Protecting Yourself as a 401(k) Plan Fiduciary

advertisement

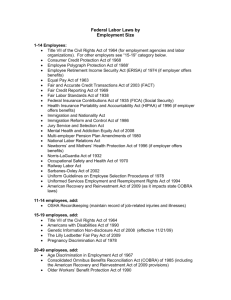

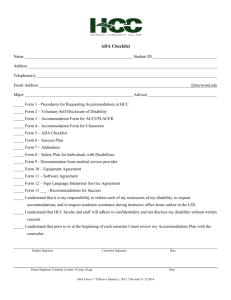

February 20, 2009 Times of Change and Your HR Responsibilities Presenters Chuck Campbell & Matt Dow Jackson Walker L.L.P. 401 Congress Avenue, 14th Floor, Austin, TX 78701 512-473-4520 Overview: • • • • • • Why do we have the ADA? What did the ADA originally say? How was the ADA interpreted? What caused the ADA to be changed? How has the ADA been changed? What difference will this make to you? Who Is Covered Under the ADA? • ADA prohibits discrimination against any qualified individual with a disability and requires employers to provide reasonable accommodations to enable such individuals to perform the essential functions of their job • It is not always apparent which employees or prospective employees are “disabled.” Who Is Covered Under the ADA? • At the outset, it was obvious that a person walking into your office with a cane and dark glasses or arriving in your office in a wheelchair was “disabled.” • But the drafters of the ADA had larger ambitions and wanted to include more people within the category of “disabled” individuals. • So they set about defining “disability” more broadly. Who Is Covered Under the ADA? • But they also had to recognize that employers should not be obligated to hire a person with a disability who was not qualified to work. • This led to the concept of the “qualified individual with a disability.” Who Is Covered Under the ADA? • The ADA accordingly prohibited discrimination against any qualified person who • had a disability and who, • with or without reasonable accommodation, • could perform the essential functions of the job in question. ADA: The Early Experience • At the beginning of the ADA’s application to the workplace, the anticipated claims were made • blind individuals denied an opportunity to perform tasks for which they were qualified; • wheelchair bound individuals claimed they could operate a computer if the keyboard and the screen were modified to permit them to have access to it; • diabetics claimed their frequent need to take medication required that they be accommodated with additional absences. ADA: The Early Experience • Unfortunately, there were also the “other claims,” such as • worker who went on a violent rampage in the workplace and then claimed his termination was a violation of the ADA because he had a psychological impairment at the time and was otherwise qualified to do his job, or • truck driver who claimed he was not hired in violation of the ADA because his vision was too poor to see the roadway but who claimed that he could and should have been accommodated. Death Knell for the Original ADA: Sutton v. United Air Lines • The struggles the courts had with claims like these reached its apex in 1999, when a trio of cases came before the U.S. Supreme Court. • The most prominent of these was Sutton v. United Air Lines. Death Knell for the Original ADA: Sutton v. United Air Lines • In the Sutton case, two women sued United Air Lines because they were excluded from its pilot training program. • They were twin sisters who had severe myopia. Without corrective lenses, they could not see to conduct numerous daily activities; with corrective measures, both allegedly were able to function identically to individuals without similar impairments. Death Knell for the Original ADA: Sutton v. United Air Lines • They applied to be commercial airline pilots, but were told by United Air Lines they could not qualify because it had a requirement that pilots have uncorrected vision of 20/100 or better. • Their uncorrected vision was 20/600. • They then sued under the ADA, claiming that their severe myopia was a “substantially limiting” impairment, entitling them to be classified as “disabled.” Death Knell for the Original ADA: Sutton v. United Air Lines • The Supreme Court rejected their claim. • “Looking at the Act as a whole, it is apparent that if a person is taking measures to correct for, or mitigate, a physical or mental impairment, the effects of those measures––both positive and negative––must be taken into account when judging whether that person is ‘substantially limited’ in a major life activity and thus ‘disabled’ under the Act.” Death Knell for the Original ADA: Sutton v. United Air Lines • The Court concluded that a person could only be “disabled” within the meaning of the ADA if the person was presently—as opposed to potentially or hypothetically—substantially limited in a major life activity. Thus, if an impairment could be corrected by mitigating measures, the Court held that the impairment did not “substantially limit” a major life activity Sutton v. United Air Lines • The dissent pointed out that the impact of the ruling by the Court would be to exclude a person with an artificial limb from being “disabled” because the artificial limb was a “corrective device” enabling the individual to enjoy most of life’s major activities. ADAAA Findings & Purpose • Sutton took away ADA protection for people who should have it; • Supreme Court held that “mitigating measures” such as insulin to control diabetes must be considered in determining whether an impairment qualifies as a disability; • ADAAA prohibits ameliorative effects of mitigating measures • Reinstate broad scope of protection Congress intended under ADA The Amendments – Definition of Disability • A physical or mental impairment that substantially limits one or more major life functions • Greatly expands the scope of employees covered by changing the interpretations of terms • Definition of disability must be broadly construed • Whether an individual’s impairment is a disability under the ADA should not demand extensive analysis • What does “substantially limits” mean? The Amendments – Definition of Disability (cont’d) • Major Life Activities • • • • • • • • performing manual tasks learning concentrating thinking communicating walking seeing breathing The Amendments – Definition of Disability (cont’d) • A Major Life Activity now includes Major Bodily Functions: • • • • • “[F]unctions of the immune system” Digestive functions Bladder functions Respiratory functions Reproductive functions The Amendments – Definition of Disability (cont’d) • Before employees only covered if employer regarded employee as having an impairment and regarded that impairment to substantially limit a major life activity • Now, employee only has to prove employer regarded them as having an impairment • Thus – regarded as having “such an impairment” really means regarded as having an impairment. • Episodic impairments and those in remission may be disabilities The Amendments – Definition of Disability (cont’d) • ADAAA expressly rejects consideration of the effects of mitigating measures • Mitigating measures include medication, medical supplies, low vision devices (other than eye glasses or contact lens), prosthetic limbs and devices, hearing aids, mobility devices, oxygen therapy equipment, reasonable accommodations or auxiliary aids and services, or learned behavioral or adaptive neurological modifications Reasonable Accommodation Law Unchanged • The ADA provides a right to reasonable accommodation, not to the employee’s preferred accommodation. Hedrick v. Western Reserve Care System, 355 F.3d 444, 457 (6th Cir. 2004). • EEOC Appendix A to regulations: “[T]he employer providing the accommodation has the ultimate discretion to choose between effective accommodations...” Reasonable Accommodation Law Unchanged • Employee must notify employer that adjustment or change is necessary • Request can take many forms and employee not required to specifically mention the “ADA” or “reasonable accommodation” • Interactive process! Is There Any Good News? • Reasonable accommodation unchanged • Carved out exception for eye glasses and contacts as mitigating measures • “Regarded as” does not cover minor or transitory impairments – those lasting 6 months or less (or expected to last 6 months or less) • Reverse discrimination claims prohibited • Still must be “qualified” to perform essential functions Going Forward • Don’t assume no coverage unless truly minor condition that will not last 6 months; • Tighten up job descriptions paying special attention to essential functions; • Train supervisors on new definitions to avoid “regarded as” claims; • Carefully document valid, non-disability related reasons for any job action. Going Forward • Focus of litigation will now be on whether employer failed to reasonably accommodate, not on whether employee was actually disabled; • Must perform and document reasonable accommodation process-interactive; • Draft reasonable accommodation policy that tracts EEOC regulations; • Prepare to grant more requests for accommodation than in past. NEW FMLA REGULATIONS • Includes overhaul of original regulations-does differ from proposed regulations • Adds new regulations addressing the National Defense Authorization Act of 2008, which amended the FMLA to provide for Military Family Leave MEDICAL CERTIFICATION PROCESS – TIMING • Employers may request medical certification up to five days after the employee has either given notice of need for leave or, in the case of unforeseen leave, the date the employee begins leave. • Employer may also require a new medical certification each leave year for conditions that last longer than a year. • Employer may request a recertification every six months if the leave involves an on-going “serious medical condition.” MEDICAL CERTIFICATION PROCESS – CONTENT • If employer determines medical certification is incomplete or insufficient, required that the employer inform the employee of the deficiencies in writing and provide seven calendar days to cure the deficiency. • An employer can contact the employee’s healthcare provider for clarification of information contained in medical certification. • Employer’s representative must be a healthcare provider, human resources professional, leave administrator, or a management official but never direct supervisor. FITNESS-FOR-DUTY CERTIFICATIONS • Employer may require that a fitness-for-duty certification specifically address the employee’s ability to perform the essential functions of the job. • If employer has reasonable safety concerns, may require an employee on intermittent leave to provide a fitness-for-duty certification before returning to work. EMPLOYER NOTICE OBLIGATIONS • Employers must post a general FMLA notice in the workplace and include the notice in the company’s employee handbook (use DOL form) • Electronic posting • Employers must provide a personalized eligibility notice when an employee requests FMLA leave or the employer has knowledge that leave may be FMLA qualified (use DOL form) EMPLOYER NOTICE OBLIGATIONS • Employers must issue a “rights and responsibilities” notice detailing the employee’s obligations to provide a medical certification, the right to substitute paid leave, etc. (use DOL form) • Require employers to issue a designation notice within five days after receiving sufficient information to determine that leave will be covered, notifying the employee that the leave has been designated as FMLA leave. • Increased liability for failure to provide timely notice. EMPLOYEE NOTICE REQUIREMENTS • Employee must follow the employer’s normal and customary call-in procedures, unless there are unusual circumstances • New regulation modifies requirement that employees notify their employers of need for FMLA leave up to two days after an absence; follow employer policy SERIOUS HEALTH CONDITION • New regulations do not change the six individual definitions of a serious health condition • The two visits to a healthcare provider must occur within thirty days of the incapacity • First visit must occur within seven days of the start of the incapacity • “Periodic visits to a healthcare provider” require at least two visits to a healthcare provider per year DISPUTE RESOLUTION • If a dispute arises between an employer and an employee as to whether leave qualifies as FMLA leave, it should be resolved through discussions between employee and employer. • The discussions and decision must be documented. WAIVER OF RIGHTS • Employees may now voluntarily settle their FMLA claims without court or DOL approval • Prospective waivers of FMLA rights are prohibited • Employers should modify releases to include waiver of FMLA claims WHAT SHOULD EMPLOYERS DO? • Update policies and procedures to include new regulations • Train supervisors to be aware of changes • Improve communications with employees • Discuss and document FMLA disputes • Use DOL forms MILITARY-RELATED FMLA LEAVE • • • • Two new types of Military Family Leave created Military care giver leave Qualifying exigency leave Unless otherwise noted, normal FMLA procedures apply General Provisions • Twelve weeks of FMLA leave available while employee’s spouse, son, daughter, or parent is on active duty or call to active duty for qualifying exigencies Defining “Active Duty” • Exigency leave applies only to members of the Reserve and National Guard, and certain retired members of the Regular Armed Forces and Retired Reserve. • Excludes active members of the Regular Armed Forces. • Applies only to a Federal call to active duty of a National Guard or Reserve member. A State call to active duty of National Guard or state militia is not included within this section unless under order of the President. Qualifying Exigencies • • • • • • • • Short-notice Deployment Military Events and Related Activities Childcare and School Activities Financial and Legal Arrangements Rest and Recuperation Post-Deployment Activities Counseling Additional Activities Short-Notice Deployment • Applies when a covered military member is notified of an impending call to active duty in support of a “Contingency operation” 7 or less days from date of deployment • Provides 7 days of leave from the date military member is notified of call of duty Military Events and Related Activities • Leave is permitted to attend an official ceremony, program, or event sponsored by the military that is related to active duty or call to active duty, and • To attend family support or assistance programs and informational briefings sponsored or promoted by the military, military service organization, or American Red Cross that are related to active duty or call to active duty Childcare and School Activities • Allows leave to be taken for a child who is either under 18 or 18 or older and incapable of selfcare because of a mental or physical disability in order to: • Arrange for alternative childcare • Provide childcare on an urgent, immediate need basis • Enroll the child or transfer the child to a new school or daycare facility • Attend meetings with staff at school or daycare facility Financial and Legal Arrangements • To make or update financial or legal arrangements to address the covered military member’s absence while on active duty or call to active duty status, and • To act as the covered military member’s representative before a federal, state, or local agency to obtain, arrange, or appeal military service benefits while the member is on active duty or call to active duty status, and for 90 days following termination of active duty status. Rest and Recuperation • Allows up to 5 days leave to spend time with a military member who is on short-term, temporary rest and recuperation leave during the period of deployment. Post-Deployment Activities • Allows leave to attend arrival ceremonies, reintegration briefings and events, and any other official ceremony or program sponsored by the military for 90 days following termination of covered member’s active duty (not literal 90 days but until the end of the Dep’t of Defense “Yellow Ribbon Reintegration Program”) • And allows leave to address issues that arise from the death of a member while on active duty Counseling • Allows leave to attend counseling provided by someone other than a health care provider (because otherwise covered under traditional FMLA) for oneself, the military member, or child under 18 (or 18 or over and incapable of self-care because of mental or physical disability). • Need for counseling must arise from the active duty or call to active duty status of covered military member. Additional Activities • Allows leave to address other events which arise out of covered military member’s active duty or call to active duty status. • Employer and employee must agree that such leave will qualify as an exigency, and agree to both the timing and duration of the leave. Certification Requirements for Qualifying Exigency Active Duty Orders • The first time an employee requests leave because of a qualifying exigency, may require copy of active duty orders or other military-issued documentation indicating active duty status and the dates of the active duty service. • This information need only be provided once. • May require a copy of new active duty orders if the need for leave arises out of a different active duty of the same or different covered military member. Other Required Information • An employer may require that additional information regarding the exigency be supported by a certification from the employee. • Form WH-384: http://www.dol.gov/esa/whd/forms/WH-384.pdf • No information may be required beyond that specified in this section of the regulations or on the form. Military Caregiver Leave General Provisions • Allows an eligible employee who is the spouse, son, daughter, parent or next of kin to a covered service member to take 26 workweeks of leave during a single 12 month period to care for the service member who is on the temporary disability retired list, who has a serious injury or illness incurred in the line of duty on active duty for which he or she is undergoing medical treatment, recuperation, or therapy; or otherwise in outpatient status or in the temporary disability retired list “Covered Service Member” • Includes members of the Regular Armed Forces, current members of the National Guard or Reserves, and members of the Regular Armed Forces, the National Guard and Reserves who are on temporary disability retired list. “Next of Kin” • A servicemember’s nearest blood relative other than the covered servicemember’s spouse, parent, son, or daughter, in the following order of priority: • Blood relatives who have been granted legal custody of the service member by court decree or statutory provisions • Brothers and sisters • Aunts and uncles • First cousins • Exception: if a servicemember has written designation otherwise “Serious Injury or Illness” • An injury or illness incurred by a covered servicemember in the line of duty on active duty that may render the servicemember medically unfit to perform the duties of his or her office, grade, rank, or rating. “Single 12 month period” • An eligible employee may take no more than 26 workweeks of leave during any single 12 month period. • The 26-workweek entitlement is to be applied as a perservicemember, per-injury entitlement, meaning that an eligible employee may take 26 workweeks of leave to care for one covered servicemember in a single 12-month period, and then take another 26 workweeks of leave in a different 12-month period to care for another covered servicemember or to care for the same covered servicemember with a subsequent serious injury or illness • The “single 12-month period” begins on the first day the eligible employee take military caregiver leave, and ends 12 months after that date Forfeiture of Leave • If an employee does not use his entire entitlement during the single 12-month period, the remaining workweeks of leave are forfeited. • However, an employee may be eligible to take additional periods of 26 workweeks of leave in subsequent “single 12-month periods” if the leave is to care for a different covered servicemember of to care for the same servicemember with a subsequent serious injury or illness Certification Requirements for Military Caregiver Leave Certification from Health Care Provider • An employer may require an employee to obtain certification completed by an authorized health care provider of the servicemember when leave is taken to care for a servicemember with a serious injury or illness. • Prototype is WH-385: http://www.dol.gov/esa/whd/forms/WH-385.pdf Fiduciary Concerns and Your 401(k) Plan I. II. III. IV. V. VI. Fiduciary Overview Plan Administrative Structure Participant Directed Investments Concerns with Current Market Conditions Common Administrative Errors Qualified Plan Developments Why Are You a Fiduciary? • You have authority and responsibility for the administration and management, including the investment of assets, of a trust for the benefit of employees, retirees, and beneficiaries. • You are personally liable if you are a fiduciary. What are your duties? • Act with prudence • Ordinary person vs. prudent investor • Act solely in interest of participants and beneficiaries • No self-dealing • Incur only appropriate and reasonable costs and expenses • Diversify assets • Follow Plan Documents Prudence (n): • Careful management • Avoidance of possible hazards • Knowing how to avoid embarrassment Prudence does not require perfection! • It requires carefulness, discretion, and consistency. • Prudence is about following a sound process in making a decisions. • Prudence does not require always making the “right” decision. It is how you make the decision. Best Practices for Prudence 1. Establish and follow a process 2. Obtain necessary education 3. Monitor your decisions 4. Document all of the above Establishing a process – for what? • For most statutorily-required actions • For actions and behavior implicating fiduciary duties • For administration and management decisions affecting participants • Any other aspect of your plan that may provide a “possible hazard” or cause “embarassment” • Example: Investment Policy; Loan procedures Establishing a process – in what form? • Written processes and procedures are usually appropriate. • These may be incorporated into plan document, administrative rules, or board governance documents. • If you put it in writing, you better follow it! Education • Prudence requires: • Understanding your duties and responsibilities. • Obtaining information necessary to make informed decisions in carrying out these duties and responsibilities. Education (cont.) Duties and Responsibilities • Know your plan document. • Know your governing documents. • Know your fiduciary duties. • Know your applicable Codes of Conduct. Education (cont.) Information to Make Informed Decisions General • General investment theory and practices. • Benefit structures and plan funding issues. Specific • Selection of outside consultants and providers. Education (cont.) How can I Learn What I Need to Know? • Review plan documents and board governing documents and ask questions. • Fiduciary Education Seminars and Conferences • Consultants (attorneys, TPAs, investment consultants) • For specific decisions, you may need to acquire specific information. Monitoring • Prudence requires monitoring of your decisions. • You must ensure that the intended outcomes and results of your decisions are achieved. • Mistakes may be forgiven, but failing to correct such mistakes will not. • Some ongoing responsibilities are monitoring in and of themselves. Monitoring (cont.) Monitoring • Build it into the process • Require periodic review of decisions. • Frequency of such review depends on the nature of the decision. • If your duties are on-going or multi-step, set forth when and how the follow-up decisions are made. • Monitor your processes as well. Document • Keep a written record! • It is Exhibit A of your defense Document – how?? • Establish written procedures and keep them current • Keep minutes of all Board or Committee meetings in which processes are implemented and decisions made • Collect all material used to make decisions • Keep a record of conference and seminars attended with materials and agendas Protecting Yourself as a 401(k) Plan Fiduciary II. Plan Administrative Structure • Who is your “plan administrator”? • Who is your “named fiduciary”? • Consider a “Benefits Administrative Committee.” • Check your insurance policies. Protecting Yourself as a 401(k) Plan Fiduciary III. Investment Policy • Do you have one? Is it updated? • Does it include a process for selecting and monitoring investments? • How do you analyze fee structures? Protecting Yourself as a 401(k) Plan Fiduciary IV. Participant-Directed Investments • 404(c) Protection—do you have it? • What about when participants do not make elections? • QDIA – Qualified Default Investment Option • Safe Harbor if participant fails to make an election as to investments • What if a participant’s election is no longer valid due to change in investment offerings? • QCIO – Qualified Change in Investment Option • Safe Harbor for “mapping” investments during fund change or plan merger Protecting Yourself as a 401(k) Plan Fiduciary IV. Concerns with Current Market Conditions • Be careful with “blackout” periods in plan or fund conversions • Be prepared for heightened participant “interest.” • Be mindful of employer stock fund concerns. • Follow investment policy and procedures---do not panic!! Protecting Yourself as a 401(k) Plan Fiduciary V. Common Administrative Errors A. Improper Exclusion of Eligible Employees • How? When? • Change in employment status or age • Fail to provide enrollment • Miscalculation of service • Mergers & Acquisitions • Problem: • Missed opportunity for deferrals and employer contribution • Plan operational defect • Fix: • EPCRS (self-correction or VCP) Protecting Yourself as a 401(k) Plan Fiduciary B. Definition of Compensation • • • How? When? • Include items of compensation that are excluded under the Plan • Exclude items of compensation that are included under the Plan • Payroll classification error • Mergers & acquisitions Problem: • Over or under funding of deferrals and contributions • Compensation limit implications Fix: • EPCRS (self-correction or VCP) Protecting Yourself as a 401(k) Plan Fiduciary C. Failure to Timely Transfer Elective Deferrals as soon as Administratively Practical • • • How? When? • Mistaken belief that the 15th day of following month is a safe harbor for transfer—it’s not! Transfer must be as soon as administratively practicable. • Payroll errors • Cash flow considerations Problem: • Amounts become “plan assets” in hands of employer • Prohibited Transaction under Code and ERISA • # 1 issue on DOL audit Fix: • Restore amounts to plan plus interest/earnings • Pay excise tax and file return (Form 5330) Economic Stimulus Package and COBRA Economic Stimulus Package and COBRA • Signed by President Obama on Tuesday, February 17, 2009 • Includes several important provisions that affect COBRA continuation coverage and that place new requirements on employers. • Most notably, certain COBRA beneficiaries may be eligible for a 65% discount on their premiums for a limited period of time. Who is eligible? • “Assistance Eligible Individual” • Must have been involuntarily terminated from employment during the period from September 1, 2008 to December 31, 2009. • Certain maximum income levels ($125k-$145 individ. ;$250-$290 joint) at which an individual is no longer eligible for the subsidy or is eligible for a reduced subsidy. What is the subsidy? • 65% reduction in COBRA premium for a period not to exceed 9 months • Can terminate earlier if either of the following occurs: • the individual is eligible for Medicare benefits or coverage under another group health plan (flexible spending accounts, dental and vision coverage and other certain benefits are excluded); or • the maximum period of continuation coverage required under COBRA expires. Notice Requirement for Beneficiary Receiving Subsidy • If an assistance eligible individual who is receiving the subsidy subsequently becomes eligible for coverage under another group health plan or Medicare, he or she must notify in writing the group health plan providing the COBRA coverage. • If the beneficiary fails to provide the notification and continues to receive the subsidy, the individual will be subject to a tax penalty equal to 110% of the subsidy received after ineligibility. New Special COBRA Election period • For those individuals who are eligible for the subsidy but who did not originally elect COBRA coverage, or who did elect COBRA coverage and subsequently terminated it, the Act provides for a new 60 day election period, beginning on the date that notice is provided to the assistance eligible individual. • Employers must notify these assistance eligible individuals of the special election period within 60 days of the enactment of the Act. New Special COBRA Election period • This 60 day election period will not extend the period of COBRA continuation coverage beyond the original maximum period required by COBRA. • Once an individual elects coverage, the coverage begins on or after the date of enactment of the Act and does not include any prior period What plans are subject to subsidy? • Subsidy applies not only to coverage required to be offered under the COBRA rules but also to similar continuation coverage required under State law for group health plans not subject to COBRA and to Federal or State government-maintained health plans. • Health flexible spending accounts are not eligible for the subsidy COBRA Notices • The usual COBRA notice provided to qualified beneficiaries must now include forms to establish eligibility for the subsidy as well as information about the beneficiary’s right and conditions of the subsidy. • Employers must also provide notice to those individuals who qualify for the special 60 day election period. COBRA Notices • Employers whose group health plans are not subject to the COBRA continuation coverage requirements but still qualify for the subsidy must provide notice to the assistance eligible individuals. • The Act directs the Secretary of Labor to provide model notices within 30 days of enactment of the Act Who provides subsidy? Employers • Employers are required to provide subsidized COBRA coverage and will be reimbursed for the remaining 65% of the premium by treating such amounts as a credit against their liability to the Federal government for payroll taxes. • If the reimbursable amount exceeds an employer’s liability for payroll taxes, then Treasury will reimburse the employer directly. Employers subject to reimbursement must file reports required by the Secretary of Treasury. Circular 230 The statements contained herein are not intended to and do not constitute an opinion as to any tax or other matter. They are not intended or written to be used, and may not be relied upon, by you or any other person for the purpose of avoiding penalties that may be imposed under any Federal tax law or otherwise Matt Dow Charles (Chuck) H. Campbell, Jr. Jackson Walker L.L.P. Austin 100 Congress Avenue, Suite 1100 Austin, Texas 78701 ccampbell@jw.com mdow@jw.com

![(NPD-60) []](http://s3.studylib.net/store/data/007320126_1-47edb89d349f9ff8a65b0041b44e01a8-300x300.png)