Chapter 10

Real GDP and

the Price Level

in the Long Run

Introduction

After a tsunami hit the Indian Ocean region in

2004, observers predicted it might also deal a

mortal blow to the regional economies.

Yet inflation rates in most nations hit by the

tsunami rose only slightly in 2005 and levels of

GDP increased by at least 4%.

In this chapter, you will learn why positive

long-run real GDP and price level trends can

overwhelm even a tsunami.

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-2

Learning Objectives

• Understand the concept of long-run

aggregate supply

• Describe the effect of economic growth

on the long-run aggregate supply curve

• Explain why the aggregate demand

curve slopes downward and list key

factors that cause this curve to shift

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-3

Learning Objectives (cont'd)

• Discuss the meaning of long-run

equilibrium for the economy as a whole

• Evaluate why economic growth can

cause deflation

• Evaluate likely reasons for persistent

inflation in recent decades

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-4

Chapter Outline

• Output Growth and the Long-Run

Aggregate Supply Curve

• Total Expenditures and

Aggregate Demand

• The Aggregate Demand Curve

• Shifts in the Aggregate Demand Curve

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-5

Chapter Outline (cont'd)

• Long-Run Equilibrium and the

Price Level

• The Effects of Economic Growth

on the Price Level

• Causes of Inflation

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-6

Did You Know That...

• Several times during the period known as the

“Roaring Twenties” the price level declined in

the United States?

• In the meantime, average prices of

shares of stock more than doubled, and

real GDP increased?

• Why did the United States experience

deflation even as the nation experienced

economic growth in the 1920s?

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-7

Output Growth and the Long-Run

Aggregate Supply Curve

• Aggregate Supply

The total of all planned production for

the economy

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-8

Output Growth and the Long-Run

Aggregate Supply Curve (cont'd)

• Long-Run Aggregate Supply Curve

A vertical line representing the real output

of goods and services after full adjustment

has occurred

It represents the real GDP of the economy

under conditions of full employment;

the economy is on its production

possibilities curve

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-9

Figure 10-1 The Production Possibilities

and the Economy’s Long-Run Aggregate

Supply Curve

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-10

Output Growth and the Long-Run

Aggregate Supply Curve (cont'd)

• LRAS is vertical

Input prices fully adjust to changes in

output prices

Suppliers have no incentive to

increase output

Unemployment is at the natural rate

Determined by endowments and

technology (or existing resources)

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-11

Output Growth and the Long-Run

Aggregate Supply Curve (cont'd)

• Endowments

The various resources in an economy,

including both physical resources and

such resources as ingenuity and

management skills

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-12

Output Growth and the Long-Run

Aggregate Supply Curve (cont'd)

• Growth is shown by outward shifts of

either the production possibilities curve

or the LRAS curve caused by

Growth of population and the labor-force

participation rate

Capital accumulation

Improvements in technology

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-13

Figure 10-2 The Long-Run Aggregate

Supply Curve and Shifts in It

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-14

Figure 10-3 A Sample Long-Run

Growth Path for Real GDP

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-15

Total Expenditures

and Aggregate Demand

• Aggregate Demand

The total of all planned expenditures in the

entire economy

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-16

Total Expenditures

and Aggregate Demand (cont'd)

• Questions

What determines the total amount that

individuals, governments, firms, and

foreigners want to spend?

What determines the equilibrium

price level?

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-17

The Aggregate Demand Curve

• Aggregate Demand Curve

A curve showing planned purchase rates

for all final goods and services in the

economy at various price levels, all other

things held constant

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-18

Figure 10-4

The Aggregate Demand Curve

As the price

level rises, real

GDP declines

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-19

The Aggregate Demand

Curve (cont'd)

• What happens when the price

level rises?

The real-balance effect (or wealth effect)

The interest rate effect

The open economy effect

• What happens when the price

level falls?

The greater the total planned spending

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-20

The Aggregate Demand

Curve (cont'd)

• The Real-Balance Effect

The change in the real value of money

balances when the price level changes

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-21

The Aggregate Demand

Curve (cont'd)

• The Interest Rate Effect

Higher price levels indirectly increase the

interest rate, which in turn causes a

reduction in borrowing and spending.

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-22

The Aggregate Demand

Curve (cont'd)

• The Open Economy Effect

Higher price levels result in foreigners’

desiring to buy fewer American-made

goods while Americans desire more

foreign-made goods (i.e., net exports fall).

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-23

Aggregate Demand versus

Demand for a Single Good

• When the aggregate demand curve is

derived, we are looking at the entire

circular flow of income and product.

• When a demand curve is derived, we

are looking at a single product in one

market only.

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-24

Shifts in the Aggregate

Demand Curve

• Any non-price-level change that

increases aggregate spending (on

domestic goods) shifts AD to the right.

• Any non-price-level change that

decreases aggregate spending (on

domestic goods) shifts AD to the left.

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-25

Table 10-1 Determinants of

Aggregate Demand

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-26

GDP Deflator

Shifts in the Aggregate

Demand Curve (cont'd)

120

90

AD

0

1

2

3

4

5

Real GDP per Year

($ trillions)

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

6

7

10-27

GDP Deflator

Shifts in the Aggregate

Demand Curve (cont'd)

120

90

AD

0

1

2

3

4

5

Real GDP per Year

($ trillions)

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

6

7

10-28

Shifts in the Aggregate

Demand Curve (cont'd)

GDP Deflator

Increase in aggregate demand

120

90

AD

0

1

2

3

4

5

Real GDP per Year

($ trillions)

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

6

AD1

7

10-29

Shifts in the Aggregate

Demand Curve (cont'd)

GDP Deflator

Decrease in aggregate demand

120

100

0

9

10

11

12

AD1

AD

13

14

Real GDP per Year

($ trillions)

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

15

10-30

Long-Run Equilibrium

and the Price Level

• For the economy as a whole, long-run

equilibrium occurs at the price level

where the aggregate demand curve

(AD) crosses the long-run aggregate

supply curve (LRAS).

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-31

Figure 10-5 Long-Run

Economywide Equilibrium

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-32

Long-Run Equilibrium

and the Price Level (cont'd)

• The effects of economic growth on the

price level

Economic growth and secular deflation

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-33

Long-Run Equilibrium

and the Price Level (cont'd)

• Secular Deflation

A persistent decline in prices resulting from

economic growth in the presence of stable

aggregate demand

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-34

Secular Deflation versus Long-Run

Price Stability in a Growing Economy

• Secular deflation

An increase in LRAS will, ceteris paribus, result in

a decrease in the price level.

• Avoiding secular deflation

If the AD curve shifts outward by the same

amount as the LRAS curve, the price level

remains constant.

The AD curve can be shifted outward by increasing the

money supply.

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-35

Figure 10-6 Secular Deflation versus

Long-Run Price Stability in a Growing

Economy, Panel (a)

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-36

Figure 10-6 Secular Deflation versus

Long-Run Price Stability in a Growing

Economy, Panel (b)

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-37

International Example:

Deflation is the Norm in Japan

• Since 1998, Japan’s real GDP has

increased every year except 2002.

• As the LRAS curve shifted rightward,

the price level gradually declined.

• Consequently Japan experienced

deflation.

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-38

Figure 10-7 Inflation Rates

in the United States

Source: Economic Report of the President; Economic Indicators, various issues

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-39

Figure 10-8 Explaining Persistent

Inflation, Panel (a)

• When LRAS1 shifts to

LRAS2, the price level

rises from 120 to 140

• Inflation is caused by

a decrease in LRAS

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-40

Figure 10-8 Explaining Persistent

Inflation, Panel (b)

An increase in AD from AD1

to AD2 causes the price

level to rise from 120 to 140,

and an increase in AD

causes inflation

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-41

Figure 10-9 Real GDP and

the Price Level in the United States,

1970 to the Present

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-42

International Policy Example:

The People’s Bank of China Rediscovers

How to Create Inflation

• LRAS has been increasing rapidly in

China.

• Real GDP has risen at least 7% per

year since 1998.

• Recently the price level has increased.

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-43

International Policy Example:

The People’s Bank of China Rediscovers

How to Create Inflation (cont'd)

• Money supply growth caused aggregate

demand to shift rightward.

• AD shifted at a faster pace than the

rightward shift in the LRAS curve.

• The end result was an increase in the

price level.

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-44

Issues and Applications:

Why the 2004 Tsunami Did Not Swamp

Asian Economies

• The estimated death toll from the

tsunami of 2004 exceeded all others

since the year 1556.

• In spite of this huge toll, most of the

regional economies stayed on their

long-run growth paths.

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-45

Issues and Applications:

Why the 2004 Tsunami Did Not Swamp

Asian Economies (cont'd)

• Observers were concerned that…

LRAS would decrease, causing price

levels to jump, resulting in sudden inflation

and then real GDP would drop, leading

to recession.

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-46

Issues and Applications:

Why the 2004 Tsunami Did Not Swamp

Asian Economies (cont'd)

• Yet tourism drop-off generated a decline

in AD, which helped reduce price

increases.

• Inflation rates dropped back to levels

consistent with long-term trends.

• Real GDP grew in 2005 in all

four nations.

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-47

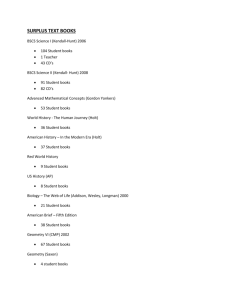

Table 10-2 Inflation Rates

and Real GDP Growth Rates

in Selected Southeast Asian Nations

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-48

Summary Discussion

of Learning Objectives

• Long-run aggregate supply

The long-run aggregate supply curve is vertical

at the level of real GDP that firms plan to

produce when they have full information and

when input prices have adjusted to any change in

output prices.

• Economic growth

Shown by an outward shift of the LRAS curve or

of the production possibilities curve

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-49

Summary Discussion

of Learning Objectives (cont'd)

• Why the aggregate demand curve

slopes downward and factors that

cause it to shift

Slopes downward due to the real-balance

effect, the interest rate effect, and the open

economy effect

May shift due to a number of factors

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-50

Summary Discussion

of Learning Objectives (cont'd)

• Long-run equilibrium for the economy

Occurs when the price level adjusts until

total planned real expenditures equal

actual real GDP

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-51

Summary Discussion

of Learning Objectives (cont'd)

• Why economic growth can cause deflation

If AD is stationary during a period of economic

growth, the LRAS curve shifts rightward along the

AD curve and the equilibrium price level falls.

• Likely reasons for persistent inflation

One event that causes inflation is a decline in

LRAS; another occurs in a growing economy

when AD growth exceeds the increase in LRAS.

Copyright © 2008 Pearson Addison Wesley. All rights reserved.

10-52

End of

Chapter 10

Real GDP and

the Price Level

in the Long Run