basicapp_Prin_Chap_11_12

advertisement

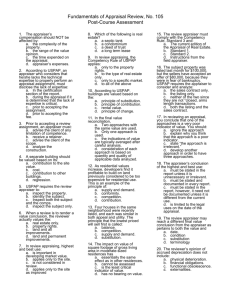

Chapter 11 Overview of Real Estate Market Analysis Chapter 11: Objectives • After completing this chapter, students will be able to: – Identify effective real estate market analyses. Key Terms • Absorption Analysis Amortization • Base Companies • Competitive Supply • District • Economic Base Analysis • Feasibility Study • Gentrification • Household • Market Analysis • Market Area • Market Disaggregation • Market Segmentation • Marketability Analysis • Neighborhood • Service Companies • Transition Market Areas and Market Analysis • Market area: a specified geographic area or location for a specific type of property. • An appraiser cannot use unsupported conclusions by defining a neighborhood: – Race – Handicap – Color – Receipt of public assistance income – Religion – Gender – National origin – Familial status – Marital status – Age Market and Marketability Analysis • Market analysis: a study of supply, demand and other economic conditions in an area. Sub-Markets • Sub-markets: delineating a market further using subcategories. • Subcategories, or sub-markets of a market area are: – Neighborhoods – Districts Defining Real Estate Market Areas • Market Analysis: – Define – Delineate Defining Market Areas by Location • Defining location, examples: – Geographic boundaries – School districts • Comparable sales – These should come from the same neighborhood, when possible. Defining Markets by Property Type • Examples of property type: – Single-family homes – Multi-unit rental properties Analysis of Market Conditions • Neighborhood Life Cycle – Four Forces (P-E-G-S): • Physical forces • Economic forces • Governmental forces • Social forces Analysis of Market Conditions • Four phases of a neighborhood life cycle: – Growth – Stability – Decline – Revitalization • Gentrification: a form of revitalization with displacement of current residents that takes place in a more natural fashion and is not driven by any public movement. Business Cycles • The four phases of the business cycle are (remember the acronym EPCoT): – Expansion – Peak – Contraction – Trough Economic Base Analysis • Economic base analysis examines the present business and employment climate in an area to determine the likelihood of continued stability, growth, or decline. • Base companies are only those that bring new business and jobs to the area. • Service companies are the remainder of the companies and businesses in the area act as service companies to those base companies and industries. Real Estate Cycles • Real estate cycles are general swings in real estate activity that result in increasing or decreasing activity and property values during different phases of the cycle. Supply-Side and Demand-Side Analysis • Buyer’s Market: – Homes are on the market longer (days on market) due to high supply and low demand – Home prices and values decline – Buyers become price sensitive and fear paying too much for a property – Sellers and homebuilders may provide incentives to buyers to purchase their homes which may include offering better loan rates, no closing costs, bonuses, free options, etc. Supply-Side and Demand-Side Analysis • Seller’s Market – A limited supply or no homes for sale in an area – Homes sell quickly—some may not even make it on the market before they are sold – Selling prices rapidly increase – Multiple buyers compete for a particular home or property for sale – Homes may sell for more than the asking price Market Disaggregation • Market disaggregation: A supply analysis that identifies properties by type, features, and use, which are similar and likely to compete with the subject property. • Competitive supply: Properties available in the marketplace that a buyer would accept as ready substitutes for the subject property. Final Supply and Demand Analysis • Absorption Analysis: A supply and demand study of the number of property units that will be sold (or rented) in the marketplace during a certain period of time. • Forecasting: Estimating future supply and demand trends. – Demographics – Competition Other Types of Analysis • Productivity Analysis: A means of determining the current position of a property in relation to the marketplace. • Feasibility Study: A study of the costbenefit relationship of an economic endeavor. Chapter 11 Quiz 1. __________ factors are NOT a force influencing housing cycles. a. b. c. d. Economic Social Structure Supply Chapter 11 Quiz 2. When housing prices fall due to the relocation of a major employer, it is an example of a(n) __________ force influencing value. a. b. c. d. economic governmental physical social Chapter 11 Quiz 3. A neighborhood is undergoing much rehabilitation and property improvement. The movement is not part of any public movement or initiative but rather from a general trend toward people desiring to live there. What phase of the neighborhood life cycle is being evidenced? a. b. c. d. expansion gentrification growth transition Chapter 11 Quiz 4. The point in a business cycle when prices fall and production slows until demand catches up with supply is most likely a period of a. b. c. d. contraction. expansion. peak. trough. Chapter 11 Quiz 5. During the course of a market analysis, an appraiser notes that a particular area, which has been predominately residential properties, is rapidly undergoing a complete change of use to commercial due to the widening of a street and increasingly higher traffic counts. What is the appraiser observing? a. b. c. d. decline equilibrium gentrification transition Chapter 11 Quiz 6. The various complimentary land uses present in an area are being examined as part of a larger market. What component of a market area is being analyzed? a. b. c. d. district neighborhood quadrant zone Chapter 11 Quiz 7. An appraiser primarily considers general data concerning the overall conditions of the real estate marketplace when performing a a. b. c. d. economic base analysis. household study. market analysis. productivity analysis. Chapter 11 Quiz 8. Existing inventory of houses and planned new construction are elements of what type of analysis? a. competitive supply analysis b. economic base analysis c. market segmentation d. productivity analysis Chapter 11 Quiz 9. Analysis indicates that 170 residential lots are needed for sale in the next four years based on projected demographics. There are currently 80 residential lots available with another 28 soon to be completed. If 50% of the demand will come in year one and 30% of the demand will come in year two, how many lots are projected to be needed to satisfy demand in year three? a. b. c. d. 27 31 34 51 Chapter 11 Quiz 10. A study is being performed that will examine the benefit of a proposed real estate project in relation to the project’s cost. What type of analysis is being performed? a. b. c. d. absorption study feasibility study marketability study productivity analysis Chapter 12 Application of Ethical Principles Chapter 12: Objectives • After completing this chapter, students will be able to: – Interpret USPAP concepts and acceptable standards of appraisal practices. Key Terms • Extraordinary Assumption • Hypothetical Condition Competitive Supply Appraisal Principles in Action • Review of the subject property The Appraisal Assignment • The lender has initially provided the appraiser with following information: – – – – – – – Property address Seller’s name (owner of record) Purchaser’s name Type of value in the assignment—market value Pending contract price—$300,000 Appraised value needed—$375,000 Requirement for the appraisal report to be completed and submitted to the lender within 48 hours of inspection The Appraisal Assignment Point Break Do you see any problems with this scenario? • Do the assignment conditions conflict with the appraiser’s independence? • Is the inclusion of the “appraisal value needed” with the appraisal order an issue? • Is the information provided by the lender enough to properly identify the problem? • Why is the appraisal value needed greater than the pending contract price in context of economic principles in a market value assignment? • Is the transaction of the property likely “arm’s length”? The Appraisal Assignment • Other specific data as noted by appraiser: – Year built—approximately 1930 – Total gross living area of each unit— 2,200 square feet – Exterior—wood lap siding • The appraiser concluded the following: – Indicated value by the income approach— $180,000 – Indicated value by the sales comparison approach—$385,000 – Appraiser’s final conclusion of market value— $385,000 The Appraisal Assignment Point Break Who is the intended user(s) in the assignment? • The company with which the loan originator was affiliated, as the company engaged the appraiser and was not evidently acting as a designated agent for any other entity. No other intended users have been identified at the time the appraisal assignment was accepted. The Appraisal Assignment Point Break What is the intended use of the appraiser’s opinions and conclusions? • To assist in a mortgage finance transaction. Review of Appraisal • In summary, the review appraiser reported the following: – Economic characteristics of the subject neighborhood were faulty. – Highest and best use of the property was misstated. – Physical characteristics of the property were misstated. – Sales data selected for the sales comparison approach represented characteristics of a different market, which was not addressed by adjustments or commentary as to why adjustments were not warranted. – Significant differences between the subject and the selected comparable sales data were improperly addressed. – Final opinion of value was not supported by a rational and logical reconciliation regarding the quality of the indications produced by the two approaches that were developed. This led to a final opinion of value that was more than double of that concluded by the review appraiser. Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Findings of Regulatory Investigation Highlighted USPAP Concepts and Obligations • Hypothetical Conditions and Extraordinary Assumptions – A hypothetical condition is something that the appraiser knows to be false but he is considering it as being true for the purpose of his analysis and obtaining credible results. – An extraordinary assumption is used in a specific assignment when the appraiser has a reasonable basis for his belief, but something about which the appraiser is not certain. Hypothetical Conditions and Extraordinary Assumptions • The USPAP definitions for extraordinary assumption and hypothetical condition are: – EXTRAORDINARY ASSUMPTION: an assumption, directly related to a specific assignment, as of the effective date of the assignment results, which, if found to be false, could alter the appraiser’s opinions or conclusions. – Comment: Extraordinary assumptions presume as fact otherwise uncertain information about physical, legal or economic characteristics of the subject property; or about conditions external to the property, such as market conditions or trends; or about the integrity of data used in an analysis. – HYPOTHETICAL CONDITION: a condition, related to a specific assignment, which is contrary to what is known by the appraiser to exist on the effective date of the assignment results but is used for the purpose of analysis. – Comment: Hypothetical conditions assume conditions contrary to known facts about physical, legal, or economic characteristics of the subject property, or about conditions external to the property, such as market conditions or trends, or about the integrity of data used in an analysis. Workfile Requirements • USPAP has very specific workfile requirements. Items that must be included in the workfile for a written appraisal include, but are not limited to: – Name of the client and the identity, by name or type, of any other intended users – True copies of any written reports, documented on any type of media – All other data, information and documentation necessary to support the appraiser’s opinions and conclusions and to show compliance with USPAP or references to the location(s) of such other documentation. Misleading Report • Communicating a misleading or fraudulent report is a violation of professional ethics. Valuation Methods • The appraiser in the case study employed the sales comparison method and the income method in his development. USPAP has very basic and broad obligations for development of the approaches to value. Reconciliation • Appraisal development standards of USPAP require the appraiser to address reconciliation as a two-part process. An appraiser must: – Reconcile the quality and quantity of data available and analyzed within the approaches. – Reconcile the applicability and relevance of the approaches, methods, and techniques used to arrive at the value conclusion(s). Definition and Source of Definition of Market Value • The appraiser must identify the type of value and the specific definition of value during problem identification. In the case scenario, the appraiser did state that the purpose of the appraisal (type of value in the assignment) was market value. Analyzing Agreements of Sale • Appraisal development standards require, in market value assignment, for the appraiser to analyze all agreements of sale, options, and listings of the subject property current as of the effective date of the appraisal, if available in the normal course of business. Unacceptable Assignment Conditions • USPAP prohibits appraisers from accepting assignments with unacceptable assignment conditions. • USPAP does not specifically identify a “value needed” as an unacceptable assignment condition. Highest and Best Use Analysis • Depending on the reporting option chosen for the appraisal report (self-contained, summary, or restricted use) the highest and best use of the property must be: – described – summarized, or – stated. Appraising a Physical Segment • Appraising a physical segment of a property that has differing ownership of the segments is not a violation of professional ethics and is not at all uncommon for some properties in some locations. However, specialized methodology and technique must be applied to determine the affect of the multiple ownerships. Prior Sales History • USPAP requires the analysis and disclosure of all sales of the subject property that occurred within the three years prior to the effective date of the appraisal. Reporting the Scope of Work • For reporting the scope of work, professional standards require that the scope of work actually performed in the assignment be (depending on the reporting option chosen) described summarized, or stated. Chapter 12 Quiz 1. Jack appraised a residential dwelling located across the street from a factory that he determined is negatively affecting the value of the subject property. Jack applied a location adjustment in his sales comparison approach; however, the client asked that the factory not be discussed in the appraisal report. Since Jack addressed the condition with an adjustment, has he complied with USPAP? a. b. c. d. No, because USPAP requires explanation for each adjustment. No, omitting the discussion could produce a misleading report. Yes, since an adjustment was included. Yes, since the client requested the omission. Chapter 12 Quiz 2. If a property is known by the appraiser, on the effective date of the appraisal, to have an inoperative mechanical system component, but the appraiser is considering the component as if it were operating properly on that date for the purpose of his analysis, what is the appraiser basing his opinions and conclusions on? a. b. c. d. anticipated condition extraordinary assumption hypothetical condition hypothetical exception Chapter 12 Quiz 3. Josh received an appraisal request from a lenderclient who told him to immediately call if the value on the property is less than the amount stipulated by the lender, as he doesn’t intend to pay for an appraisal that won’t benefit his position. Will acceptance of this assignment be in compliance with USPAP? a. b. c. d. Yes, it is permissible for a client to call the client with the value prior to adequately supporting the opinion. Yes, this would be a hypothetical condition, which is acceptable. No, an appraiser may not accept an assignment with unacceptable assignment conditions. No, it is not permissible unless Josh discloses this fact in the report. Chapter 12 Quiz 4. What information is NOT required to be in an appraisal workfile? a. copy of the bill sent to the client b. documentation to support the appraiser’s opinions and conclusions c. references to the location of other documentation not in the workfile d. true copies of any written reports Chapter 12 Quiz 5. The scope of work disclosed in an appraisal report must include the a. appraiser’s final conclusions and value opinion. b. initially planned scope of work at the onset of the assignment. c. intended use in the assignment. d. scope of work that was actually performed. Chapter 12 Quiz 6. Appraisers must analyze agreements of sale, options, and listings of the subject property current as of the effective date of an appraisal, in a market value assignment, if it is a. b. c. d. available in the normal course of business. a matter of public record. not deemed confidential information. required by the client. Chapter 12 Quiz 7. While appraising a property, Lydia could not check the furnace to see if it is in good working order due to the utilities being off at the time of the inspection. Since the home is relatively new and the components appear to be in good condition, Lydia has a reasonable basis to believe that the furnace is in satisfactory operating condition, but she is uncertain. Therefore, Lydia bases her conclusion on a(n) a. b. c. d. expected condition. extraordinary assumption. hypothetical assumption. hypothetical condition. Chapter 12 Quiz 8. For reconciliation, in addition to reconciling the quality and quantity of data available within the approaches used, USPAP also requires an appraiser to ________ the approaches, methods, and techniques used to arrive at the value conclusion. a. b. c. d. mathematically average the results of not rely solely on reconcile the applicability and relevance of report the conclusions individually of Chapter 12 Quiz 9. In an appraisal report, sufficient information regarding the scope of work includes disclosure of research and analyses performed and might also include disclosure of a. the client’s objectives for the assignment’s results. b. confidential information used in development. c. fees and things of value paid to the appraiser. d. research and analyses not performed. Chapter 12 Quiz 10. An appraiser determines the appropriate definition of market value to be used in the assignment during a. b. c. d. market analysis. problem identification. reconciliation. valuation analysis.