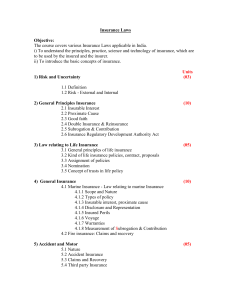

Presentation from David Abbott (Powerpoint format, 270Kb)

advertisement

Business Interruption Legal Issues David Abbott Victoria Sherratt Graham Eklund QC (of Four New Square) Commercial Risk and Reinsurance Department Barlow Lyde & Gilbert LLP 15 September 2009 Welcome David Abbott – Causation Victoria Sherratt – Damage Graham Eklund QC – “What if the insurers are responsible for causing additional business interruption losses and additional damage?” Business Interruption – Do you need a Lawyer? Trigger Causation is one of the most common legal issues Approaching causation in logical steps This talk addresses… The cause of the damage: Basic Principles: proximate and concurrent causes Interpretation of exclusion clauses Example of Tektrol v Hannover The cause of the BI losses Did material damage cause the BI loss Postscript: notifiable diseases causing BI losses Causation in a traditional BI policy Standard BI policy requires damage to property and the BI loss to flow from that. Therefore two questions: Did the peril cause the property damage? Did the property damage cause the BI losses? Peril must cause the property damage Principles apply to both property damage and BI, discuss initially in relation to damage. Issues arise when: It is unclear what is the cause Concurrent causes Exclusion clauses Causation – The Proximate Cause Insurer only pays for losses caused by an insured peril But some losses have a range of possible causes. An insurer only pays if the “proximate cause” was an insured peril Ascertaining the proximate cause of a loss can be complex Leyland v Norwich Union (1918) “Ikaria” torpedoed by German sub during WW1 Towed to Le Havre where she could have been saved if allowed to stay But gale blew up and she was sent outside the harbour in case she sank and blocked it Two days later she sank after being buffeted by weather Held: the proximate cause was war risk. It did not matter that she could have been saved if allowed to stay in the harbour Proximate cause: Summary The proximate cause may not be the first in time … nor the last Nor the sole cause It must be the “dominant”, “effective” or “operative” cause “Common sense” - Lord Denning in Gray v Barr (1971) Look at chain of causation. Was there a new intervening cause? Concurrent causes When two causes of equal dominance, specific rules apply Where one cause insured and the other uninsured, there is coverage – Miss Jay Jay (1987) Where one cause insured and the other excluded, there is no coverage – Wayne Tank & Pump (1974) Causation : Shifting the Balance Use of words such as “solely caused by” or “directly or indirectly caused by” Look out for who has the burden of proof Exclusion Clauses If the established cause is an excluded peril – no claim Same principles of proximate cause apply Courts will look carefully at exclusion clauses to assess whether a cause falls within them Interpretation of Exclusion Clauses Clauses interpreted from objective standpoint Courts will consider ‘background knowledge’ and commercial context Look at the general sense of the documents Only if there is ambiguity after these tests have been applied will the courts invoke “contra proferentem” and construe the contract against the insurer. But in general, the courts will expect insurers to be clear in exclusion clauses and will construe any uncertainty about the context, or ambiguity, against them Concurrent causes and Exclusions – Tektrol Ltd –v- Hannover Ltd (1) Tektrol’s business providing energy saving devices for industrial motors Business interruption resulting from disappearance of source code Issue as to application of the following exclusions “Thus, damage caused by or consisting of consequential loss arising directly or indirectly from : (1) Erasure loss distortion corruption of information of computer systems or other records programs or software caused deliberately by rioters strikers locked-out workers persons taking part in labour disturbances or civil commotion or malicious persons (2) Other erasure loss distortion or corruption of information on computer systems or other records programs or software unless resulting from a defined peril insofar as it is not otherwise excluded.” Application of Exclusions – Tektrol Ltd – v- Hannover Ltd Underwriters argued Sending of the virus caught by the first exclusion (“malicious persons”) Burglary caught by the second part of the exclusion (“loss”) Only needed to be correct on one of these for the loss to be excluded Insured argued that While hackers may be malicious persons, insured premises not specifically deliberately targeted by a virus Second part of exclusion only excluded electronic loss Tektrol –v- Hannover Court held there were concurrent causes Sufficient for either virus or burglary to be excluded for insurers to succeed Court of Appeal reversed the High Court decision “Malicious persons”, used in the context of rioters and locked out workers, did not mean not a hacker targeting the world at large. If insurers wished to exclude all damage caused by such hackers, they should have had a separate clause The word ‘loss’ in the exclusion limited to electronic loss, because surrounded by words like ‘erasure’ and ‘corruption’. Conclusion on causation in traditional policies Ascertain the proximate cause. There may be two proximate causes. If one cause is an excluded peril, there is no liability. Exclusion clauses must be read in context, and are often construed against the insurer. There are two steps in a traditional BI policy, did the peril cause the property damage and did the property damage cause the BI loss. The second step– did the property damage cause the BI? A separate question to whether the insured peril caused the property damage: but same principles of analysis An example: an insured gun explodes injuring the policyholder’s hand. He cannot drive and claims for the Increased Cost of Working of a driver. He does not have Personal Injury cover, just BI cover for BI losses caused by property damage: “If the business is interrupted or interfered with in consequence of insured damage happening during the period of insurance, the Insurance Company indemnify the Insured in respect of the additional expenditure necessarily and reasonably incurred by the Insured, in consequence of the insured damage” Gun Example Conclusion Answer: probably no BI coverage. The BI losses are caused by personal injury, not by the damage to the shotgun. Insurers repudiated the claim. The insured argued that the personal injury was caused by damage to the shotgun, but in fact it was caused by explosion. Now for another example… Explosions Ltd –v- Universal Insurers Ltd Did the property damage cause the BI? The insuring clause is as follows:“This policy insures [BI losses] directly resulting from physical loss or damage of the type insured by this policy.” Insured manufactured explosives. Explosion occurred, killing an employee, damaging a building Health & Safety were involved. HSE involvement primarily motivated by the fatality and not the property damage. HSE would have investigated even if there had been no fatalities, because of the risk of fatalities in the future No actual orders by Health & Safety, though a warning that any attempt to begin rebuilding the damaged building would obstruct their investigation and be a criminal offence Explosions Ltd –v- Universal Insurers (2) The key issue – whether the BI cover under the policy extends to losses attributable to any delay in repairing the damaged buildings caused by the investigations into the explosion being undertaken by the HSE? In other words, was the material damage the proximate cause of the BI losses attributable to HSE’s investigations? In the end, underwriters decided that the BI losses were sufficiently proximate. Causation and property damage: summary Two different causal links: peril causes property damage, property damage causes BI A cause must be the proximate cause If concurrent causes, one must be insured, and one cannot be excluded Notifiable Diseases Cover for notifiable diseases further to an extension Common to provide cover when there is a notifiable disease “within 25 mile radius” Practical difficulty of separating impact of virus within 25 miles and outside 25 miles. Query: if losses are caused concurrently by virus within 25 miles and outside 25 miles, and given that there is no specific exclusion for virus outside 25 miles, would all the BI losses be covered? SARS Hong Kong hotels All of Hong Kong in a 25m radius Practical approach to separating impact of SARS in Hong Kong from outside Hong Kong. Extremely difficult to be exact. One QC advised that losses caused in parallel by SARS inside and outside Hong Kong would be covered. In our opinion, primarily a question of fact not law.