Loan Summary tab

advertisement

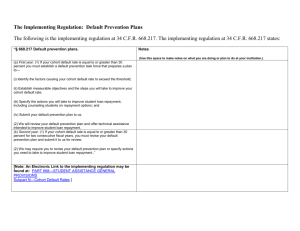

The FedLoan Servicing Experience An Overview of Borrower and School Services Agenda • The Borrower Experience – Borrower Communications – Customer Service – Borrower Portal – Account Access • The School Experience – – – – 2 Communications Access Products & Tools Training The Borrower Experience You can view our sample letters and emails at: MyFedLoan.org/borrowertimeline 3 Borrower Communication Timeline Borrower communication timeline from In-school to the Grace period. Interest Bill* Outstanding Interest Email Enrollment Change Confirmation Loan Summary Email Disbursement Notification Email Welcome Letter & Email / Privacy Notice 4 *To receive an interest bill while in school, a student must contact us and request to pay interest. All students, regardless of whether or not they pay interest while in school, receive an interest notice when they have 20 days left of the grace period. Borrower Communication Timeline This shows the borrower communication timeline from Grace to Repayment. Repayment Obligation/ Schedule Interest Notice Disclosure Statement 3-Month Grace Email Entering Grace Email 5 Installment Bill Entering Repayment Email View complete sample timeline of communications for borrowers at www.myfedloan.org/StudentBorrower Borrowers can opt to receive all account-related correspondence in the borrower portal. Road to Repayment Entering Grace Email • In an effort to reach out to withdrawn borrowers the Grace email has been segmented. The emails have the same message, but the withdrawn email specifically states that the borrower withdrew from school. • The emails provide account specific information for the borrowers including: – School name and separation date – Steps for borrowers to take during the next six months are included to keep them informed on their loans 6 Communications – In Repayment Additional letters and emails may be sent based on unique situations. • Repayment Summary/Repayment schedule changes • Monthly statements • Deferment/Forbearance notifications • Delinquency notices • Forgiveness and Discharge 7 FedLoan Borrower Experience • We take approximately 15,000 calls each day and average 5 to 7 minutes per call. – 65% of callers opt to speak to one of our counselors. – 35% of callers opt to remain within the self-service system. • Specially trained school agents are on staff to assist with calls from financial aid professionals. • Customer Services Representatives are available Monday through Friday from 8:00 A.M. until 9:00 P.M. ET. 8 Borrower Portal – Sign in Easy access to the secure portal from our public site at MyFedLoan.org 9 Creating an Account Step 1 • Provide personal information • Create a username and password • Select a site image and caption Step 2 • Verify that the information provided is accurate. Step 3 10 • Confirmation • Student may now proceed to their account Borrower Portal – Account Home Alerts & Messages draw borrower attention to specifics of their own account including: • New messages within their paperless inbox • Invalid demographic information • Late or missed payments, and more Aggregate and detailed loan information helps borrowers understand their loans, including: • • • • 11 Interest rate Repayment term Monthly installment amount Original balance Borrower Portal – Billing & Payment Plans The Billing & Payment Plans section gives borrower financial management tools to: • • • • 12 Understand their monthly bill Schedule payments Review payment plans Learn about interest and more … Targeting Payments Borrowers have the option to pay extra towards their loan balance by targeting payments. How to Target Payments 13 Step 1 Sign in to your account Step 2 Click “Make a Payment” Step 3 Select the “Specify Loan Payment Amounts” tab Step 4 Enter payment information (Minimum Amount Due + Additional Funds) Step 5 Hit the “Make a Payment” button Repayment Calculators and Estimators Repayment calculators and estimators show how different financial choices and situations can affect a student’s monthly payment and budget. 14 • Repayment Schedule Estimator • Grace Period Calculator • Interest Savings Calculator FedLoan Servicing Consolidation Counselor The Consolidation Quiz and assists borrowers in deciding whether or not consolidation is the best choice and will direct interested borrowers to the consolidation application. Use the Consolidation Estimator to review current repayment options versus repayment options available after consolidation to determine if consolidation is the right choice. 15 Contact Us & MyFedLoan Mobile From any page within the portal, a borrower can contact an experienced loan advisor by email, phone or mail. 16 With MyFedLoan Mobile, borrowers/co-signers can: • View their Account Summary • Review balances • Make a payment Borrower Help Center Direct your students to the Borrower Help Center for quick answers to frequently asked questions and self service tools. Some of our FAQ topics include: • New Borrower FAQ • Graduate & Professional Borrowers FAQ • Billing FAQ • Tax FAQ • Enrollment Status FAQ Check out the Borrower Help Center at: http://www.myfedloan.org/helpcenter/faq/index.shtml 17 The School Experience • The School Experience – – – – 18 Communications Access Products & Tools Training Communications – Weekly/Monthly 19 Communication – Customized Bulletin • Includes an overview of your school’s student loans serviced at Fedloan Servicing – Student borrower portfolio – Default figures – Loan cure information • Sent quarterly and emailed directly to your inbox • No access required to receive this valuable update 20 School User Access • Schools requesting access to FedLoan Servicing borrower data must have a Remote Access Agreement (RAA) on file • All access is managed on the Business Partner Access Management System (BPAMS) • The designated Authoritative Source is responsible for – Approving/Denying access requests – Completed the Annual Access Review 21 Business Partner Access Management System (BPAMS) View the BPAMS tutorials for more information on the various functions available. For assistance on user access related issues, please call 1-800-443-0646, Option 1 22 Products & Tools – School Portal School Portal Features: • Real-time borrower account details • 24/7 access 23 School Portal – Customized Reports From our Loan Portfolio Summary you are able to: • • • • 24 Search for borrowers by name or SSN Save and export your reports Create custom reports (filter & modify) View reports by status School Portal – Borrower Detail View Loan Summary tab: • Loan status • Number of days delinquent • Disbursement history • Additional loan detail – School Enrollment – Repayment Schedule – Interest rate Billing Summary tab: • Payment due date • Billing method and type • Total amount due • Total bill amount Payments Summary tab: • Loan level payment details • How payments affect balance and schedule 25 School Portal – Borrower Detail View Rahzieh Test SSN:123-45-6789 ACCT: 98-7645321 26 Deferment/Forbearance Summary tab provides: • View Deferment or Forbearance type • Begin date • End date • Interest cap notice • Processing status Tools - Default Prevention Plan Builder • Create a customized delinquency management plan • Select how active you want to be based on your resources Contact your Sector Representative for assistance with tailoring a default prevention plan targeted specifically for your student population. 27 Tools - Before You Owe/Go Worksheets Before You Owe encourages students to record their loan balance and servicer information before they take on additional debt. Before You Go - provides students with a convenient location to record the information they learn when reviewing their loan portfolio at Exit Counseling. Found at MyFedLoan.org/schools on our Publications page. Also available in Spanish! 28 Tools - Reporting Option from NSLDS Use the NSLDS Delinquent Borrower Report to produce letters to delinquent borrowers who have loans serviced by any federal servicer. More information and instructions found at MyFedLoan.org/schools on our Training page. Check out the NSLDS Mail Merge tutorial! 29 Financial Literacy Budget Central will point you to the most useful information on YouCanDealWithIt.com and MyFedLoan.org to get you started on the right path to a solid financial foundation. YouCanDealWithIt.com Focuses on the financial future of college students and recent graduates • Offers tools to successfully manage financial decisions • • • • 30 Calculators Financial Wellness Curriculum Web Banners Student Aid Modules • • • Entrance Counseling Retention Exit Counseling Five Star Training • Request a customized training webinar. – Overview of Products & Services – Portal Navigation • Monthly webinars are available on various topics: – – – – FedLoan Servicing Products & Services Default Prevention & Financial Literacy Policy and Compliance Professional Development • Visit MyFedloan.org/schools/training to learn more about all of the training opportunities available. 31 Contact Information • If you or anyone at your institution would like more information about FedLoan Servicing, please call 800.655.3813 or email SchoolSupport@MyFedLoan.org. • If your student borrowers need assistance, they can call 800.699.2908 or follow the 'Contact' link at www.MyFedLoan.org 32 Your Dedicated Sector Representatives Public & Proprietary Private/Graduate & Professional Diona Brown Lisa Ciritella 717-720-3546 dbrown1@pheaa.org 717-720-2309 lciritel@pheaa.org Facebook.com/fedloanpublic Facebook.com/fedloanprivate Facebook.com/fedloanproprietary Contact us if you have any questions!