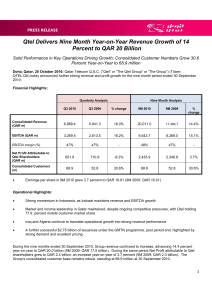

Qtel Management Report on Consolidated Financial Results for the

advertisement

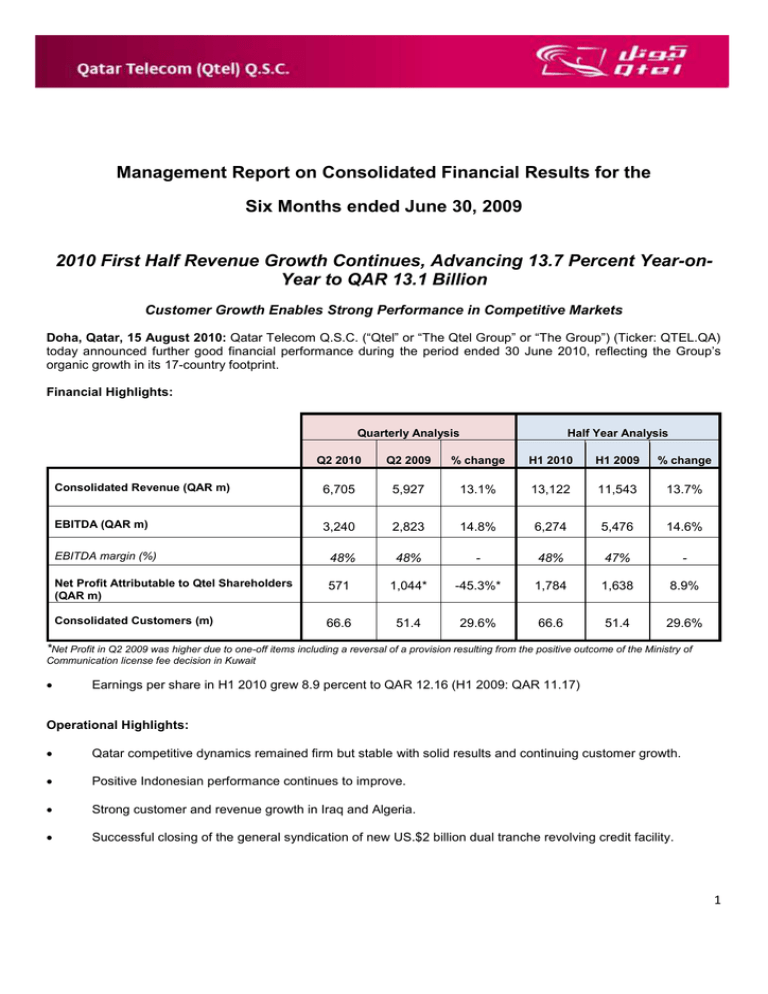

\= Management Report on Consolidated Financial Results for the Six Months ended June 30, 2009 2010 First Half Revenue Growth Continues, Advancing 13.7 Percent Year-onYear to QAR 13.1 Billion Customer Growth Enables Strong Performance in Competitive Markets Doha, Qatar, 15 August 2010: Qatar Telecom Q.S.C. (“Qtel” or “The Qtel Group” or “The Group”) (Ticker: QTEL.QA) today announced further good financial performance during the period ended 30 June 2010, reflecting the Group’s organic growth in its 17-country footprint. Financial Highlights: Quarterly Analysis Half Year Analysis Q2 2010 Q2 2009 % change H1 2010 H1 2009 % change Consolidated Revenue (QAR m) 6,705 5,927 13.1% 13,122 11,543 13.7% EBITDA (QAR m) 3,240 2,823 14.8% 6,274 5,476 14.6% EBITDA margin (%) 48% 48% - 48% 47% - Net Profit Attributable to Qtel Shareholders (QAR m) 571 1,044* -45.3%* 1,784 1,638 8.9% Consolidated Customers (m) 66.6 51.4 29.6% 66.6 51.4 29.6% *Net Profit in Q2 2009 was higher due to one-off items including a reversal of a provision resulting from the positive outcome of the Ministry of Communication license fee decision in Kuwait Earnings per share in H1 2010 grew 8.9 percent to QAR 12.16 (H1 2009: QAR 11.17) Operational Highlights: Qatar competitive dynamics remained firm but stable with solid results and continuing customer growth. Positive Indonesian performance continues to improve. Strong customer and revenue growth in Iraq and Algeria. Successful closing of the general syndication of new US.$2 billion dual tranche revolving credit facility. 1 During the period ended 30 June 2010, the Qtel Group revenues increased 13.7 percent to stand at QAR 13.1 billion (H1 2009: QAR 11.5 billion). Net profit attributable to Qtel shareholders at the end of the period stood at QAR 1.8 billion (H1 2009: QAR 1.6 billion) and at 30 June 2010 the Group’s consolidated customer base stood at 66.6 million (H1 2009: 51.4 million). The Group’s EBITDA performance was strong, increasing 14.6 percent to QAR 6.3 billion (H1 2009: QAR 5.5 billion), resulting in an EBITDA margin of 48%, an improvement of 2 percent compared to the first six months of 2009. Qtel continued to receive excellent support from the financial community with the successful closing of the general syndication of its new US.$2.0 billion three- and five-year dual tranche revolving credit facility in May 2010. The total subscribed amount of US $3.9 billion substantially exceeded the original target of US $1.5 billion. Commenting on the results, His Excellency Sheikh Abdullah Bin Mohammed Bin Saud Al-Thani, Chairman of the Qtel Group said: “Qtel has demonstrated that we can turn challenging investments and market situations to our advantage, as we continue to deliver shareholder value. Our performance in core territories such as Kuwait and Qatar shows that we are capable of driving progress in competitive markets, and our performance in Indonesia continues to improve, as we unlock the potential of this key investment in Southeast Asia. We are pleased to report EBITDA growth in the first half of 14.6 percent, highlighting the ongoing profitability of our Group and the resilience of our operational approach.” Also commenting on the results, Dr. Nasser Marafih, Chief Executive Officer of the Qtel Group said: “We are pleased to see the results starting to come through on our in-market strategies. In particular, we continue to enjoy good results in Qatar and see important progress in Kuwait, where decisive efforts to maintain market share are yielding results. Indonesia, Iraq and Algeria continue to demonstrate their growth potential while the roll-out of fixedline services in Oman also represents an exciting landmark in our development as a Group.” Review of Operations The Group’s operational performance can be summarized as follows: Qtel – Qatar Qtel saw solid and sustainable results in its home market, driven by ongoing innovation and investment in its relationship with its customers. Qtel continued to grow its customer base, by 11 percent, to end the quarter with 2.4 million customers (H1 2009: 2.2 million customers). A number of key initiatives in Qatar laid the groundwork for future Qtel Group growth and development. In March Qtel announced the first phase of a national programme for “Fibre to the Home” (FTTH), aiming to link homes across Qatar with fibre connections over the next three years. In line with its vision to create the first Mobile Innovation hub for the region, Qtel also co-founded the first Mobile Entertainment Forum (MEF) Middle East office for the MENA region based in the Qatar Science and Technology Park. In Qatar revenue ended H1 2010 at QAR 2.8 billion (H1 2009: QAR 2.9 billion) with EBITDA at QAR 1.5 billion (H1 2009: QAR 1.8 billion) with sequential quarterly results positive for both revenue and EBITDA. Indosat – Indonesia The underlying strength of the Indosat business has shown sustained improvement, closely following the positive trajectory started in the prior quarter. During H1 2010, Indosat’s customer base increased by 34.3 percent to end the period at 38.5 million customers (H1 2009: 28.7 million). This customer base continues to provide an increasingly higher-value revenue mix to the company, with Indosat revenue increasing 28.7 percent year-on-year to end H1 2010 at QAR 3.8 billion (H1 2009: QAR 3.0 billion). Operational efficiencies and a relatively stable foreign exchange environment also had a positive impact on EBITDA, which also increased during the period, improving 31.1 percent to QAR 1.9 billion (H1 2009: QAR 1.5 billion). 2 Wataniya Telecom Wataniya Telecom (“National Mobile Telecommunications Company K.S.C.”) encompasses the Qtel Group’s businesses in Kuwait, Tunisia, Algeria, Kingdom of Saudi Arabia, the Maldives and Palestine. Wataniya has benefited from the strong response taken in previous quarters to address enhanced competition in some of the markets in which it operates. These benefits were visible in Kuwait, where strong growth in year-over-year subscriber numbers has helped to preserve Wataniya Telecom’s Kuwaiti market share. Similarly in Algeria, market share was maintained while revenue and EBITDA both saw robust growth over the same period of 2009. At a consolidated level, Wataniya Telecom’s customer base increased 33 percent to end the first half at 15.8 million (H1 2009: 11.9 million). Revenue also improved during the same period, increasing 12 percent year-on-year to stand at QAR 3.3 billion (H1 2009: QAR 3.0 billion) and positive EBITDA momentum also continued, increasing 10.2 percent to QAR 1.3 billion (H1 2009: QAR 1.2 million). Nawras – Oman Qtel’s operations in Oman – operating under the “Nawras” brand – passed another significant milestone during the second quarter, launching a broad range of fixed line services which will play an important role in diversifying and enhancing Nawras’ future revenue. The Nawras fixed line network, created following its successful bid in 2009 for Oman’s second fixed-line license, is already able to reach more than 50 percent of the population. In addition, an important international fixed-line gateway is also now in place. Although the competitive landscape of the Omani mobile market has continued to evolve, Nawras has successfully maintained its strong market position. At the close of H1 2010, customer numbers stood at 2.0 million (H1 2009: 1.7 million). Revenue has continued to grow, increasing by 14.9 percent year-on-year to QAR 864 million (H1 2009: QAR 752 million). EBITDA has also improved, increasing 43.3 percent year-on-year to QAR 487 million (H1 2009: QAR 340 million). Asiacell – Iraq Asiacell’s performance remains robust, building on two successive quarters of substantial revenue and profit growth. Asiacell’s strong brand helped to lift the customer base even further during H1 2010, closing the first half 13 percent higher at 7.9 million customers (H1 2009: 7.0 million).Customers have responded well to billing changes introduced during the quarter, following a carefully planned customer education programme, and revenue has continued to grow, ending the period 31.4 percent higher at QAR 2.4 billion (H1 2009: QAR 1.8 billion). EBITDA also improved year-onyear, increasing by 38.1 percent to end the quarter at QAR 1.4 billion (H1 2009: QAR 989 million). Qtel will publish its H1 2010 financial statement on its website, accessible at: www.qtel. qa - Ends About Qtel Qatar Telecom (Qtel) Q.S.C. is a diversified telecommunications company with a presence in 17 countries, providing voice and data services to people and businesses, and bringing advanced technology to more than 66 million customers. Qtel is committed to expansion in the MENA region where it is the largest telecommunications company by number of operations, and South East Asia. Qtel’s vision is to be among the top 20 telecommunications companies in the world by 2020. Qatar Telecom (Qtel) Q.S.C. cautions investors that certain statements contained in this document state management's intentions, hopes, beliefs, expectations, or predictions of the future and are thus forward-looking statements. Management wishes to caution the reader that forward-looking statements are not historical facts and are only estimates or predictions. Actual results may differ materially from those projected as a result of risks and uncertainties including, but not limited to: Qtel’s ability to manage domestic and international growth and maintain a high level of customer service; future sales growth; market acceptance of its product and service offerings; its ability to secure adequate financing or equity capital to fund its operations; network expansion; performance of its network and equipment; its ability to enter into strategic alliances or transactions; cooperation of incumbent local exchange carriers in provisioning lines and interconnecting our equipment; regulatory approval processes; changes in technology; price competition; other market conditions and associated risks. Qtel undertakes no obligation to update publicly any forward-looking statements, whether as a result of future events, new information, or otherwise . 3