In order to configure IBM Sterling to calculate tax for return orders, it

advertisement

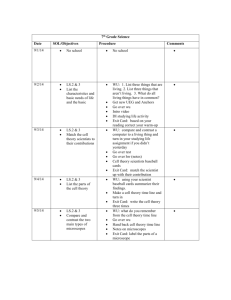

Avalara Tax Configuration Guide Avalara Tax Configuration.docx Version Code: V 1.0 Lightwell Avalara Tax Configuration guide Document Distribution and Change Notification This document is available from the author. When reissued with changes, the document owner will notify all users, either by personal note, or general notice on the appropriate forum. Summary of Changes Changes resulting in document revisions will be summarized in this table in chronological sequence. Revision bars (|) will highlight the text changed in new document versions. Version 1.0 2.0 Date 12/04/2014 16/07/2014 Avalara Tax Configuration Author(s) Lightwell Lightwell Change Description Initial Draft Avalara user guide Contents 1. User Exit Management Configuration ............................................................................................................................ 4 1.1 Sales Order .............................................................................................................................................................. 4 1.2 Return Order ........................................................................................................................................................... 5 2. Customer Overrides settings........................................................................................................................................... 7 3. Testing Avalara connection ............................................................................................................................................. 8 4. Setting up Tax codes for Items ........................................................................................................................................ 8 5. Common code setup for Shipping Tax .......................................................................................................................... 10 6. Common code setup for taxable discounts .................................................................................................................. 11 Avalara Tax Configuration 1. User Exit Management Configuration 1.1 Sales Order In order to configure IBM Sterling to calculate tax for sales orders, it needs to be implemented under the correct user exit. This integration will make use of the following Sterling User Exit to make calls to Avalara to make the tax calculations and update the tax for the order: YFSRecalculateLineTaxUE: used to recalculate the tax for the order at the line level. This user exit is called at the Change Price order modification, when the shipping address changes, at invoicing, and at the calculation of release costs. It is also invoked when the SettledQuantity of an order line changes in order to compute the SettledAmount; these taxes are not stored separately and are only rolled up into the SettledAmount. This user Exit will be implemented by custom made java code to calculate the tax using the Avalara API. These are the steps to enable tax calculation on orders, to disable it please remove this UE configuration: a) Log on to IBM Application Console with your username and password. b) Click on Configuration, and then Launch Applications Manager. c) Select Application platform > System Administration > User Exit Management > com.yantra.yfs.japi.ue.YFSRecalculateLineTaxUE > Click the green plus next to User Exit Implementation List: d) Select sales order as Document Type, and enter - com.oxford.oms.ue.CalculateTax under Implement as Java class. Lightwell Confidential Page 4 3/23/2016 1.2 Return Order In order to configure IBM Sterling to calculate tax for return orders, it needs to be implemented under the correct user exit. This integration will make use of the following Sterling User Exit to make calls to Avalara to make the tax calculations and update the tax for the return order: YFSRecalculateLineTaxUE: used to recalculate the tax for the return order at the line level. This user exit is called at the Change Price order modification, when the shipping address changes, at invoicing, and at the calculation of release costs. It is also invoked when the SettledQuantity of an order line changes in order to compute the SettledAmount; these taxes are not stored separately and are only rolled up into the SettledAmount. OMPGetReturnOrderPriceUE: The OMPGetReturnOrderPriceUE user exit is called to compute the refund amount on return orders. This user Exit will be implemented by custom made java code to calculate the tax using the Avalara API. These are the steps to enable tax calculation on return orders, to disable it please remove this UE configuration: a) Log on to IBM Application Console with your username and password. b) Click on Configuration, and then Launch Applications Manager. c) Select Application platform > System Administration > User Exit Management > com.yantra.yfs.japi.ue.YFSRecalculateLineTaxUE > Click the green plus next to User Exit Implementation List: d) Select Return order as Document Type, and enter - com.oxford.oms.ue.CalculateTax under Implement as Java class. Lightwell Confidential Page 5 3/23/2016 e) Close, and find com.yantra.yfs.japi.ue.OMPGetReturnOrderPriceUE, double click and put Return Order as Document Type, and enter com.oxford.oms.ue.CalculateReturnTax under Implement as Java… and save. Lightwell Confidential Page 6 3/23/2016 2. Customer Overrides settings Predefined integration services in Sterling use property file entries as placeholders for actual names. These include values for things like queue names, provider URLs, QCF lookups, and more. The following property file entries must be updated with the values appropriate to the implementation. Note the values for the Account/CustomerCode/CompanyCode are specific to the customer, and the URL is either the development URL or the production URL, in this example we have the development URL. customer_overrides.properties Property Name yfs.avatax4j.url Value https://development.avalara.net Description Development: https://development.avalara.net/ Production: https://avatax.avalara.net/ yfs.avatax4j.account 1100139003 yfs.avatax4j.license 4962709BCBB8D2F3 yfs.avatax4j.CustomerCode anonymous yfs.avatax4j.CompanyCode Oxford yfs.taxEngine com.oxford.oms.api.AvalaraTax yfs.returnTaxEngine com.oxford.oms.api.AvalaraTaxReturn yfs.returnTaxMethod calculateReturnTax yfs.taxMethod calculateTax Lightwell Confidential Page 7 The unique account number provided by Avalara for verification against the service. The unique alpha-numeric key provided by Avalara for verification against the service. The client application customer reference code. This is required since it is the key to the Exemption Certificate Management Service in the Admin Console. It is mapped to CustomerRewardsNo in Sterling, and if this field is blank, then it uses the value here ‘anonymous’ because a value needs to be sent for CustomerCode. The code that identifies the company in the AvaTax account in which the document should be posted. This code is declared during the company setup in the AvaTax Admin Console. If no value is passed, the document will be assigned to the default company. Dynamic class name for calculating Sales tax. Dynamic class name for calculating Return tax. Dynamic method name for calculating Return tax. Dynamic method name for calculating Sales tax. 3/23/2016 3. Testing Avalara connection In order to test the connection to Avalara is working, we have created a command that uses the ping operation to test the tax service connection: 1) In command prompt navigate to <SterlingHome>/Foundation/bin 2) Run testAvalaraConnection.cmd 3) If the Ping result is Success then your connection is working, otherwise check that the URL, account, and licence numbers here are correct for the development/production environment you are trying to connect to. 4. Setting up Tax codes for Items Product taxability code of the item. Can be an AvaTax system tax code, or a custom-defined tax code. They need to be setup for each Item or AvaTax will work out the tax using the default tax code P0000000 and that item will calculate as taxable. To set this up for an Item: 1) Log into IBM Sterling Business Center Lightwell Confidential Page 8 3/23/2016 2) Click on Products, then Find Item: 3) Search for the item that you wish to add tax code 4) Under Specifications on the left panel, choose Manage Classification Values then enter the tax code in the Tax Product Code box and save. Lightwell Confidential Page 9 3/23/2016 5. Common code setup for Shipping Tax 1. Create a new custom common code type in application manager by selecting Application Platform > Presentation > Custom Common Code Types and click on the green cross to add another Custom Common code type. 2. Enter the following: Code Type: TAX_PROD_CODE Short Description: Tax Product Code Long Description: Tax Product Code 3. For the new code type, create a new common code value as follows: Tax Product Code: DEFAULT_SHIPPING Short Description: field contains the value of the tax produce code (EX : FR) Long Description: Any description for the code value This will assign FR as the tax code for charge name Shipping. Lightwell Confidential Page 10 3/23/2016 6. Common code setup for taxable discounts 4. Create a new custom common code type in application manager by selecting Application Platform > Presentation > Custom Common Code Types and click on the green cross to add another Custom Common code type. 5. Enter the following: Code Type: DISCOUNT_CHARGE_CODE Short Description: Discount Charge Code Long Description: Discount Charge Code 6. Create a new custom common codes in application manager by selecting Application Platform > Presentation > Custom Common Code Types and click on the green cross to add another Custom Common codes. 7. Enter the following: Code Value: Manufacturer Description: Y This means that any charge codes that are named Manufacturer under discount charge name will be taxed. Lightwell Confidential Page 11 3/23/2016