Chapter 11 Audit of the Sales and Collection Cycle: Tests of

advertisement

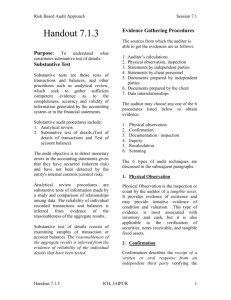

CHAPTER 11 SUBTANTIVE AUDIT TESTING: Revenue Cycle 1 What accounts are typically involved in the sales and collection cycle? - sales - sales returns and allowances - bad debt expense - cash discounts taken - trade accounts receivable - allowance for uncollectible accounts - cash in the bank 2 What classes of transactions occur in the sales and collection cycle? - sales (cash and credit) - cash receipts - sales returns and allowances - charge-off of uncollectible accounts - bad debt expense 3 As discussed in chapter 9 Understand internal control as it relates to sales How does an auditor design tests of controls and substantive tests of transactions for sales? 4 How does an auditor design tests of controls and substantive tests of transactions for sales? Understand internal control as it relates to sales Assess the planned control risk related to sales 5 In assessing control risk, the auditor should consider: Understand internal control as it relates to sales Assess the planned control risk related to sales 6 In assessing control risk, the auditor should consider: - adequate separation of duties - proper authorization - adequate documents and records - use of prenumbered documents - mailing of monthly statements - internal verification procedures Understand internal control as it relates to sales Assess the planned control risk related to sales 7 How does an auditor design tests of controls and substantive tests of transactions for sales? Understand internal control as it relates to sales Assess the planned control risk related to sales Evaluate cost-benefit of testing controls 8 Understand internal control as it relates to sales Will substantive tests be reduced sufficiently to justify the cost of performing tests of controls? Assess the planned control risk related to sales Evaluate cost-benefit of testing controls 9 How does an auditor design tests of controls and substantive tests of transactions for sales? Understand internal control as it relates to sales Assess the planned control risk related to sales Evaluate cost-benefit of testing controls Design tests of controls and substantive tests of transactions for sales 10 In designing substantive tests of transactions for sales, the auditor should consider: Do recorded sales actually exist? Understand internal control as it relates to sales Assess the planned control risk related to sales Evaluate cost-benefit of testing controls Design tests of controls and substantive tests of transactions for sales 11 In designing substantive tests of transactions for sales, the auditor should consider: Are all existing sales transactions recorded? Understand internal control as it relates to sales Assess the planned control risk related to sales Evaluate cost-benefit of testing controls Design tests of controls and substantive tests of transactions for sales 12 In designing substantive tests of transactions for sales, the auditor should consider: Are sales accurately recorded? Understand internal control as it relates to sales Assess the planned control risk related to sales Evaluate cost-benefit of testing controls Design tests of controls and substantive tests of transactions for sales 13 In designing substantive tests of transactions for sales, the auditor should consider: Are recorded sales properly classified? Understand internal control as it relates to sales Assess the planned control risk related to sales Evaluate cost-benefit of testing controls Design tests of controls and substantive tests of transactions for sales 14 In designing substantive tests of transactions for sales, the auditor should consider: Are sales recorded on the correct dates? Understand internal control as it relates to sales Assess the planned control risk related to sales Evaluate cost-benefit of testing controls Design tests of controls and substantive tests of transactions for sales 15 In designing substantive tests of transactions for sales, the auditor should consider: Are sales transactions properly included in the master file and correctly summarized? Understand internal control as it relates to sales Assess the planned control risk related to sales Evaluate cost-benefit of testing controls Design tests of controls and substantive tests of transactions for sales 16 The auditor should also perform procedures to detect fraud related to cash receipts: Determine whether cash received was recorded. 17 The auditor should also perform procedures to detect fraud related to cash receipts: Prepare a proof of cash receipts. 18 The auditor should also perform procedures to detect fraud related to cash receipts: A proof of cash receipts reconciles cash receipts recorded in the cash receipts journal with actual bank deposits. 19 The auditor should also perform procedures to detect fraud related to cash receipts: Test to discover lapping of accounts receivable. 20 Lapping is a fraud scheme that occurs because of inadequate segregation of duties related to mail, cash receipts, and accounting. 21 a lapping example A/R Able $1000 A/R Baker $1000 A/R Cain $1000 On Monday, a check is received from Able Co. in payment of their a/r. The check is stolen by the bookkeeper! No entry is made and all evidence of the payment receipt is destroyed. 22 a lapping example A/R Able $1000 -1000 0 A/R Baker $1000 A/R Cain $1000 On Tuesday, a check is received from Baker Co. in payment of their a/r. The payment, however, is credited to Able’s account. 23 a lapping example A/R Able $1000 -1000 0 A/R Baker $1000 -1000 0 A/R Cain $1000 On Wednesday, a check is received from Cain Co. in payment of their a/r. The payment, however, is credited to Baker’s account. 24 What audit procedures may detect lapping? - a/r confirmations (disputed balances, disputed timing of payments) client 32 client’s a/r customer 25 What audit procedures may detect lapping? - a/r confirmations (disputed balances, disputed timing of payments) - comparison of deposit slips to cash receipts journal (different amounts, different timing) 26 Other than adequate segregation of duties, what client internal control may prevent or detect lapping? required vacations (and rotation of duties during vacations) 27 Confirmation Sequence obtain a/r aging select specific a/r for confirmation print confirmations and mail them analyze results, investigate disputed amounts statistically and/or judgmentally determine whether the extent of exceptions will affect internal control evaluation and acceptability of a/r balance 28 Receivables Audit Procedures - perform analytical procedures on receivables and related accounts - review year-end cutoff for sales. Examine all sales invoices and related shipping documents and cash receipts for several days before and after the balance sheet date. Determine when title to the goods passed. 29 Receivables Audit Procedures - perform analytical procedures on receivables and related accounts - review year-end cutoff for sales. - after reviewing a/r aging, discuss possible a/r write-offs and the adequacy of the allowance with management - inspect notes receivable - vouch a sample of a/r to customer order, sales order, sales invoice, shipping documents, cash receipts 30