docx - 3.31mb - Department of Education and Early Childhood

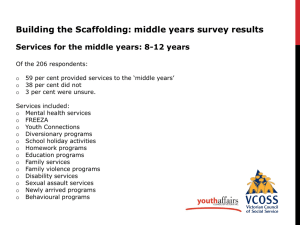

advertisement