Chapter 10

Real GDP and

the Price Level

in the Long Run

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

Introduction

During the early 2000s, Japan’s price level declined at a

steady pace.

Between late 2003 and 2008, the price level oscillated very

little.

Then, in the late 2000s, the price level suddenly jumped

upward at over 2 percent per year before plunging downward.

What caused Japan’s price level to behave as it did across

the 2000s?

In this chapter, you will learn how a nation’s equilibrium price

level is determined.

Learning Objectives

• Understand the concept of long-run aggregate

supply

• Describe the effect of economic growth on the

long-run aggregate supply curve

• Explain why the aggregate demand curve

slopes downward and list key factors that

cause this curve to shift

Learning Objectives (cont'd)

• Discuss the meaning of long-run equilibrium

for the economy as a whole

• Evaluate why economic growth can cause

deflation

• Evaluate likely reasons for persistent inflation

in recent decades

Chapter Outline

• Output Growth and the Long-Run Aggregate

Supply Curve

• Total Expenditures and Aggregate Demand

• Shifts in the Aggregate Demand Curve

• Long-Run Equilibrium and the Price Level

• Causes of Inflation

Did You Know That ...

• Until the spring 2008, the U.S. price level had not exhibited a

decline during any single 12-month interval since 1955?

• Why did the U.S. economy experienced deflation, or a

decrease in the price level over time, for the first time in half a

century?

Output Growth and the Long-Run

Aggregate Supply Curve

• Aggregate Supply

– The total of all planned production for the

economy

Output Growth and the Long-Run Aggregate Supply

Curve (cont'd)

• Long-Run Aggregate Supply Curve (LRAS)

– A vertical line representing the real output of

goods and services after full adjustment has

occurred

– It represents the real GDP of the economy under

conditions of full employment; the economy is on

its production possibilities curve

Figure 10-1 The Production Possibilities Curve and the

Economy’s Long-Run Aggregate Supply Curve

Output Growth and the Long-Run Aggregate Supply

Curve (cont'd)

• LRAS is vertical

– Input prices fully adjust to changes in output

prices

– Suppliers have no incentive to increase output

– Unemployment is at the natural rate

– Determined by endowments and technology (or

existing resources)

Output Growth and the Long-Run Aggregate Supply

Curve (cont'd)

• Base-year dollars

– The value of a current sum expressed in terms of

prices in a base year

• Endowments

– The various resources in an economy, including

both physical resources and such resources as

ingenuity and management skills

Output Growth and the Long-Run Aggregate Supply

Curve (cont'd)

• Growth is shown by outward shifts of either

the production possibilities curve or the LRAS

curve caused by

– Growth of population and the labor-force

participation rate

– Capital accumulation

– Improvements in technology

Figure 10-2 The Long-Run Aggregate Supply Curve and

Shifts in It

Figure 10-3 A Sample Long-Run

Growth Path for Real GDP

Example: How Much Might “Going Green” Reduce U.S. Economic

Growth?

• President Obama and the U.S. Congress have agreed on a goal

to reduce greenhouse gas emissions to 2005 levels by 2014,

and by an additional 30 percent by 2030.

• Attainment of these goals would lead to a decline in

production of capital goods and thus future economic growth.

• According to the Environmental Protection Agency, these

efforts to cut greenhouse gas emissions would lead to a

cumulative reduction in real GDP of about 4 percent by 2030.

Total Expenditures and Aggregate

Demand

• Aggregate Demand

– The total of all planned expenditures in the entire

economy

Total Expenditures and Aggregate

Demand (cont'd)

• Questions

– What determines the total amount that

individuals, governments, firms, and foreigners

want to spend?

– What determines the equilibrium price level?

The Aggregate Demand Curve

• Aggregate Demand Curve (AD)

– A curve showing planned purchase rates for all

final goods and services in the economy at various

price levels, all other things held constant

Figure 10-4 The Aggregate Demand

Curve

As the price

level rises, real

GDP declines

The Aggregate Demand Curve (cont'd)

• What happens when the price level rises?

– The real-balance effect (or wealth effect)

– The interest rate effect

– The open economy effect

• What happens when the price level falls?

– The greater the total planned spending

The Aggregate Demand Curve (cont'd)

• The Real-Balance Effect

– The change in expenditures resulting from a

change in the real value of money balances when

the price changes, all other things held constant;

also called the wealth effect

The Aggregate Demand Curve (cont'd)

• The Interest Rate Effect

– Higher price levels indirectly increase the interest

rate, which in turn causes a reduction in

borrowing and spending

– One of the reasons that the aggregate demand

curve slopes downward

The Aggregate Demand Curve (cont'd)

• The Open Economy Effect

– Higher price levels result in foreigners’ desiring to

buy fewer American-made goods while Americans

desire more foreign-made goods (i.e., net exports

fall)

– Equivalent to a reduction in the amount of real

goods and services purchased in the U.S.

The Aggregate Demand Curve (cont'd)

• Aggregate Demand versus Demand for a

Single Good or Service

– When the aggregate demand curve is derived, we

are looking at total planned expenditures on all

goods and services (i.e., the entire economic

system)

– When a demand curve is derived, we are looking

at a single good or service in one market only

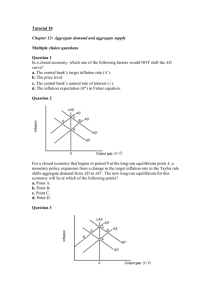

Shifts in the Aggregate Demand Curve

• Any non-price-level change that increases

aggregate spending (on domestic goods) shifts

AD to the right

• Any non-price-level change that decreases

aggregate spending (on domestic goods) shifts

AD to the left

Table 10-1 Determinants of Aggregate

Demand

Example: Explaining the Drop in Aggregate Demand in the Late

2000s

• By late 2007, the market values of many U.S. houses

purchased with mortgage loans from banks had fallen below

the amount people had borrowed, leading many borrowers to

simply walk away from their houses.

• Banks responded by cutting back on loans to businesses,

which in turn cut back on hiring.

• A significant decrease in aggregate demand resulted when

many U.S. residents experienced decreased security about

their jobs, incomes and wealth.

Long-Run Equilibrium and the Price

Level

• For the economy as a whole, long-run

equilibrium occurs at the price level where the

aggregate demand curve (AD) crosses the

long-run aggregate supply curve (LRAS)

Figure 10-5 Long-Run Economywide

Equilibrium

Long-Run Equilibrium

and the Price Level (cont'd)

• The effects of economic growth on the price

level

– Economic growth and secular deflation

Long-Run Equilibrium

and the Price Level (cont'd)

• Secular Deflation

– A persistent decline in prices resulting from

economic growth in the presence of stable

aggregate demand

– An increase in LRAS will, ceteris paribus, result in a

decrease in the price level

Long-Run Equilibrium and the Price

Level (cont’d)

• Avoiding secular deflation

– If the AD curve shifts outward by the same

amount as the LRAS curve, the price level remains

constant

• The AD curve can be shifted outward by increasing the

money supply

Figure 10-6 Secular Deflation versus Long-Run Price Stability in a

Growing Economy, Panel (a)

Figure 10-6 Secular Deflation versus Long-Run Price Stability in a

Growing Economy, Panel (b)

Why Not … pass a law that prohibits firms from raising their

prices?

• Between 1971 and 1973, the U.S. government tried to reduce

inflation by limiting price increases to specific allowed

percentages.

• This policy of direct inflation controls led to widespread

shortages and reductions in product quality.

Figure 10-7 Inflation Rates in the United States

Causes of Inflation

• Supply-Side Inflation

– Figure 10-8 panel (a) shows a rise in price level

caused by a decline in long-run aggregate supply

– A leftward shift could be caused by:

• Reductions in labor force participation

• Higher marginal tax rates on wages

Figure 10-8 Explaining Persistent

Inflation, Panel (a)

• When LRAS1 shifts to

LRAS2, the price level

rises from 120 to 140

• Inflation is caused by

a decrease in LRAS

Causes of Inflation (cont’d)

• Demand-Side Inflation

– Figure 10-8 panel (b)

• If aggregate demand increases for a given level of longrun aggregate supply, the price level must increase

Figure 10-8 Explaining Persistent

Inflation, Panel (b)

An increase in AD from AD1

to AD2 causes the price

level to rise from 120 to 140,

and an increase in AD

causes inflation

Figure 10-9 Real GDP and the Price Level in the United States,

1970 to the Present

You Are There: Fighting Inflation in Pakistan

• When Shamshad Akhtar became the governor of Pakistan’s

central bank, inflation was around 18 percent while the

quantity of money in circulation was growing at over 16

percent.

• As Akhtar has managed to reduce Pakistan’s money growth

rate to below 10 percent, the nation’s annual inflation rate

has dropped to a single digit.

Issues & Applications: Japan’s Deflation Rate Switches from

Steady to Volatile

• During the early 2000s, secular deflation occurred in Japan as

its aggregate demand was nearly stationary, but its long-run

aggregate supply curve shifted rightward.

• From late 2003 through the middle of 2008, the deflation rate

was lower as Japanese aggregate demand began to grow at a

steadier pace.

Issues & Applications: Japan’s Deflation Rate Switches from

Steady to Volatile (cont’d)

• During the latter part of 2008, Japan experienced a 2.5

percent inflation rate as its growing exports raised Japanese

aggregate demand.

• By 2010, Japan experienced a deflation rate of 2.5 percent as

purchases of Japanese export goods by residents of the

United States and other nations plunged, causing a sudden

drop in aggregate demand.

Figure 10-10 The Rate of Change of Japanese Prices Since 2000

Summary Discussion of Learning

Objectives

• Long-run aggregate supply

– The long-run aggregate supply curve is vertical at

the level of real GDP that firms plan to produce

when they have full information and when input

prices have adjusted to any change in output

prices

• Economic growth

– Shown by an outward shift of the LRAS curve or of

the production possibilities curve

Summary Discussion of Learning

Objectives (cont'd)

• Why the aggregate demand curve slopes

downward and factors that cause it to shift

– Slopes downward due to the real-balance effect,

the interest rate effect, and the open economy

effect

– May shift due to a number of factors

Summary Discussion of Learning

Objectives (cont'd)

• Long-run equilibrium for the economy

– Occurs when the price level adjusts until total

planned real expenditures equal actual real GDP

Summary Discussion of Learning

Objectives (cont'd)

• Why economic growth can cause deflation

– If AD is stationary during a period of economic

growth, the LRAS curve shifts rightward along the

AD curve and the equilibrium price level falls

• Likely reasons for persistent inflation

– One event that causes inflation is a decline in

LRAS; another occurs in a growing economy when

AD growth exceeds the increase in LRAS