Economic Inequality and the Bush Tax Cuts

advertisement

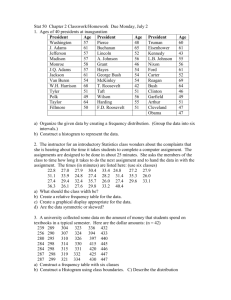

Is Inequality a Problem? What do I mean by a problem? – Empirical component – Moral component Alms and Cox View? Is Inequality a Problem? Alms and Cox – Income mobility – Track individual incomes over years – of the lowest 20% of income earners in 1979 • 86% move to higher group by 1988; • 15% make it to top tier • Quickest rise is among the young! Is Inequality a Problem? Alms and Cox- source of changes – Shift from blue – white collar economy – Increasing rewards to education & experience Inequality is inevitable Is Inequality a Problem? Krugman – Economic Globalization – bunk! McDs Source of Inequality – Values change• Idolatry of CEOs Jack Welch – Decline of labor- 12% in unions Consequences – government for the comfortable Who Governs? Dahl—”In political system where nearly every adult may vote, but where knowledge, wealth, social position, access to officials, and other resources are unequally distributed, who actually governs?” 2001 Bush Tax Cuts 36% 40% 28% 30% 20% 31% 15% 33% 25% 15% 10% 10% 0% $0 $6,000 Pre-2001 $27,050 Bush Plan $136,750 Bush Tax Cuts Reductions in federal income tax rates Increase child credits, higher limits on Roth and Education IRAs, elimination of Estate Tax Total Cost $1.3 trillion 2001-2010 After 2010, $200 billion a year Who Benefits 2001-2010 top 1% will receive – $477 billion – $342,472 each bottom 60% will receive – $268 billion – $3,251 each Benefits for Top 1% are back-loaded – get 7.3% of benefits in 2001 – But 51.8% of benefits in 2010 2003 Bush tax cuts $318 billion – – – – Tax breaks for married couples, Increased child credit ($400) Dividends and capital gains Last minute revision • families $10-26,000 not eligible for $400 % Reduction in Federal Tax Burden Bottom 95% Richest 4% Richest 1% 0 5 10 15 20 % Reduction in Federal Tax Burden 25 30 Public’s Ignorance of Tax Policy Do you pay more in income or payroll taxes? (60%+ get it wrong) Bush 2003 tax proposal on corporate dividends – 61% didn’t know “Most families have to pay federal estate tax when someone dies or only a few families have to pay” – 50% most families – 18% don’t know 40% said 2001 tax cut was something they “haven’t though about” Where do Taxes come from/go? Federal Govt Receipts, CBO Taxes as % of GNP 10 9.18.5 5.9 5 7 4.5 1.5 3.84.9 1.1 3.83.4 1.2 0 Individual Income Payroll Corporate Income Other 1950 1970 1990 Puzzle of Public Support Harris Poll, June 2003 American Public – 42% said it would “help the rich a lot” – 10% said it would “help themselves a lot” – BUT 50% 2003 tax cut was a good thing Conventional wisdom American Ideology of Opportunity Americans emphasize individual responsibility Care about opportunity, not inequality 82 90 80 70 60 50 40 30 20 10 0 81 65 64 61 44 43 Sw it z er la nd Un ite d St at es lia Au st ra an y G er m Br it a in Ne th er la nd s a Au st ri Ita ly 29 It is the responsibility of government to reduce the differences in income between people with high incomes and those with low incomes (% who agree) Percentage saying they agree with the statement: "The way things are in my country, people like me and my family have a good chance of improving our standard of living." 72 61 37 36 Ne th er la nd s an y 40 G er m ly Ita lia Au st ra US 45 Br it a in 80 60 40 20 0 70 75 70 65 60 55 50 45 40 35 30 64 60 52 51 47 ng do m Ki a Un i te d Au st ri Sw it z er la nd an y G er m ly Ne th er la nd s Ita lia Au st ra at es 41 St te d Un i 62 % who agree that taxes are much too high or too high But……. Is difference in incomes a … 60 50 40 30 20 10 0 43.2 49.8 7 Good thing Bad thing Haven't thought about it Big Question Bartels-- Not unusual for citizens to be ignorant about details of public policy. Question is how do they deal with uncertainty; what intellectual short cuts do they use to develop those opinions? What might explain individual’s support for Bush tax cuts? 1. Conservative ideology 2. GOP identification 3. rich tax burden too high or low 4. poor tax burden too high or low 5. own tax burden too high or low “unenlightened considerations of self interest” Hacker and Peirson Did Americans support the Bush tax plan? "Do you favor or oppose Bush tax cut plan?" 100% 50% 0% 56% Support 33% Oppose 11% Don't Know Average share of respondents 18 21 16 ABC/Washington Post Pew NBC/Wall Street Journal 74 77 21 19 41 36 14 65 18 25 32 Educ/Health Care LA Times 37 36 24 CNN/Time 32 20 25 Fox News 18 Bloomberg News 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Medicare Other governmental programs Debt Reduction Defense/Domestic Programs Social Security Tax Cut Which do you prefer.. 80% 60% 40% 20% 0% 73% 20% "would reduce federal income "take full effect this year, and taxes across the board and whould be aimed more att give the larges share of this tax middle income Americans and cut to wealtherier Americans involve either credits or who currently pay the most in reductions in the payroll taxes Support 80 70 60 50 40 30 20 10 0 70 24 "Rich get a bigger tax cut because they pay more in taxes" "Everyone should get the same level of tax cut" Treasury Department Memo “The public prefers spending on things like health care, and education over cutting taxes. It’s crucial that you make clear that there are no tradeoffs here. Roll-out events like this are the clearest examples of when staying on message is absolutely crucial.” Why did Congress support the Bush Administration’s tax cut plans despite tepid public support? Why didn’t they fear electoral retribution? The President's Agenda for Tax Relief "These are the basic ideas that guide my tax policy: lower income taxes for all, with the greatest help for those most in need. Everyone who pays income taxes benefits — while the highest percentage tax cuts go to the lowest income Americans. I believe this is a formula for continuing the prosperity we've enjoyed, but also expanding it in ways we have yet to discover. It is an economics of inclusion. It is the agenda of a government that knows its limits and shows its heart." — President George W. Bush Design of Tax Cuts- Hacker and Peirson, Abandoning the Middle, p. 45 Create Political Demand for More Tax Cuts Hacker and Peirson, Abandoning the Middle, p. 46 Time-bombs Sunsets Throw Momma from the Train Implications for Social Security Reform Bartels—voters have very limited cognitive ability to process complicated issues – “Social Security is in crisis” – Demographic imbalance – Young people are going to get social security Policy elites are able to frame the discussion and design the policy in such a way that obscure the distributional consequences of policy Jefferson on Citizenship "I know of no safe depository of the ultimate powers of the society but the people themselves, and if we think them not enlightened enough to exercise their control with a wholesome discretion, the remedy is not to take it from them, but to inform their discretion by education."