Lecture Note 6

advertisement

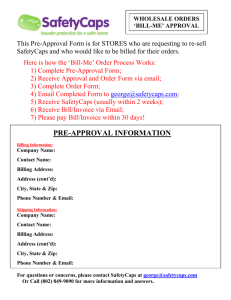

I S 5 3 0 : A c c o u nti ng I n f orm at ion S y s t em s h t t p : / / w w w. c s u n . e d u / ~ d n 5 8 4 1 2 / I S 5 3 0 / I S 5 3 0 _ F 1 5 . h t m Order Entry/Sales & Billing/AR/Cash Receipts Lecture 6 Order Entry / Sales (OE/S) Process Relationship between the OE/S process and its business environment. Potential of the OE/S process to assist management decision making. Logical and physical characteristics of the OE/S process. Control matrix for some typical OE/S processes Improvement of OE/S process with new technologies IS 530 : Lecture 6 2 Process Definition and Functions Order Entry/Sales (OE/S) Process accomplishes the following: • • Support repetitive work routines of the sales order department, credit department, and shipping department Support decision makers in various sales and marketing functions. IS 530 : Lecture 6 3 Management Questions Where is sales volume (quantity and dollars) concentrated? Who are the specific major customers (by sales and by profitability), both present and potential? What opportunities exist to sell after-sales services; to cross sell and to up-sell? What types of advertising and promotions have the greatest influence on customers? IS 530 : Lecture 6 4 Horizontal View of the OE/S Process IS 530 : Lecture 6 5 Description of Horizontal Information Flows IS 530 : Lecture 6 6 Vertical Perspective of the OE/S Process IS 530 : Lecture 6 7 The OE/S Process : Context Diagram IS 530 : Lecture 6 8 The OE/S Process : Level-0 DFD IS 530 : Lecture 6 9 The OE/S Process : Level-1 DFD for 1.0 IS 530 : Lecture 6 10 Process 1.1 : Verify Inventory Availability Inquiry of inventory master file to check inventory availability. • “Available to promise (ATP)” can be complicated. • Facilitated by an enterprise system that can look worldwide and up and down the supply chain to determine when goods can be delivered. If inventory is on hand, order is forwarded for further processing. If not, a back order routine. Record demographic and other info into the marketing data store. IS 530 : Lecture 6 11 Process 1.2 : Check Credit Establish the customer’s existence and then evaluate credit. Comprehensive credit check using: • Amount of order. • Amount of open orders (sales order master data). • Amount of open accounts receivable (AR master data). • Available credit (customer master data). IS 530 : Lecture 6 12 Process 1.3 : Complete Sales Order Update inventory master data to allocate the quantity ordered to the sales order (or reduce inventory balance). Update sales order master data to indicate that a completed sales order has been created. Disseminate the sales order. IS 530 : Lecture 6 13 Process 1.3 : External Data Flows Picking ticket: authorizes the warehouse to “pick” the goods from the shelf and send them to shipping. Identifies the goods to be picked and usually indicates the warehouse location. Customer acknowledgement: notifies the customer of the order’s acceptance and the expected shipment date. Sales order notification: document or computer message sent to the billing department to notify them of a pending shipment. IS 530 : Lecture 6 14 The OE/S Process : Level-1 DFD for 2.0 IS 530 : Lecture 6 15 The OE/S Process : Level-1 DFD for 3.0 IS 530 : Lecture 6 16 Process 3.2 : Produce Shipping Notice Update sales order master data: goods have been picked, packed, and shipped. Update inventory master data with actual shipment Shipping’s billing notification: notifies billing. • Bill of lading: contract between the shipper and the carrier in which the carrier agrees to transport the goods to the shipper’s customer. • Packing slip: sent with the package to identify the customer, destination, and contents. Update General Ledger inventory sales : inventory has been sold and cost of goods sold has increased. IS 530 : Lecture 6 17 OE/S Data Stores Customer master data: record of every authorized, regular customer. Inventory master data: record of each item that is stocked in the warehouse or regularly ordered from a vendor. Marketing data: repository of a variety of salesoriented data from presales or sales activities. Sales order master data: created on completion of a sales order and updated when goods have been shipped. IS 530 : Lecture 6 18 ERD for OE/S Process IS 530 : Lecture 6 19 Selected Relational Tables (Partial) for the OE/S Process IS 530 : Lecture 6 20 Electronic Data Capture Bar code readers: devices that use light reflection to read differences in bar code patterns in order to identify a labeled item. Optical character recognition (OCR): similar to bar code readers, but recognize a pattern of handwritten or printed characters. Scanners: input devices that capture printed images or documents and convert them into electronic digital signals that can be stored on computer media. IS 530 : Lecture 6 21 Digital Image Processing Major steps : • Scanners capture documents. Key additional data as • • needed. Documents are organized and filed. Documents may be made available worldwide. Additional processing • Additional data might be added, or someone might act on data contained in the document. • Documents might be routed using workflow. • Retrieval and processing capabilities may be incorporated into existing applications. • Linking images in an enterprise system Information can readily be distributed throughout the organization to where it is needed. IS 530 : Lecture 6 22 The OE/S Process System Flowchart IS 530 : Lecture 6 23 Validity for the OE/S Process Sales order input validity: order is from an existing, authorized customer—one contained in the customer master data (i.e., authorized customers that have passed initial credit investigation)—whose current order falls within authorized credit limits. Shipping notice input validity: shipping notice input is one that is supported by both an approved sales order and an actual shipment of goods. IS 530 : Lecture 6 24 Key OE/S Controls Customer credit check: performed to ensure that an organization does not extend more credit to a customer than is prudent. Compare picking ticket to picked goods: an example of one-for-one checking that ensures that the correct goods are picked from the shelf and that any errors are detected and corrected in a timely manner. Independent shipping authorization: establishes, for the shipping personnel, that someone other than the warehouse personnel authorized the shipment. IS 530 : Lecture 6 25 Key OE/S Controls . . . Compare shipment to sales order and picking ticket: Any discrepancy among these items might indicate an unauthorized or duplicate shipment (no open sales order) or an inaccurate shipment (quantities to be shipped do not agree with the picking ticket or open sales order). IS 530 : Lecture 6 26 Key OE/S Controls . . . Independent customer master data maintenance: segregation of duties between the personnel who create the customer record (to authorize sales to the customer) and the personnel who create the sales order (execute the sale). Review file of open sales orders (tickler file): to detect any shipments that should have taken place. This will ensure that all shipments are made in a timely manner. IS 530 : Lecture 6 27 Control Matrix For OE/S Business Process IS 530 : Lecture 6 28 Control Matrix for OE/S Business Process . . . IS 530 : Lecture 6 29 Global e-business Two categories of E-business systems: • Buy Side o Systems use the Internet to automate and manage purchases and vendors. o The predominant technology in this area EDI. • Sell Side o Systems allow a company to market, sell, deliver, and service goods and services to customers throughout the world via the Internet. o Can handle both B2B and B2C business transactions. o One facet is known as CRM applications. IS 530 : Lecture 6 30 CRM Systems Designed to manage all customer-related data. Cultivate customer relationships by prospecting, acquiring, servicing, and retaining customers. Features include: • Contact management. • Organizing and retrieving information on historical sales • • activities and promotions. Uses “Segmentation,” the grouping of customers into categories based on key characteristics. Sales-force automation to, for example, support call centers. Customer self-service systems. IS 530 : Lecture 6 31 Digital Image Processing Digital image processing systems: computer-based systems for capture, storage, retrieval, and presentation of images of objects, such as pictures and documents. Major steps : • Scanners capture documents. Key additional data as • • needed. Documents are organized and filed. Documents may be made available worldwide. IS 530 : Lecture 6 32 Digital Image Processing . . . After input, additional processing may take place. • Additional data might be added, or someone might act on data contained in the document. • Documents might be routed using workflow. • Retrieval and processing capabilities may be incorporated into existing applications. • Linking images in an enterprise system makes accessibility easier. Information can readily be distributed throughout the organization to where it is needed. IS 530 : Lecture 6 33 Electronic Data Capture Bar code readers: devices that use light reflection to read differences in bar code patterns in order to identify a labeled item. Optical character recognition (OCR): similar to bar code readers, but recognize a pattern of handwritten or printed characters. Scanners: input devices that capture printed images or documents and convert them into electronic digital signals that can be stored on computer media. IS 530 : Lecture 6 34 Billing/Accounts Receivable/Cash receipts (B/AR/CR) Process Relationship between the B/AR/CR process and its business environment. Potential of the B/AR/CR process to assist management decision making. Depict the logical and physical characteristics of the B/AR/CR process. Control matrix for some typical billing and cash receipts processes Improvement of OE/S process with new technologies IS 530 : Lecture 6 35 Process Definition and Functions The billing/accounts receivable/cash receipts (B/AR/CR) process accomplishes the following: • Support the repetitive work routines of the cashier, and the • • credit and accounts receivable departments. Support the problem-solving processes of financial managers. Assist in the preparation of internal and external reports. IS 530 : Lecture 6 36 Horizontal View of the B/AR/CR Process IS 530 : Lecture 6 37 Description of Horizontal Information Flows IS 530 : Lecture 6 38 Optimizing Cash Resources Treasurer’s goal: make funds available to acquire assets, make investments, or reduce interest charges. Billing’s goal: get invoices to customers quickly, hopefully reducing the time it then takes to obtain customer payments. Having the B/AR/CR process produce invoices automatically helps ensure that invoices are sent to customers shortly after the goods have been shipped. IS 530 : Lecture 6 39 Cash Receipts Management The treasurer’s goal is to reduce float and hasten the availability of good funds. • Float: when applied to cash receipts, is the time between • the payment by the customer and the availability of good funds. Good funds: funds on deposit and available for use. Procedures designed to reduce or eliminate the float associated with cash receipts: • Credit card: a method of payment whereby a third party • such as a bank removes from the collector the risk of not collecting the amount due from a customer. Debit card: form of payment authorizing the collector to transfer funds electronically from the payer’s bank account to the collector’s bank account. IS 530 : Lecture 6 40 B/AR/CR Process Context Diagram IS 530 : Lecture 6 41 B/AR/CR Process Level-0 DFD IS 530 : Lecture 6 42 B/AR/CR Process Level -1 DFD for 1.0 IS 530 : Lecture 6 43 Process 1.1 : Validate Sales Order Process 1.1 performs the following task: • validates sale by comparing the details on the sales order notification (what was supposed to be shipped) to those shown on shipping’s billing notification (what was shipped). IS 530 : Lecture 6 44 Process 1.2 : Prepare invoice Process 1.2 performs the following actions: • Obtains from the customer master data certain standing • • • • data, such as the bill-to address, needed to produce the invoice. Creates the invoice and sends it to the customer. Updates the accounts receivable master data. Adds an invoice to the sales event data (i.e., the sales journal). Notifies the general ledger process that a sale has occurred (GL invoice update). An immediate update of the GL for a single sale. IS 530 : Lecture 6 45 B/AR/CR Process Level-1 DFD for 2.0 IS 530 : Lecture 6 46 B/AR/CR Process Level-1 DFD for 3.0 IS 530 : Lecture 6 47 Process 3.1 : Compare Payment and Remittance Advice Remittance advice (RA): business document used by the payer to notify the payee of the items being paid. Process 3.1 validates the remittance by comparing the payment notice to the RA. IS 530 : Lecture 6 48 Process 3.2 : Record Customer Payment Process 1.2 performs the following actions: • Uses the RA to update the accounts receivable master data to reflect the customer’s payment. • Records the collection in the cash receipts events data and notifies the general ledger process of the amount of cash deposited. This is an immediate update of the GL for a single cash receipt. Process 3.2 is a controller function, is typically performed by the payment applications section of the accounts receivable department. IS 530 : Lecture 6 49 Balance-Forward System AR records show a customer’s balance – current, past-due, and current account activity, including current charges, finance charges for past-due balances, and payments. Monthly statements display previous balance, payments, and balance forward, to which is new charges are added to get the current balance due. Unpaid current balances are rolled into the pastdue balances. IS 530 : Lecture 6 50 Open-Item System Appropriate where invoices are prepared and sent for each sale. In the AR master data, each record consists of individual open invoices, to which payments and adjustments are applied. Periodic statements list invoices and payment details. Monthly, or at specified times, customer accounts are aged and an aging schedule is printed. IS 530 : Lecture 6 51 B/AR/CR Data Stores Accounts receivable master data: Repository of all unpaid invoices issued by an organization and awaiting final disposition. Sales event data store: invoice (sales) records. Is a sales journal in a manual process. Accounts receivable adjustments events data store: records from sales returns, bad debit write-offs, estimated doubtful accounts, etc. Cash receipts event data store: details of customer payments. IS 530 : Lecture 6 52 ERD (Partial) for B/AR/CR Process IS 530 : Lecture 6 53 Selected Relational Tables (Partial) for the B/AR/CR Process IS 530 : Lecture 6 54 Selected Relational Tables (Partial) for the B/AR/CR Process (cont’d) IS 530 : Lecture 6 55 Types Of Billing Systems Pre-billing system Post-billing system • Invoice prepared upon acceptance of customer order (after inventory and credit checks). • There is little or no delay between receiving order and shipping. • Invoices are prepared after goods are shipped and shipping notice compared to sales order notice. • There may be a delay between receiving the order and shipping. IS 530 : Lecture 6 System Flowchart of the Billing Process IS 530 : Lecture 6 57 Control Matrix for the Billing Business Process IS 530 : Lecture 6 58 Validity for the Billing Process Valid shipping notice inputs are: properly authorized and reflect actual credit sales; for example, a shipping notice should be supported by a valid sales order and a real shipment, and the invoice should be prepared using authorized prices, terms, freight, and discounts. If a billing process is completed without a real shipment (a genuine sale), revenues will be overstated. IS 530 : Lecture 6 59 Key Billing Controls Review shipped not billed sales orders (tickler file): monitor sales orders that have been shipped but not yet billed. Compare input shipping notice to sales order master data: ensures that the invoice, accounts receivable, and revenue accurately reflect the items and quantities ordered by, and shipped to, the customer. IS 530 : Lecture 6 60 Key Billing Controls . . . Independent billing authorization: establishes that the shipment is supported by an actual sales order (a copy of the sales order from customer service or the open sales order records on the sales order master data). Assumes a segregation of duties among sales (customer service), shipping, and billing. IS 530 : Lecture 6 61 Key Billing Controls . . . Check for authorized prices, terms, freight, and discounts to ensure that invoices, accounts receivable, and revenue reflect prices, terms, freight, and discounts authorized by management. Independent pricing data: assumes segregation of duties between those who approve unit prices and those involved in the selling function. Confirm customer accounts regularly: The customer can be used as a means of controlling the billing process; the customer can review the report of open invoices to determine that the invoices are valid and accurate. IS 530 : Lecture 6 62 System Flowchart of the Cash Receipts Process IS 530 : Lecture 6 63 Control Matrix for the Cash Receipts Process IS 530 : Lecture 6 64 Validity for the Cash Receipts Process Valid RA inputs (i.e., cash receipts) are those that represent funds actually received and for which cash discounts have been authorized and approved. If a cash receipts process is completed without actual funds, assets will be misstated (AR too low and cash too high). IS 530 : Lecture 6 65 Key Cash Receipts Controls Immediately endorse incoming checks: to protect payments from being fraudulently misappropriated, checks should be restrictively endorsed as soon as possible following their receipt in the organization. Immediately separate checks and remittance advices: RAs should be immediately separated from the checks to accelerate deposits and reduce opportunities to divert cash and undertake lapping. IS 530 : Lecture 6 66 Key Cash Receipts Controls . . . Lockbox: payments are sent directly to a third-party lockbox service for more secure, timely, efficient, and accurate processing. Turnaround documents: the remittance advice is the stub from a statement or invoice and can processed more efficiently and accurately. IS 530 : Lecture 6 67 Key Cash Receipts Controls . . . Reconcile bank account regularly: reconcile bank statement to the cash receipts event data to ensure that all valid deposits were recorded correctly. Should be performed by someone other than those that handle cash receipts and disbursements. Monitor open accounts receivable: regularly review and follow-up on accounts receivable aging reports to ensure that payments are received in a timely manner. IS 530 : Lecture 6 68 The Fraud Connection B/AR/CR process provides opportunity to manipulate final results such as revenue and AR by violating GAAP revenue recognition rules. Improper segregation of duties between handling cash and recording cash transactions can result in misappropriating cash: • Lapping: fraud by which funds being paid by one customer are stolen, and the theft is covered up by applying funds from another customer to the first customer’s account. Rotation of duties and forced vacations help prevent this type of fraud. IS 530 : Lecture 6 69 Electronic Bill Presentment and Payment (EBPP) Electronic Bill Presentment and Payment (EBPP) systems: B2C systems that use a Web site to post customers’ bills and to receive their electronic payments. Types of EBPP systems: • Biller direct method, whereby a company posts its • bills/invoices to its own Web site (or to a Web site hosted for it by a third party). Consolidation/aggregation method, in which bills are not posted to the billing company’s Web site but are posted to a Web site hosted by the billing company’s own bank or by a company such as Fiserv. IS 530 : Lecture 6 70 Accelerating Cash Receipts Electronic funds transfer (EFT): general term used to describe a variety of procedures for transmitting cash funds between entities via electronic transmission instead of using paper checks. Includes wire transfers, credit and debit card processing, as well as payments made via the ACH Network. Automated Clearing House (ACH) Network: batch processing system for the interbank clearing of electronic payments. IS 530 : Lecture 6 71 Accelerating Cash Receipts . . . Lockbox: postal address maintained by a third party—typically a bank—which is used solely for the purpose of collecting checks. Remote deposit capture uses scanners to capture check images and to use those images, instead of the paper check, to make a deposit to a checking, savings, or money market account. IS 530 : Lecture 6 72