3.0 Products and Services

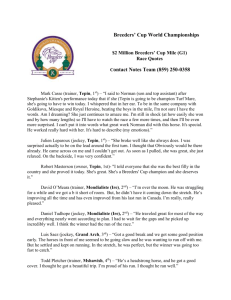

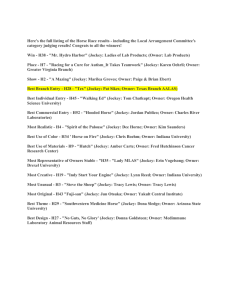

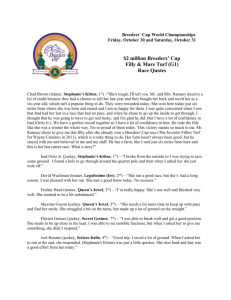

advertisement