Ch. 15 Notes - Solon City Schools

advertisement

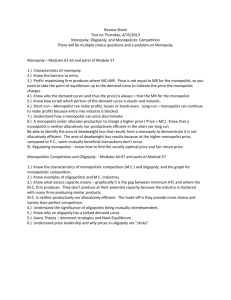

Firm that is sole seller of product without close substitutes Price Maker not a Price Taker There are barriers to entry thru: Monopoly Resources, Gov’t Regulation or Production Process Will produce when P > MC One firm has sole ownership of a key resource used in production of a good DeBeers is good example with diamonds Usually created because of use of patents and copyrights Trade-off is less competition, but encourages research & development A single firm can supply a good/service to a market at a smaller cost than 2 or more firms could There are economies of scale, ATC falls as scale becomes larger Demand curve for monopolist is downward sloping, not perfectly elastic as in a competitive market MR is always less than P for monopolist True because of downward shaped D curve When monopolist increases Q, there is an output effect (higher Q, increases TR) and a price effect (lower P, decreases TR) MR can even be negative if price effect is greater than output effect Also produce where MR = MC just like competitive markets However for a monopoly: P > MR = MC So monopolist sets Q where MR = MC then goes up to Demand curve to set P Profit = (P – ATC) x Q Does a monopoly maximize total surplus? To do this, we would need to produce where Demand & MC intersect Monopolist produces less than the socially efficient quantity of output Similar to situation with a tax, but instead of tax revenue it is profit to the monopolist Monopoly’s profit gives producers more surplus than consumers’ surplus, but keeps same total surplus as it would have had Deadweight loss is created by inefficiently low level of output, not really the higher price Selling the same good at different prices to different customers Ex: Hardback vs. Paperback Novels Strategy for monopolists to increase profit Requires ability to separate customers based on their willingness to pay Can raise economic welfare by lowering DWL, shows up as higher producer surplus Buying a good at a lower price in one market and reselling it in another market at a higher price This prevents price discrimination by monopolists Monopolist knows exactly each customer’s willingness to pay and can charge each person a different price In this case, consumer surplus is zero and total surplus equals the firm’s profit – no DWL Movie tickets Airline prices Discount coupons Financial aid Quantity discounts 1. Antitrust Laws - Sherman Antitrust Act (1890) - Clayton Antitrust Act (1914) • Allows gov’t to prevent mergers that limit competition, and can break up companies that reduce social welfare • Can the gov’t effectively judge social benefit vs. social cost? 2. Regulation - Often regulate prices of natural monopolies (PUCO) - Where does the gov’t set the price? MC pricing? • Problem with that is MC < ATC for monopolist, so this would mean the company loses $ Alternatives: 1. 2. 3. Subsidize the monopoly: but this creates need for taxes to pay for it & more DWL Average-cost pricing: like a tax on the good because P no longer = MC MC-pricing also gives no incentive to monopolist to lower costs (unless you let them keep part of cost savings as profit) 3. Public Ownership - Common in Europe; in U.S., we do this with Post Office - Problem again is creating incentive to cut costs 4. Doing Nothing - All “solutions” to monopolies have their drawbacks, so many economists prefer doing nothing