Industry & Competitor Analysis

advertisement

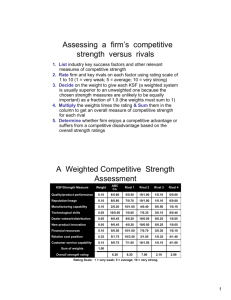

EXTERNAL ANALYSIS (INDUSTRY AND COMPETITION) Payne (3) “Analysis is the critical starting point of strategic thinking.” Kenichi Ohmae 1 Environmental Analysis Levels EXTERNAL or MACROENVIRONMENT Macro Level Economic Industry Level Competitors Firm Demographic Suppliers Connect Connect Social Global Substitutes Political/Legal Industry and competitive conditions (opportunities and threats) INTERNAL or Customers Technological MICROENVIRONMENT Its competencies, capabilities, resources, and competitiveness (strengths and weaknesses) 2 Macro Environment (1) Socio-cultural segment Women in the workplace Workforce diversity Attitudes about quality of worklife Concerns about environment Shifts in work and career preferences Shifts in product and service preferences Political/Legal Segment Antitrust laws Taxation laws Deregulation philosophies Labor training laws Educational philosophies and policies 3 Macro Environment (2) Economic segment Inflation rates Interest rates Trade deficits or surpluses Budget deficits or surpluses Personal savings rate Business savings rates Gross domestic product Technological Segment Product innovations Applications of knowledge Focus of private and government-supported R&D expenditures New communication technologies 4 Macro Environment (3) Global Segment Important political events Critical global markets Newly industrialize countries Different cultural and institutional attributes Demographic Population size Age structure Geographic distribution Ethnic mix Income distribution 5 Five Forces Model of Competition Substitute Products (of firms in other industries) Suppliers of Key Inputs Rivalry Intensity Among Competing Sellers Bargaining Power of Buyers Threat of Substitutes Buyers Threat of New Entrants Potential New Entrants 6 Stakeholder Analysis and Social Capital Stakeholder A Focal Firm Stakeholder B Stakeholder C 7 Who are Stakeholders? Identifying stakeholders is one way of sizing up the internal and external constituents that influence the firm. Stakeholders are individuals and groups who can affect and are affected by a firm’s strategic outcomes and who have enforceable claims on its performance Stakeholders include individuals, groups, and other organizations who have an interest in the actions of an organization and who have the ability to influence it Stakeholders may be categorized as internal, interface and external. Analyzing stakeholders involves 1) determining who matters and 2) how they might be managed for the betterment of the firm. 8 Social Capital Social capital is “the sum of actual and potential resources embedded within, available through, and derived from the network of relationships possessed by individuals or social units,” Nahapiet and Ghoshal’s (1998, p. 243) The “bonding” view of social capital suggests that persons derive social capital from the internal forces within their collective. This is achieved primarily as the collective matures and strong recursive bonds develop between actors who interact frequently (Coleman, 1988). The “bridging” view of social capital (e.g., Burt, 2000) represents the value of resources derived from connections spanning structural holes in a network. 9 Key Success Factors KSFs or CSFs are competitive elements that most affect every strategic group member’s ability to prosper in the marketplace: Specific strategy elements Product attributes Resources or Competencies Competitive capabilities KSFs spell difference between: Profit and loss Competitive success or failure Ask: For our organization to be successful, we MUST be especially good at ___________? 10 Key Success Factors KSF 1 Optimize Performance KSF 3 KSF 2 A sound strategy incorporates efforts to be competent on all industry key success factors and to excel on at least one factor! 11 Strategic Group Mapping One technique for revealing the different competitive positions of industry rivals is strategic group mapping A strategic group consists of those rivals with similar competitive approaches in an industry 12 Strategic Group Mapping Firms in same strategic group have two or more competitive characteristics in common . . . Sell in same price/quality range Cover same geographic areas Be vertically integrated to same degree Have comparable product line breadth Emphasize same types of distribution channels Offer buyers similar services Use identical technological approaches 13 A Framework of Competitor Analysis High II I III IV Market Commonality Low KEY The shaded area represents degree of market commonality between two firms Low Resource Similarity High Resource endowment A Resource endowment B 14 Market Commonality Market Commonality is concerned with Most industries’ markets are somewhat related in terms of the number of markets with which a firm and a competitor are jointly involved the degree of importance of the individual markets to each competitor technologies core competencies Multi-market competition Firms competing in several markets 15 Resource Similarity Resource similarity Firms with similar types and amounts of resources are likely to the extent to which the firm’s tangible and intangible resources are comparable to a competitor’s in terms of both type and amount have similar strengths and weaknesses use similar broad strategies Assessing resource similarity can be difficult if critical resources are intangible rather than tangible 16 Procedure: Constructing a Strategic Group Map STEP 1: Identify competitive characteristics that differentiate firms in an industry from one another STEP 2: Plot firms on a two-variable map using pairs of these differentiating characteristics STEP 3: Assign firms that fall in about the same strategy space to same strategic group STEP 4: Draw circles around each group, making circles proportional to size of group’s respective share of total industry sales 17 Interpreting Strategic Group Maps (i.e., Implications of the Strategic Groups Concept) Driving forces and competitive pressures often favor some strategic groups and hurt others – such recognition may be the key to developing a competitive advantage. Profit potential of different strategic groups varies due to strengths and weaknesses in each group’s market position. Important niches may be identified that are not currently being filled by competitors. The closer strategic groups are on map, the stronger the competitive rivalry among member firms tends to be (“Organizations most like yours are the most dangerous.”) 18 Within or Between Strategic Groups Price / Quality / Image High Medium Low Specialty Full-line Providers Limited-category Retailers Broad-category Retailers Product Line / Merchandise Mix 19 Categorizing the Objectives and Strategies of Competitors Competitive Scope Strategic Intent Market Share Objective Competitive Position Strategic Posture • Aggressive expansion via acquisition & internal growth •Getting stronger; on the move •Mostly offensive •Striving for low-cost leadership •Wellentrenched •Mostly defensive •Mostly focusing on a market niche • Local • Be dominant leader • Regional • Overtake industry leader • National • Be among industry leaders • Expansion via internal growth •Stuck in the middle of the pack •Combination of offensive & defensive • Multi-country • Move to top 10 • Expansion via acquisition •Going after a different position •Aggressive risk-taker • Global • Move up a notch in rankings • Hold on to present share •Struggling; losing ground •Conservative follower • Maintain current position • Just survive •Give up present share to achieve shortterm profits •Retrenching to a position that can be defended Competitive Strategy •Pursuing differentiation based on – Quality – Service – Technology superiority – Breadth of product line – Image & reputation – More value for the money – Other attributes 20 Unweighted Competitive Strength Assessment KSF/Strength Measure ABC Co. Rival 1 Rival 2 Rival 3 Rival 4 Quality/product performance 8 5 10 1 6 Reputation/image 8 7 10 1 6 Manufacturing capability 2 10 4 5 1 Technological skills 10 1 7 3 8 Dealer network/distribution 9 4 10 5 1 New product innovation 9 4 10 5 1 Financial resources 5 10 7 3 1 Relative cost position 5 10 3 1 4 Customer service capability 5 7 10 1 4 Overall strength rating 61 58 71 25 32 Rating Scale: 1 = Very weak; 10 = Very strong 21 A Weighted Competitive Strength Assessment KSF/Strength Measure Weight ABC Co. Rival 1 Rival 2 Rival 3 Rival 4 Quality/product performance 0.10 8/0.80 5/0.50 10/1.00 1/0.10 6/0.60 Reputation/image 0.10 8/0.80 7/0.70 10/1.00 1/0.10 6/0.60 Manufacturing capability 0.10 2/0.20 10/1.00 4/0.40 5/0.50 1/0.10 Technological skills 0.05 10/0.50 1/0.05 7/0.35 3/0.15 8/0.40 Dealer network/distribution 0.05 9/0.45 4/0.20 10/0.50 5/0.25 1/0.05 New product innovation 0.05 9/0.45 4/0.20 10/0.50 5/0.25 1/0.05 Financial resources 0.10 5/0.50 10/1.00 7/0.70 3/0.30 1/0.10 Relative cost position 0.35 5/1.75 10/3.50 3/1.05 1/0.35 4/1.40 Customer service capability 0.15 5/0.75 7/1.05 10/1.50 1/0.15 4/1.60 Sum of weights 1.00 6.20 8.20 7.00 2.10 2.90 Overall strength rating Rating Scale: 1 = Very weak; 10 = Very strong 22