Seminar 7 - Presentation of Mauro (1995)

advertisement

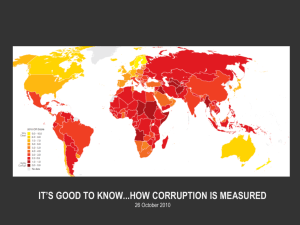

GROWTH AND CORRUPTION Introduction • Malfunctioning government institutions as severe obstacles to investment, entreprenuership and innovasion – Inefficient judicial system – Low security of property right – Cumbursom and dishonest bureaucracies • Debate on the impact of Corruption on Growth – Positive impact on growth – Negative impact on growth Introduction (cont’d) • Although most economists agree that efficient government institutions foster economic growth not much is know about the magnitude • The paper tries to identify the channels through which corruption and other institutional factors affect economic growth and the magnitude of the effect • In order to fix the problem of endogeniety the index of ethnolinguistic fractionalization is used as an instrument for the institutional factors • The paper found that corruption lowers investment and growth Data • The BI Indices of Corruption and Institutional Efficiency – Data gathered from BI correspondents and analysts based in each country – Nine selected indices: insitutional change, social change, oppostion takeover, stability of labor, relationship with neighbors,terrorism, judiciary system, red tape and corruption – All BI indices are postively and strognly correlated • E.g., corruption vs red tape – Bureaucratic efficiency proxied by the average of judiciary system, red tape and corruption indices – Political stability proxied by the average of the other six indices Data (cont’d) – All the nine indices can be aggregated to give an average index of institutional efficiency – Richer countries and fast growing countries tend to have better institutions than poorer countries. But, there are exceptions: Thailand (most corrupt but good economic performance) and Korea (fast growth but relatively inefficient institutions) – Strong association between bureaucratic efficiency and political stability: there is strond correlation between two varibles and most countries lie in the same quintile based on the two indices (this does not apply to all countries however) Data (cont’d) – The fact that the indices reflect the subjective opinions of BI’s correspondents has both advantages and disadvantages: • the addvatage is related with the political stability variables. • One disadvantage is the problem of unclear scale of measurement. • An even more serious disadvantage that the correspondents evaluation of the difference indices might have been influenced by the economic performance of the country – In addition to the possible measurement error, economic perfomance may affect institutional effieciency – In order to fix the problem of endogeniety arising either from measruement error or geniunn endogeniety, an index of ethnolinguistic fractionalization was used as an instrument Data (cont’d) • The Index of Ethnolinguistic Fractionalization (ELF) and Other Variables – The raw data from which ELF index was constructed refer to 1960 and the source is Deparment of Geodesy and Cargography of the State Geology Committee of the USSR 1964 – The criteria for characterizing groups as ethnically separate was based on historical linguistic origin – The ELF index can be given as follows: ELF = 1- Where ni is the number of people in the ith group, N is the total population and I is the number of ethnolinguistic groups in the country. Data (cont’d) – Assumed that ELF is is exogenous and unrelated to economic variables except through its effects on institutional effeciency; it is a valid instrument – Negative and significant correlation between institutional efficiency and ethnolinguistic fractionalization. Ethinic conflict may lead to political instability. The presence of many different ethnolinguistic groups worsens corruption – ELF index is a valid instrument only for institutional efficiency index – Varible related with collenial history was also used based on the data sources of Encyclopedia Britannica and the World Handbook of Political and Social Indicators Emperical Estimates • Corruption and Investment – Corruption affects investment rate negatively and significantly both in the OLS and 2SLS estimates using the simple corruption index – The magnitude is also considerable: a one SD increase in the corruption index is associated with an increase in the investment rate by 2% of GDP – The slope coeffiecient does not significanlty differ in lowred-tape and high-red-tape sub-samples of countries – Similar result is observed when the bureaucratic efficiency index is used instead of the simple corruption index Empirical Estmates (cont’d) – Equipment invesment which is more related with growth is significanlty more closely associated with bureaucratic efficiency than nonequipment investment – Both the simple corruption index and bureacratic inefficiency are negatively associated with the investment rate even after controlling for a variety of other determinants of investment – The main channel through which bad institutions affect the growth rate is by lowering the invesment rate Empirical Estimates (cont’d) • Corruption and Growth – The corruption and the bureaucratic effieciency indices both significantly affect average per capita GDP growth – The result is robust to different specification of control variables – The null hypothesis of no relationship between investment and corruption can be rejected at a level of significance higher than the null hypothesis of no relationship between growth and corruption can – In the context of an endogenous growth model, bureaucratic inefficiency could affect growth indireclty through investment or directly – Similarly, in neoclassical growth models, corruption could affect the steady-state level of income • E.g, through missallocation of production among sectors Empirical Estimates (cont’d) – When investment is included as a an independent variable in the growth regression, the bureacratic efficiency and corruption indices will either become insignificant or their slope become smaller – Investment may also be affected by growth (endogeneity problem) – 2SLS was used using the nine BI indices – There is only weak support for the hypothesis that corruption reduces growth by leading to inefficient investment choices – A considerable portion of the effects of corruption on growth works through its effects on the total amounts of investment Conclusion • The negative association between corruption and investment as well as growth is significant in both a statistical and an economic sense • The result is robust to different regression specifications including IV estimation and inclusion of relevant factors • Three areas for further research inlcude – The positive and significant correlation between indices of bureaucratic efficiency and political stabilty • Stratagic complementarity may be one explanation Conclusion (cont’d) – The behavior of different types of governments with respect to the compostion of government expenditure; e.g, corrupt governements may invest less on education – The reverse causal link from poverty to bad institutions; persistent poverty may lead to bad institutions