AP ECo Final Review

advertisement

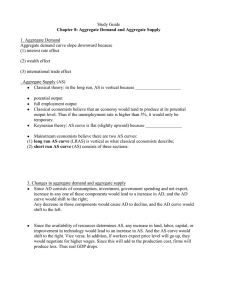

AP ECO Final review… 1. What does this statement describe,” if the price level increases in the US relative to foreign countries, then American consumers will purchase more foreign goods and fewer US goods.” 2. What is the relationship between consumption and disposable income? 3. What is currency in circulation part of? 4. Graphically, what is the market demand curve? 5. Why does economics involve “marginal analysis”? 6. What is the natural rate of unemployment? 7. What is structural unemployment? 8. Why is money not an economic resource? 9. How can the Fed change the money supply? 10. What does the law of supply indicate? 11. What would cause a rightward shift for a product in the demand curve? 12. In economics, what is a group of firms that produce identical or similar products called? 13. What does the term “ceteris paribus” mean? 14. What would happen if intermediate goods were included in GDP? 15. What do economists mean when they say that money serves as a medium of exchange? 16. What best explains a rightward shift in the aggregate supply curve? 17. Why would an increase in the price of a product reduce the amount that is purchased? 18. What does the law of demand state? 19. What is the discount rate? 20. How might an easy money policy be frustrated? 21. What will happen in a competitive market? 22. What will an improvement in technology do? 23. What is an economy that produces its most wanted goods but uses outdated production methods? 24. Why might the growth of GDP understate changes in the economy’s economic wellbeing over time? 25. A broad definition of competition involves? 26. How may GDP be defined? 27. What is the purpose of a tight money policy? 28. What do the reserves of a commercial bank consist of? 29. What will an excise tax on a product produce? 30. Suppose the US is experiencing an 8% rate of unemployment with stable prices and a trade deficit. All else equal, what would the use of appropriate monetary policy to reduce unemployment do? 31. What is the interest rate that banks charge their most credit-worthy corporate customers called? 32. What does productivity measure? 33. What has occurred if producers must obtain higher prices than previously to produce various levels of output? 34. When is the US considered to be at full employment? 35. What is a contraction of the money supply? 36. What would a college graduate using the summer following graduation to search for a job be classified as? 37. What does the foreign purchase effect suggest will happen in an increase in the US price level relative to other countries? 38. What is the federal fund rate? 39. What must a person have to be officially unemployed? 40. What is the smallest component of aggregate spending in the US? 41. What does a production possibility curve illustrate? 42. What does the fact that nominal GDP has risen more than real GDP illustrate? 43. What is an appropriate fiscal policy for a severe recession? 44. What viewpoint does macroeconomics approaches the study of economics? 45. What does real-balances effect indicate? 46. What does the assertion “there is no free lunch” mean? 47. What must a bank that has assets of $85 billion and a net worth of $10 billion have in reserves? 48. What are recurring upswings and downswings in an economy’s real GDP over time called? 49. What does the terms “final goods and services” refer to? 50. What can the MPC be defined as that fraction of? 51. Why is expansionary fiscal policy so named? 52. What can the Fed do to cause an increase in money supply? 53. What causes cyclical unemployment? 54. What are part-time workers counted as? 55. What does the location of the product supply curve depend on? 56. What backs the money supply? 57. What is the paper money used in the US? 58. What can the APC be defined as? 59. How can we calculate GDP? 60. What is the scarcity problem? 61. During a serious recession, where would we expect output to fall the most? 62. What happens in a decline in disposable income? 63. What does money function as? 64. A reserve requirement of 20% means a bank must have $1000 of reserves if its checkable deposits are what? 65. What is economic self-interest according to economists? 66. When are net exports negative? 67. What does the labor force include? 68. What happens when a commercial bank borrows from a Federal reserve bank? 69. What happens when current tax revenues exceed current government expenditures and the economy is achieving full employment? 70. A study found that an increase in the federal tax on beer would reduce the demand for marijuana, what can we conclude? 71. If an economy is operating on its production possibilities curve, what would an increase in the production of capital goods do? 72. Why is growth advantageous to a nation? 73. When do banks create money? 74. Why is specialization in production important? 75. Suppose the Federal reserve banks sell $12 billion of government bonds to the public which pays for them by drawing checks, what would happen to commercial banks reserves? 76. What can the Fed do to reduce the Federal funds rate? 77. What is contractionary fiscal policy named so? 78. What does the upward slope in the supply curve reflect? 79. What are the 3 main tools of monetary policy? 80. How is fiscal policy primarily carried out? 81. What is the largest component of the money supply?