Public Policy in Private Markets

advertisement

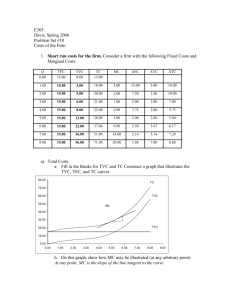

Public Policy in Private Markets Monopolization (section 2, Sherman Act) Announcements Case presentations: 1 case has been assigned Clickers: Case 8, K&W, 5th edition Debate date: March 6th. Video due to me: March 2nd. There will be a homework on that day The number of points for iclicker on a day will be equal to the number of questions on that day (e.g. 1 question = 1 point; 5 questions = 5 points). Your 10% of in-class work will be computed as the fraction of total iclicker points in the semester. Homework 1 posted, due Feb. 14, in class, group work is encouraged. Overview of Antitrust Laws What we are studying Sherman Act, section 2: Monopolization 1. Substantial market power A. B. 2. Define relevant market Show market power Intent to monopolize Brief history Predatory Pricing What we are studying Sherman Act, section 2: Monopolization 1. Substantial market power A. B. 2. Define relevant market Show market power Intent to monopolize Brief history Intent: Any behavior that is used to perpetuate and extend monopoly power with the use of abusive practices (e.g. predatory pricing, sabotaging competitors) Intent: Predatory Pricing What is predatory pricing? “Irrationally low prices” Anticompetitive vs. good healthy competitive behavior? Two approaches: Average cost approach Recovery approach Question Which of the following best characterizes average variable costs (AVC) and average total costs (ATC)? A. AVC does not include fixed costs and ATC does B. ATC>=AVC C. ATC=AVC in the long run D. ATC and AVC are always upward sloping Average Cost Approach MC ATC P AVC Operate Q TC=Variable Cost + Fixed Cost Cost includes a normal return to capital If P>ATC: cover all costs (including fixed costs, and return to capital) Average Cost Approach MC P ATC AVC Operate in SR, but shut down in LR Shut down Q If AVC<P<ATC: operate in short run (exit in long run) Exit losses > stay losses If P<AVC: shut down immediately (short run) Exit losses < stay losses Average Cost Approach 1. AVC Rule: if P<AVC Must have predatory intent (economically irrational) P>AVC: not challenged 2. ATC Rule: if P<ATC May have predatory intent: AVC<P<ATC: Are prices the result of natural variation? Special deals, oversupply, perishables Must have predatory intent: P<AVC: Irrefutable evidence of predatory behavior Bottom line: AVC rule: lenient (smaller range of illegal pricing). ATC rule: stricter (broader range of illegal pricing) Average Cost Approach Current interpretation: Supreme Court: never formally adopted AVC rule However, some Appeals Court cases (e.g. AA in DFW) used AVC rule Problems: Accounting cost is different from economic cost How to interpret it with multi-product firms? Average Cost Approach MC ATC P AVC Q Example 1: Increasing MC Average Cost Approach P ATC MC=AVC Q Example 2: Constant MC=AVC Recovery Approach A.K.A.: “recoupment” Low prices may or may not be “successful” Focus on consumer well-being: Are consumers hurt? In SR consumers benefit from lower prices In LR consumers will only be hurt if predatory pricing is successful: Competitors leave Recovery period (high price afterwards) is achieved Recovery Approach Worry only if recovery period is achieved Illegal behavior: only if consumer is hurt Affected firms are not factored in Generally, approach is not as widely accepted in court as the average cost approach However, important in cases such as AA Summary of Approaches Average cost: AVC (lenient) ATC (stricter) Recovery: Sacrifice? (How long? How much?), AND Recovery? (How soon? How much?) Microsoft Case (1): Evidence of Intent 1970’s: personal computers are introduced 1985: Microsoft introduces first commercial software for PCs Relevant Market: Product: OS for PCs 1991-1993: 50% for all OS, >70% for IBM compatible PC’s Geographic: National Microsoft Case (1): Evidence of Intent Pre-announcement of software DR-DOS (rival), 1990, captures 10% MS-DOS 5.0 announced, but inexistent Exclusionary licensing: Microsoft charges license fees based on all computers shipped by manufacturer (OEM), with or without MS-DOS: consumer paid twice for non-MS-DOS Penalties to non-MS-DOS OEMs (higher fees, less support, no credit) OEMs forced to install MS-DOS Incompatibilities: Denying software developers access to application programming interface (API) Microsoft Case (1): Details Microsoft’s view: Large market share = superior product Competitive market, large market share is not guaranteed Practices are good and transparent competition Consumers have gained Remedies will hurt innovation rate Microsoft Case (1): Details Consent decree (6/95): OEM contracts limited to 1 year No minimum commitment on OEM contracts Elimination of non-disclosure agreements for beta testers Next time Second Microsoft case (1998) Poll: What Concept is the least clear? A. Nolo Plea (16/36%) B. Rule of reason v. Per se Rule (9/20%) C. Market Definition (9/20%) D. AVC v. ATC rule (3/7%) ???? E. Cross-price elasticity (15/33%) More Polling On a scale from 1-10 what is your understanding of: (10=awesome, 1=no idea) Nolo Plea AVC v. ATC rule Cross-price elasticity