion of Learning Objectives The long-run aggregate supply curve is vertical at the level of real GDP that firms plan to produce when they have full information and when input prices have adjusted to any change in output prices. Economic growth is shown by an outward shift of the LRAS curve or of the production possibilities curve. Slide 10-46 Summary Discussion of Learning Objectives The aggregate demand curve slopes downward because of the real-balance effect, the interest rate effect, and the open economy effect. Long-run equilibrium for the economy occurs when the price level adjusts until total planned real expenditures equal total planned production. Slide 10-47 Summary Discussion of Learning Objectives If aggregate demand is stable during a period of economic growth, the price level falls. Because real GDP has been increasing, the most likely factor causing inflation is that AD increases faster than LRAS. Slide 10-48 End of Chapter 10 Real GDP and the Price Level in the Long Run