economics - woodlandecon

advertisement

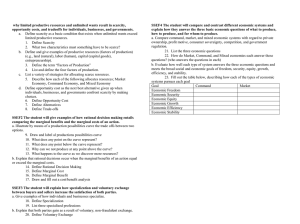

Chapter 1: Limits, Alternatives and Choices The Economic Perspective 1. Scarcity & Choice- We start with the economic reality that our economic wants far exceed the productive resources available to meet those wants and as a result are forced to make choices. In fact economics is defined as a social science concerned with how people, institutions and nations make optimal choices under conditions of scarcity. TINSTAAFL- is the idea that there is no such thing as a free lunch. The true cost of any good or service are the other things we could have had if those resources had been used somewhere else. Resources have alternative uses and therefore society gives up something in order to get something. Opportunity cost describes what must be sacrificed in order to get the thing we want. Opportunity cost represents the next best alternative given up when a choice is made. Every decision we make then has an opportunity cost with it. 2. Purposeful Behavior-Economics assumes that human behavior reflects rational self-interest. People look for opportunities to increase their utilitywhich means pleasure or satisfaction. They allocate their time, energy and money to maximize their utility. In weighing the costs and benefits of their actions people act rationally as opposed to randomly. Rational self-interest is not the same thing as selfishness. People do many things that are in their self-interest but would not be considered selfish. 3. Marginal Analysis-When making decisions people focus primarily on changes in the status quo by comparing the marginal benefits of an action with its marginal cost. The word marginal means additional or extra. In a world of scarcity, the decision to obtain the marginal benefit associated with some action always includes the marginal cost of forgoing something else. Look at the consider this article on fast food lines to see how marginal analysis is used. Economists develop theories, principles and models to help explain economic behavior. There are 3 noteworthy things about these theories, principles and models. 1. Economic principles are generalizations about behavior expressed as the tendencies of typical or average consumers, workers, or business firms. For example economists say that consumers buy more of a particular product when its price falls, but they recognize that some consumers may buy a lot more, others a little more, and a few not at all. 2. Other things equal assumption, also called ceteris paribus assumes that all variables except those under immediate consideration are held constant. This allows the economist to focus on the relationship between 2 variables without being confused by changes in other variables. We will invoke our ceteris paribus assumption many times throughout this text. 3. Graphical expressions are used many times to illustrate how a particular model works. In particular pay attention to the key graphs throughout the text. Micro vs. Macro Microeconomics deals with decision making by individual consumers, workers and business firms. Here we examine the trees, not the forest. Macroeconomics looks at the economy as a whole or its basic subdivisions or aggregates. Here we focus on the forest, not the individual trees. Macro seeks to obtain an overview, or general outline of the structure of the economy and the relationships of its major aggregates. Society’s Economizing Problem Society has limited or scarce economic resources that are used in the production of goods and services. Let’s look at how these resources are classified. Resources are also called factors of production or inputs. 1. Land: is also called natural resources or gifts of nature. These occur naturally without human effort. These would include forests, minerals, oil deposits, water, wind power, sunlight and soil. 2. Labor: consists of all the physical and mental effort that workers contribute to the production process. This includes loggers, retail clerks, machinists, teachers, pro athletes and policemen. 3. Capital: includes all manufactured aids used in producing consumer goods and services. Economists use the term investment to describe business spending on capital goods. These include factories, machines, tools and equipment. Capital goods differ from consumer goods because consumer goods satisfy wants directly, whereas capital goods do so indirectly by aiding the production of consumer goods. Note that capital in this context does not mean money or financial capital. 4. Entrepreneurship: represents the risk taker in search of profits. They are distinct from labor because they perform several unique functions. a. Takes initiative in combining the resources. b. Makes strategic business decisions that determine the course of the business. c. An innovator who comes up with new products, technologies, or new ways of doing things. d. Bears the risk of possible failure in exchange for the possibility of profits. Production Possibilities Frontier/Model This model will help illustrate some lessons about how our economy works. To keep things simple we will make 4 assumptions. Full employment- the economy is employing all of its available resources. Fixed resources- the quantity and quality of our resources are fixed at a point in time. Fixed technology- Our methods used to produce output is constant. Two goods- We are producing robots and pizza. Robots symbolize capital goods and pizza symbolizes consumer goods. Table 1.1 lists the different combinations of our 2 products that can be produced with a specific set of resources, assuming full employment. Generalization: At any point in time, a fully employed economy must sacrifice some of one good to obtain more of another good. The data in Table 1.1 is shown graphically in figure 1.2. Here are the basic lessons we learn from the model. All points on the curve are equally efficient (A-E). Points inside the curve are inefficient (U). Movements along the curve involve an opportunity cost. Points outside the curve are currently unattainable (W). Outward shifts over time are called economic growth. Figure 1.2 clearly shows that more pizza means fewer robots. The number of robots that must be given up to obtain another unit of pizza is called opportunity cost, but notice that as we move from A-E or E-A the cost of the other product increases. This illustrates the Law of Increasing Opportunity Cost and is reflected in the fact that the curve is bowed or concave from the origin. As we move down along the curve the slope becomes steeper indicating that the cost is increasing. The reason for the bowed shape is due to the fact that economic resources are not completely adaptable to alternative uses. Optimal Allocation Of all the possible combinations of pizza and robots on the curve, which is the optimal or best mix? Remember that economic decisions center on comparing marginal benefits with marginal costs so the optimal amount of the 2 products occurs where MB=MC. Look at figure 1.3 and see that the optimal quantity of pizza is indicated by point e which equals 200,000 pizzas. The MB is the benefit we derive from additional units of pizza as represented by it’s selling price. The MC represents the value of the other goods we could have had if those resources were used elsewhere. Ex. At 100,000 pizzas MB=$15 and MC=$5 so society is saying it values those units of pizza more than the other things we could have had which are valued at $5. When society gets something valued at $15 at a cost of $5, it is better off. Net gains continue to be realized until pizza production reaches 200,000. Look at 300,000 to see why it’s a losing proposition for society. So resources are being efficiently allocated to any good when the MB and MC are equal. If we apply the same analysis to robots, we might find the optimal output of robots is 7,000. This would mean that alternative C in figure 1.2 is the optimal combination for this economy. As circumstances change the optimal mix can also change so it is not fixed over time. Unemployment, Growth and the Future Does the economy always operate at full employment? Obviously not! Our analysis and conclusions can change then when we relax 1 or more of our assumptions, say that resources are no longer fully employed. Graphically, we represent situations of unemployment by points inside our PPF such as point U in figure 1.4. Notice the arrows indicate 3 possible paths back to full employment with greater output of one or both products. The best example of this situation is an economy in recession or depression. A Growing Economy When we drop the assumptions that the quantity and quality of resources and technology are fixed, the PPF shifts positions and the potential maximum output of the economy changes, see figure 1.5. An outward shift in the curve is called economic growth and reflects an expanded productive capacity. Key point: Economic growth is the result of increases in the supplies of resources, improvements in resource quality and technological advances. Whereas static, no growth economies must sacrifice some of one good to obtain more of another, dynamic, growing economies can have larger quantities of both goods. Figure 1.6 illustrates that our present choices will determine future location of that PPF. See Presentville vs. Futureville. Notice Futureville is choosing to make larger current additions to its national factory by devoting more of its resources to capital vs. consumer goods. The payoff is greater future production capacity and economic growth. A Qualification: International Trade The PPF implies that an individual nation is limited to the combination of output indicated on the curve. We will see later that an economy can circumvent, through international trade the output limits imposed by its domestic PPF. With trade each nation specializes in those items for which it has the lowest opportunity cost. International trade allows a nation to get more of a desired good at less sacrifice of some other good. Specialization and trade have the same effect as having more and better resources or discovering improved production techniques. Last Word: Pitfalls to Sound Reasoning, pg. 16-17 1. 2. 3. 4. 5. Biases Loaded Terminology Fallacy of Composition Post Hoc Fallacy Correlation vs. Causation