Competitive Rivalry & Dynamics: Business Strategy

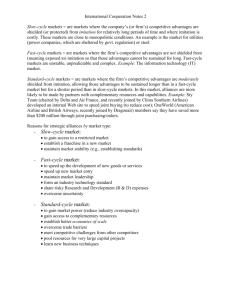

advertisement

PART III CREATING COMPETITIVE ADVANTAGE Chapter 6 Competitive Rivalry and Competitive Dynamics 1 Dramatic increase in competitive actions and reactions between firms Decreased decision making time Increased speed of new ideas and products Soaring speed at which knowledge “pulses” between competitors Fast firms generate advantages and market power. Faster firms generate more advantages and greater market power. Key Terms Competitors Firms operating in the same market, offering similar products, and targeting similar customers Competitive rivalry Ongoing set of competitive actions and competitive responses occurring between competitors as they contend with each other for an advantageous market position Key Terms Competitive behavior Set of competitive actions and competitive responses the firm takes to build or defend its competitive advantages and to improve its market position Competitive dynamics Total set of actions and responses taken by all firms competing within a market Multimarket competition Firms competing against each other in several product or geographic markets The total number of competitors Market characteristics Quality of individual firms' strategies Drivers of competitive behavior Market Commonality Resource Similarity Firms with high market commonality and highly similar resources are clearly direct and mutually acknowledged competitors. Key Terms Market commonality Number of markets with which the firm and a competitor are jointly involved and the degree of importance of the individual markets to each Key Terms Resource similarity Extent to which the firm's tangible and intangible resources are comparable to competitors' resources in terms of both type and amount Awareness Motivation Ability Resource Dissimilarity Key Terms Competitive action Strategic or tactical action the firm takes to build or defend its competitive advantages or improve its market position Competitive response Strategic or tactical action the firm takes to counter the effects of a competitor's action Tactical action (or response) Market-based move that is taken to fine-tune a strategy Strategic actions/responses are marketbased moves that signify a significant commitment of organizational resources to pursue a specific strategy. They are difficult to implement and reverse. Tactical actions/responses are market-based moves that are taken to fine-tune a strategy that is already in place, involving fewer resources. They are relatively easy to implement and reverse. First mover incentives Organizational size Quality Key Terms First mover Firm that takes an initial competitive action to build or to defend its competitive advantages or to improve its market position Second mover Firm that responds to the first mover's competitive action, typically through imitation Late mover Firm that responds to a competitive action, but only after considerable time has elapsed after the first mover's action and the second mover's response Often build upon a strategic foundation of superior research and development skills Tend to be aggressive and willing to experiment with innovation Tend to take higher, yet reasonable, risks Need to have liquid resources that can be quickly allocated to support actions Competitive advantage Above-average returns Customer loyalty Industry standards Market share Difficulty to accurately estimate potential returns Substantial costs of product innovation, which reduces organizational slack available for other opportunities Low likelihood of introducing or converting to the product that eventually becomes the dominant design or industry standard as the market evolves More cautious than first movers Tend to study customer reactions to product innovations Tend to learn from the mistakes and avoid the large investments required of first movers, reducing their risks Can take advantage of time to develop more efficient processes and technologies than first movers, reducing their costs Will not benefit from first mover advantages, lowering potential returns Respond to market opportunities only after considerable time has elapsed after first and second movers, substantially reducing risks and returns Typically, a late response is better than no response at all Small firms Nimble and flexible competitors Rely on speed and surprise to defend their competitive advantage Greater variety of competitive behavior options available Large firms Often have greater slack Greater likelihood to initiate competitive and strategic actions over time Tend to rely on a limited variety of competitive actions, which can ultimately reduce their competitive success Key Terms Quality Customer perception that the firm's goods or services perform in ways that are important to the customer to meet or exceed their expectations Types of competitive action Actor’s reputation Dependence on the market Competitive dynamics Strategic actions elicit different responses than tactical actions. Strategic actions generally elicit strategic responses. Tactical actions generally elicit tactical responses. Strategic actions elicit fewer total competitive responses. Actions that target a large number of a rival’s customers are likely to elicit strong responses. Key Terms Actor Firm taking an action or response (in the context of competitive rivalry) Reputation Positive or negative attribute ascribed by one rival to another based on past competitive behavior Key Terms Market dependence Extent to which a firm's revenues or profits are derived from a particular market Slow-cycle markets Fast-cycle markets Standard-cycle markets Key Terms Slow-cycle markets Markets in which the firm's competitive advantages are shielded from imitation for what are commonly long periods of time and where imitation is costly One-of-a-kind proprietary competitive advantage Orient competitive behavior to protecting, maintaining, and extending that advantage Key Terms Fast-cycle markets Markets in which the firm's capabilities that contribute to competitive advantages are not shielded from imitation and where imitation is often rapid and inexpensive Complex and rapid strategic decisions Relatively easy imitation Unprotected technology High volatility Rapid and continuous development of new competitive advantages – innovation Temporary competitive advantage Avoid loyalty to products – willingly cannibalize own products Key Terms Standard-cycle markets Markets in which the firm's competitive advantages are moderately shielded from imitation and where imitation is moderately costly Continuously upgrade quality Serve many customers and gain a large market share Gain customer loyalty through brand names Deliver consistent customer experiences When competing against one another, firms jockey for a market position that is advantageous, relative to competitors. In this jockeying, what are the ethical implications associated with the way competitor intelligence is gathered? Second movers often respond to a first mover’s competitive actions through imitation. Is there anything unethical about a company imitating a competitor’s good or service as a means of engaging in competition? The standards for competitive rivalry differ in countries throughout the world. What should firms do to cope with these differences? What guidance should a firm give to employees as they deal with competitive actions and competitive responses that are ethical in one country but unethical in others? In slow-cycle markets, effective competitors are able to shield their competitive advantages from imitation by competitors for relatively long periods of time. However, this is not the case in fast-cycle markets. Do these conditions have implications in terms of ethical business practices? Do ethical standards in slow-cycle markets differ from those in fast-cycle markets? Is it ethical for the firm competing against a competitor in several markets to launch a competitive response in a market that differs from the one in which that competitor took a competitive action against the local firm? Why or why not?