Chapter 8 - micro

advertisement

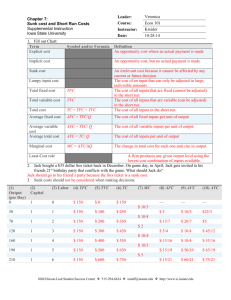

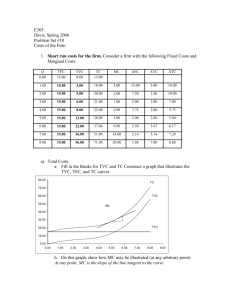

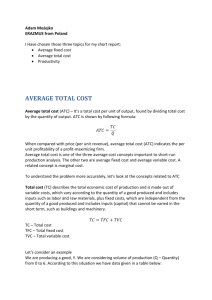

Chapter 8 Costs and the Supply of Goods 1 Overview Shirking and the Principle-Agent Problem The 3 Types of Business Firms Economic vs. Accounting Profits The Normal Rate of Profit Short-run vs. Long-run Categories of Costs Law of Diminishing Returns Cost Curves (short-run and long-run) Sunk Costs 2 Incentives and Cooperation Residual Claimants: Individuals who personally receive the excess of revenues over costs They have the incentive to increase revenues or reduce costs 3 Incentives and Cooperation There are two ways to organize productive activity 1. Contracting: using outside producers for specific tasks 2. Team Production: Where employees work together under the supervision of the owner (or owner’s representative) 4 Incentives and Cooperation Shirking: Working at less than the expected rate of productivity, which reduces output. Principle-agent problem: The incentive problem that occurs when the purchaser of services lacks full information about the circumstances faced by the seller, and therefore, cannot know how well the seller performs the service. 5 Shirking and the Principle Agent Problem 6 The 3 Types of Business Firms 1. Proprietorship: a business firm owned by a single individual. Gets all the profits, but accepts all the risk 7 The 3 Types of Business Firms 2. Partnership: A business firm owned by two or more individuals They share the profits and the risk 8 The 3 Types of Business Firms 3. Corporation: A business firm owned by shareholders They have the right to the firm’s profits, but their liability is limited to the amount of their investment 9 Calculating Economic Costs and Profits 1. Explicit Costs: The payments a firm makes to purchase the goods and services of productive resources. 2. Implicit Costs: The opportunity costs associated with the firm’s use of resources that it owns ex. Foregone interest, foregone rent 10 Calculating Economic Costs and Profits 3. Total Costs (TC): The costs (both explicit and implicit) of all of the resources used by the firm includes the normal rate of return for the firms equity capital. 11 Economic vs. Accounting Profit Economic Profit: The difference between the firms total revenue and its total costs (including both explicit and implicit costs) Accounting Profit: The sales revenue minus the expenses of the firm (does not usually include implicit costs) 12 Normal Profit Rate Normal Profit Rate: Zero economic profit, the competitive rate of return on the capital and labor of the owners *Note: Zero economic profit does NOT mean the business is failing ≠ 13 Short Run vs. Long Run Short Run: A time period so short that a firm is unable to vary some of its factors of production. Long Run: A time period long enough to allow the firm to vary all of its factors of production. 14 Lets Throw a Party! What do we need? 15 Categories Of Costs Total Fixed Costs (TFC): The sum of the costs that do not vary with output Fixed costs will remain unchanged as output rises or falls in the short run Ex. Insurance premiums, property taxes, etc. 16 Categories Of Costs Average Fixed Costs (AFC): Total Fixed Costs divided by the number of units produced AFC = TFC / Q average fixed costs always declines with output 17 Categories Of Costs Total Variable Costs (TVC): The sum of those costs that change with output Ex. wages, raw materials 18 Categories Of Costs Average Variable Costs (AVC): Total variable costs divided by the number of units produced AVC = TVC / Q 19 Categories Of Costs One can get Total Costs (TC) by adding together Total Fixed Costs (TFC) and Total Variable Costs (TVC) TC = TFC + TVC 20 Categories Of Costs Average Total Costs (ATC): Total Cost divided by the number of units produced ATC = TC / Q or ATC = AFC + AVC The ATC curve is U-shaped because Average Total Cost will be high for both an under-utilized plant (AFC is high) and an over-utilized plant (MC is high) 21 Categories Of Costs Marginal Costs (MC): The change in total costs required to produce an additional unit of output. To increase profits: one only produces if the additional revenue from one more unit is greater than the marginal cost of that unit 22 Diminishing Returns and Production Law of Diminishing Returns: As more and more units of a variable resource are applied to a fixed amount of other resources, output will eventually increase by smaller and smaller amounts 23 Diminishing Returns and Production Total Product (TP): The total output of a good at a given rate of input Marginal Product (MP): the change in total product associated with each additional unit of labor 24 Diminishing Returns and Production (pg. 181) Average Product (AP): The total product divided by the number of variable units (labor) used to get that total product AP = TP / Q *Note: Average product increases as long as marginal product is greater than the average product Ex. Your GPA 25 The Cost Curves! 1. 2. 3. Remember that ATC is U-shaped Remember that AFC falls with output AVC is a small part of ATC when output is small and a LARGE part of ATC when output is LARGE 4. 5. MC curve may decrease at first, but then rises MC < AVC (ATC) → AVC (ATC) decreases MC > AVC (ATC) → AVC (ATC) increases 26 Output and Costs in the Long Run The Long Run Average Total Cost Curve (LRATC): shows the minimum average cost of producing each output level when the firm is free to choose among all possible plant sizes Outlines the possibilities available in the planning stage. 27 Economies of Scale (pg. 188) Economies of Scale: Occurs when the firm’s per-unit costs decrease as output increases (Q↑ → LRATC↓) Diseconomies of Scale: Occurs when the firm’s per-unit costs increase as output increases (Q↑ → LRATC↑) 28 Economies of Scale Constant Economies of Scale: Occurs when the firms per-unit costs do not change as output changes. Economies and diseconomies of scale are long run concepts (where all factors are variable). Increasing and diminishing returns are short run concepts (where at least one factor of production is fixed). 29 Production: Economies of Scale 30 Shifting The Cost Curves Shifters of the Cost Curves 1. 2. 3. 4. Price of resources Taxes Regulations Technology 31 Sunk Costs Sunk Costs: Costs that have already been incurred as a result of past decisions Sunk costs should be ignored Ex. Painting your room Ex. Taking a class 32 Review 1. 2. 3. 4. 5. Understand the principle-agent problem Know the difference between economic profits and accounting profits and what we mean by the normal rate of profit Know the difference between the short run and the long run Be able to fill in the cost table Be able to recognize the cost curves and why they slope the way they do 33 Review 6. 7. 8. Know the law of diminishing returns Know what we mean by economies and diseconomies of scale. Understand the idea of sunk costs. 34