Company Analysis: Foot Locker Inc.

advertisement

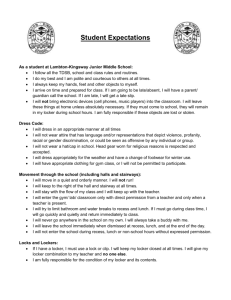

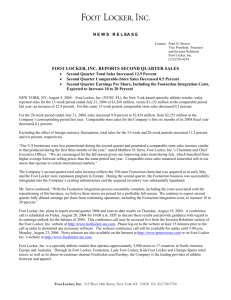

Company Analysis Assignment PRT 503 Jordan Green Table of Contents Executive Summary 3 Company Profile 4 Economic Issues 5 Revenue & Expenditure Summary 6 Assets and Liabilities Summary 7 Financial Analysis and Ratios 9 Future Trends 10 Appendix 11 Executive Summary Foot Locker Inc. is the world’s leading retailer of athletically inspired footwear and apparel. Headquartered in New York City, it operates approximately 3,500 athletic retail stores in 21 countries in North America, Europe and Australia under the brand names Foot Locker, Lady Foot Locker, Kids Foot Locker, Footaction, Champs Sports and CCS. In 2008, Foot Locker generated $5.24 billion in total revenue, a 3.7% decrease in sales from 2007. Despite the decline in sales, Foot Locker remains far ahead of second place retailer Finish Line by revenue, which reported $1.26 billion in 2008 sales. Foot Locker’s struggles have continued through 2009 as same-store sales, a key gauge of retail performance, fell 12% in second quarter 2009. For the entire fiscal year 2009, Foot Locker made $4.85 billion, down from $5.24 billion the year before, while its net income was $48 million, up from $-80 million the year before. After Foot Locker’s company-side operating margin fell to 6.6% in 2006, from 7.2% in 2005, the company began an initiative to improve efficiency and profitability by changing their store base. This strategy comprised opening new stores, relocating existing stores to optimal locations and closing down unproductive stores. During 2007, Foot Locker closed 157 stores and in 2008 closed 208 stores. Foot Locker’s approach to merchandising is to offer trendy brand name products. Consequently, its five biggest vendors accounted for 80% of its products in 2009, with Nike comprising 50% of all offerings. These ties to Nike and other vendors offer exclusive products and experiences but also expose the company to significant risk from a pricing perspective. Foot Locker prepared for a weak consumer spending environment, and focused on implementing strategies designed to protect profitability, remain financially strong and improve their competitive position. Company Profile Mission Statement: “Be the leading global retailer of athletically inspired shoes and apparel.” Objectives: - Be the power merchandiser of athletic footwear and apparel with clearly-defined brand banners. - Develop a compelling apparel assortment. - Make stores and internet sites exciting places to shop and buy. - Aggressively pursue growth opportunities. - Increase the productivity of all assets. - Build on the industry leading retail team. Company History: - Top athletic shoe retailer Foot Locker, Inc., was known until 1998 as the Woolworth Corporation and until 2001 as Venator Group Inc. Foot Locker is a multinational retailer of athletic shoes with stores and support operations in North America, Europe, Australia, and Asia. The company's holdings include the chains Foot Locker (and its Kids and Lady store concept versions), Footaction USA, and Champs Sports. Since Woolworth's establishment in 1879, the business has been involved in general merchandising; in its incarnation as Venator, however, the company focused on the retailing of athletic footwear and apparel. In 2001 Venator renamed itself after its best-performing specialty chain, the Foot Locker athletic footwear shops. 1879: Frank Woolworth opens his first "Great 5¢ Store" in Utica, New York. 1905: Woolworth incorporates his business as F.W. Woolworth & Co. 1912: F.W. Woolworth & Co. becomes the publicly traded F.W. Woolworth Co.; the company moves into the Woolworth Building. 1926: Woolworth inaugurates its German operating subsidiary. 1960: Sales surpass the $1 billion mark. 1962: Woolworth's opens the first Woolco. 1965: The company purchases G.R. Kinney Corporation. 1972: Woolworth and Woolco are consolidated in one division. 1974: The Kinney shoe division opens the first Foot Locker stores. 1982: Kinney's Canadian operation starts Lady Foot Locker. 1993: Woolco's operations are sold to Wal-Mart. 1997: Woolworth's closes the last of its five-and-dime stores in the United States. 1999: Woolworth's changes its name to Venator Group. 2001: Company closes its Northern Reflections chain and renames itself Foot Locker Inc. Economic Issues Without a doubt, the difficult economic conditions in 2009 presented considerable challenges for most retailers, Foot Locker included. In Foot Locker’s 2008 Annual Report, CEO Matthew Serra, has recognized and informed shareholders regarding this threat by stating, “Any significant declines in general economic conditions, public safety concerns or uncertainties regarding future economic prospects that affect customer spending habits could have a material adverse effect on customer purchases of our products. The financial result of U.S. businesses reflects the impact of weak consumer spending. As money becomes tight in households, the first products to be effected are those that are not essential to everyday living. This includes sporting apparel, expensive basketball and football shoes, jerseys and backpacks. Since Foot Locker’s product lines are not diversified with non-athletic offerings and the store is focused on midluxury brands like Nike and Adidas, it is more exposed to economic downturns than other retailers such as Wal-Mart and Target. Reflecting these challenges, according to the Foot Locker Annual Report, the worldwide sales for footlocker in 2009 declined to $4.9 billion from $5.2 billion in 2008 as well as a 6.4 sales decline over the course of the year. Foot Locker also faces many risks is it pertains to the economy. Since Foot Locker depends on companies such as Nike and Adidas, they are at the mercy of the athletic equipment giants when negotiating purchasing contracts such as prices, distribution and promotion. Also, if for some reason Nike or Adidas were unable to supply Foot Locker with products or was to end their relationship with Foot Locker, the retailer would suffer significantly, as Nike alone accounts for 64% of Foot Locker’s products. NBA player such as Shaquille O’Neal and Stephon Marbury have started a new phase in sponsorships by endorsing their own brand shoes at an extremely low price and are sold only at stores such as Payless and K-Mart. While we are in a recession, even during one, there is no question about whether people will buy shoes. The real question is whether consumers will trade down to places like Wal-Mart. It’s also important to consider that the competition for overall footwear is fierce. Companies such as Dick’s Sporting Goods and Finish Line sell the same shoes as Foot Locker (Forbes.com). While Foot Locker clearly has dominated the market and will likely continue to do so, all of the companies are fighting for every last customer. It should be noted however, that Foot Locker prepared for a weak consumer spending environment, and focused on implementing strategies designed to protect profitability, remain financially strong and improve their competitive position. Revenue & Expenditure Summary The following graph shoes the revenue and expenditures, or expenses of Foot Locker Inc. Both of these together help determine the net income of a company. The graph and figures below show quarterly comparisons of revenue and expenditures. It should be noted that the quarterly numbers, both revenue and expenditures are greater after closing the 2009 fiscal year and opening the 2010 fiscal year. Most clothing or sporting goods stores see an increase in sales during the holiday months. Foot Locker in particular sees an incredible jump in sales during the months of November and December, which include the holidays of Christmas and Black Friday, in which over 135 million people participate in the holiday shopping rush on one single day. A stronger or weaker than normal holiday season can considerably help or hurt Foot Locker. Unlike other retail companies, Foot Locker provides consumers with just as many warm weather products (baseball, tennis shoes, etc.) as it does cold weather, so the company doesn’t have a drastic increase in revenue during the holidays as other companies. It should be duly noted that expenditures increase when revenues increase, and vice-versa. These expenditures include merger integrations along with store closing costs. Foot locker closed 179 stores from January of 2009 to January 2010, while only opening 38. Foot Locker also made it a key objective to reduce their operating expenses. Their combined selling, general and administrative expenses and occupancy costs were reduced by approximately $100 million versus 2009 . $1,400,000,000 $1,320,000,000 $1,325,000,000 $1,210,000,000 $1,200,000,000 $1,100,000,000 $1,000,000,000 $800,000,000 $635,000,000 $657,000,000 Revenues Expendetures $600,000,000 $478,000,000 $476,000,000 $400,000,000 $200,000,000 $0 Q3 FY 09 Q4 FY 09 Q1 FY 10 Q2 FY 10 Assets & Liabilities Summary The following graph shows the assets and liabilities of Foot Locker Inc. over both a three year period and a quarterly period. The balance sheet, which consists of assets, liabilities and ownership equity, shows a “snapshot of a company’s financial condition.” Foot Locker is currently the leading athletic footwear retailer in the United States in terms of sales as well as most measures of profitability. Over the course of a year, not much change is shown between assets and liabilities. Quarterly however, while Foot Locker’s liabilities have decreased nearly $100 million in the last year, their assets have decreased nearly $400 million from 2008 to 2010. This can be directly related to the fact that in the last two years, while Foot Locker has opened 38 stores worldwide, they have closed 179 stores. In response, the company has however begun an initiative to improve efficiency and profitability by changing their store base. This strategy comprised of opening a few new stores, but focused on closing down unproductive stores. Historically, Foot Locker Inc. has relied heavily on dividends in creating value for shareholders. In 2007, after finishing the year with $45 million in net income, Foot Locker still paid $77 million in common stockholder dividends. The company currently has a 1.65% return on average assets ratio compared to 0.82% last quarter. $3,000,000,000 $2,600,000,000 $2,500,000,000 $2,600,000,000 $2,600,000,000 $2,500,000,000 $2,000,000,000 Assets $1,500,000,000 Liabilities $1,000,000,000 $605,000,000 $652,000,000 $646,000,000 Q1 FY 10 Q2 FY 10 $506,000,000 $500,000,000 $0 Q3 FY 09 Q4 FY 09 Quarterly $3,500,000,000 $3,248,000,000 $2,877,000,000 $3,000,000,000 $2,816,000,000 $2,500,000,000 $2,000,000,000 Assets $1,500,000,000 $1,000,000,000 Liabilities $977,000,000 $953,000,000 $868,000,000 $500,000,000 $0 Feb. 2008 Jan. 2009 Yearly Jan. 2010 Financial Analysis & Ratios Current Ratio The Current Ratio helps measure whether or not a company or firm has enough resources to pay its debts over a year time. It compares the organizations current assets to its current liabilities 2007: Current Assets / Current Liabilities = Current Ratio $2,064,000,000 / $977,000,000 = 2.11 2008: Current Assets / Current Liabilities = Current Ratio $1,764,000,000 / $953,000,000 = 1.85 2009: Current Assets / Current Liabilities = Current Ratio $1,772,000,000 / $868,000,000 = 2.04 Total Debt Ratio The Debt Ratio financially indicates the percentage of a company’s assets that are provided via debt. The higher the ratio, the greater risk will be associated with the company’s operation. High debt to assets ratio may indicate a lower borrowing capacity of a company, which in turn will lower the firm’s financial flexibility. 2007: Total Debt Ratio = Total Assets – Total Equity / Total Assets = $3,248,000,000 – $2,271,000,000 / $3,248,000,000 = .30 2008: Total Debt Ratio = Total Assets – Total Equity / Total Assets = $2,877,000,000 - $1,924,000,000 / $2,877,000,000 = .33 2009: Total Debt Ratio = Total Assets – Total Equity / Total Assets = $2,816,000,000 – $1,948,000,000 / $2,816,000,000 = .30 Receivables Turnover Ratio This ratio measures the number of times, on average, receivables are collected during the period. 2007: Receivables Turnover = Sales / Accounts Receivable $5,437,000,000 / $60,000,000 = 90.61 2008: Receivables Turnover = Sales / Accounts Receivable $5,237,000,000 / $64,000,000 = 81.82 2009: Receivables Turnover = Sales / Accounts Receivable $4,854,000,000 / $60,000,000 = 90.90 Days’ Sales in Receivables This is a calculation used by a company used to estimate their average collection period. A lower number of days indicates that the company collects its outstanding receivables quickly. It is considered an important tool in measuring liquidity. 2007: Days’ Sales in Receivables = 365 Days / Receivables Turnover 365 / 90.61 = 4.02 Days 2008: Days’ Sales in Receivables = 365 Days / Receivables Turnover 365 / 81.82 = 4.46 Days 2009: Days’ Sales in Receivables = 365 Days / Receivables Turnover 365 / 90.90 = 4.01 Days Profit Margin The profit margin refers to the measure of profitability, and is calculated by finding the net profit as a percentage of the revenue. It is mostly used for internal competition and is an indicator of a company’s pricing strategies and how well it controls costs. 2007: Profit Margin = Net Income / Sales $490,000,000 / $5,437,000,000 = 9% 2008: Profit Margin = Net Income / Sales $790,000,000 / $5,237,000,000 = 15% 2009: Profit Margin = Net Income / Sales $470,000,000 / $4, 854,000,000 = 9% Future Trends The global sports apparel, equipment and footwear industry had a total market size of $278.4 billion dollars at the end of 2009, 36% of which was controlled by the United States. According to NetAdvantage (2009), the sports apparel and footwear industry is increasingly moving towards globalization, especially in the footwear sector. For companies such as Foot Locker to remain competitive in the future, a global strategy must be created and implemented. Moving towards a more global strategy will not only result in reduced cost of goods sold and other related as a percentage Foot Locker has also done its part in trying to market and promote business with a new demographic. In November of 2009, Foot Locker acquired Delia’s CCS business for $104.2 million. CSS is a direct-to-consumer (internet and catalog) retailer of skateboarding apparel, footwear and accessories, mailing approximately 18 million catalogs annually. This represents their continued attempt to appeal to a younger target market, particular in the rapidly growing action and extreme sports categories. Foot Locker’s main competitor in the athletic footwear and apparel specialty retail market is Finish Line, shoes $1.27 billion in 2007 sales significantly trailed Foot Locker’s $5.3 billion. Foot Locker has also began to expand its business internationally, operating 3,500 athletic retail stores in 21 countries. Based on annual reports and numerous articles by financial analysis, the management of Foot Locker recognized that the global retail environment would be slowing and took appropriate actions to reduce costs, manage inventory levels more conservatively and close underproductive stores, in order to sustain positive cash flow from operations. As a result, Foot Locker Inc.’s leading position in the athletic retail industry is intact and their balance sheet seems to be very strong, with substantial cash and short term investments alongside minimal debt, which put together, provides an incredible amount of financial flexibility for the future. Appendix Balance Sheet Period Ending Jan 30, 2010 Jan 31, 2009 Feb 2, 2008 Assets Current Assets Cash And Cash Equivalents 582,000 385,000 488,000 7,000 23,000 8,000 - 89,000 118,000 1,037,000 1,120,000 1,281,000 146,000 236,000 169,000 1,772,000 1,764,000 2,064,000 - 21,000 4,000 Property Plant and Equipment 387,000 432,000 521,000 Goodwill 145,000 144,000 266,000 Intangible Assets 99,000 113,000 96,000 Other Assets 51,000 66,000 45,000 Deferred Long Term Asset Charges 362,000 358,000 252,000 2,816,000 2,877,000 3,248,000 433,000 418,000 380,000 Short/Current Long Term Debt - - - Other Current Liabilities - 131,000 121,000 Total Current Liabilities 433,000 418,000 501,000 Long Term Debt 138,000 142,000 253,000 Other Liabilities 297,000 393,000 208,000 Deferred Long Term Liability Charges - 12,000 15,000 Minority Interest - - - Negative Goodwill - - - 868,000 953,000 977,000 Total Stockholder Equity 1,948,000 1,924,000 2,271,000 Net Tangible Assets $1,704,000 $1,667,000 $1,909,000 Short Term Investments Net Receivables Inventory Other Current Assets Total Current Assets Long Term Investments Total Assets Liabilities Current Liabilities Accounts Payable Total Liabilities Income Statement Period Ending Jan 30, 2010 Jan 31, 2009 Feb 2, 2008 Total Revenue 4,854,000 5,237,000 5,437,000 Cost of Revenue 3,522,000 3,777,000 4,017,000 Gross Profit 1,332,000 1,460,000 1,420,000 - - - 1,096,000 1,166,000 1,176,000 Non Recurring 41,000 259,000 128,000 Others 112,000 130,000 166,000 - - - Operating Expenses Research Development Selling General and Administrative Total Operating Expenses Operating Income or Loss 83,000 (95,000) (50,000) 19,000 1,000 (100,000) (49,000) 16,000 1,000 Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense 73,000 - Income Before Tax 73,000 (100,000) (50,000) Income Tax Expense 26,000 (21,000) (99,000) Minority Interest Net Income From Continuing Ops 47,000 (79,000) 49,000 Cash Flow Period Ending Net Income Jan 30, 2010 48,000 Jan 31, 2009 80,000 Feb 2, 2008 51,000 Operating Activities, Cash Flows Provided By or Used In Depreciation 112,000 130,000 166,000 Adjustments To Net Income 49,000 225,000 3,000 - - - Changes In Accounts Receivables Changes In Liabilities 98,000 56,000 36,000 Changes In Inventories 111,000 128,000 55,000 Changes In Other Operating Activities 123,000 36,000 44,000 Total Cash Flow From Operating Activities 346,000 383,000 283,000 Investing Activities, Cash Flows Provided By or Used In Capital Expenditures 89,000 146,000 148,000 Investments 16,000 20,000 263,000 Other Cash flows from Investing Activities 1,000 106,000 2,000 Total Cash Flows From Investing Activities 72,000 272,000 117,000 Financing Activities, Cash Flows Provided By or Used In Dividends Paid 94,000 93,000 77,000 Sale Purchase of Stock 3,000 2,000 41,000 94,000 21,000 Net Borrowings Other Cash Flows from Financing Activities Total Cash Flows From Financing Activities Effect Of Exchange Rate Changes Change In Cash and Cash Equivalents 3,000 94,000 - 1,000 185,000 138,000 18,000 29,000 5,000 $197,000 $103,000 $267,000