Running head: Country Risk and Strategic Planning

advertisement

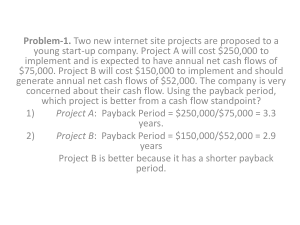

Analysis 1 Running head: Country Risk and Strategic Planning Country Rick and Strategic Planning Wind Street Energy Learning Team D Michael Magliotti, Michael Azarow and Tonya Johnson University of Phoenix MGT/448 Albert Salinas April 12, 2010 Analysis 2 Country Risk and Strategic Planning This plan provides analysis and mitigation strategies used to highlight inherent risks associated with entering the market in India for Wind Street Energy’s wind turbines. Wind Street Energy will be partnering with Andhra Pradesh Power Generation Corporation (APGENCO), an established firm in India. India offers a promising market for the company, and should offer continuing growth and a good springboard for operations throughout the continent. The plan to merge and partner with APGENCO and enter the market in India involves some risk, however. To that end, the plan accounts for risks regarding the regulatory and political issues in India, exchange and repatriation of funds; competitive market risks; taxation and double taxation issues; distribution and supply chain risks; physical and environmental challenges; and social and cultural risks. No plan is complete without stating the mitigation strategy for indentified risks. The plan will also list Wind Street Energy’s strategic risk management response to the key risk factors. This strategic plan will involve definition and clarification of the mission and objectives of Wind Street Energy, a SWOT analysis; a selection of the strategy pursued by Wind Street Energy; a selection and justification of the appropriate mode of introduction for Wind Turbines in India; and the methods by which Wind Street Energy will control and evaluate its success in this endeavor. As with any business venture, Wind Street Energy realizes that there are risks that are associated with merging with a foreign company. The ability to identify and understand such possible risks will aid in the process of addressing any issues head-on. Political, legal and regulatory risks are always a major concern when entering a foreign market. Political stability of a foreign market is a key factor when examining risks such as wide-scale corruption and ethnic and left-wing insurgencies, which are current issues in India that need to be of concern. Analysis 3 Understanding not only the political stability of the region, but also the political and legal system on a whole and what they are made up of and how they operate is also important. The international and regional institutions that make up the global monetary and financial system are composed of organizations such as The World Bank, The World Trade Organization (WTO), and The International Monetary Fund (IMF). These organizations provide important and substantial roles with the global international market in various ways. The roles can vary from monitoring credit and capital flow throughout the international community; to the monitoring and regulating domestic and international trade throughout the world. With the understanding of the principles of money management in the international business, Wind Street Energy will use this information that could be used to minimize transactions costs, cash balances and taxation. Potential complications that many MNCs experience are different currencies, regulations, economic/political risks, capital flow across borders and tax regimes. The differences pose complications, which affect the flow of goods, services and capital between different regions. A competitive risk assessment is necessary to discover any competitors in the market that may cause a problem with growth and profits. Using competitive intelligence to collect and interpret relevant information in regard to business competitors is imperative. Competitive Intelligence is a legal means to obtain information about the business practices of competitors as well as their intentions that may have an effect on the business. Rapid changes occur in markets; thus, gaining political and economical knowledge about the market as well as information about competitors will be required for creating a strategy to remain ahead of the competition. Analysis 4 Evaluating factors that may be a potential for loss and identifying risks that will impact the decisions made affect positioning and placement. Putting together a plan of implementation requires specific information and data including market indicators and trends for products and services. Having a marketing plan focus will help the firm prepare for product modification, pricing, promotional programs, distribution channels, and e-business in India. Wind Street Energy will take an active approach when analyzing risk factors such as profits and earnings as well as capital and cash flow risks. Wind Street Energy will use tools such as the “4 P’s” model to identify and address all areas of concern. The four P’s include: product, place, price and promotion. The 4 P’s model allows Wind Street Energy to break down the plan into specific areas of interest and steps to follow. Wind Street energy will take into account the fact that culture, religion and language may influence the cost of doing business in particular countries. Culturally, it is important to understand what is acceptable and not acceptable in a host country. To have a basic understanding of the prominent religious practices or customs so not to offend a particular group’s religion is also important. The understanding of language barriers and communication are fundamental concepts that must be understood, which would potentially have a direct impact on the success of global expansion. A company must be sensitive to the socio-cultural environment within the host country. If a company is not aware of or ignores socio-cultural issues, adverse affects both externally and internally may apply. That organization’s image may be damaged within that local community that could have a profound effect on how that company conducts business in that area. Internally, it may play a role on that company’s bottom line, which could affect that business Analysis 5 infrastructure. There may be a financial investment involved whenever it comes to local marketing, sales, and advertising. The lack of knowledge and/or understanding of socio-cultural issues could result in both philosophical and economical repercussions that threaten business survival in the area. Working toward a productive and meaningful entry into the market in India will require a great deal of coordination and planning. To that end, the risks identified, will need to be addressed by the company as it moves forward. The mitigation strategies for each risk are outlined below: 1. Growing Left-Wing communist Party’s Anti-Reform/Anti-Privatization Movement Although the movement could have an impact, Wind Street Energy is not seeking to takeover any government entity’s function, nor is it seeking to reform any movement. Instead, what Wind Street Energy is seeking is a way to provide inexpensive power sources to the other half of the population in India who have no electricity. Wind Street Energy will publicize this fact, and will ensure that it stays out of the political arena to the greatest extent possible. Additionally, by partnering with an already-existing Indian firm, Wind Street Energy is avoiding some of the risks inherent with foreign investment in a host nation. 2. Dispute between India and Pakistan over Kashmir. This age-old regional conflict is likely to continue for the long term. Because of this, Wind Street Energy will not pursue any wind farms in the Kashmir region, nor will any of its supply chain be located in this troubled area. Analysis 6 3. Wide-scale government corruption. While corruption in government is nothing new to a global company, operating in India will be eased because of the partnership with APGENCO. APGENCO has already worked through the issues with corrupt officials, and this will ease the entry of the Wind Street Energy’s Wind Turbines into the mix. However, Wind Street Energy will need to make known to APGENCO its code of ethics and its accepted practices before moving forward. 4. Complicated decision-making because of large coalition government. Similar to the issues with corruption, Wind Street Energy will be able to bypass many problem areas as a result of the partnership with the well-established and respected APGENCO. No insurmountable problems are anticipated at this time. Wind Street Energy will meet with APGENCO officials to identify potential issues as the merger takes place, and will develop a mitigation strategy for this issue should the need arise. 5. Ethnic and left-wing insurgencies and political-charged communal violence. Although there is a risk of ethnic and left-wing insurgencies and communal violence, they are largely predictable, as they have been occurring over a number of decades. Because of this, APGENCO and the company will meet to address mitigation strategies for this issue. At a minimum, the company will not construct Wind Farms in the areas in which such insurgencies are common, nor will firms within the supply chain be located in these areas. If such areas are unavoidable, security measures will be put in place to help ensure the preservation of corporate assets, the safety of staff and the surrounding areas as well as visitors and stakeholders. Analysis 7 6. The Dunn and Bradstreet country risk report of 2008 rated the nation as a slight risk, but deteriorating. Whereas the nation is not a huge risk now, conditions have been deteriorating. As a mitigation strategy, Wind Street Energy will consistently evaluate the status of the nation, watching trends and other issues that could indicate stress in the economic or political system. If deterioration progresses, Wind Street Energy will have a staged approach to either (a) exit the market; (b) reduce its exposure in the market; or (c) continue operations. The Wind Street Energy Corporation, industry leaders in research, development, construction, and operation of alternative “green” energy production sees a large growth opportunity in the country of India. The firm’s objective is to partner with Andhra Pradesh Power Generation Corporation Limited and build wind farms capable of supplying an environmentally clean and renewable energy source to the people of India. India has been a participant in wind power generation since the early 1990s but is still considered a newcomer compared to the US. In terms of wind capacity, India has the fifth largest wind capacity in the world but wind power supplies only 1.6% of India’s power (India to add, 2010). When a Multinational Company (MNC) is considering investing in a foreign market, a SWOT analysis tool is used. A SWOT analysis is used in the businesses planning process that helps management focus on the internal factors: Strengths and Weaknesses and the external factors: Opportunities and Threats (SWOT, 2007). The SWOT analysis below will be used by Analysis 8 Wind Street Energy to audit the target country of India. The information recorded in the SWOT will provide vital secondary research data used in the strategic planning process. Strengths India’s Government is a Democracy India’s legal system is English Common Law History of macro-economic stability Labor force of 506.9 million Young population accounts for highest percentage of fast growing workforce Technology: Largest growing sector India’s transportation system: Full access by sea, land, and air Weather and terrain: Suitable for wind energy production Over 50% of population speak English (English and Hindu: Official languages) Low interest rates Favorable tax laws Weaknesses Budget is in deficit High tariff barriers for direct exports Tight government regulations for FDI Large unemployment rate: 7.8% 25% of population live in poverty (332 million) Large coalition government: complicated decision-making process Analysis 9 Opportunities Continuous growth for imports/exports of goods and services 50% GDP spent on services Favorable exchange rate between USD and Indian Rupee Only 56% of population have access to electricity Membership in Indian Wind Turbine Manufactures Association (IWTMA) India has the 5th largest wind capacity in the World (potential energy production from wind) Wind generates only 1.6% of power for the country of India India has not meet the target to add 6,000 MV wind power by 2012 India has strong competition among alternate energy firms to include Suzlon, the Threats world’s leading global wind manufacturer. Growing left-wing Communist Party: Anti-reform and Anti-privatization Hostile, lawless regions still exist Dispute with Pakistan over Kashmir region Wide scale government and judicial system corruption Ethnic and left-wing insurgencies Terrorist activities Wind Street Energy has chosen an international strategy, which will comply with goals to maximize the value of the company for owners and stockholders (Hill, 2009); thus, the business expansion in India will increase profitability and profit growth. Wind Street Energy believes the Analysis 10 company has the needed competitive advantage, internal operations and organizational structure to create value for the country of India and APGENCO. International strategy will allow Wind Street Energy to sell a product and service developed for universal needs to a foreign country with minimal local customization required. Research and development will remain in the US and in conjunction with APGENCO, final assemble, manufacturing and marketing will be conducted in India. Two modes of entry to include turnkey and joint venture are suitable for Wind Street Energy’s global expansion strategic plans. The preferred mode of entry is the “turnkey” project, which is best suited for electrical distribution organizations in which specialization in design, construction, startup, and training is vital to a successful business venture (Hill, 2009). Using a turnkey mode of entry will require Wind Street Energy to handle every detail of the project for APGENCO. At project or contract completion, APGENCO will be given the rights to take over the operation; in other words, APGENCO will be handed the “key” to the wind farm and controls. Indefinite contracts will be in place to provide APGENCO with future R&D upgrades, customer support and employee training. Wind Street Energy is also currently in negotiations with APGENCO and the Government of India to study the possibilities of adding additional wind farm sites in addition to current plans. The advantages of a turnkey mode of entry is that Wind Street Energy will stay true to its core competencies, which include manufacturing, design and support of wind production technology. Economic risk is also lessoned because India tightly controls joint ventures and has to some degree experienced political and economic instability, which may have a negative effect on profitability and profit growth. Wind Street Energy believes the turnkey project will not create additional competitors only additional partners in Analysis 11 “clean” energy. Plus, current contracts have language for continuous R&D, product support and training. Wind Street Energy will use various control and evaluation methods to include payback, discounted payback, net present value, and Internal Rate of Return (IRR) (hill, 2009). The payback method measures the risk involved in an investment opportunity (payback, 2010). The discounted payback method is similar to the payback method but adjusts for the time value of money (discounted, 2010). The IRR makes the net present value of all cash flows from a particular project equal to zero; thus, the higher a project's internal rate of return, the more desirable it is to undertake the project (IRR, 2010). In conclusion, Wind Street Energy’s plans to enter India’s market by partnering with APGENCO will not be without risks. However, careful planning can help the firm mitigate the risks, and ensure profitability of the Wind Turbine industry in India. The mitigation strategies, market planning, strategic and contingency plans all work together to help make this endeavor a success. Although the challenges exist in any new market entry, India’s improving political stability, environment and macroeconomic economy offer an opportunity to bring wind power to half of the nation’s large population, thus serving as a springboard to wind turbine operations around the world. Analysis 12 References Discounted Payback Method. (2010). Investopedia. Retrieved April 10, 2010 from http://www.investopedia.com Hill, C. (2009). International Business. Competing in a Global Marketplace. 7th ed. from https://ecampus.phoenix.edu/content/ebooklibrary2/content/eReader.aspx India to add 6,000 MV by 2012; but Below Target. (2010 Apr 9). Business Standard. Retrieved April 9, 2010 from http://www.business-standard.com/india/storypage.php?tp=on&autono=44562 Internal Rate of Return. (2010). Investopedia. Retrieved April 10, 2010 from http://www.investopedia.com Marketing Mix and 4 P’s, (2010). Mind tools. Retrieved April 10, 2010, from http://www.mindtools.com/pages/article/newSTR_94.html Payback Method. (2010). Investopedia. Retrieved April 10, 2010 from http://www.investopedia.com South Asia: India (2010 Apr 7). The World Fact book. Central Intelligence Agency. Retrieved April 7, 2010, from https://www.cia.gov/library/publications/the-world-factbook/geos/in.html SWOT Analysis (2007). Strategic Management. Quick MBA. Retrieved April 10, 2010 from http://www.quickmba.com/strategy/swot/ Analysis 13 Vision & Mission. (2003). APGENCO. Retrieved April 3, 2010, from http://apgenco.gov.in/default.asp. .