Brand Audit

advertisement

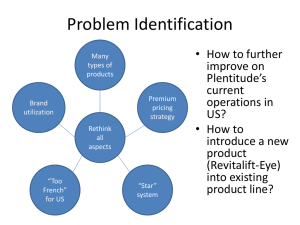

L’Oréal Paris By Gloria Garza Table of Contents I. Brand Inventory A. B. C. D. E. F. G. H. I. J. II. Company………………………………………………………………..3 Category………………………………………………………………...6 Products within category………………………………………………10 Brand Analysis…………………………………………………………13 Consumer Profile………………………………………………………14 Advertising/Marketing Communications………………………………15 Media…………………………………………………………………...16 Promotions……………………………………………………………...16 Internet and New Media………………………………………………...16 Other Pertinent Information……………………………………………..16 Brand Exploratory A. Research Methods………………………………………………………18 B. Recommendations………………………………………………………19 Works Cited…………………………………………………………………20 I. Brand Inventory 2 A. Company: L’Oreal Paris • Location: L’Oreal International headquarters are located in Clichy Cedes France. However, L’Oreal has many other subsidiaries located all around the world including the United States, Mexico, Canada, Israel, South Africa, Australia, China, and India (L’Oreal around the world). • Organization and major activities, subsidiaries: 1. Organization: L’Oreal is an organization that “relies on global research and innovation, a unique portfolio of brands organized by distribution channel, and integrated industrial production.” (Loreal.com) 2. Major Activities: L’Oreal’s major activities consist of creating and developing cosmetic products. These cosmetic products include: hair care, hair coloring, skin-care, makeup, and perfume. (Loreal.com) 3. Subsidiaries: The Body Shop became L’Oreal’s subsidiary after its acquisition in 2006. (L’oreal.com) • Brand History: L’Oreal was created in 1909 by Eugene Schueller, a chemist who created hair dye and sold it to Parisian hairdressers (loreal.com/group/history). However, after the war in 1920 his products became popular outside of France and L’Oreal became an international brand. Since then L’Oreal has continued to grow and expand its horizons. What once was a local company specialized in hair dye products, became the world’s leader in cosmetics with thousands of brands specializing in different areas of cosmetics such as makeup, perfume, skincare, and hair products. • Financial Data: L’Oreal’s latest fiscal year (2012) was a successful year for L’Oreal. 3 Sales equaled to 22.46 billion euros, which resulted in 2.12 billion dollars more than the previous year. The following graphs provide a summar of L’Oreal’s financial performance. Performance over five years (consolidated sales) ( 2012 annual report p.88) Key figures for 2012: http://www.loreal.com/group/our-activities/key-figures.aspx 4 • Annual Report: L’Oreal’s most recent report can be found in the following link: http://www.lorealfinance.com/_docs/fichiers_contenu/0000000713/LOre al_Results_2012.pdf • Key personnel/managers (try to arrange an interview with a few key individuals): L’Oreal’s executive committee is formed of 15 members led by JeanPaul Agon, the chairman and CEO of L’Oreal (2012 Annual report p.12-13). o o o o o o o o o o o o o o Laurent Attal: Executive VP Research & Innovation Jean-Philippe Blanpain: Executive VP Operations Nicolas Hieronimus: President Selective Divisions Brigitte Liberman: President Active Cosmetics Division Marc Menesguen: President Consumer Products Division Christian Mulliez: Executive VP Administration and Finance Alexis Perakis-Valat: Executive VP Asia Pacific Zone Alexandre Popoff: Eexecutive VP Eastern Europe Zone Sara Ravella: Executive VP Communication, Sustainability and Public Affairs Frederic Roze: Executive VP of the Americas Zone Geoff Skingsley: Executive VP Africa-Middle East Zone Jerome Tixier: Executive VP Human Resources and Advisor to the Chairman An Verhulst-Santos: President Professional Products Division Jochen Zaumseil: Executive VP Western Europe Zone Recent news (from online database sources, newspapers, etc.) L’Oreal creates a group travel retail division (11.21.2013) 5 L’Oreal announced that it would create a travel retail division that will include products from its luxe, consumer products, and professional products division. http://www.loreal.com/Finance.aspx?topcode=CorpTopic_Secondary_Medi as_FinanceNews&id=929 Melbourne Fashion Festival drops L’Oreal as naming rights sponsor (11.26.2013) In this article the magazine mentions how L’Oreal will no longer be the principal sponsor of Melbourne’s fashion festival. http://www.marketingmag.com.au/news/melbourne-fashion-festival-dropsloreal-as-title-sponsor-46556/#.UpVzF6X5FiE L’Oreal “gobsmacked” after Adele turns down $19 million contract (11.10.13) L’Oreal was in negotiations with Adele on a $19 million dollars contract because she didn’t want to have her name associated with any other brand. http://www.washingtontimes.com/news/2013/nov/10/loreal-godsmackedafter-adele-turns-down-19-millio/ B. Category • Category Definition: Cosmetics company. • Size of category in units, dollars, etc: L’Oreal organizes its brands and products in 7 divisions. These divisions include: L’Oreal luxe, consumer products, active cosmetics, professional products, The Body Shop and Galderma (lorealfinance.com/eng/brands.com). The following pie chart demonstrates the 2012 consolidated sales of the cosmetic branch by division (2012 annual report p.88). 6 - L’Oreal Luxe: Offers different domains of luxury beauty, skincare, make up, fragrances and hair care. Their goal is to offer high quality products through a selective distribution channel. Brands that are included in this division are: Lancôme, Kiehl’s, and Giorgio Armani. - Consumer products: This division offers “the best in cosmetics innovation to the greatest number of people on every continent.”(Loreal.comfinance.com/eng/brands.com). To provide their products to the largest number of people this division’s brands are available in mass-market channels like supermarkets and drugstores. Some brands that belong to this category are: Garnier, L’Oreal Paris, Maybelline New York. 7 - Professional products: This division offers hair products with the highest standards of quality. These brands include Redken, Kerastase, and Matrix (lorealfinance.com/eng/brands.com). - Active cosmetics: Focuses on products for skin that “is half way between healthy and problem skin.” (loreal-finance.com/eng/brands.com). These products are distributed through pharmacies, beauty and health retailers, drugstores and medi-spas. This division is the world’s number one in dermocosmetics (loreal-finance.com/eng/brands.com). Some brands include Vichy, Skinceuticals, La Roche-Posay. - Body shop - Galderma. • Category history and growth The following graph represents the “Worldwide cosmetics market from 2003 to 2012” in annual growth rate as a percentage. It demonstrates how the cosmetics market has grown in the past 9 years (2012 annual report p.87). 8 • Category growth projections There was no information available. • Distribution channels/methods of distribution There are different distribution channels depending on the division the product is categorized in. For example, higher end brands such as Kiehl’s and Lancôme have a selective distribution channel and can be found in stores such as Sephora, Ulta, and Macy’s. Consumer products can be found in more convenient channels such as supermarkets and drug stores. (loreal-finance.com/eng/brands.com). • Major manufacturers/players: L’Oreal has an integrated production facility and has 41 factories around the world that produce almost 90% of all the units of the cosmetics products sold by L’Oreal. It also only has one single unit, the Operations Division that is in charge of worldwide production and product distribution. Under this division, 7 lines of business (purchasing, packaging, production, quality, logistics, environment, hygiene and safety) are integrated. In a few words, the Operations Division is in charge of the entire production chain, from beginning to end (loreal.com/group/group-activities). • Seasonal factors Cosmetics are products that can be worn and used throughout the entire year. However, there are some seasonal factors that can increase the likelihood of certain products being bought more at certain times of the year. For example, sales of skin care products such as sunscreen will be higher during the summer time than the wintertime. For makeup, the same time of products might be bought (mascaras, lip-glosses, foundations) but the shades of colors being bought might be different depending on the season. For example, it might be more likely that a consumer will buy darker shades in the fall/winter, and brighter colors during the spring/summer. • Regional factors: One thing L’Oreal is very good at is creating and adapting products according to the region they are going to be sold in. How they are able to do this is by locating their research facilities in the main regions so that they may develop 9 products specific to that region’s need. An example that is provided in the company’s annual report is a black eyeliner “Colossal Kajal” by Maybelline New York that has been created specifically for India. This eyeliner was inspired by an ancient beauty ritual Indian women have in which they apply a black paste to “emphasize and care for their eyes” (2012 annual report p.21). Through research and innovation Maybelline was able to create an eyeliner that would provide them with the qualities and benefits Indian women seek in this beauty ritual (2012 annual report p.21). • Other relevant category factors N/A • Legal considerations Legal considerations can vary depending on the country. In the U.S.A there are different standards that FDA has created and that L’Oreal has to abide by. Some regulations that the FDA has in the U.S is that anybody who is involved in the cosmetics commerce, whether it be a manufacturer or retailer, has to ensure that the product has not been “adulterated or misbranded” (fda.gov/cosmetics). • Major trade publications For the cosmetics industry there are several trade magazines including: Happi, GCI magazine, Skin Inc. magazine, Modern Salon (chemistcorner.com). • Major trade organizations in category L’Oreal U.S.A is a member of the National Advertising Review Board panel, which is the review board within the Advertising Self Regulatory Council (ASRC) (fairworldproject.org). C. Products Within Category • Share of category by product Since L’Oreal has a large selection of products due to the many brands it owns, we will instead discuss the share of category by the type of product (i.e.: skincare, makeup, etc.). 10 The following chart provides a breakdown of the 2012 consolidated sales of the cosmetics branch by business segment (2012 annual report p.88). • Product-form description (size, flavor, model, etc.) L’Oreal has different skincare, makeup, hair care, hair colorants and perfume products from different brands. Sizing varies according to the brand and the product they’re offering. • New product introductions (in the United States) “Magic Nude is our 1st revolutionary liquid-powder formula that glides on and transforms to a fresh, powder-like finish. It's so light, like you're wearing no makeup at all!” (lorealparisusa.com/en/brands) 11 “EverCurl is Sulfate-Free so curls are left hydrated, defined and full of bounce. Our formulas, with Hibiscus Extract and Grape Seed Oil, nourish and care for curls while also imparting fruity and floral fragrance notes. Find your must-have curl product for wavy hair - Silk & Gloss Dual Oil care, curly - Sculpt and Hold Cream-Gel, coily - Cleansing Conditioner.” (lorealparisusa.com/en/brands) “From L’Oréal Paris, a breakthrough mascara innovation to deliver a bold lash effect. The breakthrough wing tip brush catches lashes and extends to the outer corners of the eye. The new fiber infused formula delivers lashes with up to 6x more volume.” (lorealparisusa.com/en/brands) • Benefits and appeals of new products Some benefits and appeals of the products mentioned above are: bold eye lashes, a shampoo and other hair products to help control curls, and having coverage without making you feel like you’re wearing makeup. 12 • New packages, innovations, etc. L’Oreal is a company that is continuously innovating and that is largely due to its many research facilities across the world. It is currently working on beauty products that provide different benefits consumers around the world are looking for such as a lip-gloss that will continue to provide color without the sticky feeling (2012 annual report p.76). • Recent news about product category N/A D. Brand Analysis • Top brands by dollar or unit sales There was no information on the top brands by dollar or unit sales. •Growth trends of top brands N/A • Category share by country and by region The following chart shows a category share by geographic zone according to the 2012 consolidated sales (2012 annual report p.88). • Pricing trends Prices vary among countries. 13 • Recent news about brand N/A E. Consumer Profile • Demographics of users Most of L’Oreal’s consumers are female because the majority of its products are targeted towards women (lipsticks, eye-make up, nail polishes, etc). However, it also carries colognes, skin products and hair products for men. There is no data on L’Oreal’s annual report about it’s consumer profile, but it can be guessed that most of its products are being targeted towards a consumer of 17 years old and older. • Frequency of purchase/usage There was no information about the frequency or usage of the product in L’Oreal’s website but since most of the products are daily use products (such as makeup, skincare and hair products) the frequency of the usage is quite high. • Place of purchase The place of purchase varies on the product and brand the consumer is buying. For more luxurious and/or professional products of brands like Lancôme and Kerasotes, they might be found at higher-end stores like Macy’s. For more common brands like Maybelline, the place of purchase can vary from drugstores to stores like Wal-Mart and Target. • Heavy-user profile N/A • Awareness and attitudes toward brand There wasn’t much information about brand awareness and attitudes toward the brand. However I conducted my own survey and it seemed that there was awareness for the L’Oreal but not for many of it’s other brands. It also appeared that L’Oreal was not their “go-to” brand for cosmetics. Further discussion will be provided in part II “Brand Exploratory.” 14 • Decision-makers vs. purchaser (same, different? If different, what is purchase decision like?) Decision-makers are the same as purchaser because usually the products are personal products since cosmetic choices are based on the consumer/purchaser’s specific needs and preferences. • Normal purchase cycle n/a • Brand loyalty/switching n/a F. Advertising/Marketing Communications Messages • Creative strategies of top brands -In India Maybelline New York used Facebook to promote their new Colossal Kajal Kohl (an eyeliner). This strategy was very successful as sales doubled in just a few months (2012 annual report p. 25). -True Match by L’Oreal Paris had a new marketing campaign that was represented by 4 brand ambassadors from different cultural backgrounds to represent the diversity of different skin colors. These ambassadors included Beyoncé Knowles, Jennifer Lopez, Liya Kebede and Aimee Mullins. A unique aspect about this marketing campaign is that they created an app, True Match Maker, which allows women to find the right shade for their skin color. It has been so successful that one million consumers have found their true match through the app (2012 annual report p.45). • Specific promises, appeals, claims, special effects Specific appeals for Colossal Kajal, is that women are getting a modern product while remaining close to tradition. Appeals for Color True Match is that women will be able to find the right color foundation for them. • Examples of past and current executions n/a 15 G. Media • Category and brand spending According to L’Oreal’s annual report, advertising and marketing and promotional expenses equaled to a 30.2% of sales (p.89) in 2012 (2012 annual report p.89). • Seasonality (by quarter) N/A • Regionality (spot buying) N/A • Media employed by top brands L’Oreal’s top brands use a variety of media including magazine advertising, TV commercials and social media. • Spending patterns – flighting, continuous, etc. N/A • Spending compared with market share N/A H. Promotions • Promotions used in category Promotions vary depending on region and brand. • Major brand promotion types and examples Some examples include buy one and get one half off, buy one and get a free sample. • Success rates of promotions n/a I. Internet and New Media • Website/URL -Company Official website: http://www.loreal.com -L’Oreal U.S.A website: http://www.lorealusa.com/_en/_us/ -L’Oreal product website: http://www.lorealparisusa.com/?cid=lorus_rm_Google_Brand+Brand_Lorea l&gclid=CKSqqKLNtrsCFclcMgodQAIAoQ 16 • Purpose of site: -Company official website: To provide information about L’Oreal Paris internationally, it’s brands, financial reports, news, careers etc. -L’Oreal U.S.A: same as above but with a focus on the United States sector. -L’Oreal product website: To provide consumers information about new and existing products. They also provide makeup tips, apps for hair color and makeup. • e-commerce activities: The L’Oreal product website has the option for customers to purchase online or find the in a store near them. • Social media activities: They have a twitter, Facebook and a youtube channel. In their YouTube channel they have a lot of behind the scenes videos of photo shoots. They also have “how to” makeup videos with professional makeup artists. In their twitter and Facebook page they send out informational tweets about their products. J. Other Pertinent Information • Personal interviews n/a • Other information sources n/a 17 II. Brand exploratory A. Research: A survey of 23 participants was conducted in which participants were asked questions to find out more about L’Oreal’s brand awareness. The participants consisted of all females between the ages of 17 and 22 years old and out of these 23 participants 56% said that they occasionally used L’Oreal products (see graph below). How familiar are you with L’Oreal and it’s products? Participants were then asked to select the brands they recognized. The following graph represents the choices and how many participants recognized them. 18 Results seem pretty good, with most brands being recognized with the exception of Vichy and La Roche-Posay, who weren’t recognized by as many participants. However, one interesting thing was that when participants were asked if they knew that all of the brands above belonged to the L’Oreal group, 100% of participants answered no. Another interesting finding was when participants were asked, “ What brand first comes to mind in the cosmetics industry?” Out of 23 participants only 2 out of 23 participants said L’oreal, and 2 other said Maybelline. The most popular responses were Cover girl (5 responses) and MAC (5 responses). B. Recommendation From the various secondary research I have conducted, L’Oreal is the largest cosmetics company in the world. They have many well-known brands as part of their group, which helps their sales. However, my primary research shows that L’Oreal is not the first brand that comes to mind in the female consumer between the ages of 17 and 22. I think that this is because a lot of the products L’Oreal creates seem to be targeted towards an older audience, and their brand ambassadors are always women between the ages of 27 and older. What L’Oreal could do is to get younger celebrities to represent a new product line that is more attractive to a younger audience. The reason why I think it is important to increase awareness and likeability of the L’Oreal brand in this younger generation is because if L’Oreal doesn’t create that personal relationship with this younger generation now, in a few years they will struggle to make them buyers of L’Oreal products. 19 Works Cited L’Oreal. Key figures. Web. 4. Dec. 2013 http://www.loreal.com/group/ouractivities/key-figures.aspx L’Oreal. Organization. Web. 4. Dec. 2013 http://www.loreal.com/group/ouractivities/organization.aspx L’Oreal. Activities. Web. 4. Dec. 2013 http://www.loreal.com/group/ouractivities.aspx L’Oreal. Around the World. Web. 4. Dec. 2013 http://www.loreal.com/group/ouractivities/loreal-around-the-world.aspx L’Oreal. Brands. Web. 7. Dec. 2013. http://www.loreal.com/brands/brandshomepage.aspx FDA. Cosmetics. Web. 10.Dec.2013 http://www.fda.gov/Cosmetics/GuidanceComplianceRegulatoryInformation/ default.htm Chemist corner.Top cosmetic industry magazines you should be reading. Web. 10. Dec.2013 http://chemistscorner.com/top-cosmetic-industry-magazines-youshould-be-reading/ Fair world project. Voices of Fair Trade. Web. 15.Dec.2013. http://fairworldproject.org/voices-of-fair-trade/alternative-trade-organizationsand-the-fair-trade-movement/ L’Oreal. Voluminous Butterfly. Web. 14.Dec. 2013 http://www.lorealparisusa.com/en/Brands/Makeup/Voluminous-Butterfly.aspx L’Oreal. Magic Nude. Web. 14.Dec. 2013 http://www.lorealparisusa.com/en/Brands/Makeup/Magic%20Nude.aspx L’Oreal. EverCurl. Web. 14.Dec. 2013 20 http://www.lorealparisusa.com/en/Brands/Hair-Care-Styling/EverCurl.aspx L’Oreal. History. Web. 9.Dec. 2013 http://www.loreal.com/group/history.aspx L’Oreal. Annual Report. Web. 9.Dec. 2013 http://www.loreal-finance.com/eng/annual-report 21