here

advertisement

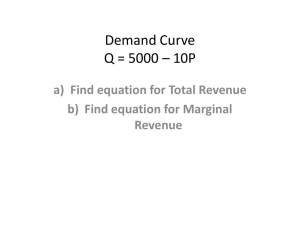

Page 1/7 Answers to Pop quizzes and other questions Section 1.1 – markets (Chapters 4 – 8) Note that the answers below are my own and have no links to ‘official’ IB exam questions. I have not included the questions for the simple reason that one might reasonably assume that you have a copy of the book – and I am simply not interested in providing free-riders with material. I have left these answers ‘unlocked’ in that you may print them out and re-vamp them to your needs. Again, feel free to write me with comments and/or questions at matt.ibid@hotmail.com S1.1 Ch 4 HL extension on the demand function Page 35 Pop Quiz 4.1 1. i) to iii) are moot. 2. Error: the five prices should go from $100 to zero! Stick in each price value into the D-function: Price Qd 100 0 75 50 50 100 25 0 150 200 Page 2/7 3. Plotting out the demand curve using the values in the above table: P ($/unit) 100 Qd = 200 - 2P 75 50 25 D 0 50 100 150 200 Q/t 4. Again, a bit of an error; the question should read “…20% change in autonomous demand…but no change in slope…” A decrease in the price of a substitute will decrease demand for this good. The new Qintercept is thus 160 (200 * 0.8) and the new D-function is Qd = 160 – 2p. Putting this in a table and diagram… Price Qd 80 0 60 40 40 80 20 0 120 160 Note that we get a new price intercept of $80. (This is given by dividing ‘a’ with ‘b’, i.e. 160/2.) The shift in the demand curve tells us that the quantity demanded has decreased by 40 units at all price levels – which is termed a decrease in demand. Page 3/7 P ($/unit) 100 80 Qd = 200 - 2P 60 40 Qd = 160 - 2P 20 D1 0 40 D0 80 120 160 200 Q/t 5. At a Q-intercept of 200 (D0, the original), for every dollar increase in price the quantity demanded will decrease by 3; slope = ‘run over rise’ → slope = -3/1. Thus our new demand function is Qd = 200 – 3P. The new price intercept is $66.6 (200/3) so we indeed see that this good has become more sensitive to a change in price as there is a larger decrease in quantity demanded for any given increase in price. Price Qd 66.7 0 49.9 60.2 33.3 93 16.6 0 126.8 200 P ($/unit) 100 Qd = 200 - 2P 66 D1 Qd = 200 - 3P 49 33 D0 16 0 60 93 Q/t 126 200 Page 4/7 S1.1 Ch 5 HL extension on supply function Page 46 Pop Quiz 5.1 1. i) to iii) are moot. 2. The supply function Qs = 200 + 10P gives us the following table of quantity supplied at five different prices: Price Qs 0 200 10 300 20 400 30 500 40 600 3. Putting these values into a basic diagram: P ($/unit) S 40 Qs = 200 + 10P 30 20 10 0 -20 200 300 400 500 600 Q/t The negative portion of the P-axis is included simply to illustrate that any supply curve with a positive value of ’c’ (the Q-axis intercept) will have a negative P-axis intercept. 4. Again, a bit of an error here. The question reads “…20% change in supply…” but should in fact read “…20% change in autonomous supply…” In any case, a decrease in the price of raw material causes Page 5/7 supply to increase – in this case we get a parallel shift of the supply curve to the right (increase in supply) and a new S-function based on a 20% increase in autonomous supply: Qs = 240 + 10P. Table for the new Qs at various prices: Price 0 10 20 30 40 Qs 240 340 440 540 640 P ($/unit) Qs = 200 + 10P S0 S1 40 Qs = 240 + 10P 30 20 10 0 200 240 340 440 Q/t 540 640 -20 -24 The new P-intercept is calculated by inserting Q = 0 into the S-function and solving for P (as an absolute number – we know it will be negative!), as in 0 = 240 + 10P → 240 = 10P → P = 240/10 → P = │24│or -24. An alternative method to calculate the new P-intercept – perhaps easier – is by increasing the original Pintercept value (in absolute values, e.g. │1│ and not ‘-1’) by the same percentage as the increase in autonomous supply (‘c’ in the S-function). Original ‘c’, the Q-intercept, was 200 and increased by 20% to 240, so increasing the P-intercept (again, in absolute values!) by the same percentage gives us │24│or -24 in reality. The end result is that quantity supplied has increased by 40 units at all price levels – which is known as an increase in supply. Page 6/7 5. Note that the question reads “…the new Q-intercept remains unchanged…” and since we are changing the slope, the P-intercept must change. The new S-function has a slope (again, ‘run over rise’) that is 8, since ‘run’ (ΔQ) divided by ‘rise’ (ΔP) is 8/1. The new S-function becomes Qs = 200 + 8P. Price 0 10 20 30 40 Qs 200 280 360 440 520 P ($/unit) Qs = 200 + 8P S1 S0 40 Qs = 200 + 10P 30 20 10 0 200 280 360 440 520 Q/t -20 -25 The new P-intercept is easiest calculated by inserting Q = 0 into the supply function and solving for P in absolute terms (we know it is a negative value!): 0 = 200 + 8P → 200 = 8P → P = 200 /8 → P = │25│, i.e. -25. Page 7/7 S1.1 Ch 6 Market equilibrium Page 58 Pop Quiz 6.4 1. One reasonable expectation – and this proved to be the case – that the increased price of oil and thus gasoline (petrol) would lead to an increase in demand for alternative energy. One such alternative is solar panels on houses. The rise demand for solar panels drove up the price of them. 2. The demand for silicon is derived from the demand for photovoltaic solar cells. The increased demand for solar panels led to an increase in demand for silicon since silicon is used in the production of photovoltaic solar cells. 3. Increasing demand and thus price of oil leads to a search for substitutes – here, solar energy – which drives up the price of silicon. Silicon is used in computer chips, so a rise in the price of silicon drives up costs for chip makers and the cost of manufacturing computers. 4. There is no contradiction! One need simply keep clear what is ‘cause’ and what is ‘effect’. It is of course the increased demand (= shift right of D-curve) that causes the rise in the price of houses. 5. Straightforward supply and demand curves, possibly using inelastic curves (see Chapters 11 and 12) to convey the concept of short run, where demand or supply increases/decreases during high/low season. For example, demand for scooter rentals in tourist areas will rise in the high season and fall in low season. Concomitantly, supply of strawberries in Alaska will rise in July but fall (seriously fall!) in November. This results in seasonal price fluctuations. 6. The expectations-effect means that we act ‘before the fact’ – e.g. when investors/speculators believe that prices will adjust downwards, two things will happen; they will sell off properties (= increase in market supply) and be wary of being additional properties (= fall in market demand). Taken together, one might expect the market price for houses to fall. Page 8/7 S1.1 Ch 6 Linear supply and demand functions Page 63 Paper 3 example for HL 1. Qs = -40 + 30P and Qd = 200 -10P a. Price is calculated by solving -40 + 30P = 200 – 10P → 40P = 240 → P = €6 b. Put in the D-curve ‘limits’ first, i.e. the Q and P intercepts for the demand curve. c. Draw the curves… i. The Q-intercept for demand is ‘b’, 200 units. The P-intercept is ‘b’/’a’ (absolute values) 200/10 = €20. ii. The same for the supply curve, where Q-intercept is ‘d’, -40, and the P-intercept is ‘d’/’c’ (use absolute values and forget the underlying maths – we know that the Pintercept will be a positive value since the Q-intercept is negative!) gives us €1.33. d. The price is €6, so inserting this into either of the functions gives us quantity. 200 – 10 * 6 = 140 units per week. P (€/unit) 20 S 10 7 6 1.33 3 -40 D0 0 100 140 170 200 D1 Q/t (units/week) 2. This question should read “…demand increases by 40 units at all prices…” rather than “…40%...” a. New D-function is Qd = 240 – 10P b. See diagram above. c. Increased demand (D0 to D1) causes upward pressure on the price (P0 to P1 – or, rather, €6 to €7) and thus an increase in quantity supplied (Q0 to Q1, 140 to 170 units/week). d. Solve for -40 + 30P = 240 – 10P → 40P = 280 → P = €7 e. A minimum price at €6 would mean unchanged Qs but an increase in Qd – and thus an excess of demand. Qd at a price of €6 is given by 240 – 10*6 = 180 units. The excess in demand is 40 units. 3. The new supply function, Qs = -10 + 30P, has the same slope (‘d’) and gives the supply curve a Pintercept of 0.33. This is €1 lower than the previous P-intercept – this is the subsidy per unit.