Year 11 General Mathematics

advertisement

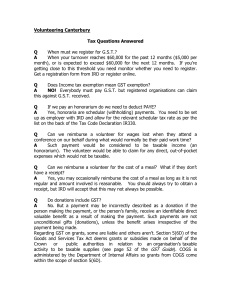

Taxation Chapter 10 Lesson 1 - Taxable Income – Intro – Read ALL of the information from p334 (below) Definition Total Income = All incomes that you earn added together (including wages, bonuses, interest, commissions, allowances etc…) Deductions are things like union fees, donations, car travel expenses, uniforms, tools… Taxable Income = Total income Allowable Deductions An extra tax added to all taxable incomes is the Medicare Levy, so that Australians can access the public hospital Medicare system. It is currently calculated at 1.5% of taxable income. Example 1 Gary uses the following information to work out his taxable income: Wages $42 322, Interest $224 (Joint account), Holiday Loading $620, Cost of union fees $154, Travel Expenses $80. Calculate his taxable income. Example 2 Calculate the Medicare levy payable on a taxable income of $43 000. (Note: Medicare levy is 15% of taxable income) Example 3 Find the Medicare levy on a salary of $53 100. Class Work Example 10A (p334) Q1,2,3,4,7(a,c) FM3 - Taxation Page 1 of 7 Document1 Lesson 2 - Calculating Tax Refer to Tax Table from p328 below. Easy - Example 1a Use the tax table on p328 to find the tax payable on incomes of: (a) $51 300 (b) $28 730 (c) $8344 **Hard - Example 1b Trevor works two jobs. In his main job he receives a salary of $33 500. He also receives $5400 for a part time job. His total tax deductions are $1250. Over the year he has paid tax fortnightly to a total of $7200. Find: (a) his total income for the year (b) his taxable income (i.e. take off deductions) (c) the tax payable on his taxable income (refer to Tax Table) (d) his tax refund / bill Class Work - Exercise 10B (p347) Q1(optional), 2, 3, 5, 7, 8*,9*(similar to above), Extension Q12,13 FM3 - Taxation Page 2 of 7 Document1 Good and Services Tax – GST Definitions GST stands for Goods & Services Tax - The GST is a tax on goods and services of 10%. To find the GST on a pre GST item, divide by 10 (i.e. find 10%) To find the GST on an item where GST has already been included, divide by 11 (i.e. this is equivalent to realising that item + 10 GST = 110%, hence to find the 10% you divide by 11%) Most unprepared food items (meat, vegetables, bread) are GST free. Example 1 Calculate the GST on: (a) a restaurant meal of $45.00 (b) a bill from a plumber of $340. Example 2 Jenni buys a TV for $462 which includes GST. Find: (a) the GST paid on the TV, (b) the original cost of the TV before GST was added (i.e. pre-GST cost). Class Work Exercise 10C (p341) Q1 (a,c,e), 2,4,6(a,c,e), 8, 10 GST in Other Countries Optional Extension - http://en.wikipedia.org/wiki/Sales_tax Most countries in the world have sales taxes or value-added taxes at all or several of the national, state, county or city government levels. Countries in Western Europe, especially in Scandinavia have some of the world's highest valued-added taxes. Norway, Denmark and Sweden have higher VATs at 25%, Hungary has the highest at 27%,[17][18] although reduced rates are used in some cases, as for groceries, art, books and newspapers.[19] In some jurisdictions of the United States, there are multiple levels of government which each impose a sales tax. For example, sales tax in Chicago (Cook County), IL is 10.25%—consisting of 6.25% state, 1.25% city, 1.75% county and 1% regional transportation authority. Chicago also has the Metropolitan Pier and Exposition Authority tax on food and beverage of 1% (which means eating out is taxed at 11.25%).[20] For Baton Rouge, Louisiana, the tax is 9%, consisting of 4% state and 5% local rate.[21] In California, sales taxes are made up of various state, county and city taxes. The state tax is "imposed upon all retailers" for the "privilege of selling tangible personal property at retail." [22] Strictly speaking, only the retailer is responsible for the payment of the tax; when a retailer adds this tax to the purchase price, the consumer is merely reimbursing the retailer by contractual agreement. FM3 - Taxation Page 3 of 7 Document1 Heading “Graphing Tax Rates” Go to the PowerPoint on Tax Graphs… HINTS - for hints on how to do these qns, they should refer to Examples in text Q1-3, refer to Example 1 (p343) Q4 refer to Example 2 (p344) Q6 refer to Example 3 (p345) If finished complete the following activities, Diagnostic Test 10 Q1-14 (p350) Then if time, Review Set 10A (p350) Q1-9 Exam-style Questions (p354) FM3 - Taxation Page 4 of 7 Document1 FM3 - Taxation Page 5 of 7 Document1 FM3 - Taxation Page 6 of 7 Document1 FM3 - Taxation Page 7 of 7 Document1